- EBITDA Add Backs and Adjustments - February 20, 2023

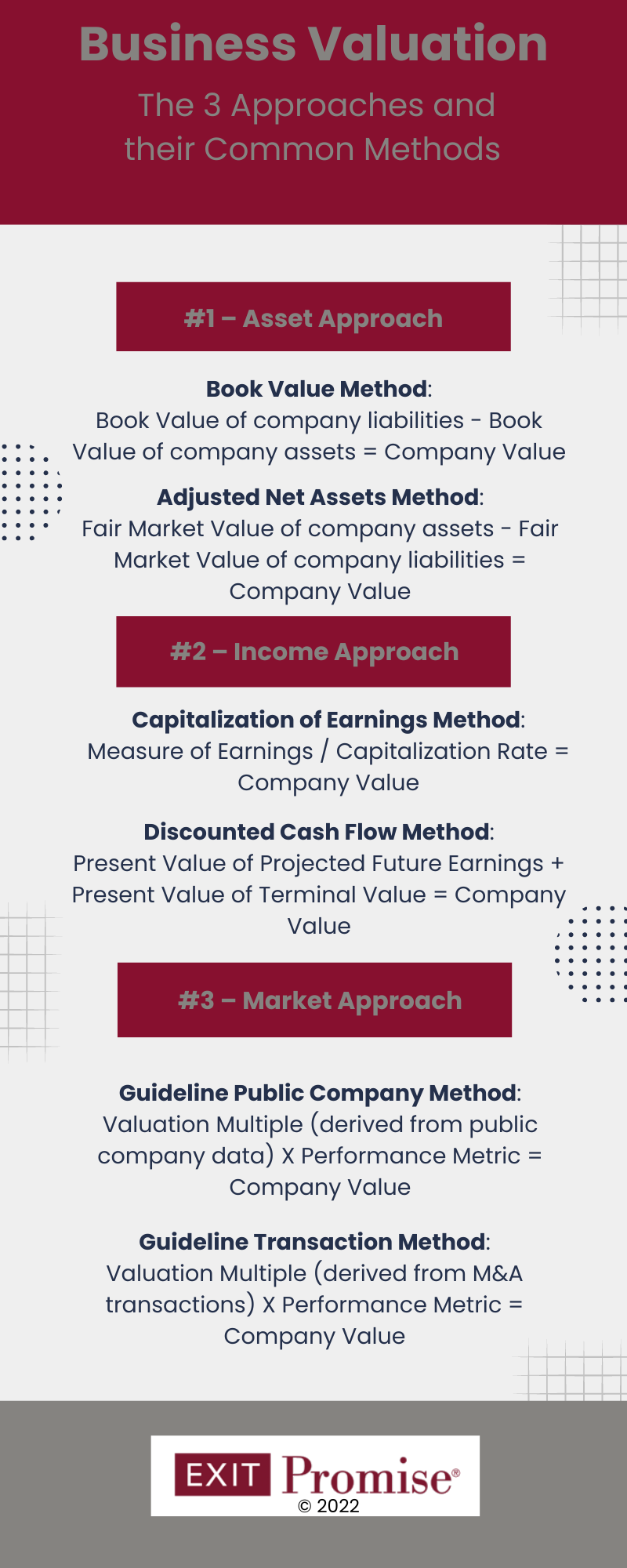

- The Three Business Valuation Approaches [Infographic] - November 1, 2022

- The Negative Effect of Concentrations on the Value of a Business - August 17, 2022

Have a Question?

Ask your Question below!

One of our investors or advisors will answer.

At some point during a company’s existence, it’s very likely a business owner will need a business valuation. The reasons for getting a business valuation can range from estate planning, partner buy-out, merger or acquisition, selling the company, or even a divorce. But regardless of the reason, it is very important to understand how business valuations are conducted.

Based on the variables and information available, a valuation professional can follow three types of business valuation models to arrive at the value of a business.

These three approaches used in valuing a business are: the asset-based approach, the income approach, and the market approach.

Business Valuation Professionals typically rely on one or two depending on the type of case it is plus other factors. It’s vital that business owners who rely on business valuations understand the basics of each approach. To help business owners fully understand each of the three business valuation approaches, we’ve created the Business Valuation Approaches.

Asset Approach

The asset based approach is defined by the International Glossary of Business Valuation Terms as “a general way of determining a value indication of a business, business ownership interest, or security using one or more methods based on the value of its assets net of liabilities.”

Any asset-based approach involves an analysis of the economic worth of a company’s tangible and intangible, recorded and unrecorded assets in excess of its outstanding liabilities.

Nevertheless the actual value in the asset-based approach could be much higher than the sum of all the recorded assets of the business.

For example, a Balance Sheet may not always have all the significant assets such as the company’s method of conducting business (its unique business model) and internally-developed procedures, business systems, and products. Placing a value on the method of conducting business that makes a company unique can be difficult.

A business owner can calculate an asset-based valuation for their company using the help of the following two approaches:

Book Value Method: This method is based on the financial accounting concept that owners’ equity is determined by subtracting the book value of a company’s liabilities from the book value of its assets. While this concept is acceptable to most analysts, most agree that the method has serious flaws. This method is recommended for businesses that do not plan to sell their assets or liquidate and want to stay in business for some time.

Adjusted Net Assets Method: This method is used to value a business based on the difference between the fair market value of the business assets and its liabilities. Depending on the particular purpose or circumstances underlying the valuation, this method sometimes uses the replacement or liquidation value of the company assets less the liabilities. Under this method the analyst adjusts the book value of the assets to fair market value and then reduces the total adjusted value of assets by the market value of all recorded and unrecorded liabilities.

All in all, the asset-based business valuation method is a great method to arrive at exact value for which a company can be sold. And even though there are many other methods out there, the asset-based valuation method is often preferred because of its applicability in instances where a business is suffering from challenges relating to liquidity.

Income Approach

The income approach measures the future economic benefits that a company can generate for a business owner. As part of this analysis, valuation professionals assess factors that determine expected income including data such as revenues, expenses and tax liabilities.

When using the income approach, a business is valued at the net present value of its future earnings or cash flows. These cash flows or future earnings are determined by projecting the earnings of the business and then adjusting them for changes in growth rates, taxes, and other relevant factors.

A business owner can calculate an income-based valuation for their company using the help of the following two approaches:

Capitalization of Earnings Method: This method is used to value a business based on the future estimated benefits, normally using some measure of earnings or cash flows to be generated by the company. These estimated future benefits are then capitalized using an appropriate capitalization rate.

This method assumes all of the assets, both tangible and intangible, are indistinguishable parts of the business and does not attempt to separate their values. In other words, the critical component of the value of the business is its ability to generate future earnings or cash flows.

Discounted Cash Flow Method: This method is based on the assumption that the total value of a business is the present value of its projected future earnings, plus the present value of the terminal value. This method requires that a terminal value assumption be made. The amounts of projected earnings and the terminal value are discounted to the present using an appropriate discount rate, rather than a capitalization rate.

The Discounted Cash Flow Method of valuing a closely held business uses the following steps:

- Determine the estimated future earnings of the business.

- Determine a terminal value at the end of the projected income stream.

- Select an appropriate discount rate.

- Discount and sum the estimated future earnings and the terminal value to the present using the discount rate previously determined. The resulting amount is the total value of the business.

Market Approach

The concept behind the market approach is that the value of a business can be determined by reference to reasonably comparable guideline companies for which transaction values are known.

This approach is commonly used especially in contexts where the user of the analyst’s report does not have specialized business valuation knowledge. The market approach is a common method of determining a measure of value by comparing the business or equity interest in question to similar businesses, interests, securities, or intangibles that have been sold.

A business owner can calculate a market-based valuation for their company with the help of the following two approaches:

Guideline Public Company Method: The guideline public company method develops an indication of value based on consideration of publicly traded companies that provide a reasonable basis for comparison to the subject company. The valuation professional will typically conduct a search to identify a group of guideline public companies based on the subject company’s industry, and review financial, industry, and market characteristics to ensure that they are reasonable for inclusion.

Analysts typically express the relationship between the value of a company and a corresponding metric in the form of a valuation multiple.

The multiple is multiplied by a performance metric such as EBITDA and the resulting amount is the total value of the business.

Guideline Transactions Method: The guideline transaction method is similar to the guideline public company method. However, instead of deriving values from public company stock prices, values are derived from transactions in the mergers & acquisition market.

Data for market transactions is typically sourced from various databases.

Conclusion

In conclusion, a business owner can determine the value of their business in several different ways, some of which are better approaches for certain companies than for others.

For example, an asset-based valuation will be particularly suited to businesses that hold investments or real estate or for a business that is generating losses.

Under the income-based valuation, the capitalization of earnings method is well-suited for businesses expected to have stable cash flows, whereas the discounted cash flow method is better suited for businesses whose cash flows may fluctuate.

And finally a market-based valuation will be best suited for businesses in the startup phase or businesses looking for financing.