As an intermediary, I have many conversations with business owners about how much their business is worth. As these conversations progress, owners realize that it’s not how much they make, it’s how much they can keep that truly matters.

As an intermediary, I have many conversations with business owners about how much their business is worth. As these conversations progress, owners realize that it’s not how much they make, it’s how much they can keep that truly matters.

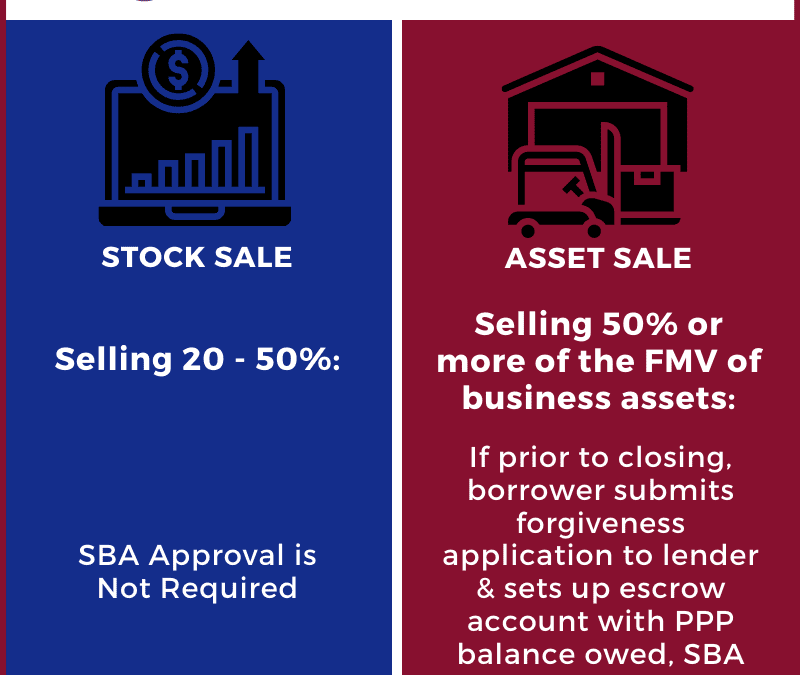

The Small Business Administration (SBA) issued a Procedural Notice on October 2, 2020 which offers business owners and lenders guidance on how Paycheck Protection Program (PPP) Loans are to be handled when a business has a change in ownership.

This post summarizes the notice and includes an Infographic to assist business owners. It includes the following topic:

When does a Business Sale Require the SBA’s Approval

Does a Business Sale Require the PPP Lender’s Approval or Notification

Required Steps Pre and Post-Closing for PPP Borrowers

SBA Timeframe to Approve a Sale or Merger when a PPP Loan Transfers

Does the EIDL Grant Impose Additional Steps When Selling a Business

The COVID 19 Era has begun. In addition to lives lost, there’s an economic toll that has yet to be determined at the time this content is being written. With small businesses on life support, these are scary times for business owners and for the intermediaries helping owners navigate through them. So how has COVID 19 affected business transactions?

An Earn Out Payment is additional future compensation paid to the...

A Data room may be a physical room or a virtual room and are used for a number of reasons – including data...

An offering memorandum is a legal document that states the objectives, terms, and risks typically associated...

The investment banking market is made up of two sides – the buy-side, and the sell-side, both of which are...

Non-Solicitation Agreements (NSAs) are made by two parties to protect one party from a potential loss of...

The term sandbagging refers to an intentional lowering of expectations. Sandbagging can apply to anything...

When a business owner begins to negotiate the sale of his or her business with buyers for the first time, he or she will inevitably face a difference between the buyer’s offer price and the desired selling price. It’s at this point when a lively debate between the parties will occur over the underlying reasons for the business’s asking price being what it is. At this time a seller will be well-served if able to offer justification for an increased business valuation and a higher business selling price.

Perhaps you are one of those business owners who feels you have plenty of time to think about exiting your business. You consider yourself lucky, and whenever you feel it’s time to leave, you will be able to do so with ease.

Why it may not be so – This is not one of those articles about how long it takes to leave a business, or how hard and expensive it can be. Instead it’s about the false impression many business owners have of life after the business – all wine and roses (PS it’s not).

When things go wrong with the sale of a business the parties involved look for remedies in the liquidated damages provisions established in the purchase agreement. Such provisions are included when a purchase agreement has been signed in advance of an actual closing when the business is transferred and a purchase price is paid.

When a business is about to be sold, the parties to the sale may find it beneficial to establish an escrow agent to handle the transfer of certain assets and cash between the buyer and seller. Many times the parties agree to use the escrow account held by one of the party’s business attorneys. However, in many cases the parties prefer to hire an independent escrow agent to handle the assets and cash that will change hands.