- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Do you have a Question?

Ask below. One of our Investors or Advisors will Answer!

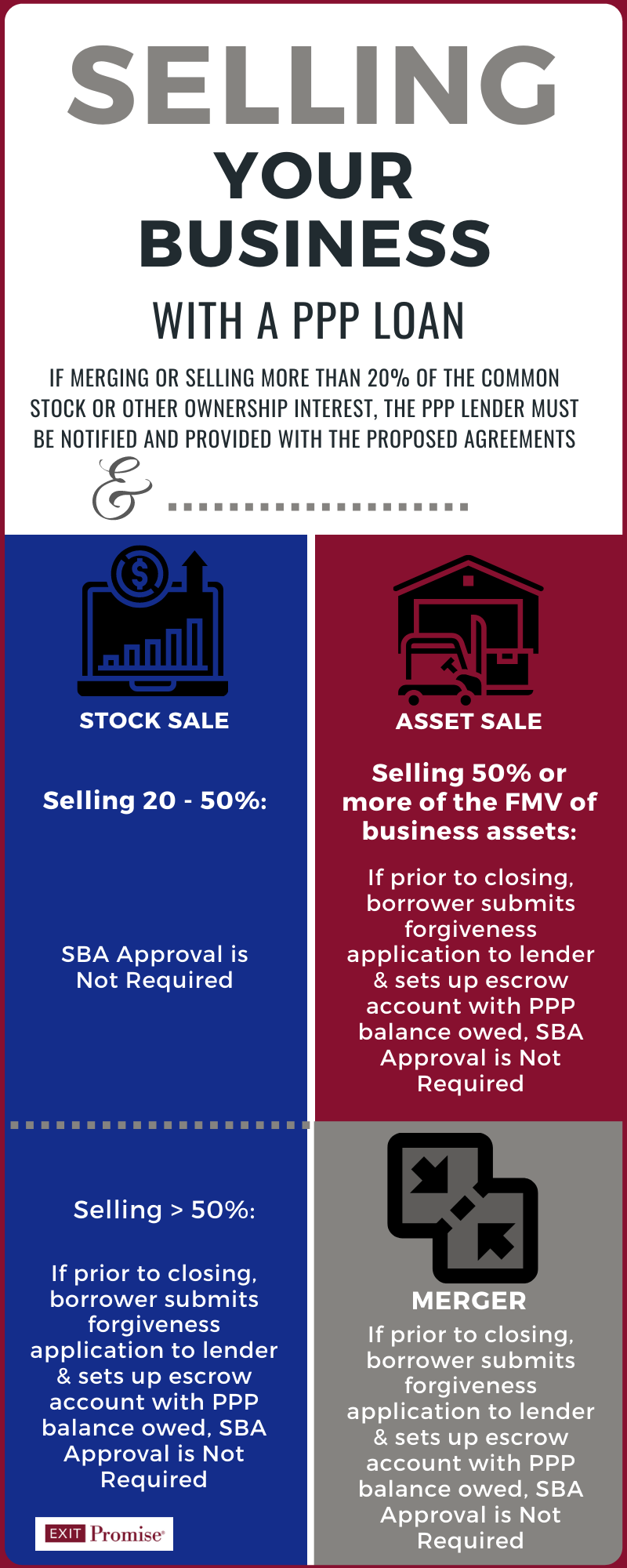

The Small Business Administration (SBA) issued a Procedural Notice on October 2, 2020 which offers business owners and lenders guidance on how Paycheck Protection Program (PPP) Loans are to be handled when a business has a change in ownership.

This post summarizes the notice and includes an Infographic to assist business owners. It includes the following topic:

- When does a Business Sale Require the SBA’s Approval

- Does a Business Sale Require the PPP Lender’s Approval or Notification

- Required Steps Pre and Post-Closing for PPP Borrowers

- SBA Timeframe to Approve a Sale or Merger when a PPP Loan Transfers

- Does the EIDL Grant Impose Additional Steps When Selling a Business

This guidance has been long overdue. Until now, business owners, lenders and M&A advisors have not had clear guidance about how a PPP loan should be handled when a business is sold, merged, or had a partial shareholder change of ownership.

The SBA guidance under this Procedural Notice defines “change of ownership” as when one of three events occur:

- At least 20% of the common stock or other ownership interest of a PPP borrower is sold or otherwise transferred. This form of business sale is considered a stock sale. All sales and other transfers that have occurred since the date of the approval of the PPP loan must be aggregated to determine whether the relevant threshold has been met. Transfers to an affiliate or an existing owner of the entity must be considered as well; or

- the PPP borrower sells or otherwise transfers at least 50% of its assets in one or more transactions; or

- a PPP borrower is merged with or into another entity.

When Do Business Owners with PPP Loans Not Need to Notify the SBA or Lender About a Sale?

If your business received a PPP loan and you’re considering a sale, there are three circumstances where you will not be required to involve the SBA or your lender in the process:

1. PPP Loan Fully Satisfied Prior to Business Sale Closing

If the PPP borrower, prior to the closing or sale, has either repaid the PPP loan in full or has completed the loan forgiveness process and the SBA has paid the PPP lender (your bank) in full, and/or the PPP borrower has repaid any remaining (unforgiven) balance in full, then no restrictions or SBA notifications are required of the PPP borrower or successor.

2. Sale or Transfer of <20% of Common Stock or Other Ownership Interest

If the sale or transfer represents less than 20% of the common stock or other ownership interest in the business, it is not considered an ownership change. Accordingly, neither the SBA nor the lender needs to be notified.

3. Sale or Transfer of <50% of the Business’ Fair Market Value of its Assets

Similar to the sale or transfer of less than 20% of the stock or other ownership interest in the business, if the sale or transfer represents less than 50% of the business’ FMV of its assets, it is not considered a change in ownership. Accordingly, neither the SBA nor the lender needs to be notified.

When Do Business Owners with PPP Loans Need to Involve the SBA and/or Lender in the Sale?

If you’re contemplating the sale of your business and you are not fortunate enough to fall into one of the three situations noted above, you will need to involve the SBA and/or lender in the sale process.

At a minimum, you will be required to notify your PPP lender in writing about the sale and provide the lender with a copy of the proposed purchase agreements.

Whether you will be required to take additional steps before the closing or to obtain the SBA’s approval depends on the type of sale (stock vs asset), the amount of ownership or assets being sold, or if the transaction is a merger.

If the type of business sale is a ‘stock sale’, where 20% or more of the common stock or other form of ownership is being sold, the SBA’s approval will not be required.

If the type of business sale is an ‘asset sale’, where 50% or more of the FMV of the business’ assets is being sold, the SBA’s approval will not be required.

If the transaction is a merger with or into another entity, the SBA’s approval will not be required.

With that said, unless the sale or transfer involves between 20% but less than 50% of the common stock or other ownership interest or is less than 50% of the FMV of the assets, there are other steps the seller and buyer will need to take before the closing to address any PPP liability.

Required Steps PPP Loan Require Pre and Post Closing When 50% or more of the Common Stock, Other Ownership Interest or FMV of the Assets are Sold or Merged

The following steps will be required:

- Complete and submit to the PPP Loan lender the forgiveness application before the closing.

- Establish an interest-bearing escrow account with the PPP Lender with the outstanding amount of PPP loan before the closing.

- Upon the conclusion of the PPP loan forgiveness process, disburse the escrow fund to repay any PPP loan balance plus any applicable interest.

- The PPP lender must also notify the SBA loan Servicing Center about the escrow account, its location, and amount within five business days of the closing.

SBA Approval is Required in Certain Circumstances Before Sale or Merger

When more than 50% of the ownership interest (stock, LLC member units, partnership shares) or when more than 50% of the FMV of the business’ assets are sold, the SBA will require pre-approval if the PPP note has not been paid in full and the the requirements noted above related to the escrowed fund cannot be met. The PPP lender handles this approval process.

The SBA’s approval of the sale or merger, under this scenario, will be conditioned on the buyer assuming all of the seller’s PPP loan obligations. Either a separate loan assumption agreement or an inclusion of the PPP loan obligation language in the transaction’s purchase agreement will be required and reviewed by the SBA.

The SBA has 60 calendar days to review and respond to the request.

Does Selling My Business Mean the PPP Loan Obligations Disappear?

The simple answer is ‘no’. Regardless of the type of sale, amount of the stock or other ownership interest transferred or sold, percentage of the assets FMV transferred or sold, or whether the transaction is considered a merger, if your business’ PPP loan has an outstanding balance, the original PPP loan recipient will remain subject to all obligations under the PPP loan.

This means as the seller of a business with an outstanding PPP loan balance, the responsibility for the PPP loan repayment, certifications, reporting compliance, and the retention of all SBA and lender forms and supporting documentation does not transfer to the buyer upon sale or merger.

Will the Sale or Merger be Reported to the PPP Lender?

If the transaction is considered a ‘change of ownership’ according to the Procedural Notice (defined above), the PPP lender will be required to notify the SBA about the identity of the new owners, their ownership percentage, the TINs for any owner holding 20% or more of the business equity and, if required, the escrow account location and amount.

Two (or more) PPP Loans Must be Segregated Post Sale or Merger

The segregation of PPP funds is required if more than one PPP loan exists after a change in ownership or merger occurs. This means the funds, as well as the expense records related to the loan, must be segregated and tracked to demonstrate compliance with the PPP loan’s requirements.

And in the case of a merger, the successor (business) entity will be held responsible for all of the PPP loan obligations.

Does the EIDL Grant Received by a PPP Borrower Matter When Selling a Business?

The SBA Procedural Notice was silent on the matter of the EIDL grants many business owners received. At this time, a PPP borrower who also received an EIDL grant is responsible for repaying the EIDL grant proceeds under the PPP loan terms.

It’s worth walking through an example to understand how the EIDL grant may affect the business sale. If a business received a $10,000 EIDL grant as well as a PPP loan, the $10,000 EIDL grant is exempt from PPP loan forgiveness. If the PPP lender approves the PPP loan forgiveness, the lender provides the business with a loan payment plan for the EIDL grant balance and the business would have a PPP loan balance of $10,000 on its books.

Given the SBA’s silence on how the EIDL grants are to be handled when a business is sold, it’s implied the rules defined in the Procedural Notice apply, regardless of the relatively small remaining PPP loan balance due to receipt of an EIDL grant.

Conclusion

When selling or merging a business, the terms of a loan from a traditional lender should be carefully reviewed and considered by all parties before the closing. Anything less, leaves the buyer, the seller, and/or the successor in the case of a merger, open to many problems.

Undoubtedly, it’s very important for buyers and sellers to familiarize themselves with the PPP loan rules well in advance of the anticipated closing. Otherwise, the transaction could be held up for months.

And for the owners of businesses with transactions involving a shift in the majority of the ownership or sale of the majority of the business’ assets fair market value, or if the loan balance is not paid off or is not available to be put aside in escrow, many will be holding their breath as they wait for the SBA’s approval to sell their businesses.

I already gave 50% of my business to my brother In January 2020. Prior to that my brother was a 1% owner of the company. We never did any official paperwork besides our taxes in 2021. We never put his name on the PPP’s or the EIDL. We were already forgiven on the first round. I think we were given forgiveness on second round as well. We do have an EIDL loan for $150,000. I want to give the remainder 50% to his wife. You had said in another post that, ” As for the EIDL, your loan falls under the $200K threshold so it’s likely you (or your LLC co-member) did not PERSONALLY guarantee the loan. Instead, the SBA secured all of the assets associated with the LLC with a UCC-1 filing at your state.”

If I find out this is the case; can I give/sell my 50% or 100% of the company and its debt? If so, How can I do this

Hi Robert,

An UCC-1 filing by a lender such as the SBA means the assets associated with the business are held in security of the loan. If these assets (or the business itself) is sold (or gifted) to another party, then the lien must be satisfied by paying off the lender. The SBA EIDL program works the same as any other traditional lender such as a bank.

Lenders don’t allow its loan to be passed on to the next business owner once it’s sold.

Hope this clarifies things for you!

We sold our business in June 2020. We received a first round PPP loan in April of 2020. The new owners applied for a first time PPP loan under their incorporation that was founded in May 2020, even though they intend to use this PPP loan for the business they purchased, which already received a 1st round loan. They were approved in March 2021. Wouldn’t they need to apply for a 2nd round of PPP under the name of the company the loan is intended for? They’ve also grossly misrepresented the number of employees in their loan. My concern is that I might be liable for their misrepresentations. Are they allowed to do this and do I have anything to be concerned about?

Hi Tyler,

Yes, when applying for the PPP Loan program, the loan proceeds must be used for the business that qualified for the loan. That’s the case whether it’s the first or second round of the PPP Loan program.

If you didn’t take the loan or sign the papers for the PPP Loan, you shouldn’t worry about what the buyer represented or misrepresented on the application. It’s their certification, not yours.

Congrats on the sale of the business Tyler!

All the best…

Hi,

I purchased a business as a 100% Membership Interest sale eff 12/1/2020. The Seller took $46k funds from the business on 12/1 to put into the escrow account waiting for PPP forgiveness. It was forgiven but then she kept the funds. We were also denied an EIDL loan because the Seller paid back all the loan funds so SBA won’t let us apply again stating there is a duplicate application since there was already an application/loan under same EIN and it was paid back. We’re one of the few business in the US operating with no disaster funding. We barely keeping head above water and we are a healthcare facility. Was the Seller entitled to keep the escrow funds?

Thank you for your help,

Tracy

Hi Tracy,

The PPP Loan forgiveness granted to the former business owner would mean the business spent the money on what the program was intended for — payroll, rents, utilities, health insurance — during the covered period. They spent the money as they should have so the seller has right to this money.

However, I completely understand your frustrations!

You may want to consider applying for the EIDL program under the RECONSIDERATION process. We’ve got a post on this topic here.

And it’s likely you’re eligible for the Employee Retention Credit for Startups. Stay tuned. We’re drafting and updated post on this topic this week.

We’re rooting for you Tracy!

Tracy: The purpose of the PPP was to fund the business immediately after the national shutdown. The seller has every right to this money. The seller also fulfilled his/her promise to the US SBA to either repay it or be granted forgiveness. Unless you agreed otherwise in the purchase agreement, you have no recourse.

Hi, we sold our highly successful restaurant in Feb 2021 for highly discounted price with all the economic uncertainties. The new buyer applied for restaurant revitalization grant in few months after the sale and based on our 2019 sale compared to losses in 2020 received $1.7M in grant money. My question is who is entitled to the grant the new buyer of 3 months or us as a seller.

Thanks

Jay: The grant is designed to get a restaurant back on its feet financially. It is not a handout if you are no longer in the game. You sold your interest in the business. The grant is not for you and, because you did not know about this grant and you made no mention of it as a condition of sale, and finally, you were not the owner of the business at the time of application, you are not entitled to any portion of it, even if it is a windfall to the buyer.

Imagine you bought a lottery ticket for $5. The lottery drawing hasn’t happened yet and because of the uncertainty of winning, you sold the same ticket to a friend for $2 with no strings attached. He ends up winning the grand prize. He’s under no moral or legal requirement to share the winnings with you in this scenario, either.

Hi,

I got the PPP 2nd loan on 2/6, and used all fund to pay the payroll cost in 8 weeks period until 4/6. But I just sold business on 7/7, can I apply for PPP loan forgiveness now? Thanks

Hi Rex,

Yes, you should apply as soon as possible because it’s likely you should have notified your lender about the sale and escrowed the PPP Loan proceeds before the closing.

Congrats for the sale and good luck with your PPP Loan forgiveness Rex!

But I already closed, and lender did not know this. Can I still try to apply the for PPP loan forgiveness now?

Hi Rex,

Yes, apply for forgiveness. If you met the requirements for spending the PPP Loan proceeds, your business should receive forgiveness.

Good luck!

If you receive a Restaurant Revitalization Fund grant and later this year or after the 12/31/21 initial period for the covered funding (based on the SBA not knowing how long Covid recovery will last) can the business entity be sold? Thanks

Hi Jean,

There is nothing published by the SBA that indicates you’d be unable to sell your business if you receive the RRF. That said, the SBA may publish rules about how a sale would be handled after the RRF grant is made to businesses. This is what happened with the PPP loans.

We’ll publish a post on the topic if that indeed happens!

All the best…

Hi,

We are looking to sell our business and hold a note with an Asset Purchase Agreement. We have EIDL loan of 125K. Can we just make the payments on the loan without getting approval or would we be in default? Thanks for your help.

Hi Tammy- Since the EIDL is covered by a blanket UCC lien on your business, it will need to be paid off from the sale proceeds to release the lien so that the assets can be transferred free and clear.

How does the PPP program work when a business was purchased/sold and the new ownership group would like to take out a PPP for the purchased business?

The new business setup has a new EIN #, new legal name, etc to the purchased business.

I don’t see how that could be any different to an old business applying and obtaining funding vs a seller that just purchased that same business.

Hi Nicole,

The SBA issued guidelines on the situation you’ve described.

Question 38 in its FAQs indicates the newco may apply for the PPPL round 2 by using the selling business’ payroll records as long as the business was in operation in February 2020.

Comb through the Q&A on this post and you will see more details about how it works.

All the best…

If an S-Corp is selling a business that has PPP Rd 1 and Rd 2 and has submitted forgiveness on Rd 1 and is selling more than more than 50% of it business does SBA need notification? Also, the corporation that holds the two PPP loans will stay active outside of the sold business until all loans are forgiven or set up for repayment with the original lender.

Hi Sue,

The SBA doesn’t need to be notified, however the selling business will need to escrow the PPP rounds one and two at the closing until the funds are used appropriately, repaid and/or forgiven.

All the best…

Recently I had a heart attack and need to sell my restaurant ASAP. I received a second draw PPP and have finished my covered period and used all the funds as required. B of A has not begun accepting forgiveness apps and when I call and ask when they expect to, I get a different answer every time. The issue is that I have a buyer right now and I can’t even get a forgiveness app. Is there a way I can sell the business and subsequently go through the forgiveness process considering I used all the funds as required and my covered period is over ? The loan was less 150K.

Hi Robert,

The steps you need to follow require you to apply for forgiveness and to be prepared to escrow the borrowed money at closing.

If you’re not getting anywhere with your bank to apply for the PPP Loan second draw, you may want to consider contacting your local SBA office about the situation.

Your congress rep may be helpful too.

Truly wish you success Robert…