by Holly Magister, CPA | Business Capital |

When seeking money for your business, it is necessary only to approach accredited investors because regulations restrict the types of investors allowed to participate in such private placements. By limiting investments to accredited investors, regulators aim to protect less sophisticated investors from the higher risks associated with certain types of investments, such as private placements or hedge funds.

To qualify as an accredited investor, an individual must typically meet one or more of the following criteria:

by Holly Magister, CPA | Business Capital |

The Employee Retention Tax Credit (ERTC aka the ERC) applicable to the Covid-19 pandemic has been evolving from its initial congressional act in March of 2020, was enhanced by the Consolidated Appropriations Act passed in January 2021, updated by the American Rescue Plan in March of 2021, and most recently updated by the Infrastructure Investment and Jobs Act.

If your head is spinning as you try to unravel the ERC rules, you are not alone. The ERC or Employee Retention Credit offers a viable and alternative way to recover payroll costs for any type of employer, except state and local government entities, regardless of their size.

by Holly Magister, CPA | Business Capital |

The SBA EIDL Round 2 extended application deadline to 12/31/2021 and introduced the New Targeted EIDL Advance Grants for businesses continuing to suffer from the Covid-19 pandemic. Learn more about the changes to the EIDL program, which businesses can qualify for the EIDL grant and how to apply.

by Holly Magister, CPA | Business Capital |

On Monday, May 3rd, 2021, the Small Business Administration (SBA) opened its application portal for the Restaurant Revitalization Funding (RRF) to certain restaurants, bars and other similar businesses that serve food and/or drink which have suffered a reduction in revenue in 2020 when compared to 2019 as a result of the pandemic.

Similar to the Paycheck Protection Program Loan (PPPL) program, this federally-funded program is intended to provide cash to businesses which have suffered revenue losses and if spent on the proper types of expenses within a specific period of time (the Covered Period), the loan may be fully-forgiven by the SBA.

by Holly Magister, CPA | Business Capital |

Up until now, the PPP Loan proceeds for Schedule C filers was based on the 2019 net profit (referred to as the net earnings from self employment) plus payroll costs if employees worked in the business. The Interim Final Rule (IFR) effective on March 3, 2021 allows a business owner to use either their gross income or net income as the basis to compute its PPP Loan request amount.

by Holly Magister, CPA | Business Capital |

On June 15, 2020, the Small Business Administration reopened the Economic Injury Disaster Loan (EIDL) applications to businesses with no more than 500 employees and non-profit organizations operating and suffering substantial economic injury as a result of the pandemic in all of the U.S. states, Washington D.C., and territories.

Independent Contractors, sole-proprietors (with or without employees), gig workers and freelancers are also eligible to apply for the EIDL.

by Holly Magister, CPA | Business Capital |

On June 5, 2020, President Trump signed into law the Paycheck Protection Program Flexibility Act (PPPFA), which is the latest attempt to save struggling businesses from permanent shutdown.

The Flexibility Act offers business owners seven significant changes to the original Paycheck Protection Program (PPP) Loan terms. The House and Senate were driven to make these changes due to the lengthy pandemic and the fact that many PPP Loan recipients have not been able to re-open their doors for business during the required eight-week ‘covered period’ set forth in the original PPP Loan Act.

The PPP Loan Flexibility Act will make it much easier for business owners to achieve full, or nearly full, loan forgiveness.

The new law provides business owners with seven significant changes to the original law and those include:

by Holly Magister, CPA | Business Capital |

The Small Business Administration announced on Thursday, April 16th all federal funds set aside for the Paycheck Protection Plan (PPP) Loans have been allocated to those business owners who were persistent (and fortunate) enough to get through the application process and receive an official registration number from the SBA via its bank.

In simple terms, the PPP Loans are out of money to assist business owners.

by Holly Magister, CPA | Business Capital |

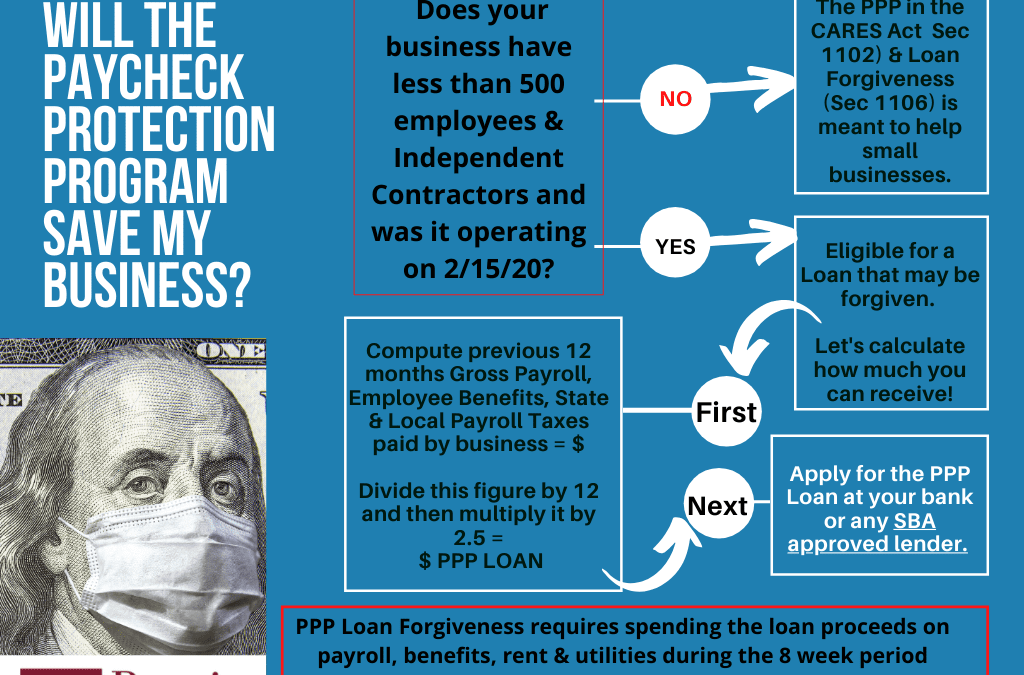

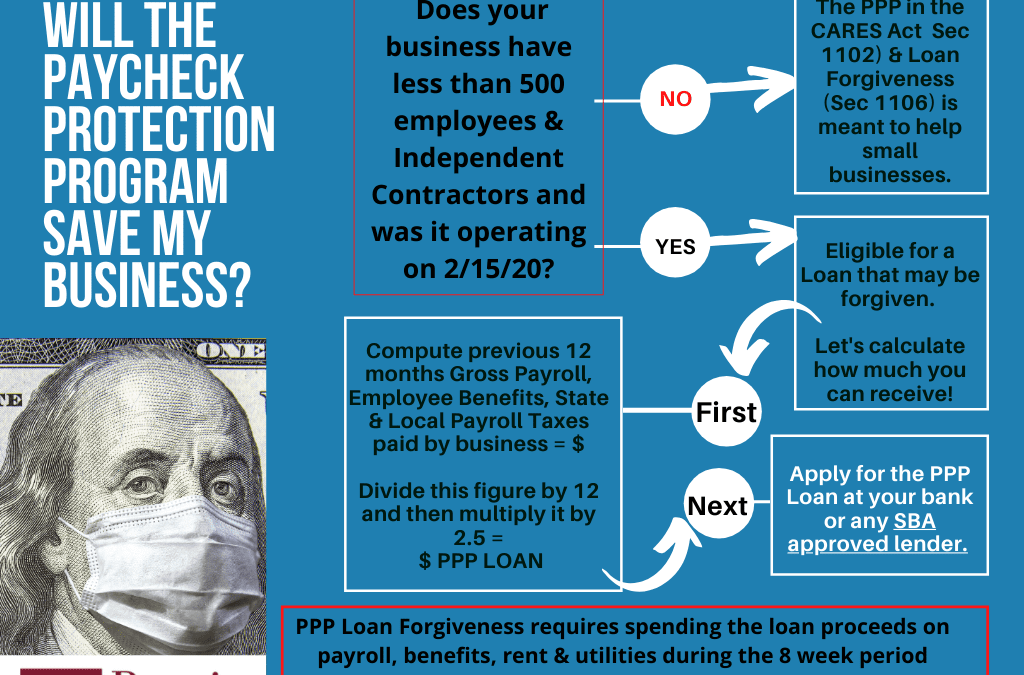

On Friday, March 27, 2020, the Paycheck Protection (Loan) Program (PPL) for small businesses was approved as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This new law is intended to help small business owners in an unprecedented way.

First, while the Paycheck Protection Program Loan will be initially set up by banks and approved by the SBA under section 7 (a), unlike other SBA loan programs, the PPL is guaranteed 100% by the SBA.

Second, if the proceeds of the loan are used by business owners as Congress, the Senate and President Trump intended, the loan will be forgiven.

by Holly Magister, CPA | Business Capital |

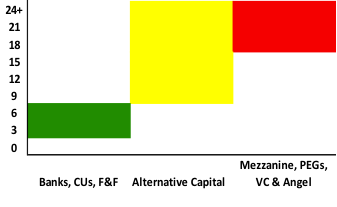

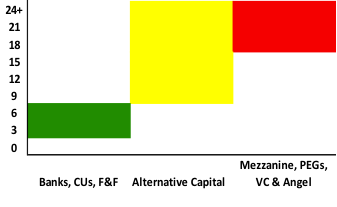

Without cash flow, a business cannot pay its employees, make debt payments, or invest in its future growth – making cash flow a critical focal point in every business, regardless of size. Yet searching for the correct small business financing can be overwhelming,...

by Holly Magister, CPA | Business Capital |

Have a Question? Ask your question below and one of our Advisors will answer. Business Lending from Banks Whether you’re a Main Street small business, an Entrepreneur growing a business from start-up, or a Middle Market Business about to embark on an Initial...

by Holly Magister, CPA | Business Capital |

Sufficient cash, otherwise known as business capital, is necessary for any business to pay vendors and employees on time and to invest in real and intangible assets that enable growth. That’s why, as a business owner, it’s critical to understand what business...

by Holly Magister, CPA | Business Capital |

Whether you’re growing a business organically or searching for ways to jump start business growth with a large cash infusion, don’t allow the large number of capital sources for your business become overwhelming. This post identifies several...

by Holly Magister, CPA | Business Capital |

v Have a Question? Add it to the bottom of this post! What Are Loan Covenants? A covenant is simply a fancy term for the word ‘promise’. Banks include covenants in their loan agreements to preserve their position as the lender and to improve the likelihood a loan...

by Holly Magister, CPA | Business Capital |

A business debt schedule is a tool that helps businesses review, assess, and visualize debts. A debt schedule allows businesses to make strategic decisions about paying off debt, acquiring new debt, or creating long-term projections for investors and creditors. It...

by Holly Magister, CPA | Business Capital |

Business debt consolidation refers to the practice of taking out a new loan to pay off any number of other business debts (generally unsecured debts). Multiple separate debts are combined into one new loan, often with more favorable loan terms and conditions....

by Holly Magister, CPA | Business Capital |

Have a Question? Ask your question below and one of our Advisors will answer. What is Invested Capital? MVIC (Market Value of Invested Capital) is the amount of money raised by issuing securities to shareholders and bondholders, and typically includes total debt and...

by Holly Magister, CPA | Business Capital |

Once you’ve successfully assessed your financial needs for a business loan, you’ll want to follow these guidelines to determine what, if any capital funding you may need, and the best type of business loan for your business. What are the best reasons for a small...

by Holly Magister, CPA | Business Capital |

v Have a Question? Add it to the bottom of this post! As a small business, it is imperative that you understand your financial needs. Knowing your projected annual expenses, having a business plan in place, and assessing your need for funding sets the foundation for a...

by Holly Magister, CPA | Business Capital |

Have a Question? Ask your question below and one of our Advisors will...