- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

On Friday, March 27, 2020, the Paycheck Protection (Loan) Program (PPL) for small businesses was approved as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This new law is intended to help small business owners in an unprecedented way.

On June 5, 2020, the Paycheck Protection Program Loan Flexibility Act was signed into law and loosened the rules for business owners to qualify for loan forgiveness. This post has been updated to reflect these changes.

First, while the Paycheck Protection Program Loan will be initially set up by banks and approved by the SBA under section 7 (a), unlike other SBA loan programs, the PPL is guaranteed 100% by the SBA.

Second, if the proceeds of the loan are used by business owners as Congress, the Senate and President Trump intended, the loan will be forgiven.

Essentially, how the paycheck protection loans work for small business owners depends on whether loan proceeds are used properly. If so, the loan becomes a grant from the federal government to help you get your business back in business as soon as possible.

In this post, we will cover the following about the Payroll Protection Loan program:

- How to qualify for the Paycheck Protection Loan?

- What type of Employees are eligible for the PPL?

- How much is the maximum amount of PPL available for my business?

- What’s included in Payroll Costs when calculating the maximum PPL?

- Which Payroll Costs do NOT qualify for the PPL?

- What can I use the loan proceeds for?

- What’s the Recipient Good Faith Certification?

- Do I have to personally guaranteed the PPL?

- What are the costs associated with the PPL?

- When do I have to start making PPL payments?

- How do I get PPL forgiveness or make the PPL a Grant?

- How do I apply for a Paycheck Protection Loan for my business?

How to qualify for the Paycheck Protection Loan

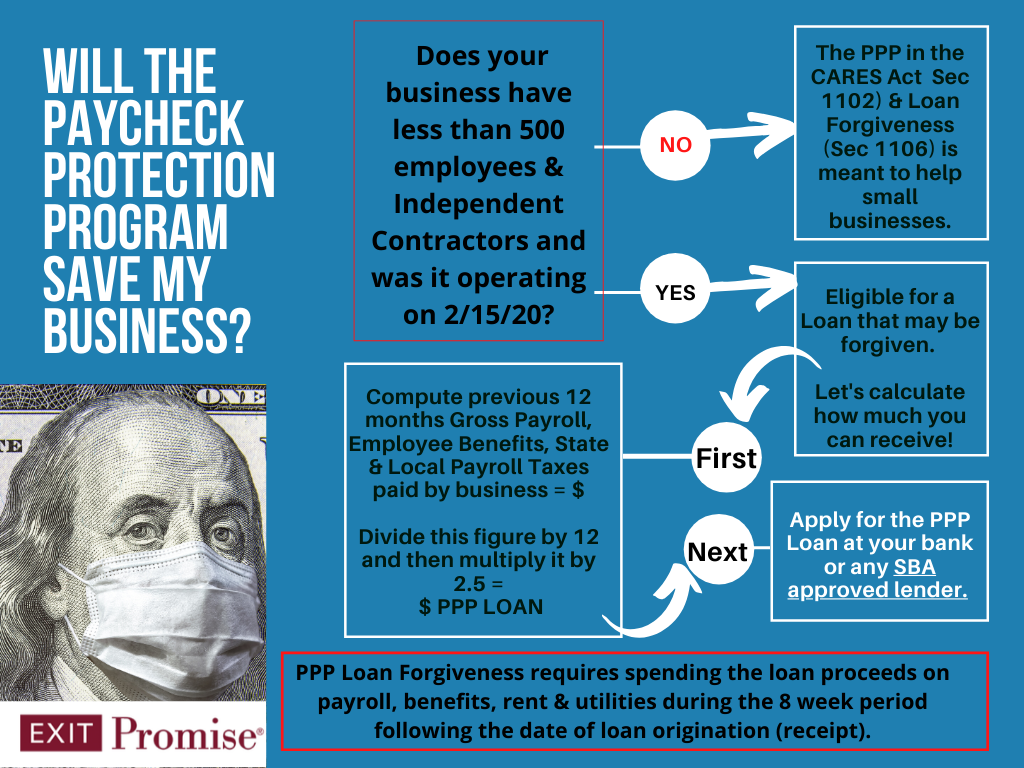

In order to qualify for the PPL, the business must have been in operation on February 15, 2020 and had employees being paid wages, salary and payroll taxes OR paid independent contractors and reported those payments on federal form 1099-MISC.

What type of Employees are eligible for the PPL

The PPL eligible business may not have employed more than 500 employees as of February 15, 2020. The term employee includes individuals who work on either a full-time or part-time basis.

The Accommodation and Food Services businesses may measure the employee count based on each physical location.

And for those individuals who operate their business as sole proprietors (filing a tax return on a Schedule C) or as a self-employed business owner, they also may be eligible to receive a Paycheck Protection Loan.

How much is the maximum amount of PPL available for my business

During the period from February 15, 2020 and ending on June 30, 2020, the maximum PPL amount is the LESSER of:

- The AVERAGE TOTAL MONTHLY PAYMENTS by the business owner for PAYROLL COSTS incurred during the one-year period before the date on which the loan is made MULTIPLIED BY 2.5;

- PLUS any outstanding loan amounts that were made beginning on January 31, 2020 and ending on the date the business owner receives the PPL, which may be eligible to be refinanced under the PPL

OR

- $10,000,000.

What’s included in Payroll Costs when calculating the maximum PPL

Under the Paycheck Protection Loan Program, Payroll Costs include the following:

- Salary, Wages, Commissions and similar forms of compensation;

- Payment of cash tips or equivalents;

- Allowances for dismissal or separation payments;

- Payment of vacation, parental, family, medical or sick leave;

- Group Health Care Benefits, including insurance premiums;

- Retirement Benefits paid by the employer;

- State and Local Taxes assessed on employee compensation paid by the business;

- The sum of payments of any compensation to or income of a Sole Proprietor or Independent Contractor that is wage, commission, income, net earnings from self-employment or similar compensation and that is in an amount not exceeding more than $100,000 in one year, as prorated for the period beginning on February 15, 2020 and ending on June 30, 2020.

Which Payroll Costs do NOT qualify for the PPL

Under the Paycheck Protection Loan Program, Payroll Costs do NOT include the following:

- the compensation of an individual employee in excess of an annual salary of $100,000 as prorated for the period beginning on February 15, 2020 and ending on June 30, 2020:

- taxes imposed or withheld under FICA (Social Security and Medicare), Railroad Retirement Act, and IRC Chapter 24;

- any compensation of an employee whose principal place of residence is outside of the United States;

- qualified sick leave or family leave wages for which a credit is allowed under the Families First Coronavirus Response Act. (This means business owners can’t double-dip).

What can I use the loan proceeds for

The business owner who receives a Paycheck Protection Loan may use the proceeds between February 15, 2020 and June 30, 2020 for:

- payroll costs;

- any costs related to continuing group health care benefits;

- employee salaries, wages, commissions or similar forms of compensation;

- rent payments;

- utilities;

- interest payments on any mortgage obligation;

- interest on any other form of debt obligation that was incurred before the period.

What’s the Recipient Good Faith Certification

In order to obtain the PPL, the business owner will be required to sign a certification stating the reason for the loan is related to the uncertainty of the current economic conditions, confirming they don’t have another loan application pending for the same purpose, acknowledging the funds will be used to retain workers and maintain payroll, meet mortgage, rent and utility obligations, and during the period beginning on February 15, 2020 and ending on December 31, 2020, they’ve not received loan proceeds under the PPL for the same purpose.

Do I have to personally guarantee the PPL

No. The Paycheck Protection Loan Program does not require the business owner to personally guarantee the loan. And there are no collateral requirements either.

The SBA will have no recourse against any individual shareholder, LLC members or partner of the business receiving the PPL proceeds for nonpayment unless the loan proceeds are not used for the authorized purposes.

What are the costs associated with the PPL

There are no fees whatsoever to the business owner for the Paycheck Protection Loan program between February 15, 2020 and June 30, 2020.

When do I have to start making PPL payments

The PPL has a loan payment deferral of not less than six months and not more than one year between February 15, 2020 and ending on December 31, 2020.

However, if the loan proceeds are used as the PPL program intended, the PPL may be forgiven and converted to a grant.

How do I get PPL forgiveness or make the PPL a Grant

If the business owner spends the loan proceeds on certain expenses during the eight weeks following receipt of the loan, the loan will be forgiven.

The expenses that will qualify for loan forgiveness include the following:

- Payroll Costs as defined above;

- Interest payments on mortgage obligations of the business incurred before February 15, 2020;

- Rent payments made under a lease agreement in existence before February 15, 2020;

- Utility payments (electricity, water, gas, transportation, telephone, internet access which service began before February 15, 2020

How do I apply for a Paycheck Protection Loan for my business

The SBA has established the procedures for business owner applicants to go through their local banks which are authorized as an SBA lender.

Do the partner earnings from self-employment count as payroll for calculation how the loan proceeds are used ?

And as a result be forgiven ?

That is – can you essentially pay yourself for 8 weeks ?

Please let me know.

Thanks

Hi Bob,

It would seem logical that if the net earnings from self employment is considered ‘payroll costs’ for the purpose of calculating the amount of total loan eligibility that the same form of income would be eligible to qualify for the loan forgiveness in the eight weeks that follow receipt of the loan.

Hopefully, the SBA will provide the banks with more clarity on this once they get past the initial funding phase.

All the best…

I work with a LP where the owners take draws only, no W-2 wages at all. They receive K-1s but that isn’t subject to self employment tax. Does that mean they’re not eligible for a PPP loan?

Hi Brownie,

The SBA PPP Loan Guidelines indicate that what is considered to be ‘payroll costs’ for the purpose of calculating the amount of the PPP Loan includes salary, wages, commissions for employees, employee benefits, state and local taxes assessed on compensation for employees.

As a Limited Partner who is not taking a paycheck from the business and instead is receiving unearned income in the form of profit from the business, the K-1 profit is not any of the above. It’s not income subject to self-employment taxes (known as net earnings from self-employment). Therefore, it seems to me their K-1 income would not be eligible.

That said, the authorized SBA banks are the authority on what they will and will not accept as substantiation for the PPP Loan payroll costs. It would be wise to address your question to your SBA Bank business representative.

All the best…

Do all Employees have to be retained during the Paycheck Protection Loan program? We have an employee that we need to let go because of misconduct and bad customer relations, in no way related to COVID19.

Hi Darl,

The PPP Loan may be forgiven if the proceeds are spent on payroll costs and certain other costs like rent, mortgage interest and utilities during the 8 weeks following receipt of the loan.

The amount of money you spend on payroll may not decrease by more than 25%. So if letting go that one troublesome employee causes your retention rate to drop below 75%, you may have a problem.

All the best…

For LLCs that pay members on K-1s rather than W-2s, are the guaranteed payments to members considered “payroll costs” for these PP loans?

In the case that a LLC issues K-1s to it’s members, and the income is subject to SE taxes, does the LLC file an application for the PPP or does the member file an application as a self employed individual?

Hi Cathy,

The eligible business for the PPP Loan would be your LLC, not the members.

All the best…

Hi Chuck,

The regs do not spell out how K-1 income from S Corps should be handled.

What it does say is for those who are self-employed, their net earnings from self-employment is a qualified payroll cost.

That implies to me that only income that’s been taxed for FICA and Medicare would be a qualified payroll cost.

So for LLCs, it’s a bit tricky. And that’s because not all LLCs are treated for tax purposes the same way. It depends on how an LLC is being treated for federal tax purposes.

If the LLC is being treated for tax purposes as a Partnership, the income is subject to Self-Employment Taxes on their personal income tax returns. It seems that this income should be included in total payroll costs.

If the LLC is being treated for tax purposes as a S Corp, the K-1 income is NOT subject to Self-Employment Taxes on their personal income tax returns. It seems that this income should NOT be included in total payroll costs.

It would be great if the regs would spell it out a bit more clearly.

That said, I don’t envy the banks who are trying to figure this out and to train all of their underwriters :O

Hope this helps…

What is consider gross wages ? Medicare wages ? Is the amount including bonuses paid in 2019?

Could you please clarify?

Thank you

Hi Sot,

Gross wages should be the total amount of wages paid, including bonuses, to an employee.

The regulations say the amount should be the last twelve months when calculating the Total Payroll Costs.

However, I am aware of banks accepting 2019 as the 12 month period.

I guess it’s best to follow what your bank is recommending…

The definition of “pay” has me puzzled. I am helping a friend apply (no, really!) who is a real estate agent on 100% commission, has a sub S, is the only employee, and pays herself only a small salary. Her PPP loan amount would be very small if she is only an employee. If she did not have the Sub S and reported her commission income on schedule C, her loan amount would be much larger. My question would be is her total “self employment” income (which is reported by the sub S) eligible in the PPP loan / foregiveness calculation or only her status as an employee of her own Sub S? Thanks

Hi Mark,

The definition for businesses includes payroll paid to employees whose principal place of business is in the US), group health insurance premiums paid for employees, retirement contributions paid by the business and state and local taxes assessed on employees’ compensation.

If the business is a Sole Proprietor or Independent Contractor, they can include wages paid, commissions paid and their net earnings from self-employment.

S Corp shareholders do not have self-employment income. They may have a profit, however it’s not considered to be self-employment income subject to FICA and Medicare.

Does this make sense?

Has anyone submitted an application to an SBA approved lender for the paycheck protection loan?

Hi Julie,

No, not yet. See my reply to Frank’s question below for more details.

Where is application for PP Loan

How to apply for self employed

Hi Frank,

The application for the Paycheck Protection Loan is not available yet. The SBA is working on that.

Here’s where you may go to submit your contact information and we will contact you regarding the next steps asap.

It also defines the documents you should begin to gather so you’re ready to make your application.

Hope this helps…

Just a comment. Unless I’m not understanding the rules correctly there are quite a few cities with high costs of living where $100k is not an uncommon salary yet those employees don’t qualify.

Thank you. I talked to two SBA lenders in Seattle today and they didn’t know this.

Happy to help you!

More details will be forthcoming this week. At least that’s what our SBA contact is telling us!

Hi Mark,

I understand this part of the computations may be confusing.

To clarify, it’s not the entire salary that’s excluded from the eligible Payroll Costs for the PPL. Instead, it’s the excess over $100,000.

For example, if the salary of one of your employees is $175,000., $100,000. would be included in the eligible Payroll Costs computation. The excess amount of $75,000 would not be included.

Hope this helps a bit…

Can I send/repost your article “How the Paycheck Protection Loans Work” to some of my clients?

Hi Chris,

Yes, of course! Feel free to share a link to our post via email or on social media.

The more business owners who are able to access these funds, the more likely they will survive.

All the best…