Create your Valuable Business

Creating a valuable business is not easy. We get that.

Most business owners do not have a formal education in accounting, finance or law. And yet you are expected to understand these complex and important matters.

Exit Promise offers access to investors, advisors and other resources so you can create a valuable business.

Whether you choose to sell or keep your valuable business is up to you!

So far, Exit Promise has helped more than one million business owners like you.

Articles

4 Things To Do to Prepare to Sell Your Business

What should a business owner do to prepare to sell his or her business some time in the near future?

Aside from right-sizing the business’s overhead costs to line up with its current level of revenue, and looking for opportunities the pandemic may be presenting, there are four things a business owner can do now to prepare to sell. And more importantly, doing these four things will mean that when a Letter of Intent is received from a buyer, the business will be very well-prepared to survive the due diligence stage of the sale.

How Much Does it Cost to Sell a Business?

As an intermediary, I have many conversations with business owners about how much their business is worth. As these conversations progress, owners realize that it’s not how much they make, it’s how much they can keep that truly matters.

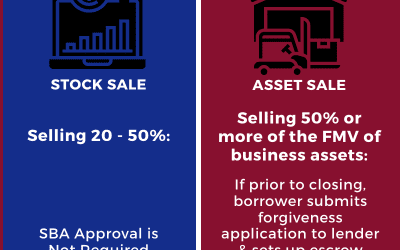

What Happens to PPP Loan When Selling a Business

The Small Business Administration (SBA) issued a Procedural Notice on October 2, 2020 which offers business owners and lenders guidance on how Paycheck Protection Program (PPP) Loans are to be handled when a business has a change in ownership.

This post summarizes the notice and includes an Infographic to assist business owners. It includes the following topic:

When does a Business Sale Require the SBA’s Approval

Does a Business Sale Require the PPP Lender’s Approval or Notification

Required Steps Pre and Post-Closing for PPP Borrowers

SBA Timeframe to Approve a Sale or Merger when a PPP Loan Transfers

Does the EIDL Grant Impose Additional Steps When Selling a Business

Disadvantages of Using A PEO

In a previous post, we discussed how a Professional Employer Organization (PEO) company works, its many benefits, and the tax implications you may face if you hire one.

As a recap, a PEO is a service that small or medium-sized businesses may use to outsource some of their human resource, payroll, benefits, taxes, recruiting, and other management tasks. As you might imagine, there are both pros and cons in hiring a PEO.

Here, we’ll discuss the disadvantages of using a PEO, along with the associated costs of a PEO.

Can A Non Profit Use A PEO?

In our PEO series, we’ve talked about what a PEO company is and who is the employer in a PEO relationship. Here, we’ll discuss PEO for nonprofits, and whether or not using a PEO for your nonprofit might make sense.

SBA Reopens Economic Injury Disaster Loan Applications

On June 15, 2020, the Small Business Administration reopened the Economic Injury Disaster Loan (EIDL) applications to businesses with no more than 500 employees and non-profit organizations operating and suffering substantial economic injury as a result of the pandemic in all of the U.S. states, Washington D.C., and territories.

Independent Contractors, sole-proprietors (with or without employees), gig workers and freelancers are also eligible to apply for the EIDL.

7 Changes PPP Loan Flexibility Act Offers Business Owners

On June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act (PPPFA), which is the latest attempt to save struggling businesses from permanent shutdown.

The Flexibility Act offers business owners seven significant changes to the original Paycheck Protection Program (PPP) Loan terms. The House and Senate were driven to make these changes due to the lengthy pandemic and the fact that many PPP Loan recipients have not been able to re-open their doors for business during the required eight-week ‘covered period’ set forth in the original PPP Loan Act.

The PPP Loan Flexibility Act will make it much easier for business owners to achieve full, or nearly full, loan forgiveness.

The new law provides business owners with seven significant changes to the original law and those include:

Who is the Employer in a PEO?

Our PEO series is aimed at addressing the common questions about PEOs, and uncovering some of the lesser-known facts about working with a PEO so that you may make the best choices for your business.

So far, we’ve learned about what a PEO company does. Here, we’ll dive into some muddy waters and decipher who is really the employer in a PEO relationship.

What is a PEO Company?

If you are wondering what a PEO is and whether or not this type of outsourcing may be a good option for your small or medium-sized business, this first article in our series of four posts will help you decide if it’s the right move for you. In this post, we cover everything you need to know about a PEO company including:

• What’s the meaning of PEO?

• PEO payroll

• PEO benefits

• PEO tax implications, and more.

Closing Business Deals in the COVID-19 Era

The COVID 19 Era has begun. In addition to lives lost, there’s an economic toll that has yet to be determined at the time this content is being written. With small businesses on life support, these are scary times for business owners and for the intermediaries helping owners navigate through them. So how has COVID 19 affected business transactions?

PPP Loans Out of Money — What To Do Now?

The Small Business Administration announced on Thursday, April 16th all federal funds set aside for the Paycheck Protection Plan (PPP) Loans have been allocated to those business owners who were persistent (and fortunate) enough to get through the application process and receive an official registration number from the SBA via its bank.

In simple terms, the PPP Loans are out of money to assist business owners.

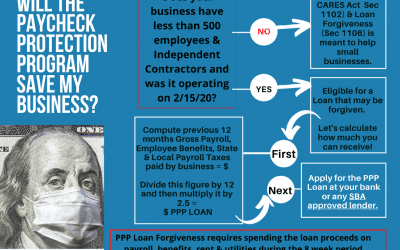

How the Paycheck Protection Loans Work

On Friday, March 27, 2020, the Paycheck Protection (Loan) Program (PPL) for small businesses was approved as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This new law is intended to help small business owners in an unprecedented way.

First, while the Paycheck Protection Program Loan will be initially set up by banks and approved by the SBA under section 7 (a), unlike other SBA loan programs, the PPL is guaranteed 100% by the SBA.

Second, if the proceeds of the loan are used by business owners as Congress, the Senate and President Trump intended, the loan will be forgiven.

Access Additional Articles