- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Whether you’re growing a business organically or searching for ways to jump start business growth with a large cash infusion, don’t allow the large number of capital sources for your business become overwhelming.

This post identifies several non-traditional (i.e. non-bank) sources of capital for your business.

Outside Investors

Debt and Equity Mezzanine Bridge Capital

Bridge Capital is used by high growth middle market businesses in need of $5 Million or more for a period of three-to-seven years and who are capable of paying 20% plus for the use of the Investors capital. Debt Mezzanine is often used in conjunction with a bank debt facility and is considered quasi-equity. Accounts Receivable and Inventory may be used as collateral with Debt Mezzanine. Equity Mezzanine is best suited when there is a very large potential upside in the business valuation in the future. Whether using Debt or Equity Mezzanine for capital, it’s safe to assume the business is expected to grow significantly, become more profitable, and be sold to a third party in three-to-five years. When a business crosses the line and takes on Mezzanine Debt or Equity, it is considered a business that is ‘in play’.

Private Equity Group

Private Equity Groups invest capital in the form of equity into private businesses and typically buyout part or the majority of the original founders/shareholders. This recapitalization offers the business owner an opportunity to sell twice: once to the PEG; and then again when the PEG sells to another investor and/or buyer. PEG’s invest in a business because they believe in its management team while recognizing the need for both capital and strategic management to take the business to the next level.

Venture Capital

Venture Capital firms invest capital in the form of equity into private businesses based on their belief in the business model and the management team’s ability to scale-up with capital, connections, and advice. Board participation on the part of the VC firm nearly always is mandated, and often controlled by the venture capital firm.

Angel Investors

Angel Investors invest capital in the form of equity into private businesses based on their relationship and confidence in its founder. Angels invest capital in the early stage and their participation in the business management varies widely.

Alternative Capital

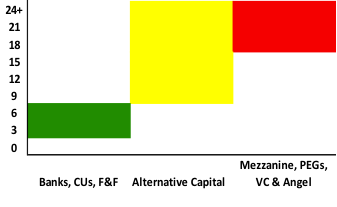

Accessing alternative capital sources outside of banks, credit unions, friends and family comes with an increase in the overall cost of capital. In other words, as the business owner travels up the business capital food chain, access to capital becomes more expensive in terms of the net interest rate or cost of business capital paid on an annual basis. Below is a summary of the cost of business capital by the following categories:

Debt – Banks, Credit Unions, Friends and Family | Alternative Capital; and

Equity – Mezzanine, Private Equity Groups, Venture Capital, and Angel Investors:

Alternative Forms of Business Capital include:

Financing Companies

These provide Capital and Operating Leases to business, similar to a term loan, however the underlying interest rate (cost of capital) is greater.

Peer-to-Peer Crowdsourced Lenders

Following the lead from the U.K., these lenders are now emerging in the United States. They pool private investors cash and lend to entrepreneurs in a streamlined application process.

Accounts Receivable Factoring

This lender acquires or buys some or all of the Accounts Receivable of a business and subsequently collects the payments directly from customers.

Purchase Order Financing

This lender is similar to an A/R Factoring Lender, however instead of purchasing the Account Receivable related to a customer, the lender acquires the Purchase Order from the customer. The P.O. Financier advances the capital needed to fulfill a purchase order, and once paid by the customer, it pays the business owner who produced the product at a reduced factor.

Inventory Financing

This lender typically lends money to the business owner for high-priced merchandise that takes a long time to sell. Automobiles, boats, and jewelry businesses use this form of financing. When the business sells the product, it pays the Inventory Financier.

Merchant Cash Advances

A sum of money is advanced to a business that collects sales revenue through credit and debit cards from its customers. Such a business is called a merchant and, at the end of each day, a portion of the daily receipts is remitted to pay down the sum of money initially received. Retailers and restaurants frequently use this form of alternative capital.

Friends and Family

Raising business capital from friends and family is the most common path and largest source of funds for startups. Business capital from friends and family is based on their comfort and confidence in the entrepreneur. Typically friends and family do not have the financial or business savvy to evaluate capital needs properly or judge the financial soundness of a business. For this reason, many refer to this source of business capital as ‘Friends, Family and Fools’ capital.

The friends and family business capital source may be the only option for the startup. If so, the entrepreneur is well advised to accept a loan or investment only from friends and family members who can afford to lose their capital. And careful consideration should be given to how the relationship may change if the loan or investment is not repaid or successful. Proper structuring of the loan or investment is important when using the friends and family to start or grow a business.

I have an S Corp that owns a wholly owned subsidiary. The subsidiary needs some funds for expansion and the S Corp is in a position to provide the funds. How should the loan be structured? Do I need a loan agreement from the parent to the subsidiary?

Aaron:

If the subsidiary is also an S-Corporation, then it will likely follow the Q-sub rules which basically makes the subsidiary essentially an ignored entity. If this is the case, then there is no “loan” to the subsidiary; it is simply money moved around internally.

If the subsidiary is a partnership or C-Corporation, then you will need to make a formal loan between the entities.

Good morning. You have an impressive business record. Below is a quick set-up for my question:

1. Took on a small food manufacturing company to buy out the two partners and their 66.% of the business.

2. Successfully negotiated buyout of the company for $4.9 million, existing plant real estate for $1.2 million, line of credit of $500K, and a construction loan for $500 (when needed).

This took 18 months to complete. What fees are fair to receive for the work? Thanks.

Hi Rod,

I am sorry for our delayed response…

This is very difficult to answer because you may not be in a position to actually receive payment for your services post closing.

When you are part of negotiating both the buyout terms and the capital to fund it, you are involved with multi-layered aspects of the transaction.

Normally, the buyer or seller engages with you to negotiate the terms with the other parties. At a $5 million purchase price, the typical Lehman Formula may be applicable.

And when you are sourcing and negotiating the capital for a deal this size, you may expect to be paid in the 1-to-2% range.

It’s very difficult to get paid after the fact unless you have a very good relationship with all of the parties. That said, there is no doubt in my mind you deserve to be paid. Doing this type of work is not easy! Congratulations!

Truly wish you all the best…