- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Do you have a Question?

Ask below. One of our Investors or Advisors will Answer!

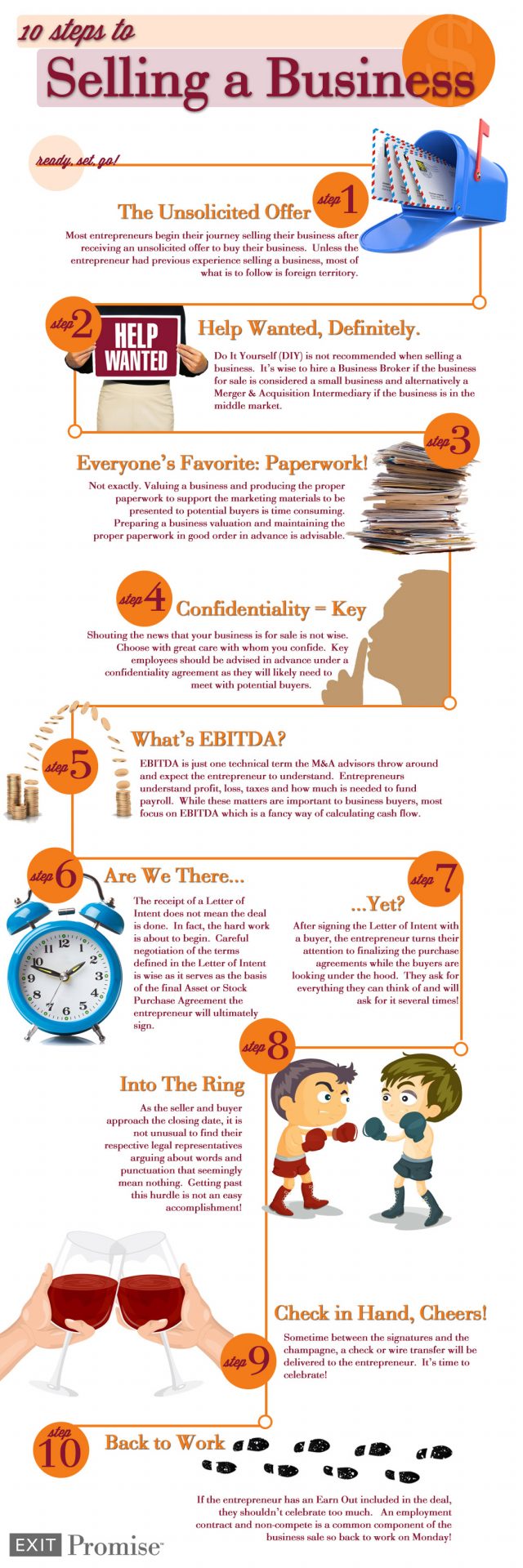

Selling a business often is a tumultuous, emotionally-draining experience for a business owner. Unless you’ve sold a business previously, the journey feels awkward and is marked with multiple high and low points.

To guide business owners, especially the first-time seller, we’ve created the 10 Steps to Selling a Business Infographic.

(Click on the image to view larger size. For more details, scroll down!)

1. An Unsolicited Offer to Buy your Business Arrives

Less than 10% of all business owners plan for the sale of their business and their eventual exit. Because this is so, most owners begin the journey selling their business after receiving an unsolicited offer to purchase. When they receive such an offer, they often scramble to learn what they should do.

In many cases, this first solicitation is not a good offer and often it’s from a competitor attempting to learn more about the competition. Without proper exit planning in place, a business owner should proceed with great caution. Unless they have previous experience selling a business, most of what follows is foreign territory.

2. Help, I need an M&A Advisor

Do It Yourself (DIY) is not recommended when selling a business. It’s wise to hire a Business Broker if the business for sale is considered to be a small business. Alternatively a Merger & Acquisition Intermediary is a good choice if the business is in the middle market.

Unfortunately, many business owners consider themselves a ‘jack of all trades’ and believe they can handle the sale of their business just as they have handled many other important matters in their business successfully. The problem with this thinking is that selling a business is unlike anything else the business owner has attempted in the past. One wrong move can be fatal.

3. What’s EBITDA? We generate profit!

EBITDA is just one technical term the buyers and M&A advisors throw around and expect the entrepreneur to understand. Business owners understand profit, loss, taxes, and how much is needed to fund payroll.

While the traditional financial terms and practical matters are important to business buyers, most buyers focus on EBITDA which is a fancy way of calculating the annual cash flow generated from the business.

4. Who May I Trust to Know I am Selling a Business?

Shouting the news that your business is for sale is not wise. Choose with great care with whom you confide. Key employees should be advised in advance under a confidentiality agreement as they will likely need to meet with potential buyers.

Never share with your suppliers or customers your plans to sell your business until the buyer has made an offer you have accepted and disclosure becomes necessary in the Due Diligence stage.

5. The Painful Paperwork is Worse than Tax Season!

Valuing a business and producing the proper paperwork to support the marketing materials to be presented to potential buyers is time consuming.

Preparing a business valuation and maintaining the proper legal documentation related to your customers, employees, vendors, landlord and all other significant parties well in advance is advisable. These are just a few of the important steps taken when an exit plan is created.

6. We have our LOI… Is it Over Yet?

The receipt of a Letter of Intent does not mean the deal is done. In fact, the hard work is about to begin. Careful negotiation of the terms defined in the Letter of Intent is wise as it serves as the basis of the final Asset or Stock Purchase Agreement.

Although the Letter of Intent is typically not binding to the buyer and seller, not negotiating in good faith after a LOI has been signed is a recipe for trouble. This is another step in the process where your advisors, especially your Attorney, play a vital part in the outcome.

7. Due Diligence. Are We There Yet?

After signing a Letter of Intent with a buyer, the business owners turn their attention to finalizing the purchase agreements while the buyers are looking under the hood. Buyers ask for everything they can think of during Due Diligence and will (likely) ask for it several times!

Often a secure data room is set up where all of the pertinent closing documents are drafted and reviewed by all parties. The documents sent to the data room by the seller and attached to the final purchase agreements are very important. A skilled and cautious advisor will scour these documents for accuracy before they are submitted for review and inclusion in the data room.

8. The Attorneys are Fighting Like My Kids

As the seller and buyer approach the closing date, it is not unusual to find their respective legal representatives arguing about words and punctuation that seemingly mean nothing. The details in the Stock Purchase Agreement or Asset Purchase Agreement are very important. Getting past this hurdle is not an easy accomplishment!

9. Signatures and Champagne

Sometime between the signatures and the champagne, a check or wire transfer will be delivered to the business owner. It’s time to celebrate!

10. No, Just a Long Weekend. I Have an Earn out

If the business owner has an Earn Out included in the deal, they shouldn’t celebrate too much. Since the pandemic decimated many company’s EBITDA, Earn Outs have become commonplace in deals.

An employment contract and non-compete are also very common components of the business sale, so it’s back to work on Monday!

When do I need to have a Confidentiality Agreement signed by the buyer? They asked to talk to me on the phone and said this wasn’t necessary?

Do you agree?

John, I am a Business Broker adviser with ExitPromise and have processed hundreds of Confidentiality Agreements. Until the buyer signs a CA, you should not disclose any information about your business that might hurt you if it got into the wrong hands.

Business owners can and often talk to buyer prospects outside of a CA, but they should be careful about what info they provide. Some initial conversation may be necessary to generate interest to get a buyer to sign a CA. A Business Broker or attorney can advise you on what info should be treated as confidential.

I am one of those business owners you described in this article.

I don’t have my business on the market for sale and one of my biggest competitors called me yesterday and asked if I wanted to sell my business to them.

They’ve asked me to give them all sorts of financial information and even want to see my payroll. Should I give them all of this?

Thomas,

As a Business Broker, I have represented sellers in the past where the buyer was a competitor. In this type of transaction, you may want to hold back some confidential information in the early discussions until you see you are moving ahead to a probable transaction. Key information that could be used against you by your competitor if you do not sell the business should probably be withheld until later in the process. In my experience, it varies from transaction to transaction as to what information is provided to a buyer and when it is provided in the process. A big factor is how significant is the competition between buyer and seller. If you are fierce competitors, you want to be very careful. However, there will probably be some level of risk in the transaction as the buyer has to see certain information on the business to determine if they want to move forward. Also, you want to have a confidentiality agreement with the buyer that will protect you as much as possible from the buyer using your information against you if a sale is not completed. I recommend you obtain the services of an experienced broker and\or attorney to advise you on how best to proceed with this buyer with a process that will minimize your risks. They would advise you on how to move forward with this buyer based on several factors about both companies and the possible transaction being discussed. Contact me if you would like to discuss this opportunity. Often times, a competitor will make the best offer on your business.

Thomas,

As Holly’s article mentions, if you’re serious about selling, an advisor is key to guide you through the process. They will help organize the disclosure, financial model, and marketing materials, and will also help to surface other buyers that are likely interested. The will run the entirely of the process from beginning to end.