- ERC Tax Return Amendment Rules Change - March 25, 2025

- Safe Financial Instruments Guide - December 4, 2024

- New Overtime Rule Increases the Salary Exemption Thresholds - November 19, 2024

Do you have a Question?

Ask below. One of our Investors or Advisors will Answer!

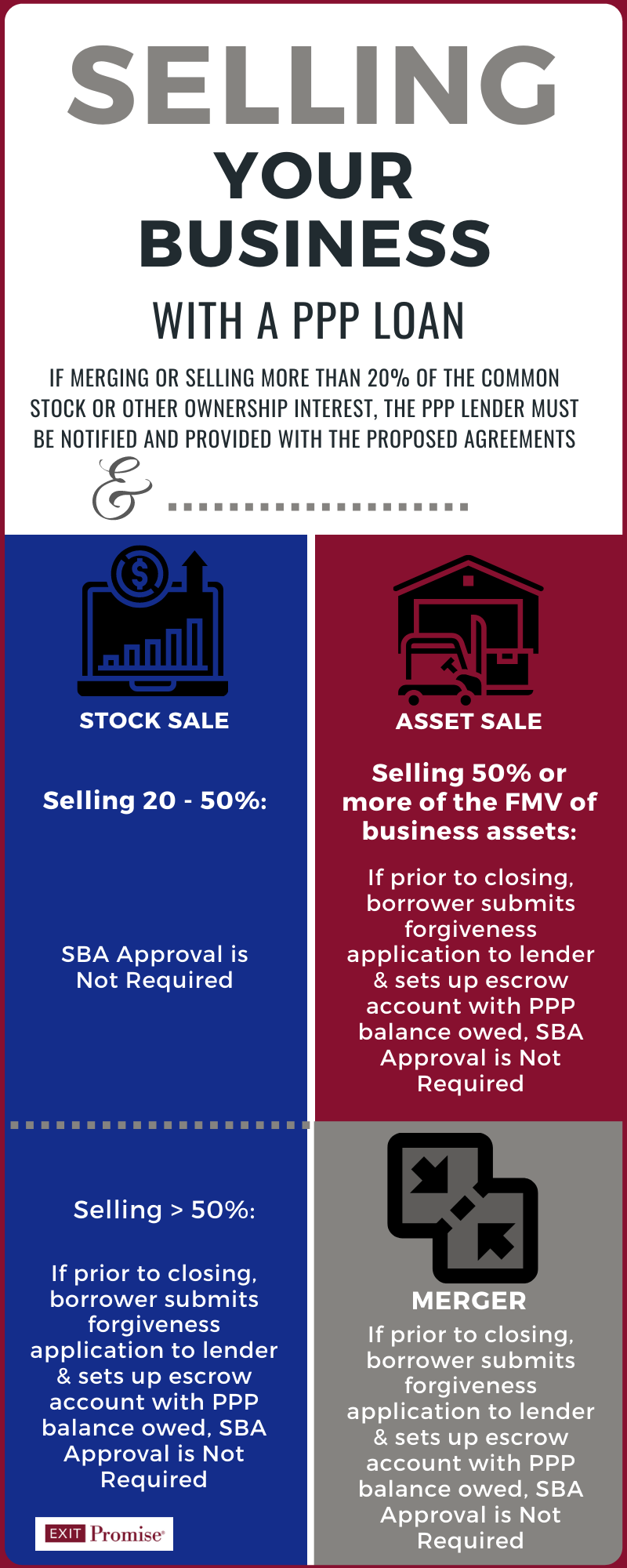

The Small Business Administration (SBA) issued a Procedural Notice on October 2, 2020 which offers business owners and lenders guidance on how Paycheck Protection Program (PPP) Loans are to be handled when a business has a change in ownership.

This post summarizes the notice and includes an Infographic to assist business owners. It includes the following topic:

- When does a Business Sale Require the SBA’s Approval

- Does a Business Sale Require the PPP Lender’s Approval or Notification

- Required Steps Pre and Post-Closing for PPP Borrowers

- SBA Timeframe to Approve a Sale or Merger when a PPP Loan Transfers

- Does the EIDL Grant Impose Additional Steps When Selling a Business

This guidance has been long overdue. Until now, business owners, lenders and M&A advisors have not had clear guidance about how a PPP loan should be handled when a business is sold, merged, or had a partial shareholder change of ownership.

The SBA guidance under this Procedural Notice defines “change of ownership” as when one of three events occur:

- At least 20% of the common stock or other ownership interest of a PPP borrower is sold or otherwise transferred. This form of business sale is considered a stock sale. All sales and other transfers that have occurred since the date of the approval of the PPP loan must be aggregated to determine whether the relevant threshold has been met. Transfers to an affiliate or an existing owner of the entity must be considered as well; or

- the PPP borrower sells or otherwise transfers at least 50% of its assets in one or more transactions; or

- a PPP borrower is merged with or into another entity.

When Do Business Owners with PPP Loans Not Need to Notify the SBA or Lender About a Sale?

If your business received a PPP loan and you’re considering a sale, there are three circumstances where you will not be required to involve the SBA or your lender in the process:

1. PPP Loan Fully Satisfied Prior to Business Sale Closing

If the PPP borrower, prior to the closing or sale, has either repaid the PPP loan in full or has completed the loan forgiveness process and the SBA has paid the PPP lender (your bank) in full, and/or the PPP borrower has repaid any remaining (unforgiven) balance in full, then no restrictions or SBA notifications are required of the PPP borrower or successor.

2. Sale or Transfer of <20% of Common Stock or Other Ownership Interest

If the sale or transfer represents less than 20% of the common stock or other ownership interest in the business, it is not considered an ownership change. Accordingly, neither the SBA nor the lender needs to be notified.

3. Sale or Transfer of <50% of the Business’ Fair Market Value of its Assets

Similar to the sale or transfer of less than 20% of the stock or other ownership interest in the business, if the sale or transfer represents less than 50% of the business’ FMV of its assets, it is not considered a change in ownership. Accordingly, neither the SBA nor the lender needs to be notified.

When Do Business Owners with PPP Loans Need to Involve the SBA and/or Lender in the Sale?

If you’re contemplating the sale of your business and you are not fortunate enough to fall into one of the three situations noted above, you will need to involve the SBA and/or lender in the sale process.

At a minimum, you will be required to notify your PPP lender in writing about the sale and provide the lender with a copy of the proposed purchase agreements.

Whether you will be required to take additional steps before the closing or to obtain the SBA’s approval depends on the type of sale (stock vs asset), the amount of ownership or assets being sold, or if the transaction is a merger.

If the type of business sale is a ‘stock sale’, where 20% or more of the common stock or other form of ownership is being sold, the SBA’s approval will not be required.

If the type of business sale is an ‘asset sale’, where 50% or more of the FMV of the business’ assets is being sold, the SBA’s approval will not be required.

If the transaction is a merger with or into another entity, the SBA’s approval will not be required.

With that said, unless the sale or transfer involves between 20% but less than 50% of the common stock or other ownership interest or is less than 50% of the FMV of the assets, there are other steps the seller and buyer will need to take before the closing to address any PPP liability.

Required Steps PPP Loan Require Pre and Post Closing When 50% or more of the Common Stock, Other Ownership Interest or FMV of the Assets are Sold or Merged

The following steps will be required:

- Complete and submit to the PPP Loan lender the forgiveness application before the closing.

- Establish an interest-bearing escrow account with the PPP Lender with the outstanding amount of PPP loan before the closing.

- Upon the conclusion of the PPP loan forgiveness process, disburse the escrow fund to repay any PPP loan balance plus any applicable interest.

- The PPP lender must also notify the SBA loan Servicing Center about the escrow account, its location, and amount within five business days of the closing.

SBA Approval is Required in Certain Circumstances Before Sale or Merger

When more than 50% of the ownership interest (stock, LLC member units, partnership shares) or when more than 50% of the FMV of the business’ assets are sold, the SBA will require pre-approval if the PPP note has not been paid in full and the the requirements noted above related to the escrowed fund cannot be met. The PPP lender handles this approval process.

The SBA’s approval of the sale or merger, under this scenario, will be conditioned on the buyer assuming all of the seller’s PPP loan obligations. Either a separate loan assumption agreement or an inclusion of the PPP loan obligation language in the transaction’s purchase agreement will be required and reviewed by the SBA.

The SBA has 60 calendar days to review and respond to the request.

Does Selling My Business Mean the PPP Loan Obligations Disappear?

The simple answer is ‘no’. Regardless of the type of sale, amount of the stock or other ownership interest transferred or sold, percentage of the assets FMV transferred or sold, or whether the transaction is considered a merger, if your business’ PPP loan has an outstanding balance, the original PPP loan recipient will remain subject to all obligations under the PPP loan.

This means as the seller of a business with an outstanding PPP loan balance, the responsibility for the PPP loan repayment, certifications, reporting compliance, and the retention of all SBA and lender forms and supporting documentation does not transfer to the buyer upon sale or merger.

Will the Sale or Merger be Reported to the PPP Lender?

If the transaction is considered a ‘change of ownership’ according to the Procedural Notice (defined above), the PPP lender will be required to notify the SBA about the identity of the new owners, their ownership percentage, the TINs for any owner holding 20% or more of the business equity and, if required, the escrow account location and amount.

Two (or more) PPP Loans Must be Segregated Post Sale or Merger

The segregation of PPP funds is required if more than one PPP loan exists after a change in ownership or merger occurs. This means the funds, as well as the expense records related to the loan, must be segregated and tracked to demonstrate compliance with the PPP loan’s requirements.

And in the case of a merger, the successor (business) entity will be held responsible for all of the PPP loan obligations.

Does the EIDL Grant Received by a PPP Borrower Matter When Selling a Business?

The SBA Procedural Notice was silent on the matter of the EIDL grants many business owners received. At this time, a PPP borrower who also received an EIDL grant is responsible for repaying the EIDL grant proceeds under the PPP loan terms.

It’s worth walking through an example to understand how the EIDL grant may affect the business sale. If a business received a $10,000 EIDL grant as well as a PPP loan, the $10,000 EIDL grant is exempt from PPP loan forgiveness. If the PPP lender approves the PPP loan forgiveness, the lender provides the business with a loan payment plan for the EIDL grant balance and the business would have a PPP loan balance of $10,000 on its books.

Given the SBA’s silence on how the EIDL grants are to be handled when a business is sold, it’s implied the rules defined in the Procedural Notice apply, regardless of the relatively small remaining PPP loan balance due to receipt of an EIDL grant.

Conclusion

When selling or merging a business, the terms of a loan from a traditional lender should be carefully reviewed and considered by all parties before the closing. Anything less, leaves the buyer, the seller, and/or the successor in the case of a merger, open to many problems.

Undoubtedly, it’s very important for buyers and sellers to familiarize themselves with the PPP loan rules well in advance of the anticipated closing. Otherwise, the transaction could be held up for months.

And for the owners of businesses with transactions involving a shift in the majority of the ownership or sale of the majority of the business’ assets fair market value, or if the loan balance is not paid off or is not available to be put aside in escrow, many will be holding their breath as they wait for the SBA’s approval to sell their businesses.

I am preparing to sell my business. We had two PPP loans that have been forgiven. However we did not spend all of the PPP monies. We have the majority of the PPP loan monies in the bank currently. The sale/acquisition is a ” no cash/no debt ” deal and that means we settle all of our debt and withdraw cash in savings. The majority of our cash in savings was from PPP loan monies that were forgiven. Are we allowed to withdraw those monies prior to sale? Or is that illegal? I am trying to figure out how to handle the no cash no debt deal, when the funds in our account savings are from PPP that has been forgiven.

yes, if they are forgiven, you may clear the cash from your accounts. we see this regularly

Hi Christopher,

The fact that the cash in your bank is originally from a PPP loan has no bearing on how you would withdraw the money. Since the loan is forgiven, you have no legal obligation to pay back the loan any more. You can either take the cash out prior or after the sale. I would consult with your CPA to determine the most tax effective way to take the cash out of the business (for example, distribution, payroll, etc.). The most tax efficient method will vary based on the type of entity (for example, C corporation, S Corporation, sole proprietorship, etc.).

Hi!

I was working at a company when the CEO took out a PPP loan in 2020. He did not qualify for forgiveness. He ended up giving the company to me, no sale, because he had to work a different job to pay off the PPP loan balance. The PPP loan is to him directly, not the company, correct?

I do not want it to affect my credit when I did not take out the loan in the first place and had nothing to do with it. He is still listed as a founder of the company but isn’t a part of the company anymore.

Hi Savannah,

The PPP Loans were made by the SBA to the business, not to the individuals who own the business.

That said, if the PPP Loan wasn’t forgiven, the business owner is responsible personally for paying it back to the SBA even though it’s a liability on the books of the business.

I recommend you consult with an Attorney about your situation.

All the best…

I have been working for a small business for over 6 years. The cell phone store owner wants out, and apparently got a PPP loan under their LLC. The PPP loan was not granted forgiveness. N he is selling me the business for a small sum. Its an authorized dealer for Tmobile. The lease is almost done and will be renewed under my LLC and is also gonna pend approval per tmobile. The assets that is not something material per say like physical assets. But just being a established business with the recurrent customer base. My question is whether my LLC taking over this location be somehow liable for those not forgiven PPP loans. And if somehow they can come back to me if he files bankruptcy . Currently the location has no lien on it. But I am sure he is gonna default on the payments for the loan in the future.

Hi Ramiro,

The PPP Loan would have been made to the business you are purchasing. Depending on the size of the PPP loan, the current owner of the business may or may not have personally guaranteed the loan.

It will be imperative for your purchase agreement for the business be drafted properly to avoid a problem for you.

Please hire a business attorney to draft your purchase agreement and one who will be able to clearly identify the assets your LLC is purchasing as well as the liabilities your LLC will not be assuming.

All the best…

My partner and I own 50% each of our business. My partner has decided he wants to move on to do other things. I will be acquiring his share. We have a PPP loan. Does he still remain responsible along with me to pay it back if it’s not forgiven?

Hi Mike,

According to the SBA, selling up to 50% of the shares (or LLC units) does not require SBA Approval for the transaction when there is an outstanding (or unforgiven) PPP loan.

The SBA did not require personal guarantees for the PPP Loan program, so I am not certain what you mean by “still remain responsible”. Please clarify and I will try to assist you further.

I’m sorry, I meant the EIDL loan. We were both guarantors for that loan.

Hi Mike,

No worries…

If you have an EIDL, regardless of your personal guarantee status, any change in ownership will require the SBA’s written consent.

If you don’t receive the SBA’s written consent, your EIDL agreement states your EIDL loan will be in default and the balance owed would be due in full.

Not something to mess with!

Reach out to the SBA to start the consent process asap!

I am rooting for you Mike.

All the best…

I sold my 25% ownership in an S-corp to the Majority owner. We received PPP loan #1 forgiveness and on my K-1 for 2020 I received an increase in my basis according to my ownership share of PPP loan #1. I Sold my ownership on 6/30/21 and PPP loan #2 was received on 3/16/21. The S-corp is pending forgiveness (likely to be granted) When I’m issued my K1 for my ownership through 6/30/21 how will the PPP loan #2 forgiveness be calculated as to the increase in my basis if at all?

Hi Justin,

Congratulations on the sale of your S Corp!

Normally, the S Corporation Shareholder’s tax basis is increased when a shareholder is personally liable for debt (recourse debt is incurred). And so it was assumed that if the PPP Loan was forgiven, then the shareholder’s personal liability to repay the loan goes away and this would mean the shareholder’s tax basis would be reduced by the PPP Loan amount.

However, under the Consolidated Appropriations Act of 2021, the PPP forgiveness rules were changed due to the forgiveness of the PPP loans is considered to be exempt from income tax within the meaning of partnerships and S corporations. This means the forgiveness of a PPP loan will result in an increase in the partner or shareholder’s tax basis when the forgiveness is granted.

So you could have a timing issue if you’ve got losses you’d like to deduct and the PPP loan forgiveness has not yet been approved.

Hi Holly, thank you. No it doesn’t make sense to me because in 2020 for PPP1 it was forgiven and on my 2020 K-1 in box 16B I received my ownership % of the loan recorded as tax exempt income and my basis was increased by that amount.

Hi Justin,

I am sorry… I wasn’t very clear when I responded to your question.

I’ve edited my reply.

All the best…

we had a first round PPP loan forgiven. We received a second loan 2/5/21, but we sold one our 3 locations on 5/1/21. our 24 week period would and 7/25/21. do I use the FTE numbers on 7/25 for the other two we still have and add to the 4/30/21 numbers for the sold location? or am I forced to use 4/30 for all 3 locations for the FTE part but 7/25 for the periond end to calculate total payroll costs and oher costs? (it is one corporation)

Hi Dave,

For purposes of applying for your corporation’s PPP Loan forgiveness when a sale of stock or assets occurs, the FTE count and the extended covered period of 24 weeks rules do not change.

All the best…