Create your Valuable Business

Creating a valuable business is not easy. We get that.

Most business owners do not have a formal education in accounting, finance or law. And yet you are expected to understand these complex and important matters.

Exit Promise offers access to investors, advisors and other resources so you can create a valuable business.

Whether you choose to sell or keep your valuable business is up to you!

So far, Exit Promise has helped more than one million business owners like you.

Articles

ERC Tax Return Amendment Rules Change

On March 20, 2025, the IRS issued updated FAQs clarifying that taxpayers no longer need to file protective claims for amended tax returns related to the Employee Retention Credit (ERC).

Safe Financial Instruments Guide

Our SAFE Financial Instruments Guide is intended to help entrepreneurs understand the key benefits of a SAFE, why they may want to use one, the differences between a SAFE and a Convertible Note, potential SAFE drawbacks, the types of SAFE investors, and the resources available.

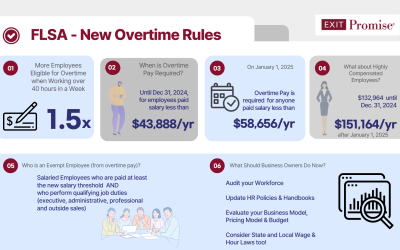

New Overtime Rule Increases the Salary Exemption Thresholds

On November 15, 2024, the U.S. Department of Labor (DOL) Fair Labor Standards Act (FLSA) overtime pay requirements requiring more employees being classified as non-exempt has been overturned.

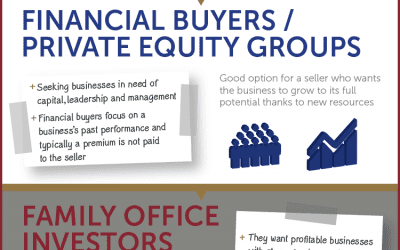

Best Business Buyer Type For Your Business

Often business owners finds it difficult to know who they should target as a potential buyer for their business. At first glance, any buyer with a checkbook may be attractive. In practice, finding the right business buyer type when selling a business is both an art and a science. Learn what to consider before going on the market.

Similar to selling commercial real estate, knowing who the buyers are and what motivates them is beneficial. Likewise, when determining the asking price for a business, it makes good sense to understand the nuances associated with the various types of business buyers. Doing so will improve the entrepreneur’s likelihood he will receive the maximum net cash from the sale.

Maximizing After Tax Proceeds When Selling Your Business

In this episode, Holly Magister, a CPA with expertise in business sales, offers valuable insights into tax planning for entrepreneurs preparing to sell their businesses. Dive into the nuanced tax considerations discussed and learn proactive strategies to enhance sale proceeds while reducing tax liabilities. This episode serves as a hands-on roadmap for business owners, equipping them with the knowledge to make informed choices and optimize their financial results throughout the intricacies of business exits. Tune in for essential guidance!

Understanding the Accredited Investor Rule 501 of Regulation D

When seeking money for your business, it is necessary only to approach accredited investors because regulations restrict the types of investors allowed to participate in such private placements. By limiting investments to accredited investors, regulators aim to protect less sophisticated investors from the higher risks associated with certain types of investments, such as private placements or hedge funds.

To qualify as an accredited investor, an individual must typically meet one or more of the following criteria:

Which is Best – Business Broker, M&A Advisor, or an Investment Banker?

When selling a business, you’ll likely engage various advisors to help you navigate the process, maximize the sale price, reduce risks associated with the deal post-transaction, and ultimately close the deal. Different types of advisors work in various business sales roles. They may assist in the transaction, each with unique expertise, deal process, and fee structure.

How To Find A Business On Sale

Finding a business for sale involves research, networking, a serious commitment of time and resources for due diligence, and above all careful consideration. Whether you are thinking about buying an existing business as an alternative to creating your own startup from scratch, there are many important factors to consider.

Follow our a step-by-step guide to help you find a business to buy.

Why Business Buyers Won’t Buy Your Business

Learn why business buyers view your business as unattractive and it fails to sell once it’s on the market. We’ve summed up the top seven reasons and included suggestions regarding how to overcome these obstacles.

EBITDA Add Backs and Adjustments

A common method used to calculate business value involves applying a multiple to the company’s EBITDA. And while business owners who intend to sell their business have many options to increase the transaction multiple, one way to unlock value using this calculation is to identify other, non-customary “add-backs” to increase EBITDA.

Employee Retention Tax Credit Guide January 2023 Update

The Employee Retention Tax Credit (ERTC aka the ERC) applicable to the Covid-19 pandemic has been evolving from its initial congressional act in March of 2020, was enhanced by the Consolidated Appropriations Act passed in January 2021, updated by the American Rescue Plan in March of 2021, and most recently updated by the Infrastructure Investment and Jobs Act.

If your head is spinning as you try to unravel the ERC rules, you are not alone. The ERC or Employee Retention Credit offers a viable and alternative way to recover payroll costs for any type of employer, except state and local government entities, regardless of their size.

How To Choose A Business Broker Intermediary

Choosing the right intermediary or business broker to represent a business owner in the sale of their business can make all the difference when it comes to the right price, the right buyer, and the ability to close the deal.

Access Additional Articles