- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

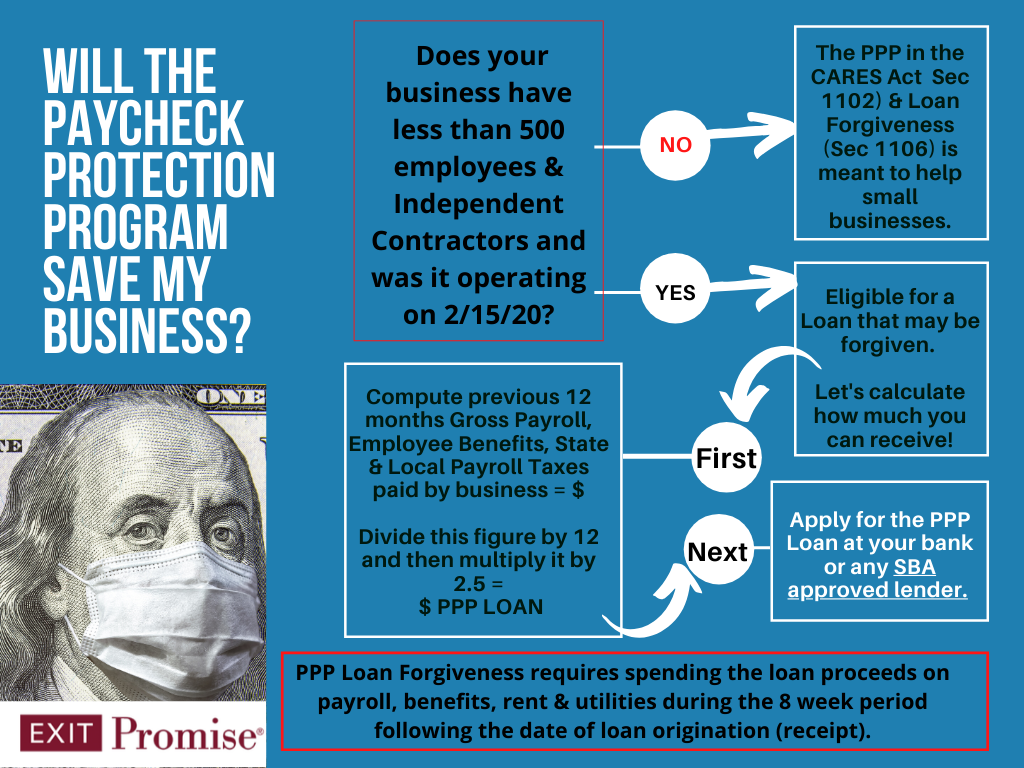

On Friday, March 27, 2020, the Paycheck Protection (Loan) Program (PPL) for small businesses was approved as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This new law is intended to help small business owners in an unprecedented way.

On June 5, 2020, the Paycheck Protection Program Loan Flexibility Act was signed into law and loosened the rules for business owners to qualify for loan forgiveness. This post has been updated to reflect these changes.

First, while the Paycheck Protection Program Loan will be initially set up by banks and approved by the SBA under section 7 (a), unlike other SBA loan programs, the PPL is guaranteed 100% by the SBA.

Second, if the proceeds of the loan are used by business owners as Congress, the Senate and President Trump intended, the loan will be forgiven.

Essentially, how the paycheck protection loans work for small business owners depends on whether loan proceeds are used properly. If so, the loan becomes a grant from the federal government to help you get your business back in business as soon as possible.

In this post, we will cover the following about the Payroll Protection Loan program:

- How to qualify for the Paycheck Protection Loan?

- What type of Employees are eligible for the PPL?

- How much is the maximum amount of PPL available for my business?

- What’s included in Payroll Costs when calculating the maximum PPL?

- Which Payroll Costs do NOT qualify for the PPL?

- What can I use the loan proceeds for?

- What’s the Recipient Good Faith Certification?

- Do I have to personally guaranteed the PPL?

- What are the costs associated with the PPL?

- When do I have to start making PPL payments?

- How do I get PPL forgiveness or make the PPL a Grant?

- How do I apply for a Paycheck Protection Loan for my business?

How to qualify for the Paycheck Protection Loan

In order to qualify for the PPL, the business must have been in operation on February 15, 2020 and had employees being paid wages, salary and payroll taxes OR paid independent contractors and reported those payments on federal form 1099-MISC.

What type of Employees are eligible for the PPL

The PPL eligible business may not have employed more than 500 employees as of February 15, 2020. The term employee includes individuals who work on either a full-time or part-time basis.

The Accommodation and Food Services businesses may measure the employee count based on each physical location.

And for those individuals who operate their business as sole proprietors (filing a tax return on a Schedule C) or as a self-employed business owner, they also may be eligible to receive a Paycheck Protection Loan.

How much is the maximum amount of PPL available for my business

During the period from February 15, 2020 and ending on June 30, 2020, the maximum PPL amount is the LESSER of:

- The AVERAGE TOTAL MONTHLY PAYMENTS by the business owner for PAYROLL COSTS incurred during the one-year period before the date on which the loan is made MULTIPLIED BY 2.5;

- PLUS any outstanding loan amounts that were made beginning on January 31, 2020 and ending on the date the business owner receives the PPL, which may be eligible to be refinanced under the PPL

OR

- $10,000,000.

What’s included in Payroll Costs when calculating the maximum PPL

Under the Paycheck Protection Loan Program, Payroll Costs include the following:

- Salary, Wages, Commissions and similar forms of compensation;

- Payment of cash tips or equivalents;

- Allowances for dismissal or separation payments;

- Payment of vacation, parental, family, medical or sick leave;

- Group Health Care Benefits, including insurance premiums;

- Retirement Benefits paid by the employer;

- State and Local Taxes assessed on employee compensation paid by the business;

- The sum of payments of any compensation to or income of a Sole Proprietor or Independent Contractor that is wage, commission, income, net earnings from self-employment or similar compensation and that is in an amount not exceeding more than $100,000 in one year, as prorated for the period beginning on February 15, 2020 and ending on June 30, 2020.

Which Payroll Costs do NOT qualify for the PPL

Under the Paycheck Protection Loan Program, Payroll Costs do NOT include the following:

- the compensation of an individual employee in excess of an annual salary of $100,000 as prorated for the period beginning on February 15, 2020 and ending on June 30, 2020:

- taxes imposed or withheld under FICA (Social Security and Medicare), Railroad Retirement Act, and IRC Chapter 24;

- any compensation of an employee whose principal place of residence is outside of the United States;

- qualified sick leave or family leave wages for which a credit is allowed under the Families First Coronavirus Response Act. (This means business owners can’t double-dip).

What can I use the loan proceeds for

The business owner who receives a Paycheck Protection Loan may use the proceeds between February 15, 2020 and June 30, 2020 for:

- payroll costs;

- any costs related to continuing group health care benefits;

- employee salaries, wages, commissions or similar forms of compensation;

- rent payments;

- utilities;

- interest payments on any mortgage obligation;

- interest on any other form of debt obligation that was incurred before the period.

What’s the Recipient Good Faith Certification

In order to obtain the PPL, the business owner will be required to sign a certification stating the reason for the loan is related to the uncertainty of the current economic conditions, confirming they don’t have another loan application pending for the same purpose, acknowledging the funds will be used to retain workers and maintain payroll, meet mortgage, rent and utility obligations, and during the period beginning on February 15, 2020 and ending on December 31, 2020, they’ve not received loan proceeds under the PPL for the same purpose.

Do I have to personally guarantee the PPL

No. The Paycheck Protection Loan Program does not require the business owner to personally guarantee the loan. And there are no collateral requirements either.

The SBA will have no recourse against any individual shareholder, LLC members or partner of the business receiving the PPL proceeds for nonpayment unless the loan proceeds are not used for the authorized purposes.

What are the costs associated with the PPL

There are no fees whatsoever to the business owner for the Paycheck Protection Loan program between February 15, 2020 and June 30, 2020.

When do I have to start making PPL payments

The PPL has a loan payment deferral of not less than six months and not more than one year between February 15, 2020 and ending on December 31, 2020.

However, if the loan proceeds are used as the PPL program intended, the PPL may be forgiven and converted to a grant.

How do I get PPL forgiveness or make the PPL a Grant

If the business owner spends the loan proceeds on certain expenses during the eight weeks following receipt of the loan, the loan will be forgiven.

The expenses that will qualify for loan forgiveness include the following:

- Payroll Costs as defined above;

- Interest payments on mortgage obligations of the business incurred before February 15, 2020;

- Rent payments made under a lease agreement in existence before February 15, 2020;

- Utility payments (electricity, water, gas, transportation, telephone, internet access which service began before February 15, 2020

How do I apply for a Paycheck Protection Loan for my business

The SBA has established the procedures for business owner applicants to go through their local banks which are authorized as an SBA lender.

As a independent contractor I only have one employee and that is me. How do I disperse the funds. I am slowly getting to back to work. I am afraid to touch my loan without the guidelines required. Thank you for your help!

Hi Susan,

You’ve described your business as an Independent Contractor. That would imply you are a sole proprietor and file a Federal Schedule C each year for your taxes. Yes?

If so, you (Susan) would not be an ‘EMPLOYEE’ of your business.

Instead, you would be the owner of your business and take any form of compensation for your work by writing yourself a check.

This is only the case IF you are a sole proprietor (or a partner in a partnership). If your business is a corporation (S or C) or an LLC that’s being treated for tax purposes as a corporation, then you should set yourself up as an employee of the business and pay yourself via payroll.

If you have a PPP Loan, then you have a finite period of time (up to 24 weeks after you received your PPP Loan proceeds) to spend the money (on payroll and other qualified expenses) if you want the loan to be forgiven.

I hope this clarifies things a bit for you Susan!

When an employee receives unearned income from a PPL, are taxes taken out of this money before dispersing to employee

Hi Barbara,

If an employee is being paid, regardless of the source of funds — PPP proceeds, cashflow from the business, or other capital — the payroll taxes (Federal, State and Local income taxes, FICA and Medicare taxes and possibly unemployment taxes) should be deducted from the gross salary or wages. The PPP Loan proceeds used to pay the employee for working or not working is irrelevant.

Hope this helps…

Can the ppl be used to pay credit card debit from living and using for expenses to pay bills?

Hi Doris,

No, using the PPP Loan proceeds for credit card debt is not permissible.

And the only expenses eligible as qualified expenses for the PPP loan forgiveness are the business expenses defined by the SBA.

You can’t pay for personal expenses, if that’s what you’re asking.

As an owner of a duplex rental i receive a 1099 Misc.

Last year we filed a Schedule E, which is giving me trouble qualifying for a PPP loan.

Just submit the 1099?

Can I file a schedule C instead of E?

Albert:

Your rental income is reported on Sch E. It never goes on Sch C. If you put rentals on Sch C, you would be subject to self-employment tax.

Filing a Sch E on your tax return has NO effect on qualifying for a PPP loan. A PPP loan is for businesses with employees (even if you are the only employee). Rental income, especially if you are only managing your 1/2 duplex, is not a business; it is considered a passive investment by definition.

Mr. Klein, if this is true and a rental business is not considered a business by your definition of a passive investment, then why does the SBA allow Schedule E to be used for an EIDL Loan for small businesses and why does it qualify as Qualified Business Income (QBI) when filing taxes? I have not been able to find an answer directly but I know for sure the SBA itself does allow a Schedule E to be used to prove business ownership for a sole proprietorship since I did this myself to allow my tenants some relief. Would you have to create an LLC company and file the rental income under the LLC to then qualify? It seems a disconnect from PPP to EIDL. Thanks in advance as I’ve done much research on this and cannot find an answer.

I am a sole proprietor who applied through one financial organization offering the PPP, but they replied that I would not qualify for the loan because I qualified for too little money. Is that possible? I can only find limitations on maximum amounts.

My earning vary a great deal by month and by year, so basing the amount on just one year’s Schedule C net profit seems weird. The net profit is arrived at after one deducts expenses for the use of a home office, and a percentage of all the consequent expenses (utilities, etc.) So am I really not able to qualify because I earned too little after paying all my expenses?? Thank you!

Can I fill out the information on the sba loan myself?

Hi Tyrone,

Yes, applying for the SBA loans — PPP or EIDL — may be done by the business owner.

PPP Loan applications are accepted through SBA-approved banks.

The EIDL loan is applied for directly through the SBA’s website.

All the best…

Mary:

While the SBA has no minimums, the lenders do. They get paid a flat fee on small loans not to exceed 5%, plus a whopping 1% interest. If you ask for a $5,000 loan, the bank’s maximum income is $300, which isn’t enough to cover its expenses plus its expected profit margin on a potential 2-year loan. So a lender can set its minimum at any level. As of today, however, the PPP is closed to new loans, so I’m sorry that you were not able to find a lender to assist you in the time the program was open.

How do you report & were do you report a company that you work for if they do not distribute the funds once they receive the ppl loan??? Some company’s are not following protocol.

what do I need to apply for the ppl

Jacqueline:

Sorry to hear that your company is not using the funds from the PPP loan in the way that benefits you, however, the company has no obligation to spend the money on payroll. If the owner(s) of the company are comfortable with the PPP being a low cost loan, they are able to use the funds for almost any business purpose–they just won’t qualify for forgiveness of the loan.

Therefore, there is nothing to report since the owners have not broken any law or promise simply by not using the money for payroll purposes.

Does the PPL include vacation pay and 401K contributions.

Hi Evelyn:

I am assuming you mean PPP money that qualifies for forgiveness.

All gross pay to employees (including yourself if you are on payroll or you are a partner) qualifies for forgiveness whether it is wages, vacation pay, sick pay, etc., as long as the annualized amount is 100K or less for all compensation to a single employee.

Employer matching 401(k) contributions also qualify. Employee elective payments to their 401(k) do not qualify because that is coming from the employee’s gross pay and is already counted.

What if your boss is not paying tips and he cut our average hours down. He has his kids working the bakery doing curb side but none of the other staff. Could he be paying them a lot extra and not being fair to us? We all went on unemployment and then found out he was going to start paying us through PPP. Doesn’t seem like he is being fair. Thanks

Hi Jo ann,

I am sorry. It sounds as if you are frustrated and understandably so.

The PPP Loans provide businesses cash to keep employees on their payroll. The program does not require employers to re-hire the pre-pandemic employees. Instead, the PPP Loan is intended to provide cash to the business to maintain at least 75% of its workforce (measured by Full-Time Equivalents). The employers are free to pay whomever they choose to hire as employees.

The PPP Loan was meant to help businesses survive during the pandemic, especially for those businesses that were forced to close its doors.

I am not familiar with the rules around paying out tips. This may be an issue to address with your state’s department of labor.

If your average hours have been reduced, you may be eligible for partial unemployment benefits. Every state has its own unique rules for partial unemployment.

Hope this helps a bit…

Dear Joann

Thank you for your question. Some of the concerns you are asking advice on should be directed to the companies HR department or talk directly to the owner of the business. As for the PPP loans and unemployment, concerns you can find the answers to these questions at the attached SBA link.

https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program