- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

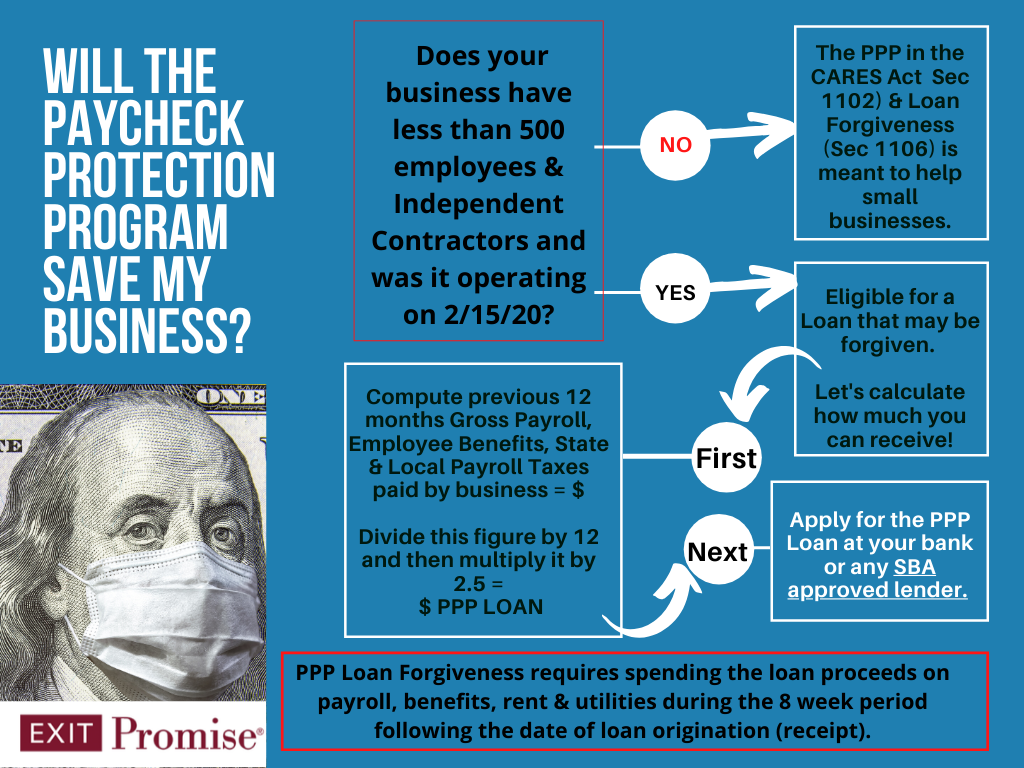

On Friday, March 27, 2020, the Paycheck Protection (Loan) Program (PPL) for small businesses was approved as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This new law is intended to help small business owners in an unprecedented way.

On June 5, 2020, the Paycheck Protection Program Loan Flexibility Act was signed into law and loosened the rules for business owners to qualify for loan forgiveness. This post has been updated to reflect these changes.

First, while the Paycheck Protection Program Loan will be initially set up by banks and approved by the SBA under section 7 (a), unlike other SBA loan programs, the PPL is guaranteed 100% by the SBA.

Second, if the proceeds of the loan are used by business owners as Congress, the Senate and President Trump intended, the loan will be forgiven.

Essentially, how the paycheck protection loans work for small business owners depends on whether loan proceeds are used properly. If so, the loan becomes a grant from the federal government to help you get your business back in business as soon as possible.

In this post, we will cover the following about the Payroll Protection Loan program:

- How to qualify for the Paycheck Protection Loan?

- What type of Employees are eligible for the PPL?

- How much is the maximum amount of PPL available for my business?

- What’s included in Payroll Costs when calculating the maximum PPL?

- Which Payroll Costs do NOT qualify for the PPL?

- What can I use the loan proceeds for?

- What’s the Recipient Good Faith Certification?

- Do I have to personally guaranteed the PPL?

- What are the costs associated with the PPL?

- When do I have to start making PPL payments?

- How do I get PPL forgiveness or make the PPL a Grant?

- How do I apply for a Paycheck Protection Loan for my business?

How to qualify for the Paycheck Protection Loan

In order to qualify for the PPL, the business must have been in operation on February 15, 2020 and had employees being paid wages, salary and payroll taxes OR paid independent contractors and reported those payments on federal form 1099-MISC.

What type of Employees are eligible for the PPL

The PPL eligible business may not have employed more than 500 employees as of February 15, 2020. The term employee includes individuals who work on either a full-time or part-time basis.

The Accommodation and Food Services businesses may measure the employee count based on each physical location.

And for those individuals who operate their business as sole proprietors (filing a tax return on a Schedule C) or as a self-employed business owner, they also may be eligible to receive a Paycheck Protection Loan.

How much is the maximum amount of PPL available for my business

During the period from February 15, 2020 and ending on June 30, 2020, the maximum PPL amount is the LESSER of:

- The AVERAGE TOTAL MONTHLY PAYMENTS by the business owner for PAYROLL COSTS incurred during the one-year period before the date on which the loan is made MULTIPLIED BY 2.5;

- PLUS any outstanding loan amounts that were made beginning on January 31, 2020 and ending on the date the business owner receives the PPL, which may be eligible to be refinanced under the PPL

OR

- $10,000,000.

What’s included in Payroll Costs when calculating the maximum PPL

Under the Paycheck Protection Loan Program, Payroll Costs include the following:

- Salary, Wages, Commissions and similar forms of compensation;

- Payment of cash tips or equivalents;

- Allowances for dismissal or separation payments;

- Payment of vacation, parental, family, medical or sick leave;

- Group Health Care Benefits, including insurance premiums;

- Retirement Benefits paid by the employer;

- State and Local Taxes assessed on employee compensation paid by the business;

- The sum of payments of any compensation to or income of a Sole Proprietor or Independent Contractor that is wage, commission, income, net earnings from self-employment or similar compensation and that is in an amount not exceeding more than $100,000 in one year, as prorated for the period beginning on February 15, 2020 and ending on June 30, 2020.

Which Payroll Costs do NOT qualify for the PPL

Under the Paycheck Protection Loan Program, Payroll Costs do NOT include the following:

- the compensation of an individual employee in excess of an annual salary of $100,000 as prorated for the period beginning on February 15, 2020 and ending on June 30, 2020:

- taxes imposed or withheld under FICA (Social Security and Medicare), Railroad Retirement Act, and IRC Chapter 24;

- any compensation of an employee whose principal place of residence is outside of the United States;

- qualified sick leave or family leave wages for which a credit is allowed under the Families First Coronavirus Response Act. (This means business owners can’t double-dip).

What can I use the loan proceeds for

The business owner who receives a Paycheck Protection Loan may use the proceeds between February 15, 2020 and June 30, 2020 for:

- payroll costs;

- any costs related to continuing group health care benefits;

- employee salaries, wages, commissions or similar forms of compensation;

- rent payments;

- utilities;

- interest payments on any mortgage obligation;

- interest on any other form of debt obligation that was incurred before the period.

What’s the Recipient Good Faith Certification

In order to obtain the PPL, the business owner will be required to sign a certification stating the reason for the loan is related to the uncertainty of the current economic conditions, confirming they don’t have another loan application pending for the same purpose, acknowledging the funds will be used to retain workers and maintain payroll, meet mortgage, rent and utility obligations, and during the period beginning on February 15, 2020 and ending on December 31, 2020, they’ve not received loan proceeds under the PPL for the same purpose.

Do I have to personally guarantee the PPL

No. The Paycheck Protection Loan Program does not require the business owner to personally guarantee the loan. And there are no collateral requirements either.

The SBA will have no recourse against any individual shareholder, LLC members or partner of the business receiving the PPL proceeds for nonpayment unless the loan proceeds are not used for the authorized purposes.

What are the costs associated with the PPL

There are no fees whatsoever to the business owner for the Paycheck Protection Loan program between February 15, 2020 and June 30, 2020.

When do I have to start making PPL payments

The PPL has a loan payment deferral of not less than six months and not more than one year between February 15, 2020 and ending on December 31, 2020.

However, if the loan proceeds are used as the PPL program intended, the PPL may be forgiven and converted to a grant.

How do I get PPL forgiveness or make the PPL a Grant

If the business owner spends the loan proceeds on certain expenses during the eight weeks following receipt of the loan, the loan will be forgiven.

The expenses that will qualify for loan forgiveness include the following:

- Payroll Costs as defined above;

- Interest payments on mortgage obligations of the business incurred before February 15, 2020;

- Rent payments made under a lease agreement in existence before February 15, 2020;

- Utility payments (electricity, water, gas, transportation, telephone, internet access which service began before February 15, 2020

How do I apply for a Paycheck Protection Loan for my business

The SBA has established the procedures for business owner applicants to go through their local banks which are authorized as an SBA lender.

If I am an LLC that acts as an S-corp and intend to file taxes as an s corp, can I apply for the the SBA Loan even though it isn’t officially an S-corp yet? I do payroll and have a separate business banking account.

Hi Tori,

In your case, you’d take the payroll for the last 12 months, add any group health insurance benefits and company-paid retirement contribution, then divide it by 12 and then multiply it by 2.5 to determine your PPP Loan application amount.

All the best…

We are a sole proprietor that just has a couple of vacation rental homes. With depreciation, taxes, interest and all of that, they don’t have a profit and we don’t have employees. How do we calculate payroll? This program isn’t well described for people that don’t have employees and their business model isn’t really a cash flow business. Our money will be on equity at the end.

Hi David,

I am sorry to say your business is regarded as an investment/rental entity which is reported on a Schedule E and not a Schedule C. Such income is typically considered to be passive income not earned income.

The PPP Loan was not intended to support investment companies as the SBA’s Regulations were initially defined.

As of today, I don’t know whether the SBA has changed its position on this.

SBA has indicated the 75% requirement for payroll costs only include the exact 8 weeks once disbursed. I only have 4 pay periods for my employees during the 8 weeks and thus will fall apx $5000 short of the 75% requirement (and the other 25% –utilities etc. won’t reach $5000). As an LLC, I just use owner draws as profit allows vs. being on payroll. Can I pay myself the $5000?

Hello! Thanks for posting this article and clarify a lot of important questions. I have an llc and I’ve apply for ppp loan and the Application is pending sba approval. When we applied it have asked how many employees we have( which is 5) by 2/29/10.

One is pregnant and probably not going back to work. My other employee might not return because she’s part time. I’ve filed all profit on my schedule c and paid self employment taxes. When I applied for ppp I did not include my “profit average “ in my ppp loan average, since one my employee is not coming back to work can I pay myself that portion and ask for “ loan Forgiveness “. ThankYou so much for answering all our questions!

Hi Tracey,

I am sorry to say the SBA has not issued any new specifics or FAQs regarding how the Loan Forgiveness process, calculations and documentation will work yet.

We have a PPP Loan Forgiveness Calculator on the site now that reflects the current SBA Guidelines. You may find it here.

All the best…

My boss is applying for the PPL and we are not impacted by the disaster. We remain open so far and no loss of income. He’s wanting to pay the employees with he PPL while he spends a higher amount than normal on other business expenses, such as office furniture and a tv for the conference room? I am the bookkeeper and I’m trying to give him solid advice on the matter. Please help.

Hi Denise,

One of the certifications the business owner will be required to certify in good faith on the SBA PPP Loan application is that “current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant”.

There are serious consequences to the person who would make false statements on the SBA PPP Loan application you may want to point out to your boss.

Hope this is helpful to you Denise!

All the best…

We applied for PPP loan for our business (LLC with 2 members and 25 employees). We were told that we can only use our W3/w2 payroll information and exclude members payroll amount. But the box 14 on our K1s show self-employment earning and those were subject to self employment taxes? So I don’t understand why we had to exclude our salaries. Can we apply Another PPP loan as self-employed separately from the company this Friday?

The guidance from the SBA was issued hours before the banks were allowed to start processing applications. The guidelines were as clear as mud. Each lender is taking their own approach. From what the SBA published, the net income of the owner and/or her pay are to be included in the average monthly payroll, as well as the employer’s share of payroll burden. That doesn’t mean every lender has been following this rule. The only limit on any person’s pay is that it cannot exceed $8,333 a month.

From the SBA:

What counts as payroll costs? Payroll costs include:

Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee); Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit; State and local taxes assessed on compensation; and for a sole proprietor or independent contractor: wages, commissions, income, or net earnings from self-employment, capped at $100,000 on an annualized basis for each employee.

We are currently working with clients to help secure both PPP and EIDL loans.

I have multiple LLCs, some wholly owned as a sole proprietor and others as partnerships with as low as 20% ownership. They span from real estate short term rental in condo hotel properties to healthcare. Can my earnings be combined into one application for a PPL or do I have to choose. In the later scenario one might have to choose which business to let fail. Any suggestions appreciated. Ron

Ron:

Each entity must apply separately. No combining of entities is allowed. Each owner will need to sign disclosures and promissory notes. Each PERSON is limited to $8333 per month to count toward the loan limits. You cannot have one person have $5,000 comp in one company and same person have $5,000 comp in another.

From the SBA:

What counts as payroll costs? Payroll costs include:

Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee); Employee benefits including costs for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit; State and local taxes assessed on compensation; and for a sole proprietor or independent contractor: wages, commissions, income, or net earnings from self-employment, capped at $100,000 on an annualized basis for each employee.

We are currently working with clients to help secure both PPP and EIDL loans.

Good Morning.

I have an ‘commission only’ sales employee “demanding” we pay her (as of yet) unearned commissions because we used her average commissions earned as part of our PPP application amount… Due to current shelter in place ordinances she is unable to make sales calls and is therefore not earning commissions… All commissions earned (through March 2020) have been paid… I have reviewed the PPP fact sheet and interim final rule, but could find no guidance on whether I am required to pay unearned commissions (essentially changing the method of pay) for this employee… Any help is greatly appreciated.

We file as an s corp. registered as an llc with the state, but file personal taxes and not business taxes…..which category do we fall on for the ppp loan

Hi Molly,

If your LLC is being treated as an S Corporation for federal tax purposes, then you business should be filing a federal Schedule 1120S each year. With that tax return, there is a Schedule K-1 that identifies each member’s share of net income from the LLC.

I don’t understand what you are asking when you say ‘which category’…

If you would clarify, I may be able to assist…

Michael:

The purpose of the PPP is to keep people on the payroll, EVEN IF THEY ARE NOT productive in your business or sitting “on the bench”. Keep in mind that to qualify for the forgiveness, your payroll amount on June 30 must be near the amount it was on Feb 15. If you don’t pay your employees, your payroll may drop below the threshold and you will have to PAY BACK the borrowed PPP amount.

My suggestion is to pay your people some “average” earnings amount, even if they didn’t “earn” it. Don’t sweat it because if your PPP loan is forgiven, it was the Government’s money paying her this salary; it didn’t come from your profits. The whole idea in using this program is to funnel money from Uncle Sam to pay employees that would otherwise be on the unemployment lines. It’s not to boost your personal profits.

On the other hand, you could stand by your principles and not pay her anything. The loan will be paid back at a modest 1% interest. But don’t expect your sales person to come back to work when this is over! She’ll gladly collect the $600+ unemployment comp she’s entitled to get and go find another employer. Now you have the added cost of hiring and training a replacement.

The rules are what you make them.

Does an unfounded dormant non profit qualify as a business for question 3 addendum?

Hi Janet,

If it is owned by or affiliated with the business owner or loan applicant, then yes. Whether it has funding or is in operation doesn’t appear in question 3.

All the best…

Within the category of utilities, can one include telephone and internet expenses?

Hi Gretchen,

Yes, when it’s time to apply for the PPP Loan Forgiveness, the money you choose to use to pay for telephone and internet services will be included in the utilities category.

All the best…

Hello! Do you have advice for a small business who currently banks with a credit union that is not authorized to process PPL Loans? Where can we be considered for a Paycheck Protection Loan? Thank you!

Hi Sarah,

The banks we’ve been in contact with regarding the SBA PPP Loan application process have all indicated they are prioritizing their existing business banking customers. There is such high demand for the PPP Loans, I can honestly say I don’t blame them.

So, if you don’t have a business deposit account with an Authorized SBA Lender, that would be my first step.

Many banks simply are not opening their physical doors to open new bank accounts, so to do so may be very challenging.

Truly wish you all the best…