- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Do you have a Question?

Ask below. One of our Investors or Advisors will Answer!

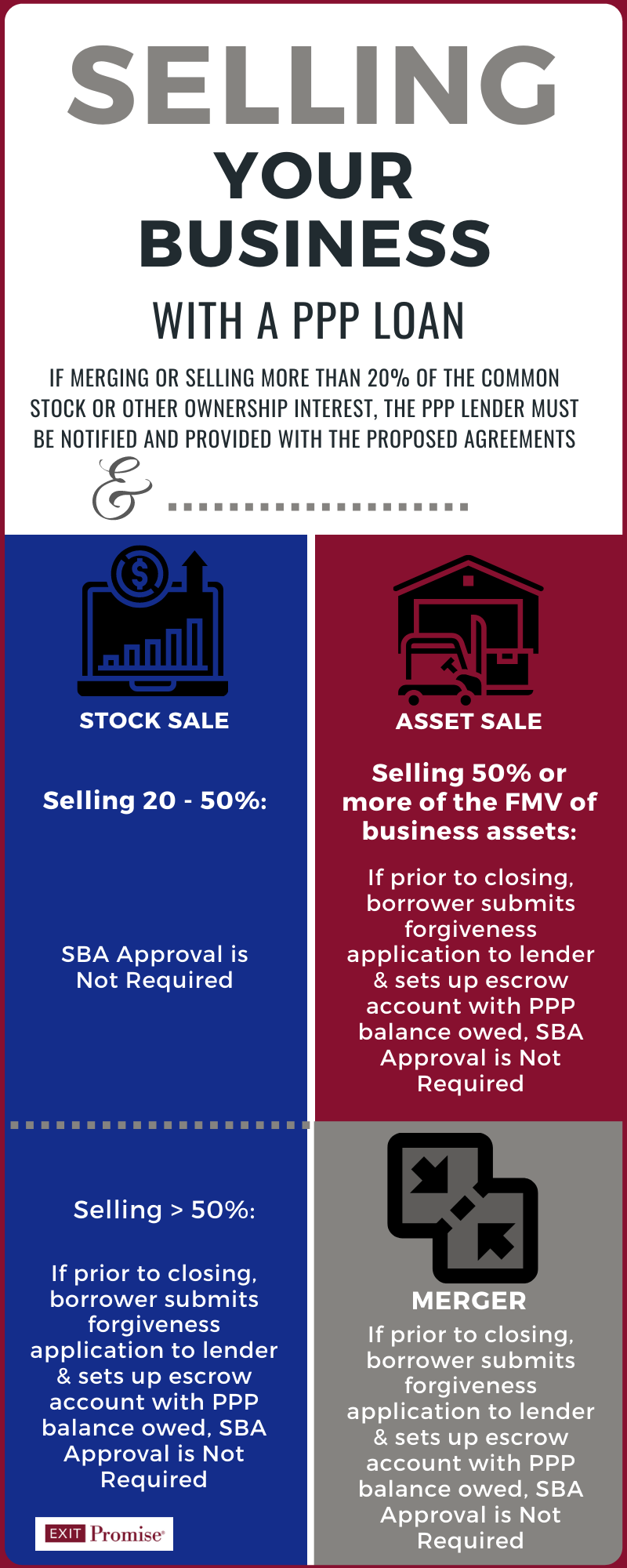

The Small Business Administration (SBA) issued a Procedural Notice on October 2, 2020 which offers business owners and lenders guidance on how Paycheck Protection Program (PPP) Loans are to be handled when a business has a change in ownership.

This post summarizes the notice and includes an Infographic to assist business owners. It includes the following topic:

- When does a Business Sale Require the SBA’s Approval

- Does a Business Sale Require the PPP Lender’s Approval or Notification

- Required Steps Pre and Post-Closing for PPP Borrowers

- SBA Timeframe to Approve a Sale or Merger when a PPP Loan Transfers

- Does the EIDL Grant Impose Additional Steps When Selling a Business

This guidance has been long overdue. Until now, business owners, lenders and M&A advisors have not had clear guidance about how a PPP loan should be handled when a business is sold, merged, or had a partial shareholder change of ownership.

The SBA guidance under this Procedural Notice defines “change of ownership” as when one of three events occur:

- At least 20% of the common stock or other ownership interest of a PPP borrower is sold or otherwise transferred. This form of business sale is considered a stock sale. All sales and other transfers that have occurred since the date of the approval of the PPP loan must be aggregated to determine whether the relevant threshold has been met. Transfers to an affiliate or an existing owner of the entity must be considered as well; or

- the PPP borrower sells or otherwise transfers at least 50% of its assets in one or more transactions; or

- a PPP borrower is merged with or into another entity.

When Do Business Owners with PPP Loans Not Need to Notify the SBA or Lender About a Sale?

If your business received a PPP loan and you’re considering a sale, there are three circumstances where you will not be required to involve the SBA or your lender in the process:

1. PPP Loan Fully Satisfied Prior to Business Sale Closing

If the PPP borrower, prior to the closing or sale, has either repaid the PPP loan in full or has completed the loan forgiveness process and the SBA has paid the PPP lender (your bank) in full, and/or the PPP borrower has repaid any remaining (unforgiven) balance in full, then no restrictions or SBA notifications are required of the PPP borrower or successor.

2. Sale or Transfer of <20% of Common Stock or Other Ownership Interest

If the sale or transfer represents less than 20% of the common stock or other ownership interest in the business, it is not considered an ownership change. Accordingly, neither the SBA nor the lender needs to be notified.

3. Sale or Transfer of <50% of the Business’ Fair Market Value of its Assets

Similar to the sale or transfer of less than 20% of the stock or other ownership interest in the business, if the sale or transfer represents less than 50% of the business’ FMV of its assets, it is not considered a change in ownership. Accordingly, neither the SBA nor the lender needs to be notified.

When Do Business Owners with PPP Loans Need to Involve the SBA and/or Lender in the Sale?

If you’re contemplating the sale of your business and you are not fortunate enough to fall into one of the three situations noted above, you will need to involve the SBA and/or lender in the sale process.

At a minimum, you will be required to notify your PPP lender in writing about the sale and provide the lender with a copy of the proposed purchase agreements.

Whether you will be required to take additional steps before the closing or to obtain the SBA’s approval depends on the type of sale (stock vs asset), the amount of ownership or assets being sold, or if the transaction is a merger.

If the type of business sale is a ‘stock sale’, where 20% or more of the common stock or other form of ownership is being sold, the SBA’s approval will not be required.

If the type of business sale is an ‘asset sale’, where 50% or more of the FMV of the business’ assets is being sold, the SBA’s approval will not be required.

If the transaction is a merger with or into another entity, the SBA’s approval will not be required.

With that said, unless the sale or transfer involves between 20% but less than 50% of the common stock or other ownership interest or is less than 50% of the FMV of the assets, there are other steps the seller and buyer will need to take before the closing to address any PPP liability.

Required Steps PPP Loan Require Pre and Post Closing When 50% or more of the Common Stock, Other Ownership Interest or FMV of the Assets are Sold or Merged

The following steps will be required:

- Complete and submit to the PPP Loan lender the forgiveness application before the closing.

- Establish an interest-bearing escrow account with the PPP Lender with the outstanding amount of PPP loan before the closing.

- Upon the conclusion of the PPP loan forgiveness process, disburse the escrow fund to repay any PPP loan balance plus any applicable interest.

- The PPP lender must also notify the SBA loan Servicing Center about the escrow account, its location, and amount within five business days of the closing.

SBA Approval is Required in Certain Circumstances Before Sale or Merger

When more than 50% of the ownership interest (stock, LLC member units, partnership shares) or when more than 50% of the FMV of the business’ assets are sold, the SBA will require pre-approval if the PPP note has not been paid in full and the the requirements noted above related to the escrowed fund cannot be met. The PPP lender handles this approval process.

The SBA’s approval of the sale or merger, under this scenario, will be conditioned on the buyer assuming all of the seller’s PPP loan obligations. Either a separate loan assumption agreement or an inclusion of the PPP loan obligation language in the transaction’s purchase agreement will be required and reviewed by the SBA.

The SBA has 60 calendar days to review and respond to the request.

Does Selling My Business Mean the PPP Loan Obligations Disappear?

The simple answer is ‘no’. Regardless of the type of sale, amount of the stock or other ownership interest transferred or sold, percentage of the assets FMV transferred or sold, or whether the transaction is considered a merger, if your business’ PPP loan has an outstanding balance, the original PPP loan recipient will remain subject to all obligations under the PPP loan.

This means as the seller of a business with an outstanding PPP loan balance, the responsibility for the PPP loan repayment, certifications, reporting compliance, and the retention of all SBA and lender forms and supporting documentation does not transfer to the buyer upon sale or merger.

Will the Sale or Merger be Reported to the PPP Lender?

If the transaction is considered a ‘change of ownership’ according to the Procedural Notice (defined above), the PPP lender will be required to notify the SBA about the identity of the new owners, their ownership percentage, the TINs for any owner holding 20% or more of the business equity and, if required, the escrow account location and amount.

Two (or more) PPP Loans Must be Segregated Post Sale or Merger

The segregation of PPP funds is required if more than one PPP loan exists after a change in ownership or merger occurs. This means the funds, as well as the expense records related to the loan, must be segregated and tracked to demonstrate compliance with the PPP loan’s requirements.

And in the case of a merger, the successor (business) entity will be held responsible for all of the PPP loan obligations.

Does the EIDL Grant Received by a PPP Borrower Matter When Selling a Business?

The SBA Procedural Notice was silent on the matter of the EIDL grants many business owners received. At this time, a PPP borrower who also received an EIDL grant is responsible for repaying the EIDL grant proceeds under the PPP loan terms.

It’s worth walking through an example to understand how the EIDL grant may affect the business sale. If a business received a $10,000 EIDL grant as well as a PPP loan, the $10,000 EIDL grant is exempt from PPP loan forgiveness. If the PPP lender approves the PPP loan forgiveness, the lender provides the business with a loan payment plan for the EIDL grant balance and the business would have a PPP loan balance of $10,000 on its books.

Given the SBA’s silence on how the EIDL grants are to be handled when a business is sold, it’s implied the rules defined in the Procedural Notice apply, regardless of the relatively small remaining PPP loan balance due to receipt of an EIDL grant.

Conclusion

When selling or merging a business, the terms of a loan from a traditional lender should be carefully reviewed and considered by all parties before the closing. Anything less, leaves the buyer, the seller, and/or the successor in the case of a merger, open to many problems.

Undoubtedly, it’s very important for buyers and sellers to familiarize themselves with the PPP loan rules well in advance of the anticipated closing. Otherwise, the transaction could be held up for months.

And for the owners of businesses with transactions involving a shift in the majority of the ownership or sale of the majority of the business’ assets fair market value, or if the loan balance is not paid off or is not available to be put aside in escrow, many will be holding their breath as they wait for the SBA’s approval to sell their businesses.

I purchased a medical practice in August 2020. The original owner had received a PPP loan, which was forgiven 3/2021. I purchased the practice via asset sale (see question 38 below from PPP FAQ sheet). I continued to operate the practice like prior owner and owned it the entire 4th quarter of 2020 and compared to 2019 we had more than 25% reduction in gross receipts. Should I be able to qualify for a second draw PPP given the SBA (per answer below) still honors an asset sale even with a change in tax ID?

38. Question: Section 1102 of the CARES Act provides that PPP loans are available only to applicants that were “in operation on February 15, 2020.” Is a business that was in

operation on February 15, 2020 but had a change in ownership after February 15, 2020 eligible for a PPP loan?

Answer: Yes. As long as the business was in operation on February 15, 2020, if it meets the other eligibility criteria, the business is eligible to apply for a PPP loan regardless of

the change in ownership. In addition, where there is a change in ownership effectuated through a purchase of substantially all assets of a business that was in operation on

February 15, the business acquiring the assets will be eligible to apply for a PPP loan even if the change in ownership results in the assignment of a new tax ID number and even if the acquiring business was not in operation until after February 15, 2020. If the acquiring business has maintained the operations of the pre-sale business, the acquiring business may rely on the historic payroll costs and headcount of the pre-sale business for the purposes of its PPP application, except where the pre-sale business had applied for and received a PPP loan. The Administrator, in consultation with the Secretary, has determined that the requirement that a business “was in operation on February 15, 2020” should be applied based on the economic realities of the business’s operations.

Hi John,

The answer is yes. Your specific situation will require you to go through more hoops than the plain vanilla PPP Round 2 process.

The best advice I can offer you is to reach out to the banker who handled the first PPP Loan and ask them to take it up the line to his/her supervisor. Depending on the size of the loan, that may mean your in the bank’s commercial banking group or the small business market group.

Sending the application through the normal PPP loan application process will fail because the EINs won’t match up when the SBA receives it. It will need special handling by your bank!

All the best…

I have an scorp and doing business as a nail salon. I have used up my 8 wks of ppp loan second draw already, just waiting for lender to open up forgiveness link. I will sell the salon but will continue to work free lance as an scorp until i find another salon to purchase. My corporation is still responsible for ppp forgiveness process, i just won’t be at a particular salon. Will i be able to sell salon? or i need permission to sell since ppp forgiveness process has not started? I figure i am still able to sell because my business entity still exist and still responsible for ppp loan. Please advise

Hi Cam,

You can begin the process of selling your business before the PPP Loan forgiveness has been awarded.

It typically takes a while to sell any business so you have time.

If the closing occurs before the SBA grants forgiveness and your bank notifies you so, you’ll need to escrow the PPP Loan proceeds until everything clears.

All the best…

My situation is a follows:

PPP#2 loan was received in approximately January 31, 2021. I plan to sell the assets of my business effective May 31, 2021 at which time I would have spent approximately 70% of the PPP#2 loan proceeds on qualifying expenses. By the end of the 24 week covered period (approx. July 15th), I estimate that I would spend 100% of the PPP#2 loan proceeds on qualifying expenses. My question is in determining loan forgiveness can I use the qualifying expenses paid by the business during the full 24 week covered period even though I sold the business on May 31.

Hi Ron,

If you’re selling the assets of your business and post-closing your business entity continues to exist and use the funds for payroll costs and other qualified expenses for the PPP Loan forgiveness, it seems reasonable you’d be able to qualify for full forgiveness.

Alternatively, if the newco (buyer) is paying for the payroll and other qualified costs post-closing, I doubt your business entity would be able to qualify for full PPP Loan forgiveness.

I am not an authority — this is just my opinion Ron!

So first PPP already forgiven. Selling business but still have second PPP because there is no forgiveness open yet. Bank refusing to close on sale unless I pay off PPP completely, no escrow. But I know I will lose PPP funds for good if I do this. Does bank have the right to refuse setting an escrow for second PPP?

Hi Dr. Waters,

The October 2, 2020 SBA Procedural Notice clearly defines for lenders how they are to handle a situation such as yours where you are trying to accomplish a sale and comply with the SBA rules.

I don’t believe any SBA-approved lender has the right to ignore the SBA’s Procedural Notice.

I’d take the matter to the lender’s legal counsel and ask them what’s their reason for doing so.

Selling a business is difficult to do and having this hurdle close to the closing is unfortunate.

Make some noise with your lender!

Hi Holly,

If you can answer this question definitively, you’re going to be in the top .0001% of PPP experts.

I purchased a business in August of 2020. It was an asset purchase for virtually all assets. The “seller” applied for, received, and has had forgiven a Round 1 PPP loan. I set my entity up in Aug 2020 for the acquisition, but the former business had been in uninterrupted operation since the 1970s.

Am I able to apply for a Round 1 draw under my new entity? (see question #38 in the SBA’s PPP FAQ doc)?

If not, am I able to apply for a Round 2?

Hi Rob,

Well, your first sentence made me LOL. I’m simply trying to clarify as much as I can for what is a very complicated (and ever evolving) set of ‘final’ rules! Yikes.

I’ll give this a whirl…

So others may benefit from the homework you’ve already done, here’s what the Federal SBA Interim Final Rules say about your situation in question number 38:

“38. Question: Section 1102 of the CARES Act provides that PPP loans are available only to

applicants that were “in operation on February 15, 2020.” Is a business that was in

operation on February 15, 2020 but had a change in ownership after February 15, 2020

eligible for a PPP loan?

Answer: Yes. As long as the business was in operation on February 15, 2020, if it meets

the other eligibility criteria, the business is eligible to apply for a PPP loan regardless of

the change in ownership. In addition, where there is a change in ownership effectuated

through a purchase of substantially all assets of a business that was in operation on

February 15, the business acquiring the assets will be eligible to apply for a PPP loan

even if the change in ownership results in the assignment of a new tax ID number and

even if the acquiring business was not in operation until after February 15, 2020. If the

acquiring business has maintained the operations of the pre-sale business, the acquiring

business may rely on the historic payroll costs and headcount of the pre-sale business for

the purposes of its PPP application, except where the pre-sale business had applied for

and received a PPP loan. The Administrator, in consultation with the Secretary, has

determined that the requirement that a business “was in operation on February 15, 2020”

should be applied based on the economic realities of the business’s operations.”

I believe the answer to your first question lies in the italicized text “except where the pre-sale business had applied for and received a PPP loan.”

If the former owner did so, then I think it’s clear your newly-formed business entity that acquired most of the business assets can’t apply for the PPP Loan first draw.

As long as the business qualifies according to the PPP Loan round 2 rules, I don’t see any reason why you could not apply for a PPP Loan Round 2.

That said, I’d approach your business banker with the IFR in hand and all of the documentation before the application is submitted. I don’t think it’s a plain vanilla application and the bank should have a group inside to help you with the situation. Otherwise, I do believe most banks will kick back the application for round 2 when they see the EINs don’t match up. And the SBA will do so as well.

We’re cheering for you here Rob — and please update us if you’re able to do so. Others will benefit and thank you!

If I sold my business October 2020 am I eligible for round 2 ppp

Hi Terry,

No, the PPP Loan round two program is only available to businesses in operation.

If you no longer own and operate the business, you can not apply for the second round.

Holly – thank you for such a thoughtful response. I have been unpacking this scenario for 6 weeks working with CPAs, attorneys, bankers and local SBA reps. I am former Ernst & Young myself.

I actually think that italicized text refers only to the portion of the sentence in front of the comma, and not to the overall question. Meaning… I think the exception related to the pre-sale business applying for and receiving a PPP only affects what’s in front of the comma, “the acquiring business may rely on the historic payroll costs and headcount of the pre-sale business for the purposes of its PPP application.” If I’m correct, this means I cannot rely on the pre-sale business’ payroll/headcounts, and I can only rely on my own since the acquisition.

My bank (one of the largest Banks in(of) America is not sure how to handle this. They advised I apply as a first round draw. The application was rejected by the SBA for the reason: Disqualifying Business Formation Date Identified. The bank believes this is because my acquiring company (created in Aug 2020) was not yet formed as of Feb 15, 2020. In other words, I do not have Sec of State filed articles or an IRS FEIN dated on or before Feb 15.

So the logical next step becomes “apply for a 2nd round draw”. Multiple banks, including mine, tell me the SBAs system is set up to auto-reject any Second Round application who’s FEIN does not match the First Round application. Obviously, since mine was an asset sale, the FEINs do not match. Thus, auto-rejection.

The FAQ #38 is clear that I qualify. But no one can tell me whether it needs to be a First Round vs a Second Round and no one can tell me what “in operation on Feb 15, 2020” documentation is needed to get the SBA to accept. If you can find these answers, you get a gold star! 🙂

Hi, Rob – I am part of an ownership group that recently completed an acquisition with a new LLC setup for the sole purpose of acquiring substantially all of the assets of a 10-year old business. The seller received a first draw PPP loan, which was fully forgiven prior to closing. We (Buyer) are applying for a second draw loan via Chase and relying on Seller’s historical info. Like you, our application fits perfectly within FAQ 38. We are facing the same challenges, too.

I read the response from the loan officer. However, according to Chase, our application was rejected before it was processed by the SBA portal, and thus there is not a Hold Code for the lender to override. Not sure if you have heard the same.

Have you found a resolution to your situation? I’ll be sure to update here if we resolve our issue.

Thanks,

Ross

Just love a challenge Rob!

So, the SBA has stated: “The Administrator, in consultation with the Secretary, has determined that the requirement that a business “was in operation on February 15, 2020” should be applied based on the economic realities of the business’s operations.”

The answer to question 38 in the SBA’s IFR is clear that your situation makes your business is eligible for a PPP Loan because your business was in operation on February 15, 2020.

While at the same time, it’s unlikely Congress intended for a business such as yours to receive two PPP Loan round one proceeds and then be eligible for another PPP Loan round two.

If you’ve already addressed this with the local SBA office, which would have been my next recommendation if the bankers are not willing to help you, I recommend taking your case to your representatives in congress. All of them.

Tonight, they’ve extended the PPP Loan round 2 application deadline to May 31, 2021 and will allow the SBA to process submissions until June 30, 2021. That’s good news and it’s expected President Biden will sign the extensions into law soon.

Even with this good news, your timeline is short to move this mountain.

Who knows, maybe with your efforts directed to congress members, the SBA may issue another ‘final IFR’ question and answer to clear things up!

Just an FYI – I’m a loan officer who has taken numerous applications. I have a borrower in almost the exact scenario as the above. The SBA kicks it back to us for the error above, saying that they believe that the business did not exist prior to the required February 2020 date. However, they give us an option to click a box and attest to the fact that we know the business DID in fact exist prior to that time and we have the proof to back it up. If we agree to certify then the application will go forward with the understanding that if we are audited by the SBA and can not prove our point then we will lose the 100% guaranty. So the answer is . . . . it’s complicated, but if your banker feels they can adequately prove the attestation there is a way to move forward.

Hi Kil,

Wow, thank you so very much for your input as a loan officer processing the PPP Loans!

Much appreciated!

My partner and I are selling 100% of the assets of our S-corp to a larger corporation around 4/1/21. Our PPP1 was fully forgiven, and our PPP2 loan was funded 2/8/21. The bank says we can’t sell until we apply for PPP2 forgiveness yet the SBA hasn’t even released the application/portal. How can we prove to the bank that if we set up an escrow with 100% of the PPP2 funds we are allowed to sell, and don’t need SBA approval?

Thank you!

Hi T,

I’d reach out to the lender’s legal counsel with the Procedural notice in hand. This document spells out what the SBA requires of the lender in your situation.

Lawyers don’t like to ignore the law. A bank lending officer or other employee may not understand the ramifications of ignoring what the SBA has stated it expects of the lenders.

All the best…

I’m in the same boat. Bank refuses to do an escrow for PPP 2 and wants me to instead pay it all back before I can sell. I am refusing.

I’m selling my business, but have a SBA loan balance of $34,000 due to start paying back in June. Can I still pay my loan back monthly? Or do I need to pay it back all up front? Business is being sold, but only with notes being paid to me every month so I won’t have any cash to pay it back after the sale? What can I do? Please help!

Hi Tommy,

When you sell your business, it will likely trip a clause in your SBA loan agreement that states the loan must be paid off.

The SBA typically files a form called a UCC-1 at the state where your business is formed. It’s their way of notifying others (like a buyer) that your business owed the SBA money and if sold, the debt must be paid in order to gain free and clear ownership of the business’ assets. The buyer’s attorney will be looking for this when you get closer to the closing.

Your broker and attorney should be made aware of this debt. They should be able to negotiate an asset purchase agreement where the assets don’t transfer to the buyer at closing. Instead, they are put into escrow until the full purchase price has been paid to you. That’s a given when a buyer is acquiring a business through a Seller’s Note!

Hope this helps…

I had a rental property, but sold it for a loss in Nov. 2020. Do I qualify for a PPP loan?

Hi Susan,

No, the PPP Loan currently available to business owners is intended to be used for operating businesses to retain employees.

Your business has been sold so it is not operating.

Hi,

I just sold my dental office (an s-corp) to a DSO. The paperwork was dated March 1, 2021. The sale money was wire transferred March 4 and I went to my lending bank (Commerce Bank) on March 5 to pay off my loans. Unfortunately, no one told me I needed to do anything with my PPP loan. I was unable to apply for forgiveness until 2 days ago because the bank was not forgiving loans. I met the payroll forgiveness criteria by October and thought it was just a matter of waiting for my time to be forgiven. I did notify Commerce Bank in January with the intent to sell. Anyway, I was never told about putting the PPP loan amount in escrow until after the business was sold. I don’t know what to do now. The loan was for $90,000. Can you help?

Hi David,

If you did not sell the S Corp STOCK to the DSO, your business sale would have been considered an ASSET SALE. And as such, you’d only be required to set up the Escrow account with your lender.

It appears you informed your lender before the sale and they did not make you aware of the requirement for an escrow account until the PPP loan is officially forgiven by the SBA.

Under an Asset Sale, you don’t have to inform the SBA.

So, I suggest you take the matter up with the lender and ask them to prioritize your PPP Loan forgiveness.

Hope this helps a bit…

Hi,

I am a 50/50 partner in an LLC that has received 2 PPP loans ($42K combined) and an EIDL loan ($131K). My business partner wants to buy my shares — 50 percent of ownership. Do we need lender or SBA approval for either the EIDL or PPP loans with a 50 percent transfer of shares? Also, if my business partner becomes 100 percent owner, would I be in any way liable since my name was on the loans originally? Our legal agreement releases me from liability for this debt, but what if my biz partner defaults on the SBA loans? Does the loan obligation revert back to me? If so, is there a process to remove me entirely from the PPP and EIDL loans? Thank you very much for your help!

Hi Shelly,

Selling a 50% share of an LLC falls under a stock sale so you don’t need the SBA’s approval related to the PPP Loans.

As for the EIDL, your loan falls under the $200K threshold so it’s likely you (or your LLC co-member) did not PERSONALLY guarantee the loan. Instead, the SBA secured all of the assets associated with the LLC with a UCC-1 filing at your state.

I recommend you consult with an Attorney representing you in the sale of your LLC member shares to the other member to be certain neither the PPP Loans or EIDL Loan becomes your personal liability if not fully forgiven or paid in full.

Hope all turns out well for you Shelley!

Thank you!

Happy to help you!