- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Do you have a Question?

Ask below. One of our Investors or Advisors will Answer!

In this post, we explain how many businesses are valued based on a measurement known as EBITDA or Adjusted EBITDA.

Valuing a business starts by understanding:

- How the EBITDA Measurement is Used to Value a Business

- The Importance of the EBITDA Multiple

- How to Calculate EBITDA (free tool) and

- The Valid Adjustments to Compute Adjusted EBITDA

One of the many questions asked by business owners as they plan for the sale of their business is related to the Adjusted EBITDA definition. Its computation is important to business owners because it’s a vital part of a multi-step process used in the valuation of a privately held company.

Adjusted EBITDA is used by Business Brokers in the valuation and sale of smaller businesses often referred to as ‘Main Street Businesses’. Likewise, the concept is used by Merger & Acquisition Intermediaries or Investment Bankers when representing businesses for sale in the lower middle and middle market.

Before we define Adjusted or Normalized EBITDA, understanding what this measurement means in the context of business valuation is a worthy exercise.

How to Value a Company

Main Street and Middle Market Business Valuations use a variety of measurements to determine an approximate fair market value of a business. Neither the valuation methodologies nor their underlying measurements are carved into stone. Instead, each industry or type of business tends to use a variety of valuation techniques to suit its own needs.

For example, a professional services business like an Information Technology (IT) company, is valued typically on a multiple of 1 to 1.5 applied to (or multiplied by) its annual gross revenue. Alternatively, businesses in other industries may rely more heavily on the Adjusted EBITDA measurement to determine business value.

Generally speaking, the greater the business’s gross revenue, the more likely its business valuation will be derived in part by the Adjusted EBITDA measurement.

EBITDA Multiple

As mentioned above, a ‘multiple’ is applied to a given measurement such as annual gross revenue or Adjusted EBITDA to determine the business value.

The product of this multiplication is one component in the business valuation. Additional adjustments may be made for assets and liabilities associated with the business operation or entity.

The EBITDA multiple also varies widely from industry-to-industry and even from year-to-year. When M&A activities increase, the EBITDA multiples used in business valuations tend to rise. When business acquisitions are less attractive in the private markets, the EBITDA multiples tend to drop.

While much debate exists over which business valuation methodology and measurement should be used, suffice it to say understanding the ‘Adjusted EBITDA’ concept is a worthy exercise for the entrepreneur. It’s useful because this measurement tells a business buyer how much cash a business produces on an annual basis. And such a measurement becomes more important to both the seller and the buyer as the business grows its annual revenues.

Before we explore Adjusted EBITDA’s definition, let’s define EBITDA and show you how to calculate it.

EBITDA Calculation

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation and Amortization.

Most business owners don’t focus on this measurement of cash flow from operations until it’s time to understand it in terms of business valuation. And often that doesn’t happen until the business owner begins his exit planning or selling process.

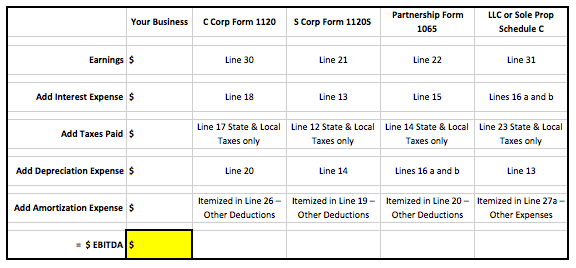

Here’s a simple formula to calculate EBITDA from the figures found on your 2017 business federal income tax returns:

Adjusted EBITDA Definition and Calculation

The EBITDA measurement of cash flow from operations often only tells the owner or buyer of a business part of the story.

In most private businesses, certain forms of income and expenses are not standard. Instead, it is safe to say anomalies related to certain income and/or expenses may exist.

Accordingly, to get a true picture of the business’s cash flow, an outside party will need to normalize EBITDA measurement. By normalizing EBITDA, a business buyer is better able to compare the cash flow from one business to another. In fact, another name used by M&A advisors for Adjusted EBITDA is ‘Normalized EBITDA’.

A few of the adjustments made to normalize EBITDA may include:

Adjustments which will Increase EBITDA

• Excessive rent expense paid to a related party

• Excessive compensation and/or benefits paid to business owners, employees, relatives, etc.

• Excessive automobile expenses paid on behalf of business owners and/or employees

• Excessive travel and entertainment expenses paid on behalf of business owners and/or employees

• Charitable contributions

• Legal, Accounting and other professional fees not related to the ongoing operations of the business

• Excessive or lavish office related expenses

• Excessive bonuses paid to business owners and employees

• Bad Debts expense outside of the normal range

• Any expense considered discretionary and not customary to the industry by the business owner and/or management

• Any expense considered outside of the normal costs to operate a business such as a lawsuit settlement paid to another party

Adjustments which will Decrease EBITDA

• Excessive Management Fee Income from a related party or related business

• Excessive Rental Income outside of normal rental rates for the market

• One time windfalls such as a lawsuit settlement received

Once a business owner, his M&A and valuation advisors, as well as any potential buyers are able to reach agreement with regard to an Adjusted EBITDA figure, this key measurement is then used in the formula to determine the business value.

While this measurement is calculated on an annual basis, it’s not unusual for buyers to review the previous three years’ Adjusted EBITDA. By doing so, a buyer is able to assess the normalized cash flow trend and compare it to the gross revenue sales trend for the same three year period. If the two trends are consistent, it’s reasonable to assume additional sales growth in the future will result in an increase in cash flow. Of course this situation is desirable and exactly what a business owner should strive to achieve as he plans for a sale or business ownership transfer.

Exit Promise Members — Download your EBITDA Calculator!

I am currently in negotiations. My ebitda is $450,000 which is agreed; however the buyer is attempting to lower my ebitda by stating he will be adding 2 positions after he buys the company totally $100,000 which is coming directly from the ebitda thus lowering my company valuation by half million dollars. In addition I have grown the company by $600,000 this year in one month just since negotiations began so basically negating his deduction; however, he is not considering the growth as he figured ebitda by 12/2018. Question is if he is going to reduce my ebitda for his future added staff isn’t it logical for him to also count company growth which is already factual data? Is this allowed or an ethical computation.

Hi Vickie,

From your description it sounds like you have either an inexperienced buyer or an unethical buyer. If, as you say, he agreed on the EBITDA and applied a factor to arrive at an offer price then he is now reneging and changing his price.

If he wants to add two positions after acquisition that is his decision but not your problem. The fact that you have grown the business in the month since the start of negotiations should both increase his interest and strengthen your bargaining position.

Unless you have a need to sell to him now I would suggest you stand firm on the original offer and not agree to any changes in price. It is likely he will want to maintain the current offer and complete negotiations.

Thanks for this article. Very helpful!

I am working with my CPA to calculate EBITDA and he’s telling me I can add back my car expenses to income. He wants to add back my wife’s car expenses too. We use our cars for business a lot. Logically, I don’t think it’s right to add back the lease, gas, insurance, etc.

All of our sales reps have these expenses too and we’re not adding those back?

Could you explain why he says to add these expense back?

Hi DJ,

The key is whether the car expenses are discretionary or required for the business to operate successfully. These car expenses can be apportioned on your estimate of the breakdown on these two dimensions. If a buyer is considering your business you will need to explain how you decided on the amount that was added back. This does include the related lease, gas, insurance etc.as part of the car expense.

Regarding your sales reps I assume you decided their car expenses are a necessary business expense. They should not be added back.

In reviewing EBITA for the sale of my small business, which is an S Corporation, the broker has not included in EBITA the cash bonus I pay myself each year which is processed as a payroll bonus. The cash bonus is subject to all the regular payroll taxes. I do take an earning distribution also, but that is separate from this cash bonus.

Should the cash bonus portion of my compensation be added back into EBITA?

Hey Jim,

I’m a business broker and featured advisor on Exit Promise and I’ve recasted hundreds of tax returns and P&L statements. It’s tough to answer without seeing your financials but the short answer is that if it was expensed and included in “Owners Compensation” or “Wages and Salary” (but it went to you the owner) then it should be added back. If it was a shareholder distribution, reflected in your K1, and/or profit of the business that was passed through to you than it’s balance sheet activity and should not be added back.

In general, expenses paid to the owner which a future owner could decide upon are discretionary, including owner’s salary/bonus & the associated payroll taxes, and therefore can be added back. I hope this helps answer your question.

We are selling our business, an LLC taxed as an S Corp. A Broker is evaluating our EBITDA to sell our business. My partner and I pay ourselves a salary, and extraordinary amount of dividends that is based on the amount of cash available in the company. Upon a sale, we would of course not take dividends any longer. The broker says that dividends can not be added back to the EBITDA number, but since we would no longer be compensated with dividends, and also a much lower salary during the transition, i don’t understand why the Dividend number can’t be added back or adjusted in the EBITDA?

Hi Michael,

What’s important to understand is the Adjusted EBITDA computation starts with Earnings. The earnings from your business is typically the NET Profit on the bottom of your Income Statement.

In the case of an S Corporation, unless the cash was from prior year earnings, the distributions paid to its shareholders were derived from the S Corp’s Net Profit. So if you add distributions back when computing Adjusted EBITDA, you would be including the same income twice. That’s why your business broker is telling you the S Corp distributions may not be added as an adjustment to EBITDA.

EBITDA is a measurement of the cash produced by the business for one year by taking the net profit and adding back finance expenses (interest), income taxes and non-cash deductions (depreciation and amortization). S Corp Distributions paid to its shareholders come from the balance sheet and are derived from the cash produced from the business operations.

Does this help Michael?

Yearly employee bonus and payroll taxes on those bonuses? Are they a recurring yearly expense.

Bonuses can be recurring every year if you want them to be. Typically bonuses are used to reward employees that exceed sales quotas or performance quotas.

If you’re the shareholder of the business you can use bonuses to add to annual salaries so that you achieve reasonable compensation.

Hi

Why is the cash and cash equivalents deducted to derive the equity value of an enterprise. The formula being prescribed for Ebitda valuations:

Editda X multiple = Enterprise value – all debt – Cash and cash equivalents = Equity value

Hi Kobus,

We’ve got another post on the subject of Enterprise Value which explains how to calculate EV and why the formula includes a deduction for cash.

Hope this is helpful to you!

Are dividends included or excluded from ebitda

Hi Kevin,

Dividends are paid from a C Corporation to its shareholders and are included in Earnings when calculating EBITDA.

I want to know that why broker use an adjusted EBITDA different from the reported EBITDA. (specially for companies in Europe)

Hi Meghna,

Typically a business broker will make adjustments to EBITDA to account for expenses which may be abnormal or unnecessary to operate the business successfully.

I don’t think there is a difference between such adjustments in the UK or the United States.

If you are able to share with me the actual types of adjustments (accounts, not the amounts), I may be able to expand on the possible reasoning.

I get a positive EBITDA but then when I go to normalized EBITDA do I factor in the significant dividends that are being pulled out each year? They have pulled dividends for at least 3 years in a row, they are not discretionary.

Hi Marie,

A dividend or a distribution paid to the business owner is not part of EBITDA. EBITDA starts with ‘Earnings’ and dividends (or distributions) are not deducted on the Profit and Loss statement. Instead, such payments to owners are part of the Capital account on the Balance Sheet.

If owners in a partnership are taking out money in the form of a guaranteed payment as you’ve implied by stating the amounts are not discretionary, then it is important to be certain such payments are not extraordinary in amount. If so, an adjustment (plus or minus) should be made to normalize the Earnings component in EBITDA.

I hope this is helpful to you!

All the best…

When calculating EBITDA do reported Operating Expenses for the EBT include Depreciation, Interest, and insurance premiums for company owners? Or are these items subtracted and itemized in the Reported EBITDA calculation and/or Adjusted EBITDA?

Good morning Terry,

When you start the EBITDA Calculation, you use Net Income, which would include the deductions for depreciation, interest, and business insurance premiums. To get to EBITDA, you would take Net Income and then add back depreciation expense, interest expense, (and Taxes and Amortization).

Insurance premiums for company’s owners may be an addback to get to Adjusted EBITDA, depending on the type of insurance premiums.

If you need more clarity on this Terry, just let me know.

All the best…