- Maximizing After Tax Proceeds When Selling Your Business - June 7, 2024

- Understanding the Accredited Investor Rule 501 of Regulation D - February 27, 2024

- Which is Best – Business Broker, M&A Advisor, or an Investment Banker? - October 2, 2023

Selling a business is one of the most exhausting endeavors an entrepreneur will undertake. Unfortunately, many simply do not succeed. In fact, only one out of ten entrepreneurs will actually complete the business sale process and transfer their business to another.

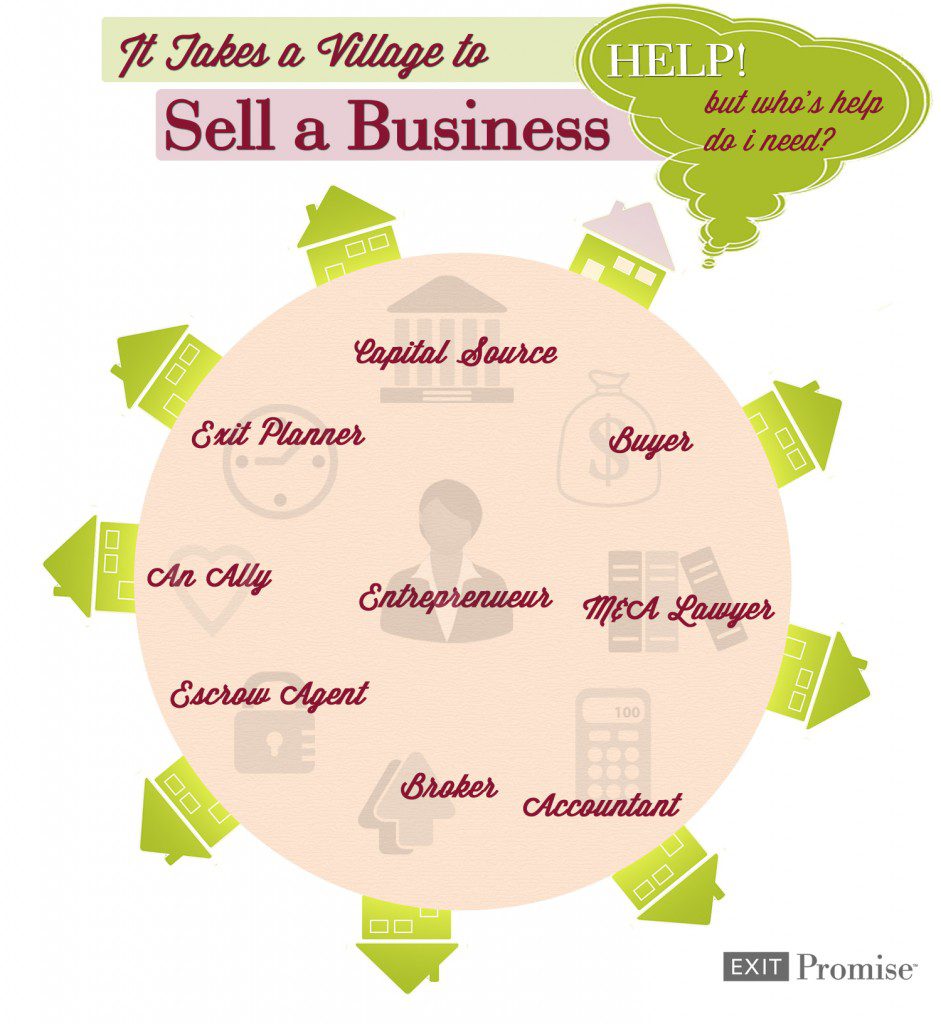

Selling a business involves many different parties, all of whom have a special role and a unique skillset. Most importantly, they must all work together. Those entrepreneurs who succeed recognize ‘it takes a village to sell a business’.

So who is involved when you’re looking to sell?

Help Selling a Business

1. Exit Planner

The exit planning professional offers unbiased advice intended to educate and guide the entrepreneur as they consider options to transfer their business to another party. Ideally, an Exit Planner should be well-versed in the tax, legal, financial, and estate planning issues related to mergers and acquisitions.

Exit Planners also should be able to advise an entrepreneur about how potential buyers or successors will view and value the business in its present condition as well as how to improve its value. A good Exit Planner will explore all options available to transfer a business, including but not limited to ESOPs, Key Management Buyout, and Private Equity.

The ideal time to hire an Exit Planner is two-to-ten years before the entrepreneur’s intended exit. The earlier one is engaged, the more likely the entrepreneur will fall into the 10% of businesses that sell successfully.

2. M&A Intermediary or Business Broker

Depending on the gross revenue of the business , either a Mergers and Acquisition Intermediary or a Business Broker will be needed to market the business to the various parties. Usually Middle Market businesses with gross revenues of $5 Million per year and over are usually represented by M & A Intermediaries. Smaller businesses with gross revenues under $5 Million per year are usually represented by Business Brokers. Of course, there are exceptions. Often M&A / Middle Market deals can be regarded as those with a purchase price in excess of $1 Million and Business Broker / Small Business deals are regarded as those with a purchase price under $1 Million. Either way, it’s important that the Seller find a representative who is familiar with the business, its industry, and the market for potential buyers.

3. Business Buyer

Although most entrepreneurs initially think they will sell their business to an outside party such as a competitor or investor, in many cases other types of buyers present viable options. Such other buyers include: key employees or management team, employees through an ESOP, Private Equity Groups, vendors, and family members. Regardless every buyer has its unique set of challenges when attempting to negotiate, finance, and close a deal.

4. M&A Attorney

Of course hiring an Attorney who understands the numerous potential pitfalls when selling a business is critical to the Entrepreneur. And not all Attorneys are equal. Just as one would seek a medical doctor who specializes in orthopedics if you have a problem with your knee, the entrepreneur should seek an Attorney who specializes in corporate/business transactions if they want to sell their business. If not sooner, an M&A Attorney should be consulted as soon as a Buyer presents a Letter of Intent to a seller.

5. Accountant

Similar to the M&A Attorney, an Accountant or CPA should be selected carefully and consulted when a Letter of Intent is received. Many terms defined in the Letter of Intent have tax implications to both the seller and the buyer. If proper tax counsel is sought, the net cash received by the entrepreneur after the sale can be positively impacted.

It is common to find M&A Attorneys and CPA’s who have worked together on multiple deals. Accordingly, they are a good source of referrals to one another.

6. Escrow Agent

Almost every Buyer sets forth a provision in a Stock or Asset Purchase Agreement where some of the purchase price is set aside in an escrow account until certain terms or conditions have been met by the Seller following the closing of the transaction. Conditions related to the proper and final transfer of Intellectual Property rights, entity closure, collection of Accounts Receivable, and many other post-closing matters may be tied to the release of the escrowed funds to the Seller. Hiring an independent escrow agent who will follow the mutually agreed upon terms and conditions of the escrow agreement is just as important to the Seller as it is to the Buyer.

7. Capital Source or Banker

Although it is not the seller’s responsibility to source the capital to purchase the business, the seller should be aware that the buyer’s capital source can have a large impact on the sale transaction. Capital sources are known for conducting their own due diligence on the business and on the purchase agreement. This can slow down the process and in some cases cause the sale to not close. Additionally, the buyer’s lender or other source of business capital may place conditions on the seller via the stock or asset purchase agreement which may be unfavorable to the seller. Careful review of all terms in the purchase agreements by the seller’s M&A Attorney and CPA is absolutely necessary.

8. A Good Friend

Ask any entrepreneur who has sold their business successfully and they will tell you there was always ‘someone’ that stuck by them through the lengthy and tumultuous process. That person may be a key employee, an advisor, a spouse, or simply a good friend. Regardless, and without fail, they will recall that “I couldn’t have done it without them”.

Hello Holly,

I am negotiating the sale of my small business and it is a retail store under a dba. I am structured as a “S” Corporation and I am interested in maintaining my corporation. Can I keep my corporation and merely sale the dba. If so how would this sale be structured?

Ilene

Hi Ilene,

Yes, it is possible to sell your DBA and other related assets to a buyer and retain the S Corporation. In fact, when most small businesses are sold, the buyer typically prefers to acquire certain assets (an in some cases certain liabilities) as opposed to acquiring the corporation stock.

In your case the sale would be structured as an ‘Asset Sale’. We’ve got a few resources for you to learn more about this type of business acquisition. I hope this is helpful to you Ilene!

All the best…