As consumers, we’ve become increasingly familiar with the notion of paying a monthly fee for various business and lifestyle services. Whereas we once rented movies by the title by driving to Blockbuster, we now have access to virtually unlimited content on Netflix.

Even morning rituals as basic as shaving, which once involved routine trips to the drug or grocery store, are now available by subscription.

So, too, have traditional enterprise software companies replaced their historical licence and maintenance business model (essentially buy once, use forever, paying only for upgrades as required), with cloud hosted and delivered software — a SaaS business model.

Take Microsoft, which (with some home-use and student exceptions) no longer offers stand-alone enterprise licenses to products like Office, instead insisting that we subscribe to annual or monthly licenses of their Office 365 suite. Or Intuit, which now sells the popular and widely-adopted QuickBooks accounting software on a subscription only basis.

In some important ways, this business model is better for the consumer or business manager. Maintenance and upgrades are bundled for a fixed price, and support is included in the cost. Often, the purchasing decision is made easier by the fact that the spend is considered a current period expense, rather than a multi-year commitment that amounts to capital cost or investment – one necessitating closer scrutiny, and more cumbersome approvals (not to mention less straightforward accounting).

SaaS vs Annuities

The ‘magic’, if you will, of the recurring revenue stream associated with a single customer of a subscription business is parallel and analogous to an annuity, a financial instrument which once purchased, then pays a steady stream of principal and interest back, over a typically fixed period of time, until the full principal is retired.

Those of us in finance are familiar with annuities. We are also familiar with how one would account for such an instrument under ordinary accrual accounting – as an asset, reduced each period by the amount of the principal repayment received, and with the interest component captured as income. . A company ‘buys’ (acquires) a new customer by spending some amount of capital on a sales and marketing effort, and then benefits from the resulting annuity by capturing the associated revenue (in the form of contribution margin, net of COGS and other delivery costs), over some period of time.

However, there are important differences, both in the accounting, and in how we should think about the certainty of repayment.

Key Differences Between Annuities and Newly Acquired Customers

The first and most important difference between an annuity and a newly acquired customer is simple. Today’s accrual accounting standards do not accommodate for the capitalization of customer acquisition cost (or CAC, as we call it in world of the recurring revenue software a SaaS business model). (This is changing, but quite slowly. For the first time, in 2017, public companies will be required to change how they account for both the revenue and costs associated with multi-year contracts. You’ll find a comprehensive summary of FASB ASU 2014-09, here, which replaces essentially all of the existing GAAP on the subject; notwithstanding, these changes don’t accommodate for the capitalization of customer acquisition costs, nor credit for the likely customer lifetime when it extends beyond the contracted period). As we cannot be certain how long a customer will remain happy and loyal (and paying, beyond the initially contracted period), neither can we know the definitive present value of the income stream associated with their patronage. And yet, in a very practical sense, customers of subscription product and service companies are – from a pure financial point of view – essentially exactly comparable to an annuity.

SaaS Business Model Valuation Fundamentals

The implications for the analysis of a subscription business’ financials (and its underlying value) are quite profound. And this is where some further Magic kicks in.

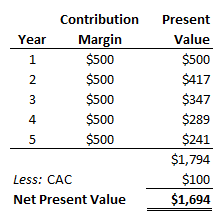

The income statement, balance sheet, and cash flow statement no longer tell a valid story. Imagine a SaaS enterprise software business that is spending $100 in sales and marketing expense, to acquire a customer that will (on average), remain a customer for a full 5 years, and each year contribute $500 (net of COGS and other marginal delivery costs) to the operating income of that same business. If we assume a 20% cost of capital (discount rate), then the net present value of this customer is $1,694; the $100 investment, which shows up as a present period expense on the income statement, will result in present value of contribution margin dollars equal to $1,794, which shows up nowhere at all, on either the balance sheet or the income statement (other than the present period contribution of $500).

Furthermore, if this business had access to an unlimited supply of similar customers, then it would behoove them to acquire as many as possible, even if they had to raise further capital and run at an operating loss to do so.

It is this dynamic – the seemingly odd situation where a clearly money ‘losing’ business is amassing a fantastic amount of enterprise value, that fuels the ‘myth’ that recurring revenue software business are overvalued.

Is Amazon, for example, overvalued? It generates almost no profit (1.81% of revenue), and yet has amassed incredible value (trades at 3.3X sales) by investing heavily in the acquisition of customers that are likely to stay for incredibly long periods of time (whether they be Amazon Prime consumer subscribers who permanently alter their buying habits by turning first to Amazon for almost anything they might buy, or Amazon AWS business customers, that once having transitioned their hosting to AWS, are unlikely to ever depart the infrastructure).

Or what about Workday, which sports an operating margin of negative 21.5%, and yet trades at over 12X trailing (12 month) sales. It makes perfect sense for them to raise further growth capital and to then invest as aggressively as possible in customer acquisition, as just as in our example, they are certain the financial value of those customers is far in excess of the capital they must invest to acquire them.

How to Value a SaaS Business Model

There are a series of standard SaaS metrics which represent and capture this ‘beyond the financials’ value in any SaaS software business, and are placed ahead of typical financial statement measures when knowledgeable Growth Equity investors or PE buyers are assessing the Enterprise Value of a SaaS business.

Whether you are assessing the value of one of these businesses as a potential buyer or investor, or considering shifting your own business model in this direction, our investment banking firm offers a wealth of good information to help you come further up the learning curve.

We’ve been talking to brokers who keep commenting that we need to change our business model to SAAS. Why?

We sell our products on an annual license and we’re happy with the arrangement.

We’re not quite a startup as we have users paying us. We’ve been told churn is a big problem that we need to get under control.

Would you have some advice on this metric? It’s not mentioned in your article.

Matthew,

As you’ve heard, churn is a critical metric, although it is arguably not as critical as your cost of customer acquisition (the so-called SaaS CAC metric).

Hi Andrew,

Really glad to have found this article! There is very little information available about how to value pre-revenue or early-revenue SaaS businesses.

We just started selling app used in home-based healthcare services. We’re getting calls and emails from Private Equity firms and are overwhelmed because we have no idea what our business is worth or even if we want to sell it at this point.

Are there metrics of any kind we should consider? Like the number of users, free trials, revenue vs. our monthly burn? Any help will be appreciated.

Trent,

Thanks for your note. Early stage SaaS valuation is dictated more by elements like 1) the quality of the founding team, 2) the total size of the market opportunity, 3) how efficiently you will be able to acquire customers.

Sounds like you’re a little further down the road, with some meaningful metrics. In your case, all of the metrics you mention are also valid for an app or digital property (website, etc), but the growth of those metrics is even more important!

Trent-

I often represent early-stage businesses and frequently work with valuation firms. Feel free to reach out if you would like to discuss in more detail.