- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

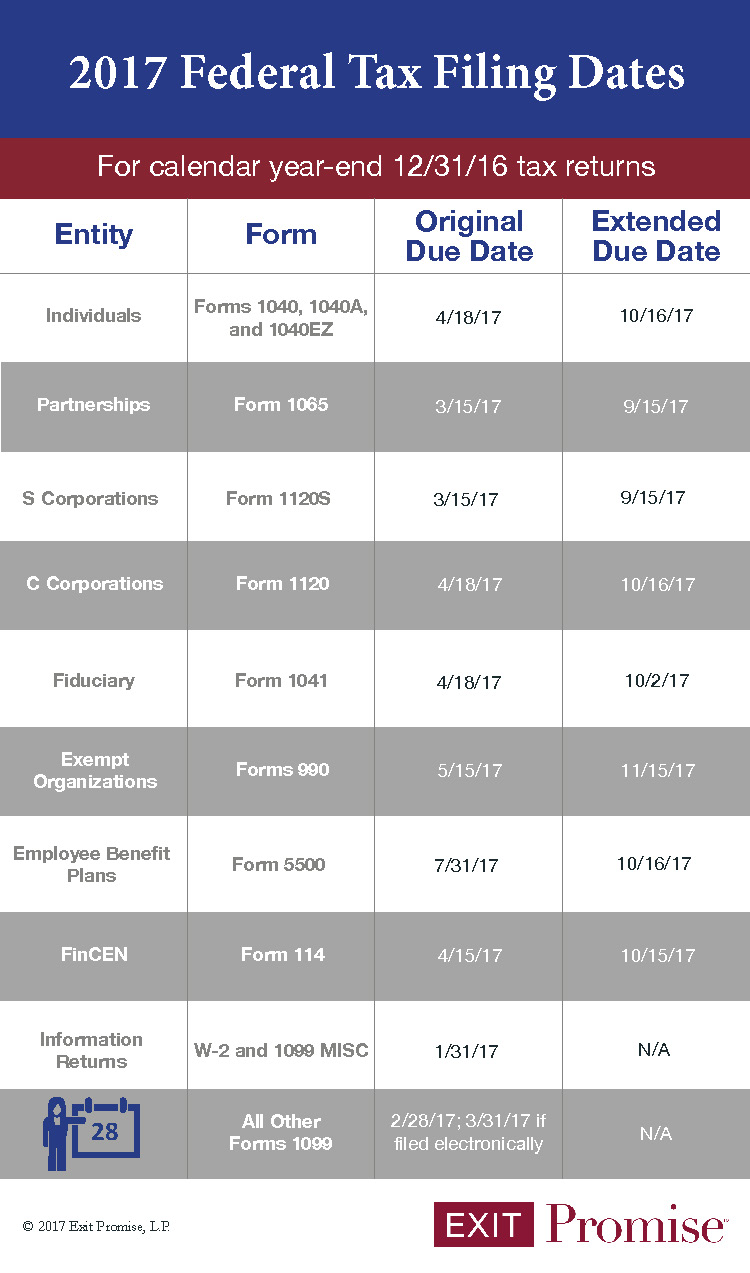

Busy entrepreneurs need to be aware of several important changes in federal 2017 Business Tax Filing Deadlines for the calendar year ending 12/31/2016.

Most notably is now employers have one month less to file Forms W-2 and 1099 MISC with the Federal Government. In the past, this information was due on February 28th. Now both the recipient and the IRS must receive these documents by January 31st.

Similarly, Partnership Form 1065 is now due a month earlier on March 15th . On the other hand, C Corporations have an additional month to file Form 1120. Its due date is now April 18th.

Here’s where you can find the Federal Extension Form to print and complete: Federal Form 7004

And here’s where you will need to mail it: Mailing Addresses for Federal Form 7004

These changes as well as other important 2017 Federal Tax Filing Dates are summarized below.

–