- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Do you have a Question?

Ask below. One of our Investors or Advisors will Answer!

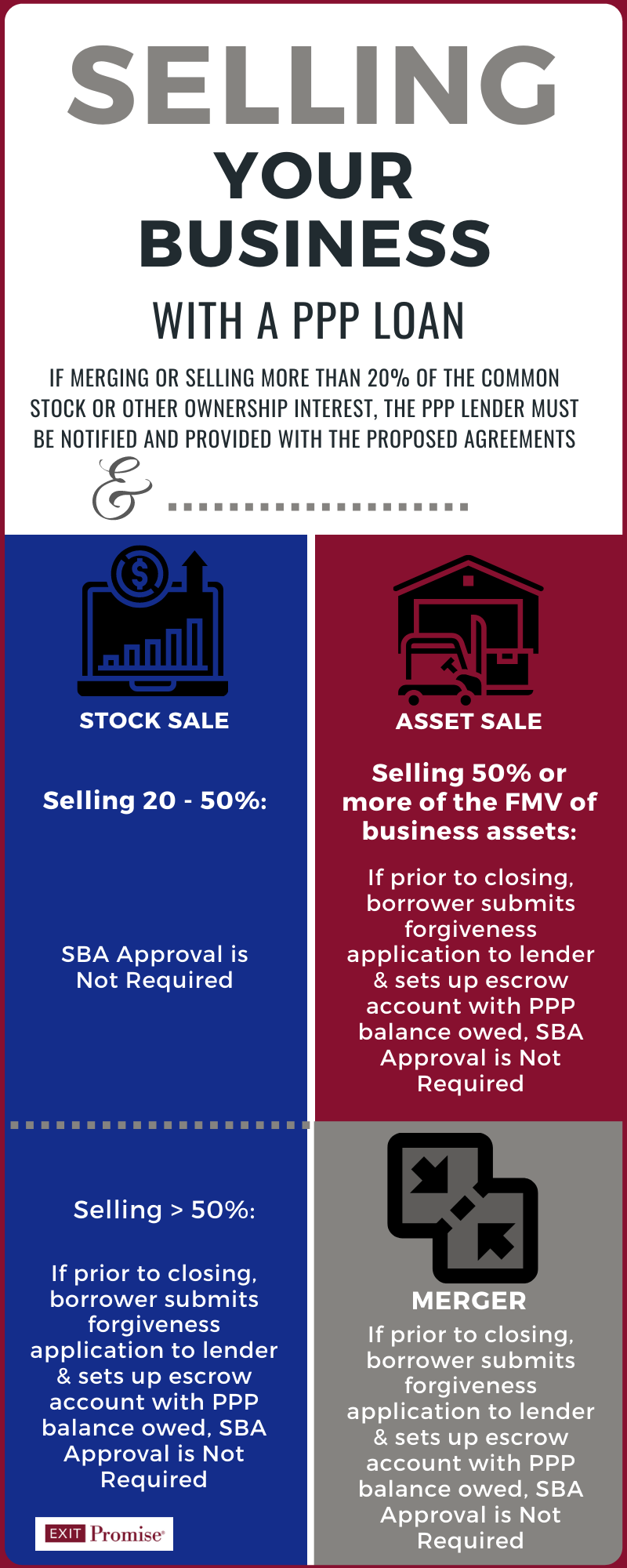

The Small Business Administration (SBA) issued a Procedural Notice on October 2, 2020 which offers business owners and lenders guidance on how Paycheck Protection Program (PPP) Loans are to be handled when a business has a change in ownership.

This post summarizes the notice and includes an Infographic to assist business owners. It includes the following topic:

- When does a Business Sale Require the SBA’s Approval

- Does a Business Sale Require the PPP Lender’s Approval or Notification

- Required Steps Pre and Post-Closing for PPP Borrowers

- SBA Timeframe to Approve a Sale or Merger when a PPP Loan Transfers

- Does the EIDL Grant Impose Additional Steps When Selling a Business

This guidance has been long overdue. Until now, business owners, lenders and M&A advisors have not had clear guidance about how a PPP loan should be handled when a business is sold, merged, or had a partial shareholder change of ownership.

The SBA guidance under this Procedural Notice defines “change of ownership” as when one of three events occur:

- At least 20% of the common stock or other ownership interest of a PPP borrower is sold or otherwise transferred. This form of business sale is considered a stock sale. All sales and other transfers that have occurred since the date of the approval of the PPP loan must be aggregated to determine whether the relevant threshold has been met. Transfers to an affiliate or an existing owner of the entity must be considered as well; or

- the PPP borrower sells or otherwise transfers at least 50% of its assets in one or more transactions; or

- a PPP borrower is merged with or into another entity.

When Do Business Owners with PPP Loans Not Need to Notify the SBA or Lender About a Sale?

If your business received a PPP loan and you’re considering a sale, there are three circumstances where you will not be required to involve the SBA or your lender in the process:

1. PPP Loan Fully Satisfied Prior to Business Sale Closing

If the PPP borrower, prior to the closing or sale, has either repaid the PPP loan in full or has completed the loan forgiveness process and the SBA has paid the PPP lender (your bank) in full, and/or the PPP borrower has repaid any remaining (unforgiven) balance in full, then no restrictions or SBA notifications are required of the PPP borrower or successor.

2. Sale or Transfer of <20% of Common Stock or Other Ownership Interest

If the sale or transfer represents less than 20% of the common stock or other ownership interest in the business, it is not considered an ownership change. Accordingly, neither the SBA nor the lender needs to be notified.

3. Sale or Transfer of <50% of the Business’ Fair Market Value of its Assets

Similar to the sale or transfer of less than 20% of the stock or other ownership interest in the business, if the sale or transfer represents less than 50% of the business’ FMV of its assets, it is not considered a change in ownership. Accordingly, neither the SBA nor the lender needs to be notified.

When Do Business Owners with PPP Loans Need to Involve the SBA and/or Lender in the Sale?

If you’re contemplating the sale of your business and you are not fortunate enough to fall into one of the three situations noted above, you will need to involve the SBA and/or lender in the sale process.

At a minimum, you will be required to notify your PPP lender in writing about the sale and provide the lender with a copy of the proposed purchase agreements.

Whether you will be required to take additional steps before the closing or to obtain the SBA’s approval depends on the type of sale (stock vs asset), the amount of ownership or assets being sold, or if the transaction is a merger.

If the type of business sale is a ‘stock sale’, where 20% or more of the common stock or other form of ownership is being sold, the SBA’s approval will not be required.

If the type of business sale is an ‘asset sale’, where 50% or more of the FMV of the business’ assets is being sold, the SBA’s approval will not be required.

If the transaction is a merger with or into another entity, the SBA’s approval will not be required.

With that said, unless the sale or transfer involves between 20% but less than 50% of the common stock or other ownership interest or is less than 50% of the FMV of the assets, there are other steps the seller and buyer will need to take before the closing to address any PPP liability.

Required Steps PPP Loan Require Pre and Post Closing When 50% or more of the Common Stock, Other Ownership Interest or FMV of the Assets are Sold or Merged

The following steps will be required:

- Complete and submit to the PPP Loan lender the forgiveness application before the closing.

- Establish an interest-bearing escrow account with the PPP Lender with the outstanding amount of PPP loan before the closing.

- Upon the conclusion of the PPP loan forgiveness process, disburse the escrow fund to repay any PPP loan balance plus any applicable interest.

- The PPP lender must also notify the SBA loan Servicing Center about the escrow account, its location, and amount within five business days of the closing.

SBA Approval is Required in Certain Circumstances Before Sale or Merger

When more than 50% of the ownership interest (stock, LLC member units, partnership shares) or when more than 50% of the FMV of the business’ assets are sold, the SBA will require pre-approval if the PPP note has not been paid in full and the the requirements noted above related to the escrowed fund cannot be met. The PPP lender handles this approval process.

The SBA’s approval of the sale or merger, under this scenario, will be conditioned on the buyer assuming all of the seller’s PPP loan obligations. Either a separate loan assumption agreement or an inclusion of the PPP loan obligation language in the transaction’s purchase agreement will be required and reviewed by the SBA.

The SBA has 60 calendar days to review and respond to the request.

Does Selling My Business Mean the PPP Loan Obligations Disappear?

The simple answer is ‘no’. Regardless of the type of sale, amount of the stock or other ownership interest transferred or sold, percentage of the assets FMV transferred or sold, or whether the transaction is considered a merger, if your business’ PPP loan has an outstanding balance, the original PPP loan recipient will remain subject to all obligations under the PPP loan.

This means as the seller of a business with an outstanding PPP loan balance, the responsibility for the PPP loan repayment, certifications, reporting compliance, and the retention of all SBA and lender forms and supporting documentation does not transfer to the buyer upon sale or merger.

Will the Sale or Merger be Reported to the PPP Lender?

If the transaction is considered a ‘change of ownership’ according to the Procedural Notice (defined above), the PPP lender will be required to notify the SBA about the identity of the new owners, their ownership percentage, the TINs for any owner holding 20% or more of the business equity and, if required, the escrow account location and amount.

Two (or more) PPP Loans Must be Segregated Post Sale or Merger

The segregation of PPP funds is required if more than one PPP loan exists after a change in ownership or merger occurs. This means the funds, as well as the expense records related to the loan, must be segregated and tracked to demonstrate compliance with the PPP loan’s requirements.

And in the case of a merger, the successor (business) entity will be held responsible for all of the PPP loan obligations.

Does the EIDL Grant Received by a PPP Borrower Matter When Selling a Business?

The SBA Procedural Notice was silent on the matter of the EIDL grants many business owners received. At this time, a PPP borrower who also received an EIDL grant is responsible for repaying the EIDL grant proceeds under the PPP loan terms.

It’s worth walking through an example to understand how the EIDL grant may affect the business sale. If a business received a $10,000 EIDL grant as well as a PPP loan, the $10,000 EIDL grant is exempt from PPP loan forgiveness. If the PPP lender approves the PPP loan forgiveness, the lender provides the business with a loan payment plan for the EIDL grant balance and the business would have a PPP loan balance of $10,000 on its books.

Given the SBA’s silence on how the EIDL grants are to be handled when a business is sold, it’s implied the rules defined in the Procedural Notice apply, regardless of the relatively small remaining PPP loan balance due to receipt of an EIDL grant.

Conclusion

When selling or merging a business, the terms of a loan from a traditional lender should be carefully reviewed and considered by all parties before the closing. Anything less, leaves the buyer, the seller, and/or the successor in the case of a merger, open to many problems.

Undoubtedly, it’s very important for buyers and sellers to familiarize themselves with the PPP loan rules well in advance of the anticipated closing. Otherwise, the transaction could be held up for months.

And for the owners of businesses with transactions involving a shift in the majority of the ownership or sale of the majority of the business’ assets fair market value, or if the loan balance is not paid off or is not available to be put aside in escrow, many will be holding their breath as they wait for the SBA’s approval to sell their businesses.

what should i do if the previous owner still use my business to apply for 2nd PPP and got funded into their account after sold the business in Nov 2020? will i be the one to make repayment?

Hi Thuy,

I believe you are asking if you bought a business in 2020 which had a PPP Loan in 2020, what should you do if its former owner applied for a second round of PPP funding under the business’ EIN?

If that’s the case, I’d contact the SBA and inform them the former owner did so. What he or she has done is not proper no matter how you look at it.

The business you bought, if that’s the EIN used in the PPP Loan round 2 application, will be held responsible for the loan.

Hope you can straighten this out!

Dear Holly,

The previous owner still keep her business bank account with Bank of Oklahoma under my business name and address, and i opened mine with Bank of America when i took over last Nov 2020. She said that she used her own information when she did her SBA loan. Which i don’t see how can you make a loan for a business without the business information. I could be wrong! I did inform her that she need to either closed the business banking account or change the mailing address on the account. Holly, are we supposed to close business banking account once you sold the business? I called SBA and they said they don’t have any data, SBA said i need to call the bank. Anyway, so I called her bank and they said that i can sue her if she refuse to do anything afterwards. Am i doing the right thing Holly?

Hi Thuy,

There are a few layers here…

Let’s start with what the seller did first:

If she used the business EIN and payroll information from 2019 or 2020 to apply for the PPP Loan round 2 and she no longer owns the business because you purchased it, the seller has committed fraud. That’s really serious and I wouldn’t want to be in her shoes!

If you know she’s done this and you know the bank in which she applied for the PPP Loan round 2 with the business EIN you now own, I’d contact the bank with the information you have. Document everything you know and provide it to them in writing.

As for how to handle the bank accounts when a business is sold, it really depends on several factors.

It’s not unusual for the business seller to keep the bank account for a while (in some cases years) as they collect A/R, pay A/P and maybe receive ongoing installment payments from the buyer. Again, it really depends on the way in which the business is sold (Asset vs. Stock sale) and the specific terms in the purchase agreements.

I can’t say if it was appropriate for your seller to keep the business bank accounts open or not. I can confidently say the seller cannot use their former business’ EIN and payroll data to apply for a PPP Loan round 2 after they’ve sold their business!

Truly hope you get to the bottom of this Thuy!

Thank you very much for your helpful feedback Holly!! I’m greatly appreciate your help! I sure will get to the bottom of this!

Happy to help you Thuy!

I sold my business 100% to new owner last Nov 2020, i paid off 1st PPP, am i eligible or regally to file 2nd PPP with even my business has been sold? please advised! Thank you

Anna: in a nutshell, no you are not eligible for another loan. The purpose of these loans is to get an existing business impacted by pandemic to get back to normal. Since you no longer have a business or payroll, there’s no basis for a loan.

Thank you for your time Sir!

Hello Holly:

I received my PPP Round 1 forgiveness on February 01, 2021 but held off on applying for Round 2 as I just sold 100% of my sole proprietorship on March 05.

Can the buyer apply for PPP Round 2 before March 31 using my original financials?

Many thanks.

APL

Hi Philip,

First, congrats on the sale of your business — in a pandemic, that’s quite an achievement!

When the buyer bought your business, by default he or she purchased it under an asset sale because your business was a Sole Proprietorship.

Your buyer either assumed those ‘assets’ that comprised your business or they formed a new business entity to buy them.

Either way, the business you were operating on February 15, 2020 doesn’t exist any longer. Here’s why that’s important:

One of the PPP Loan application requirements is for the applicant (your buyer) to prove that the business applying for the PPP Loan Round 2 existed and was doing business on February 15, 2020.

Your buyer could not do this because you (as an individual, sole proprietor) owned and operated the business on February 15, 2020.

Hope this helps…

I am selling the business, a total asset sale and we have a 1st round ppp loan. First, per the PPP program, we have received from the lender a forgiveness recommendation passed to the SBA for their review.

Also, we have initiated with the lender the process to approve the business sale and place whatever required amount of the PPP loan into escrow with the lender the lender directs us to. We are fine with this and have the cash to do it.

BUT, the lender has required us to provide information on the buyer? This information is:

1. A list of all owners of 20 percent or more of the purchasing entity which includes the following:

a. identity of the new owner(s) of the common stock or other ownership interest

b. new owner(s)’ ownership percentage(s); and how the ownership will be divided

2. Tax identification number(s) for any owner(s) holding 20 percent or more of the equity in the

Business. Either a TIN number(s) or the Social Security number(s).

3. Whether the Buyer(s) has an existing PPP loan and, if so, the SBA loan number.

This really p****d off the buyer. It is and never was their liability. That stays with me when we sell. When asked why, the lender told us it was needed by the SBA. I have a few questions. Why is information needed on the Buyer? The ppp is the my liability? Could the buyer under any circumstance end up liable for this ppp loan? PLEASE HELP!!

Hi Ross,

First, congratulations on the pending sale of your business — especially difficult to do during a pandemic!

According to the SBA’s Procedural Notice referenced in the post and published by the SBA, your situation does NOT required the SBA’s notification or approval.

If you’re willing and capable of funding the escrow account with your PPP Lender until the SBA officially accepts your bank’s recommendation for full forgiveness, you will have complied with the SBA’s Procedural Notice.

I’d deliver the SBA’s Procedural Notice to your bank and ask to speak to the banks officers about the matter.

I hope this works out for you Ross!

I am planning on retiring 6/30/21 and selling my 51% (51 shares) to my two partners. We applied and received PPP #1 and I turned in all forgiveness paperwork for full amount in August. In November the bank asked for a couple more pieces of info and I returned that immediately. I have heard nothing more of our PPP# forgiveness since. I check in with the bank every week and the status remains “pending”. My partners wanted to apply for PPP#2 also. I completed that application but we have received no word on its approval and its been 3 weeks.

All my paperwork submitted was accurate and timely. I fear the holdup is because we do our taxes on an Accrual to Cash conversion so that documentation doesn’t match exactly to tax returns? Could that be the problem and if so how can I correct or add info?

Also how can I retire? What form should my banker file to apply for change in ownership? I’m at a loss on how to proceed as I can’t reach a real person at SBA to inquire.

Hi Laura,

It’s difficult to say what may be holding up your first PPP Loan forgiveness with your bank. If you’ve provided your bank with the proper documents, including all of the payroll tax reports, paid expense receipts, etc., the way in which you file your taxes (Accrual vs. Cash) should have no bearing on the forgiveness process.

I suggest you keep poking at the bank for feedback on the PPP Loan 1 forgiveness because under certain circumstances, the SBA may be holding up your PPP Loan #2 application.

Here’s where the SBA addresses such circumstances.

In Section G of the Rules and Regulations published on January 14th, 2021 the SBA states “If a borrower’s First Draw PPP loan is under review by SBA and/or information in SBA’s possession indicates that the borrower may have been ineligible for the First Draw PPP Loan it received or for the loan amount it received, the lender will receive notification from SBA when the lender submits an application for a guaranty of a Second Draw PPP Loan and will not receive an SBA loan number until the issue related to the unresolved borrower’s First Draw PPP Loan is resolved.”

We’ve heard from several business owners trying to sell their businesses who are experiencing friction with their bank/lender when they want to sell and their PPP loan has not been forgiven. It seems many banks simply don’t know how to handle the situation.

Point them to the SBA’s regulations and be prepared to escrow the funds at the closing if the PPP Loans haven’t been forgiven.

Truly hope this helps a bit Laura…

Thank you so very much. You have been the only source of information I’ve been able to obtain on my situation. I truly appreciate the response! I will continue to prod my bank!

Very pleased to help you Laura…

Go get em!

Hi Im thinking of selling my business, I received PPP Loan 1 and have not been forgiven yet. I did follow all the spending guide lines. Would my forgivness be treated the same if I sold, Like maybe they would want me to pay the hole thing back because now I’ll have a little money.

Hi Laurie,

The PPP Loan forgiveness is dependent on whether you spent the money on payroll, payroll taxes, employee benefits, rent, etc.

Any sale of your business will not have any influence whatsoever over your PPP Loan’s forgiveness.

If the PPP Loan isn’t forgiven before the sale closing, you’ll have to follow the guidelines defined in this post.

Certainly hope this puts your mind at rest…

Good luck with the sale Laurie!

I have applied thru my C Corp, for phase 2 ppp loan and may receive the funds in a day or two. The corporate assets are scheduled to be sold in the next several days to a buyer that will take over the practice in a month or so. I planned on maintain my employees for the next month. The payroll for this month and next will fulfill the requirements for forgiveness. I am totally confused as to how to proceed. It seems with the requirements put forth by SBA it may be easier cancelling the loan at this point in time. Any input would be welcome

Hi Kenneth,

Congrats on the pending sale of your business!

If you’re selling more than 50% of the assets in your business, you will need to address the first and second PPP Loan matter.

If the first PPP Loan was already forgiven, check the box and you are good-to-go to the closing table. If not, apply for forgiveness and you’ll have to establish an Escrow Account for the original PPP loan amount received before the closing is finalized.

If the second PPP Loan arrives before the closing, you’ll have to apply for SBA approval to sell.

Given what’s going on in the SBA right now, I don’t know how receptive they are to handling such a situation.

I am one to pick up the phone, dial the local SBA office and ask. Who knows, maybe they’ve got a department to help you.

Let us know how things turn out!

I had a PPP loan on the first round which has already been forgiven by SBA. I have submitted an application for a second round PPP loan which the lender has sent to SBA for approval, but hasn’t been funded yet. Meantime I have a potential buyer for our business and I am considering selling it, but it might take somewhere between 3 to 6 months for the sale to close.

Our business is a sole ownership. If I take a loan and meet the requirements for forgiveness (payroll and rent) prior to closing the sale, would the loan be forgiven and would I be required to open an escrow account for the total amount of the loan since no payments to the lender would have been made?

I’m afraid that if I don’t take the loan and the sale does not happen I will loose out completely and I can use the PPP loan to keep the business going.

Hi A.A.,

If you meet the loan forgiveness requirements for the second round of the PPPL and apply for forgiveness, it will be up to the bank to grant forgiveness or not.

As a sole proprietorship, your sale transaction will be considered an ASSET SALE. This means if you’ve applied for forgiveness before the closing and its approval is pending, an Escrow account will be necessary.

Given what you’ve described, there doesn’t seem to be a downside to accepting the PPP Loan round 2.

Hope this helps a bit… Good luck with the sale!

February, 23, 2021

My bank told me yesterday that there was NO sale of Business without PPP Loan Forgiveness. I offered the 10/01/20 SBA letter – Paycheck Protection Program Loans and Changes of Ownership procedure.

Notify PPP lender of Change of Ownership

Send PPP Loan Forgiveness Documentation

with Sale/Purchase Agreement

AND put the Loan amount in Escrow until loan Forgiven

and the Banker told me they/SBA were not doing this.

This seems very unreasonable.

Is this the Bank being difficult or SBA changed procedure for change of Ownership for a Business?

Hi Tammy,

So sorry you are having troubles, especially while selling your business!

I am not aware of any new or updated procedural changes at the SBA regarding how the PPP Loan should be handled when a business is sold and the loan has not yet been forgiven. The October 1st, 2020 letter is the only guidance on the SBA’s website at this point in time.

I don’t think the bank has any right to stop you from selling your business as long as you follow the SBA guidance.

The guidance says permission is an SBA matter, not a lender matter.

My recommendation is to reach out directly to your local SBA office and plead your case. Contact your congress representatives too.

If we can help in any other way, we will do so.

Do you think a PPP Lender or SBA look negatively on forgiving a PPP loan if the business is sold prior to forgiveness, but borrower will meet all forgiveness requirements

T.G., I am a Business Broker Adviser on EXIT Promise and my firm has been involved in several business sales that had a PPP loan involved.

I’m not aware of any lender that would look negatively on forgiving a PPP loan in the scenario you described.

The challenge we have encountered with SBA lenders has been when the seller pays off the loan and they need written confirmation that the PPP loan was been paid off in order to close the sale. Some lenders have been slow to provide this letter.