- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

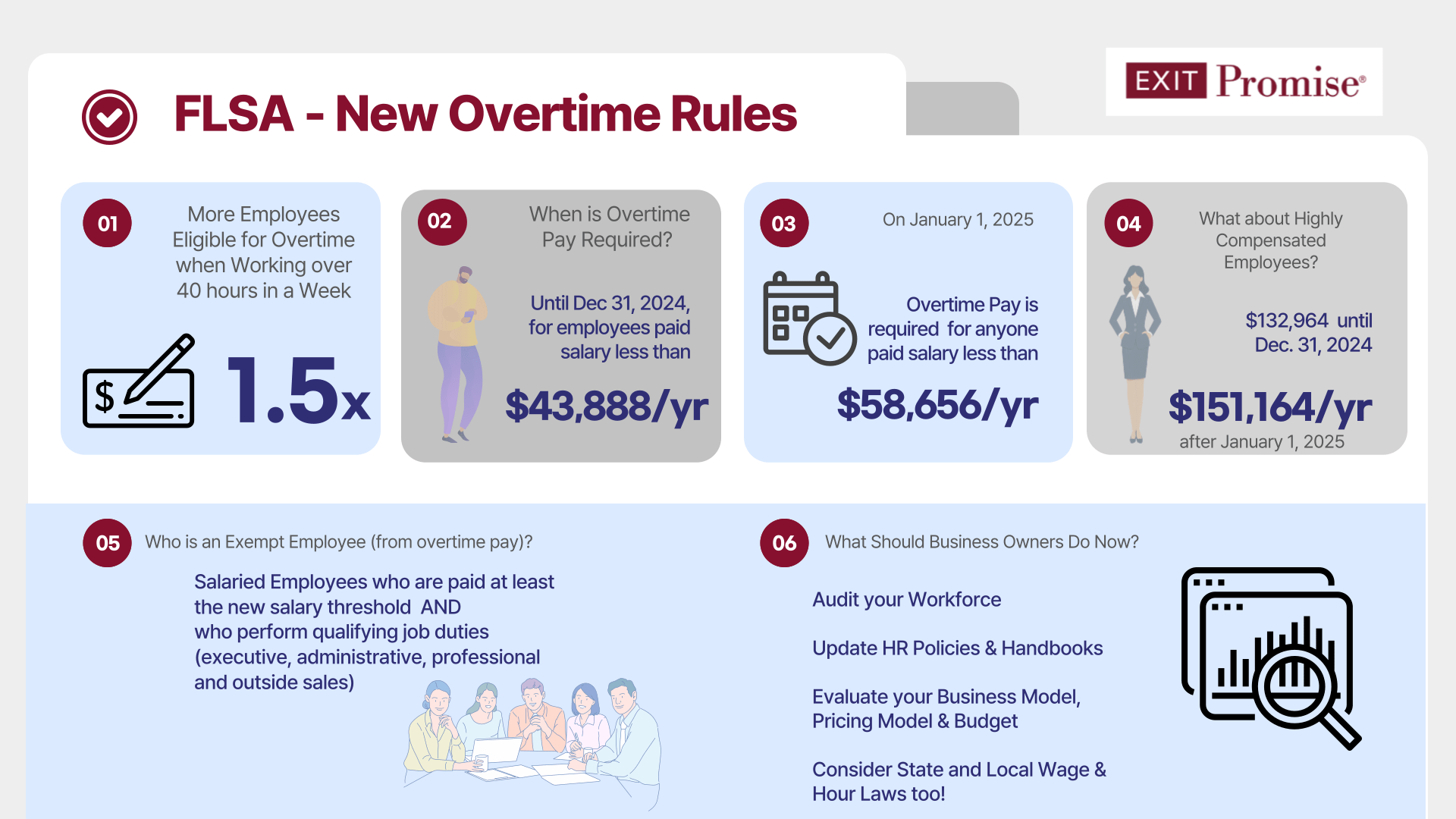

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

UPDATED on November 19, 2024

On November 15, 2024, the U.S. District Court for the Eastern District of Texas ruled in favor of plaintiffs challenging a recent Department of Labor (DOL) rule. This rule raised the minimum weekly salary level for “exempt” status under the Fair Labor Standards Act (FLSA). The court issued a summary judgment blocking scheduled nationwide pay rate increases for exempt employees set to take effect on July 1, 2024, and January 1, 2025. As a result, the required salary threshold for classifying “white-collar” jobs as exempt will remain at $35,568 per year or $684 per week.

The District Court found that the DOL had overstepped its authority by establishing the new standards. Under the FLSA, employees who fulfill specific duties and earn a salary at least equal to the federal threshold are exempt from receiving overtime pay for hours worked beyond 40 hours a week. With the DOL Rule’s increases blocked, employers may need to reassess any recent adjustments to meet the previously expected July 2024 threshold. Additionally, employers may want to review the job duties of employees classified as exempt to ensure compliance, as errors in classification could expose employers to individual liability and even class-action lawsuits.

*************

Business owners face a new federal law that may negatively impact their profitability and increase administrative costs.

In 2024, the U.S. Department of Labor (DOL) recently issued a final rule that significantly increases the salary threshold for employees to be classified as exempt from the Fair Labor Standards Act (FLSA) overtime pay requirements.

This change will result in more employees being classified as non-exempt, which means they will be eligible for overtime pay and subject to the FLSA’s requirements for accurate timekeeping records. According to the DOL published FAQ #17 regarding the new overtime rule, nearly 4.3 million workers have or will become eligible for overtime compensation unless their employers intervene.

The new overtime rule aims to extend overtime protections to millions of previously exempt workers. While this may offer more financial security to employees, it presents challenges for employers in terms of increased labor costs and potential disruption to business operations.

In this article, we will explore the impact of the new overtime rule on businesses. We’ll delve into the details of the rule, its purpose, and how it may affect your workforce and bottom line.

The New Overtime Rule Under the Fair Labor Standards Act (FLSA)

In 2024, the U.S. Department of Labor (DOL) introduced significant changes to the FLSA’s overtime regulations, substantially impacting all U.S. businesses. The Fair Labor Standards Act (FLSA) is a federal law applicable to employers that establishes standards for minimum wage, overtime pay, recordkeeping, and child labor.

All employees are covered by the FLSA and will benefit from the new overtime rule unless the business or enterprise has less than $500,000 in annual revenue. If the business or enterprise is a hospital or establishment providing medical or nursing care for residents, schools, or public agencies, or if engaged in interstate business, the $500,000 minimum annual revenue exception does not apply.

These new overtime rules intend to expand the number of eligible workers for overtime pay. Specifically, the DOL has increased the salary threshold for “white-collar” exemptions, which are employees who are exempt from receiving overtime pay. In 2024, the new rule raises the minimum salary level for these exemptions established on January 1, 2020, from $35,568 to $43,888 annually. On January 1, 2025, the minimum salary will increase to $58,656, making more employees eligible for overtime compensation.

According to the DOL, the next update to the salary thresholds will be effective July 1, 2027, and will subsequently be updated every three years.

Who is Exempt from FLSA Overtime?

Under the FLSA, employees below the salary threshold are generally entitled to receive overtime pay at 1.5 times their regular hourly rate for all hours worked beyond 40 hours in a workweek unless they qualify for specific exemptions.

To classify an employee as exempt from overtime pay, a business owner as the employer must satisfy three criteria:

The Salary Basis Test – The employee must be paid on a salary basis, not hourly.

The Salary Level Test – The employee’s salary must meet or exceed a specified threshold.

The Duties Test – The employee’s primary job duties must align with those outlined in one of the FLSA’s exemptions, such as the executive, administrative, or professional exemptions. If the duties do not meet these requirements, the employee may still be considered non-exempt even if the salary threshold is met.

What Exactly are the FLSA’s Executive, Administrative, Professional, and Outside Sales Exemptions?

Executive Exemption: An employee qualifies for the executive exemption if they primarily manage the enterprise or a recognized department, regularly direct the work of at least two full-time employees, and have authority or influence over hiring and firing decisions.

Administrative Exemption: This applies to employees who perform office or non-manual work directly related to management or general business operations and exercise discretion and independent judgment on significant matters.

Professional Exemption: The professional exemption covers employees whose job requires advanced knowledge in a field of science or learning, typically obtained through prolonged specialized education (e.g., doctors, accountants, lawyers, engineers, teachers, etc). Employees who fall into the professional category are not subject to the salary basis or salary level tests.

Outside Sales Exemption: This applies to employees whose primary duty is making sales and who regularly work away from the employer’s place of business. Similar to professional employees, outside sales employees are not subject to either the salary basis or salary level tests.

There is also a Highly Compensated Employee (HCE) Exemption, which applies to employees who perform non-manual work and earn a significantly higher total annual compensation than the standard threshold. As of July 1, 2024, the HCE salary threshold is $132,964, which will increase to $151,164 on January 1, 2025.

Highly compensated employees who meet the minimal HCE duties test are those whose primary duty includes performing office or non-manual work and customarily and regularly performing at least one of the exempt duties or responsibilities of an exempt executive, administrative, or professional employee.

The Department of Labor updated the Computer Employee Exemption in August 2024. This exemption applies to certain employees who work as computer systems analysts, computer programmers, and software engineers and earn at least $27.63 per hour. Employees in certain computer-related positions must be paid more than $27.63 per hour to be considered exempt employees for FLSA overtime pay rules.

Evaluate the Impact of the New FLSA Rules and Salary Thresholds

One critical step in achieving compliance is conducting a thorough workforce audit. A workforce audit involves reviewing all employees’ job duties, responsibilities, and compensation levels to determine their eligibility for overtime pay.

As the employer, you have three options when you find an employee does not meet the new salary threshold and does not meet the duties test:

- Pay one and one-half times their hourly wage for work time above 40 hours per week.

- Increase their salary to meet the new salary threshold.

- Limit overtime hours.

It’s important to note that even if you raise an employee’s salary to the new threshold, they must still meet the duties test to be considered exempt from overtime pay!

As the employer, you should be particularly diligent in reviewing the status of employees previously classified as exempt under the old salary threshold.

In addition to the workforce audit, businesses will need to update their payroll and timekeeping systems to track and record overtime hours worked by non-exempt employees accurately.

Employers should also review and update their employee handbooks, policies, and procedures to reflect the changes the new overtime rule brings.

Employers may face higher payroll and benefits expenses with more employees eligible for overtime pay. The consequences could necessitate budget adjustments, pricing, or staffing levels to maintain profitability. Based on updated wage data, the salary thresholds will automatically adjust every three years. For many employers, the increasing labor costs will affect their annual budget this year and in the following years.

Although the rule is subject to ongoing litigation, employers should assume the employment costs will continue to rise due to the new FSLA rule.

Employers should also stay mindful of state and local wage and hour laws, as they may impose additional or stricter requirements than the FLSA. If a state or local government establishes more protective overtime rules, they should be followed.

Employers can take these steps to ensure compliance with these important changes, minimizing the risk of FLSA violations and potential penalties.

How to Manage and Minimize the New Overtime Rules

In response to these increased costs, some businesses may restructure their workforce by reducing the hours worked by specific employees or hiring additional part-time or temporary workers to avoid triggering overtime pay. Others may explore alternative scheduling options, such as flexible work arrangements or compressed workweeks, to better manage overtime expenses.

Additionally, businesses may need to reevaluate their hiring and promotion practices to align with the new overtime regulations. This process may involve adjusting job descriptions, compensation packages, and career advancement opportunities to attract and retain talent within the new parameters of the FLSA.

Effective communication and training will be critical as businesses navigate these operational changes. Employers should proactively engage with their employees to explain the new overtime rules, address any concerns, and ensure that managers and supervisors understand their responsibilities in implementing the latest policies and procedures.

New Overtime Rules Impact on Businesses

Implementing the new overtime rule has the potential to impact businesses across various industries significantly. While the primary goal of the rule is to provide greater financial protections for workers, the implications for employers can be far-reaching and complex.

One of the most significant impacts will be the increased labor costs associated with the expanded eligibility for overtime pay. Employers will need to carefully evaluate their workforce and compensation structures to ensure compliance, which may result in higher payroll expenses, particularly for those businesses with a significant number of employees earning below the new $58,656 salary threshold, effective January 1, 2025.

In addition to the financial implications, the new overtime rule may also disrupt business operations and introduce challenges related to workforce management. Employers may need to adjust schedules, reassign tasks, or hire additional staff to ensure critical functions are performed within the new overtime guidelines. Doing so could disrupt productivity, customer service, and business continuity.

Furthermore, implementing the new rule may disproportionately impact specific industries, such as retail, healthcare, and hospitality, where lower-wage and middle-income jobs are more prevalent. Accounting, consulting, and legal services firms often rely on salaried, knowledge-based workers who may now be eligible for overtime pay. Adapting to the new rule could require these businesses to reevaluate their compensation structures and talent management strategies. These industries may face more significant challenges in adapting to the new regulations, potentially leading to increased costs, reduced profitability, and even changes in business models.

Regardless of the industry, employers will need to carefully analyze the potential impact of the new overtime rule on their specific business model, workforce, and operational needs. By proactively addressing these challenges, businesses can position themselves for success despite the evolving regulatory landscape.

Legal Considerations and Challenges under the New FSLA Overtime Rules

Navigating the legal landscape surrounding the new overtime rule is critical to ensuring compliance and mitigating potential business risks. Employers should be aware of the various legal considerations and potential challenges they may face in implementing the new regulations.

One of the primary legal concerns is the risk of misclassification of employees. Employers must carefully review their workforce’s duties, responsibilities, and compensation levels to ensure all eligible employees are classified as non-exempt and receive the appropriate overtime pay. Misclassification can lead to costly lawsuits, fines, and back-pay obligations.

Additionally, businesses may need help interpreting and applying the new overtime rule. As with any new regulation, ambiguities or gray areas may require legal expertise. Employers should consult legal counsel to ensure their policies and practices align with the DOL’s guidance and interpretations.

Another potential legal risk is the possibility of employee lawsuits or claims related to implementing the new overtime rule. Employees who feel their rights have been violated or unfairly treated may seek legal recourse. Employers should proactively address employee concerns and maintain clear and consistent communication to mitigate the risk of such claims.

Furthermore, businesses should be aware of state-level overtime regulations that may be more stringent than the federal FLSA. In such cases, employers must comply with the more favorable overtime provisions for their employees, which may require additional adjustments to their policies and practices.

Always consult your attorney regarding these important legal matters before making any changes or decisions regarding employment matters.

Key Takeaways

The 2024 changes to the Fair Labor Standards Act’s overtime regulations represent a significant shift in the business landscape, with far-reaching implications for employers across various industries. As a business owner, it is crucial to understand the critical aspects of the new overtime rule and develop a comprehensive strategy to ensure compliance and mitigate the potential risks.

- The new overtime rule raises the salary threshold for “white-collar” exemptions from $35,568 to $58,656 annually, making more employees eligible for overtime pay.

- Employers must consider more than the employee’s salary – their job duties matter!

- Compliance with the new rule requires thoroughly reviewing your workforce, updating payroll and timekeeping systems, and revising policies and procedures.

- Businesses must adjust their operations, such as workforce optimization, technology adoption, and alternative compensation structures, to manage the increased labor costs.

- Effective communications with employees regarding overtime policies, time-keeping procedures, and reporting will be necessary.

- Specific industries, such as retail, healthcare, professional services, and nonprofits, will likely be more significantly affected by the new overtime rule and will require tailored strategies for adaptation.

- Legal considerations, such as employee misclassification and state-level regulations, must be carefully addressed to avoid potential challenges and liabilities.

By staying informed, proactively planning, and implementing strategic measures, business owners can navigate the changes brought about by the new overtime rule and position themselves for success in the evolving regulatory environment.