- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Do you have a Question?

Ask below. One of our Investors or Advisors will Answer!

The Employee Retention Tax Credit (ERTC aka the ERC) applicable to the Covid-19 pandemic has been evolving from its initial congressional act in March of 2020, was enhanced by the Consolidated Appropriations Act passed in January 2021, updated by the American Rescue Plan in March of 2021, and most recently updated by the Infrastructure Investment and Jobs Act.

If your head is spinning as you try to unravel the ERC rules, you are not alone. I’ve read several dozen articles, attended multiple continuing education classes and even dug into the legal text and have concluded applying for the ERC is not for the faint of heart.

To assume a small business owner is equipped to figure out what to do (or not do… more on that later) to maximize their pandemic financial support in the form of the ERC offered by the US federal government is a stretch, at best.

There is a silver lining though. If your business qualifies, you may retroactively apply for the employer payroll tax credits. Albeit, there are deadlines approaching because the first quarter of 2020 Federal Form 941 amendment (which is how an employer files for the ERC) must be submitted by April 30, 2024.

This post covers those businesses affected by the Covid19 Disaster and defined by the IRS as a Small Employer, which employs up to 100 Full Time Equivalents (FTEs) in 2019 when applying for the 2020 ERC and up to 500 FTEs in 2019 when applying for the 2021 ERC.

In summary, this Employee Retention Tax Credit Guide covers the following questions:

- What is the Employee Retention Credit?

- Is my Business Eligible for the ERC?

- How to Calculate the Employee Retention Credit in 2020 and 2021

- What Exactly is a Qualified Wage for the Employee Retention Credit?

- How to Apply for the Employee Retention Credit?

- Which is Better, the Employee Retention Credit or the PPP?

- Is the Employee Retention Credit Taxable?

The purpose of this guide is to help business owners understand if pursuing the ERC is possible for their business and if so, when and how they should initiate the process.

What is the Employee Retention Credit

Although the ERC is a payroll tax credit available to both Covid-19 and NON Covid-19 disasters, for the purpose of this post, we will be addressing only the Covid-19 disaster scenario.

Generally speaking, if you have a business where you employ people and pay them with a paycheck, withhold payroll taxes and file quarterly 941 federal tax forms, you may be able to file for the ERTC for all quarters in 2020 and the first three quarters of 2021.

The ERC is a tax credit that is taken against payroll taxes if your business was subject to one or more government-mandated suspension of operations and/or your business gross income suffered in 2020 and/or 2021 when compared to pre-pandemic quarters in 2019.

The ERC amount per employee maxes out between $5,000 in 2020 and up to $28,000 in 2021.

Initially, the first law prevented a business owner from applying for the ERC if they’d applied for PPP loan forgiveness. For this reason, many employers ignored the ERC. This restriction has been lifted, albeit it takes a certain amount of financial gymnastics to properly calculate the ERC, especially if you want to maximize the ERC as well as the PPP loan forgiveness. More on that in a bit.

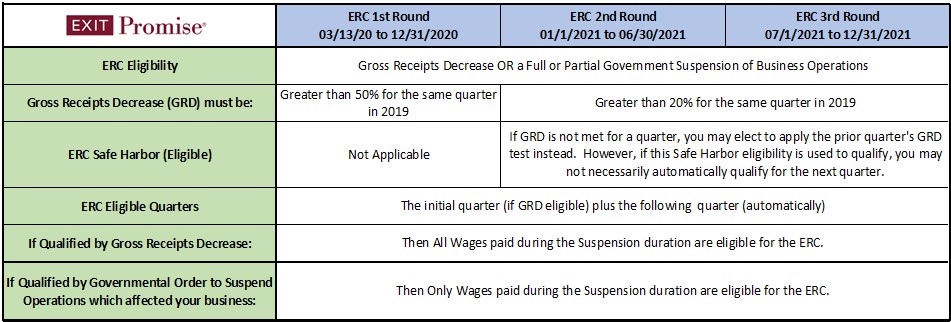

Employee Retention Credit 2020 and 2021 Eligibility

Whether your business is eligible for the ERC depends on whether it was in business in 2019, how much its Gross Receipts declined when compared to previous quarters or if it was subject to a government mandated partial or full suspension. With the passing of new laws and release of additional FAQs, the ERC rules continue to change quarter-by-quarter and year-by-year, so a chart is the best way to summarize ERC eligibility.

According the the Cares Act Code Section 2301 (c)(2), “a suspension by governmental authority means any employer for which the operation of the trade or business is fully or partially suspended during the calendar quarter due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings for commercial, social or other purposes due to Covid-19.”

Worth noting is certain clarification found in the IRS FAQs #28 regarding governmental orders. This FAQ clarifies that unless the employer’s operation of its trade or business is affected by the governmental order, the suspension does not rise to the level of a governmental order for purposes of the ERC.

Another resource for all 50 states covering shut down orders, mask mandates and travel restrictions may be found on Justia.com.

If your business intends to qualify for the ERC under the non-revenue provisions, it’s vitally important that you obtain the substantiation for the operational suspensions (shut downs and/or supply chain disruptions) for your records. Keeping the documentation in a safe place so you are able to provide evidence in the future is highly recommended. Simply assuming a shutdown in your state or a global supply chain restriction qualifies your business for the ERC is not enough.

And one more thing to consider is whether your business (or entity) has common ownership or is an affiliated service group with another business. If so, there are additional steps to consider.

Employee Retention Credit 2020 and 2021 Calculation

The first step to calculate the ERC for quarters in 2020 and 2021 is to understand the maximum ERC, the ERC Tax Credit Rates, Compensation Base and the Types of Employer Payroll Taxes which the employee retention tax credits will offset.

The PPP Loan forgiveness will come into play as well because the current law permits a business to apply for loan forgiveness and the ERC as long as it doesn’t use the same wage payments (compensation and certain healthcare insurance premiums).

Note: The Infrastructure Investment and Jobs Act retroactively removed the 4th quarter of 2021 from eligibility for most employers.

The following summarizes these variables for the 2020 and 2021 quarters:

Qualified Wages for Employee Retention Credit

It’s important to understand that to compute the ERC qualified wages (which includes other forms of employee compensation) you will have to do so for each employee and for each quarter. Unfortunately, there are no shortcuts.

All employees on the payroll may be included in the compensation calculation for ERC purposes, regardless of their full-time or part-time status, with one exception. And that exception is a non-spouse relative of a corporation’s greater than 50% shareholders (or for any other entity other than a corporation, greater than 50% of the capital and profits interests in the entity). Any non-spouse relative of a greater than 50% owner does not qualify for the ERC!

According to IRS FAQ #59 non-spouse relative is defined as:

- a child, descendant of a child; or

- brother, sister, stepbrother or stepsister; or

- father, mother or ancestor of either; or

- stepfather, stepmother; or

- niece or nephew, aunt or uncle; or

- son-in-law, daughter-in-law, father-in-law, mother-in-law, and brother-in-law or sister-in-law.

More than 50% owners and their spouses may not be included in the ERC compensation calculations, unless they have no family. Yes, you read that correctly. The compensation paid to a person who has more than 50% ownership in the business and their spouse is not eligible for the ERC unless they have zero living relatives. In my opinion, it would have been easier for the IRS to say — if you own more than 50% of the business, you and your spouse can’t include your compensation for the ERC!

Also worth noting, is that the payroll costs include the gross payroll before deductions actually paid during the quarter. The eligible payroll costs are not accrual basis (recorded when earned), instead the eligible payroll costs are cash basis (as when paid on payday). This actually makes things much simpler and is consistent with the way in which payroll tax reports are prepared.

ERC qualified wages are defined by the CARES Act Code Section 2301 (c)(3) and IRS Notice 2021-20 Q&A #30.

For small employers, the wages paid to all employees whether working or not working, is considered eligible for the ERC.

Qualified wages do not include qualified sick leave wages and qualified family leave wages under section 7001 and 7003 of the Families First Coronavirus Response Act.

The ERC compensation computation for all of the quarters in 2021 may include pay raises and bonuses, if reasonable up to a maximum compensation amount of $10,000 per quarter per employee. This was not the case in 2020 where the number of full-time equivalents (FTEs) dictated how pay raises and bonuses would be handled. If the business had less than 100 FTEs in 2019, all wages including bonuses were ERC eligible in 2020. If there were more than 100 FTEs in 2019, pay raises and bonuses were not eligible for the ERC in 2020.

Similar to the PPP Loan Forgiveness program, certain health insurance costs may be included in the ERC wage / compensation base when applying the tax credit percentage. The health insurance costs eligible for the ERC wage base include:

- The amounts paid by the employer for employer-funded health plan (Code Section 5000 (b)(1) as long as it’s excluded from the employee’s compensation (under Code Section 106 (a)) even if the employee was not paid wages for services; and

- The amounts paid by the employer for a group health care plan under Code Section 125 FSA.

And one other pre-tax employee wage/salary reduction that qualifies for the ERC wage base is the contributions from the employee to their qualified retirement plan (such as a 401K).

How to Apply for Employee Retention Credit

As of January 2023, to claim the ERC, you must file an amended Federal Form 941 for the applicable quarter. Keep in mind:

- The Federal Form 941 is a quarterly report and is due on the last day of the month following the end of the quarter.

- You have three years from the due date of the Federal Form 941 to file the amendment.

Employee Retention Credit vs PPP Loan

The ERC is less favorable than the forgiven PPP Loan and the current law allows an employer to apply for the ERC as well as to use the PPP Loan proceeds to keep their business going. However, the employer can’t double dip by using the same payroll dollars and health insurance expenses from the PPP Loan forgiveness program for the ERC.

So, it’s a matter of optimizing the two programs for as many dollars as possible to remain available for the ERC during the quarters in which the business is eligible while allowing enough payroll costs to be used during the PPP loan covered period to achieve 100% forgiveness. Easier said than done!

Unfortunately, many employers filed for PPP Loan forgiveness for the first round without regard to the payroll costs being used up that later would have benefited them for the ERC program.

Why would an employer have done this? Because, the rules kept changing and their crystal ball was broken!

Is the ERC Taxable?

Not exactly. The ERC amount received is not included in taxable income for the employer. However, the ERC received in a given year will require the business entity (the employer) to reduce the amount of wages expense by the ERC dollars received in the year for which the ERC was applied.

For example, if the ERC for calendar year 2020 was $40,000., then the compensation (wages and health insurance costs) deduction for tax purposes is reduced by the ERC amount of $40,000. Essentially, it results in taxable income (or a reduction in the reported tax loss) for the employer equal to the ERC amount received in the year in which it was applied for.

Conclusion

The ERC is a valuable benefit for small business owners who’ve been adversely affected by the pandemic. Navigating the ERC eligibility, how much the benefit may be and how to apply has been and will continue to be a big challenge for business owners and their advisors alike.

Many CPA firms simply don’t have the personnel to handle these applications due to their complexity — especially during tax season. Unfortunately, many ‘pop up ERC filing businesses’ have come out of the woodwork. Recently, the IRS Press Release (IR-2022-183 10/19/2022) stated: “Employers are warned to beware of third parties promoting improper Employee Retention Credit claims.”

I caution business owners to be careful who they work with, especially when it involves their tax filings. It’s best to use a CPA or law firm that specializes in this type of work. They will thoroughly evaluate your situation, document the files, prepare your amended federal form 941and defend you if audited.

This post has been drafted based on the information published by the IRS and available to taxpayers and tax practitioners as of January 27, 2023. If additional guidance is offered by the IRS, the post will be updated. I promise.

Clarification – If, we received the 2020 ERC in 2023, do we have to amend our 2020 income tax filing to reflect the credit?

Bruce:

You must amend the 2020 return, yes. You will be adding a “negative expense”. It is not INCOME, but a reduction of your payroll tax expenses. Of course, the bottom line is the same…your net income will increase and tax is due. Interest will be added by the IRS, but no other penalty is assessed.

I have just found out about this. Can you claim a credit for a past quarter? It looks like if you did, it would be on a 941-X, but that seems to ask questions as if you have either made a mistake, or have take the credit and forgot to show it. Confusing to say the least.

Joan: I assume you are asking about the ERT Credit. In which case, the answer is “Heck, Yes!” You can file an amended 941. Warning! The IRS is taking longer than 6 months to issue refunds on this credit.

Good luck!

Hello,

We are a construction company that employs union masons.

What part of their benefit package can be included as qualified wages for ERC? There are health, pension and annuity benefits paid by us the employer to the union on behalf of the union employee.

The health portion looks like it can be included. Would we be able to include the pension and annuity benefits?

Thank you

Hi Thomas,

If the pension and annuity benefits are part of your company’s qualified retirement plan, then such contributions on behalf of its employees would be included in the employee’s compensation when calculating the ERC.

All the best…

Can you help me file for the Employee Retention Credit? Thank you. Charlie

Hi Charlie,

Yes, here’s where you may schedule a call to discuss further.

If I use a payroll leasing company do we qualify for the ERTC? I have asked my payroll leasing company and they tell me to check with my accountant and I asked my accountant and she tells me to ask the payroll leasing company. I would love clarification.

Amanda: “Leased employees” is an odd concept, but really PEOs have replaced this arrangement whereby the employees still belong to your company and a common paymaster handles the payroll & benefits. The “leasing” company is really a third-party payer for your company’s benefit.

Third-Party Payers

In the case of a common law employer that uses a third-party payer, such as a reporting agent, a payroll service provider, PEO, or CPEO, the reporting agent is not entitled to the credits regardless of whether the reporting agent is considered an “employer” for other purposes. Instead, the reporting agent will need to reflect the credits on Form 941 that it files on the employer’s behalf, and include Schedule R-Allocation Schedule for Aggregate Form 941 Filers. An eligible employer can submit its own Form 7200 to claim an advance credit.

Basically, your Leasing company paymaster will need to reflect on its Form 941 any credits that is to YOUR company’s benefit; so, yes, it is the leasing company that must apply for the credit if YOUR company (the client) qualifies. But, you can apply for your own Advance of this credit using Form 7200.

Hello: My payroll company seems to be overwhelmed with calculating the ERC: They’ve done 2021 Q1 & Q2 for me, but are reluctant to do any quarters in 2020 and said that they can’t do Q3 or Q4 for this year. My Question is who else can file 2020 for me? If it’s only my present payroll company then I’m reluctant to switch payroll companies. Can you recommend anyone? Thank you

Hi Tom,

Let’s discuss further. Here’s where you may set up a phone call with me to do so.