by Holly Magister, CPA | Business Valuation |

Furniture, fixtures, and equipment (or FF&E) is an accounting term used in the process of valuing, liquidating, or selling a company or building. FF&E refers to any fixture, piece of furniture, or piece of equipment that is moveable and is not permanently attached to a building or is part of a structure’s utilities. Although these items tend to depreciate quickly, their value is an important consideration when valuing, transferring or liquidating a company.

Furniture, fixtures, and equipment (or FF&E) is an accounting term used in the process of valuing, liquidating, or selling a company or building. FF&E refers to any fixture, piece of furniture, or piece of equipment that is moveable and is not permanently attached to a building or is part of a structure’s utilities. Although these items tend to depreciate quickly, their value is an important consideration when valuing, transferring or liquidating a company.

What is FF&E?

Any non-permanent piece of furniture, fixture, or equipment in a building that is used by a business to conduct normal, day-to-day operations is considered to be FF&E. Some examples of FF&E include tables, chairs, electronics, computers, telephones, and desks. These are all assets that would be considered FF&E for a business that could not perform its daily operations without use of such items.

Other types of FF&E may include automotive equipment, currency counters, drill presses, x-ray scanners, and nearly any other furniture, fixture, or equipment that can be moved away from the building or site where it is used for business purposes.

Accounting for FF&E

For accounting purposes, FF&E is categorized on its own line item in a budget or financial statement, and typically has a lifespan of three years or more.

FF&E Depreciation

Depreciation for FF&E can be calculated in a number of ways. The most simple way is to examine the useful life of the item, and use the straight-line method of depreciation. A telephone may last 20 years, while a computer may need to be replaced every three years.

Many businesses use the straight-line method of depreciation for their FF&E assets, which takes the cost of the item, subtracts the salvage value at the end of its useful life, and divides by the total months of estimated useful life. This formula estimates the depreciation expense taken each month on the company’s accounting records.

FF&E Valuation

Because some assets may continue to serve their purpose well past the time when their full depreciation has been recorded on the accounting records and taken on the company’s tax return, the value of FF&E assets should be calculated based on their true economic potential, and not book value when buying or selling a business.

When a business is sold under the Asset Sale Method, both the buyer and seller of the group of assets which make up a business operation must file a Federal Form 8594. This form requires the buyer and seller to identify how the purchase price is being allocated between the various types of assets being acquired. The true economic value of FF&E should be used when completing this form and will be the tax basis for depreciation purposes used by the new business owner.

by Holly Magister, CPA | Business Valuation |

Enterprise Value, also sometimes called “EV,” is a measure of a company’s total business value.

Enterprise Value, also sometimes called “EV,” is a measure of a company’s total business value.

EV is the theoretical price for a company if it were to be bought, and because EV accounts for a company’s debt and cash, it is considered a more accurate representation of a firm’s value than many other valuation methods.

Enterprise Valuation Calculation

Enterprise value is calculated as the market capitalization (share price multiplied by the number of shares outstanding), plus debt, minority interest, and preferred shares, minus total cash and cash equivalents.

EV = market value of common stock + market value of preferred equity + market value of debt + minority interest – cash and investments.

Why Enterprise Value is Important

Enterprise value is a fundamental economic measure that reflects the total value of a business. EV is used regularly in business valuation, accounting, portfolio analysis, financial modeling, and risk analysis. While many investors will look exclusively at market capitalization to value a company, in most cases, EV is a better representation of actual value.

Market capitalization and P/E ratios are other valuation methods commonly used to calculate the value of a business, but they only take into account a company’s outstanding equity (defined as the share price multiplied by the number of outstanding shares). Conversely, enterprise value considers several other important financial factors.

In order for a buyer to purchase a company outright, it would have to assume responsibility for the acquired company’s debt, and similarly, would also receive all of the company’s cash. Both debt and cash have a large impact on a company’s value, making enterprise value a more accurate representation of a company’s ongoing operations.

How Do Investors Use EV?

Stock market investors may use EV to compare returns between two similar companies on a risk-adjusted basis. But it’s important to understand equity investors often have trouble assessing EV because they may not have access to the current market value of the company’s debt.

Is Enterprise Value Relevant to the Small or Medium Business Owner?

If you own a small or medium size business, the Enterprise Value concept is very important to understand, especially in the event you plan to sell your business and intend to sell under the stock method.

When purchasing a business under the stock method of acquisition, the cash and debt on the company’s books remain with the buyer. Understanding what your business is worth at an operational level, within the context of its capital structure, will give you an edge in negotiating a sale. It also can help you to plan how to continue to grow your business in the coming years.

by Holly Magister, CPA | Business Valuation |

The term “dry powder” is financial slang and refers to a company’s or investor’s highly liquid securities which are kept on hand to finance future obligations, purchase assets, or invest in opportunities. Such capital also may be kept on hand to provide emergency operational funding.

The term “dry powder” is financial slang and refers to a company’s or investor’s highly liquid securities which are kept on hand to finance future obligations, purchase assets, or invest in opportunities. Such capital also may be kept on hand to provide emergency operational funding.

The term “dry powder” originates from the days when military battles were fought with cannons and guns requiring loose gunpowder. The gunpowder needed to be kept dry in order for it be effective – and now the term is used metaphorically in reference to the financial world, and keeping liquid securities on hand ‘just in case.’

Dry powder securities usually include cash reserves, Treasuries, and other fixed income securities. Any investment or security that can be converted quickly to cash may be considered dry powder.

Why dry powder?

Keeping drypowder on hand can offer an advantage over other businesses with less-liquid assets on hand. Often, businesses will stock up their ‘dry powder’ in anticipation of tougher economic conditions in the future. A prime example of this was Ford Motor Company’s build up of cash reserves prior to the 2008 financial crisis. They correctly anticipated a tight credit market in the wake of the stock market collapse.

Large cash reserves especially are beneficial to SMBs (Small and Medium Businesses) during times when security and other investment prices fall. Not only do cash reserves maintain their value, but they can be used to purchase stocks at substantially lower prices during periods of economic decline. When the market eventually recovers, the business has the potential to be in a stronger financial position than before.

How does dry powder effect an acquisition or partnership?

Any SMB looking to purchase or partner with a private equity firm should consider the entity’s levels of dry powder. Higher levels often mean a higher valuation and should be considered in negotiations, as dry powder allows for future acquisitions and other avenues of growth.

How does dry powder effect credit?

The more liquidity an organization has, the better the bargaining power when it comes to obtaining credit. Credit institutions will assess an organization’s level of liquid assets (dry powder) to determine how much cash it has on hand to to meet immediate debt obligations. The more dry powder a business has, the less risk the lender faces, and the lower the interest rate will be for the borrower. Conversely, businesses with very little liquidity pose more risk to a lender, and they are more likely to face higher interest rates.

Is it possible to have too much dry powder?

While it is good practice to keep some dry powder on hand, too much can actually be a risk for your business. Too much cash and other liquid securities can reduce a company’s ability to grow, as it sits idly – not offering much of a return in terms of investment. Each business owner, in consultation with his advisors and on an ongoing basis, should decide what the correct amount of liquidity the company’s balance sheet should have.

by Holly Magister, CPA | Business Valuation |

Middle market or “mid-market” companies or firms are businesses that typically earn between $5 million and $1 billion in yearly revenue. This group of businesses makes up the middle third of the U.S. economy’s revenue and employs 25% of its labor force, with large and small companies making up the other two thirds of revenue and 75% of labor force.

Middle market or “mid-market” companies or firms are businesses that typically earn between $5 million and $1 billion in yearly revenue. This group of businesses makes up the middle third of the U.S. economy’s revenue and employs 25% of its labor force, with large and small companies making up the other two thirds of revenue and 75% of labor force.

How is the Middle Market Defined?

Some sources define middle market companies as $5 million to $500 million, while others define this group as $100 million to $1 billion. While the ranges can vary widely, these companies are defined as larger than small, main street companies (which earn less than $5 million) but smaller than large, multinational corporations, which are generally defined as earning more than $1 billion.

Alternatively, some business authorities define a company’s size not by revenue, but instead by the number of employees. Middle market companies often employ somewhere between 100 and 1,000 employees, although this number can swing depending on the business and industry.

But since this part of the U.S. market makes up such a very broad range, it’s difficult to define it clearly by revenue or employees. Nonetheless, these companies make up a significant segment of our economy’s businesses. They often feel invisible to the average consumer because they fall somewhere in between the mom and pop shop on Main Street and global companies with household names. Companies in this part of the market are more likely to be found in your city’s industrial park – but they are doing important work and their economic impact cannot be understated.

Breaking It Down Further

Since there are so many companies that can fall within it’s range, the middle market can further be divided into three sub-segments: the lower middle market ($5-50 million in revenue), the middle market ($50-$500 million in revenue), and the upper middle market ($500 million to $1 billion in revenue).

Breaking the middle market down into these segments can be helpful since a company in the lower middle market segment is dramatically smaller than a company in the upper middle market segment. Those buying businesses in the lower middle segment will be different from buyers in the upper middle segment, and likewise, obtaining financing and investment will vary in each of these groups.

What Should a Middle Market Business Owner Pay Close Attention To?

Buy-sell agreements. Your company is big enough that a workable buy-sell agreement is necessary, and should be a top priority. Because many mid-market companies are large and complex enough to have more than a single owner, it is important to have an ownership transition plan in place in case a life event (such as retirement, death or disability) means one owner leaves the company.

Creating a Valuable Middle Market Company Brings Wealth To Many. Owners of middle market companies should focus on the wealth created by their business. Because these companies are typically fast-growing and enjoy relatively high revenue, the wealth created should be nurtured, managed and invested with the same focus and attention to detail as those business enterprises in the public markets. The tremendous amount of wealth created in middle market companies is shared with many including shareholders, employees, suppliers, and service providers.

by Holly Magister, CPA | Business Valuation |

As a business owner journeys through entrepreneurship, it’s inevitable for most to seek a quick business valuation on one or more occasions. Such a conversation with a business advisor may be about the need to understand the value of the business for the purpose of funding an insurance policy to support a cross-purchase or buy-sell agreement. Or it may be one of the owners is facing a divorce or desires to transfer some or all of his business interest to family members and needs to determine the value of a business.

As a business owner journeys through entrepreneurship, it’s inevitable for most to seek a quick business valuation on one or more occasions. Such a conversation with a business advisor may be about the need to understand the value of the business for the purpose of funding an insurance policy to support a cross-purchase or buy-sell agreement. Or it may be one of the owners is facing a divorce or desires to transfer some or all of his business interest to family members and needs to determine the value of a business.

For a business owner considering the possibility of exiting, asking advisors how much is my company worth is wise. That said, not all business owners have access to an advisor educated and experienced in the practice of preparing business valuations. Furthermore the cost of such professional services may simply be out of reach.

One of the most basic questions asked by business owners – both small business owners and middle-market business owners alike – is “what is the value of my business?”

There are many ways to go about answering this important question and the purpose of this post is to provide business owners with a comprehensive overview and available resources to enable them to make an informed choice.

Company Valuation Methods

Before we address how to find out how much a business is worth, it’s very important to understand that not all valuations are equal because company valuation methods vary and several measurements of income are used. We’ll start by identifying the various business valuation methods first:

Discounted Cash Flow Valuation Method

Although most business owners won’t be too excited about this method, in its simplest terms, the discounted cash flow valuation method values a business based on its anticipated future cash flow discounted back to today’s dollars. If this makes your head spin, not to worry. This method is normally reserved mostly for middle-market businesses, venture capital or private equity investments, and initial public offerings (IPOs). Small businesses with revenue less than $5 Million generally are valued under one of the Multiples Methods and adjusted based on comparable industry transactions.

Business Valuation Multiples Method

The three most common multiple methods for small businesses use a measurement of income (or profit produced by a given business to provide resources to capitalize the business and income to its owners) that is multiplied by a factor. The factor applied to the measurement of income varies widely by industry and other outside circumstances or business conditions such as the current prevailing interest rates investors may earn on other, less risky investments.

It’s easy to understand why there is no such thing as a single formula to value a business. There are simply too many variables that enter into the computation. Nonetheless, now let’s review the three basic measurements of income to which multiples are applied in order to compute the value of a business:

Seller’s Discretionary Earnings

This is the amount of cash a business owner (or business seller) has access to from the operation of his business. The SDE measurement is typically used when a main street business is available for sale and when the business may not have the need to maintain a balance sheet because income and expenses are reported on the business owner’s personal tax return (Schedule C).

EBITDA – Earnings Before Interest, Taxes, Depreciation and Amortization

This measurement of income may be adjusted for one-time expenses or personal expenses which may flow through the business’ books.

EBIT – Earnings Before Interest and Taxes

This measurement is similar to EBITDA and it also may be adjusted to more accurately represent the cash flow a business produces. EBIT differs from EBITDA in that it accounts for the capital expenditures necessary to operate the business by excluding (or not adding back) the depreciation and amortization expense related to capital expenditures.

Company Valuation Based on Revenue

An alternative to the Discounted Cash Flow and Multiples methods is when a business value is estimated simply by knowing its gross revenue and the appropriate industry multiple. This business valuation methodology is often used when valuing a business in a service industry. Professional firms such as accounting, technology support, and law practices use this rough estimation of value by applying the firm’s gross revenue by its industry’s multiplier. Again, it’s important to understand the multiple applied to the gross revenue measurement when valuing a service company based on revenue will vary by the applicable industry. Other factors, such as recurring revenue vs. one-time transaction revenue, will increase or decrease the applicable industry multiple.

Small Business Valuation Multiples

When pricing a business or franchise for sale, it’s very important to understand how its industry value is perceived. Similar to a home in one neighborhood with the same number of bedrooms and baths plus an updated kitchen will differ from the same home in another neighborhood, the small business valuation multiples will be driven mostly by the industry in which the business operates. And every industry has its own nuances. One may be heavy on inventory while another may be heavily leveraged with debt. This means the same amount of net income (cash flow, EBITDA, EBIT, etc.) derived from a business in one industry will result in a different business value from a business in another industry.

Valuation Company Services

Business owners may need to hire a valuation company which employs certified valuation specialists to prepare a written valuation report for a legal or tax purpose. This is especially true when a business is being transferred from family member to another family member as part of an estate planning and/or gifting strategy. It’s also necessary when a business chooses to change its federal tax treatment or transfer assets from one business to another in a tax-free exchange. Such valuation services typically take several weeks, or even months, to complete the work and prepare the written report. The cost for such services for small-to-medium sized business is approximately $3,000 to $10,000 and is dependent on the size and complexity of the business being valued.

These valuation specialists may have credentials such as:

- CVA (Certified Valuation Analyst by the National Association of Certified Valuation Analysts),

- ABV (a Certified Public Accountant who has been Accredited in Business Valuation),

- CBA (Certified Business Appraiser by the Institute of Business Appraisers), and

- ASA (Accredited Senior Appraiser by the American Society of Appraisers), among others.

Online Business Valuation Services

Similar to many other industries, the business valuation industry is not immune to disruptors due to advances in technology. Business owners now have the opportunity to use online business valuation calculators to obtain an up-to-date valuation for their business.

Many of the online business valuators offer business owners a quick business valuation and insights as to what a business owner may do proactively to improve the value of their business.

Business Valuation Report

A written business valuation report may be as simple as a calculation report or as detailed as a professional appraisal report prepared by a professional valuation advisor.

When a business owner simply wants to know the answer to the question “what is my company worth?”, hiring a professional to compute the value and to produce a massive, written business valuation report may be overkill. It certainly may also be out of the question, given its cost.

On the other hand, a business owner may understand the importance of knowing the various business values pertinent when contemplating the sale of his business. When selling a business, the business has four values which usually are relevant and should be considered carefully. Those are:

- Asset Value – Typically small businesses are sold under an asset purchase agreement where only the inventory, supplies, fixed and intangible assets are sold. Cash and Accounts Receivable are normally retained by the seller in such a sale.

- Equity Value – Few small businesses are sold under this arrangement, known as a stock purchase agreement or equity sale. In this type of sale, the entire business entity is sold to the new owner and the seller retains nothing from the business.

- Enterprise Value – This business value is most often applicable to middle-market businesses where the level of debt has a big impact on the business and investors are comparing several companies.

- Liquidation Value – The key assumption in this value is insolvency and the immediate need to sell all assets related to the business while nearly and simultaneously retiring all liabilities.

Conclusion:

If you’re like most business owners, there will be a time when you need to value your business and there will be many times where you will simply wonder “what’s my business worth?”

The world of business valuation has been hidden behind closed doors for several decades and now technology and improved access to information across multiple industries has opened up new ways for business owners to answer this burning question.

Whether you’re the type of business owner who loves to read textbooks on the topic of financial ratios and accounting metrics, prefers to learn about your industry’s valuation multiples or are willing to enter your own data into an online business valuation calculator, access to learning about your business’ value and what you can do to improve it is now available to all.

And of course if you’d rather leave the business valuation question to the professionals, that’s always an option. Tell me about your business valuation journey. I’d love to learn what’s worked well (or not so well) for you!

by Holly Magister, CPA | Business Valuation |

The term ‘rule of thumb’ generally refers to the idea of a principle with a broad application – something that is not intended to be exact or strictly accurate. In the business world, the term ‘rule of thumb’ refers to a guideline that provides simplified advice about a particular subject.

The term ‘rule of thumb’ generally refers to the idea of a principle with a broad application – something that is not intended to be exact or strictly accurate. In the business world, the term ‘rule of thumb’ refers to a guideline that provides simplified advice about a particular subject.

The ‘rule of thumb’ definition is considered to be a general principle that provides guidance for accomplishing or approaching a certain task or reaching a certain goal. Rules of thumb never describe an exact or strict method, but rather a broad and general approach to completing the task.

More often than not, rules of thumb are established based on experience, involvement, and/or practice, and not from science or theory. Rules of thumb exist in nearly every context – from cleaning and cooking, to investments and business. Here, we’ll explore some examples of common rules of thumb as they relate to starting, growing, and selling a business.

Starting a business rule of thumb

The average time to liquidity of an equity investment in a startup company is about five years. This means, that as a rule of thumb, a new business owner should prepare a five-year financial projection. Most investors will ask for a five-year projection in an effort to understand the opportunity as well as the risk they face while their money is tied up.

Private Equity and Venture Capital Firms typically prefer to exit their investment positions in businesses within seven years so this rule of thumb has a practical application when seeking this type of investor.

Growing a business rule of thumb

As a rule of thumb, 80% of a company’s profits comes from 20% of its customers. Known as Pareto’s Principle, the 80/20 Rule is instrumental in understanding your customer or client-base, and where your business has the most potential for growth.

The practical application of the Pareto’s Principle to your growing business allows a business owner to evaluate which customers or clients deliver the most profit. Knowing which customers or clients are most profitable and which are the least profitable will allow you to improve the value of your business effectively.

Selling a business rule of thumb

In the event you are preparing to sell your business, you’ll need to have a good idea of what the business is currently worth. Applying your business/industry multiple of earnings, typically measured as EBITDA (earnings before interest, taxes, depreciation, and amortization) is a standard rule of thumb used in the process of valuing a business.

Keep in mind that rules of thumb usually apply under general circumstances to a wide audience and may not necessarily apply to every unique situation.

by Holly Magister, CPA | Business Valuation |

The business valuation formulas used to compute the value of a business for sale are numerous and can be confusing to many small business owners. In fact, many professionals can be similarly confused by the various multiple formulas currently in use.

The business valuation formulas used to compute the value of a business for sale are numerous and can be confusing to many small business owners. In fact, many professionals can be similarly confused by the various multiple formulas currently in use.

When pricing a business for sale, a valuation multiple is applied to either revenue and/or earnings and then often adjusted to account for assets and liabilities which may be transferred to the buyer when the business is sold. Additionally, every business buyer will apply adjustments to the value of a prospective acquisition based on a specific perception of risk as the new business owner as well as future opportunities.

The actual ‘multiple’ varies widely by industry. It also increases and decreases according to how well the economy at large is performing in addition to the performance of financial markets and the cost of capital available for investment purposes. Accordingly, a given business, which produces a certain level of revenue and earnings, will be more or less valuable over time as its industry falls in or out of favor while the economy and financial markets ebb and flow. Suffice it to say a business owner can only control one of the four major factors which influence the value of his business — its revenue and earnings. Beyond that, he is at the mercy of his industry, the economy at large, and the condition of financial markets when valuing his business for sale.

Below we’ve defined the various measurements of revenue and/or earnings to which valuation multiples are applied from the various business valuation formulas for your reference. Along with each measurement definition you will find an explanation regarding when the valuation multiple formula is typically used.

Seller’s Discretionary Income or SDE

A Seller’s Discretionary Income or Earnings consists of pretax profits before non-cash expenses (which is EBITDA, defined further below), owner’s benefits, non-recurring expenses, and any non-related income or expenses. SDE is used to value small businesses that typically have earnings of less than $1 million. Many small businesses are run by the owner, which is why the owner’s compensation is added back into the calculation of the SDE.

Non-recurring expenses refer to one-time fees such as licensing, facility renovation, new equipment, etc. The buyer will not expect to pay those costs every year while they are running the business, so they are also added back to the SDE. Many small business owners run expenses through their business even if they are not directly related to it, such as expensing the cost of an owner’s vehicle maintenance. With detailed record keeping, some of these owner expenses can be added back.

The multiples calculated with SDE depend on the size of the SDE; smaller SDEs result in smaller multiples from 1 to 2, while larger SDEs can pull multiples from 2 to 4.

Earnings Before Interest and Taxes or EBIT

Earnings Before Interest and Taxes represents a measure of a business’s earnings from operations. To determine EBIT, interest expenses and taxes that are not payroll related are added back to the net operating income. Payroll taxes, such as Medicare and Unemployment, are necessary to operate the business. Federal, state, and local taxes, on the other hand, are added back to the net operating income.

EBIT is a useful metric when comparing multiple companies within the same industry, because it disregards variations due to different capital structures and tax rates.

Earnings Before Interest, Taxes, Depreciation and Amortization or EBITDA

While EBIT measures operating earnings, EBITDA measures cash flow. EBITDA begins with the business’s net profit and adds back interest, taxes, depreciation, and amortization. This measure removes variations between companies with different financing and accounting practices.

A multiple is often applied to EBITDA to determine the value of a business. For smaller and middle market businesses, Brokers use an Adjusted EBITDA. This Adjusted, or Normalized, EBITDA takes into account non-standard income and expenses present in private businesses.

Adjusted EBITDA. This Adjusted, or Normalized, EBITDA takes into account non-standard income and expenses present in private businesses.

Using Gross Sales as the Basis for Business Valuation Formulas

Gross Sales refers to the total of all sales without any deductions for discounts, returns, or operating expenses. Gross Sales are commonly used in some industries to compute the business value, such as consumer retail and restaurants.

Even if multiples of gross sales are common in your business’s industry, many business valuations and buyers will still want to examine other measures such as net profit and gross profit margin.

by Holly Magister, CPA | Business Valuation |

Business valuation specialists come in many forms, and for a business owner it can be very difficult understanding the various business valuation expert designations. More importantly, when the business owner is in need of a valuation, understanding exactly what type of expertise or special designations may be necessary and ultimately who to hire can become a daunting task.

Let’s break the challenge down into two parts:

First, we will address the purpose for the business valuation. Then we will address the various types of business valuation specialists available to business owners.

Various Business Valuation Purposes:

Business Valuation Litigation

Business valuations are sometimes needed for court proceedings such as lawsuits, ownership or shareholder disputes, and business disolutions. For example, if an incident takes place and a business is sued, a business valuation can help determine how much the defendant owes the plaintiff.

Business Buyout Valuation

If an investor or co-shareholder wants to buy a portion of a business or a whole business, a business buyout valuation must take place. This establishes how much the investor or co-shareholder will pay the business owner.

Cross Purchase Buy Sell Valuation

Cross purchase agreements are used for business continuity planning purposes. In a cross purchase buy sell agreement, a business owner’s surviving partners will buy his interest in the company from his family if he dies. This type of valuation will determine how much the surviving owners pay to the deceased owner’s family.

Divorce Business Valuation

These business valuations will have an impact on the amount of money or interest in the company each party receives in the divorce settlement. When a couple gets divorced, all of their combined assets are typically valued. Assets may be divided according to each person’s circumstance if the state follows equitable distribution laws. If the state supports community property laws, the couple’s joint assets will be divided exactly in half.

Business Valuation for Gift Tax Purposes

If a business owner or shareholder wants to gift his common stock or equity to a family member or another person, the IRS requires reporting of the gift’s value.

This involves two steps: the valuation of the business itself, and determining the valuation discounts, if applicable. A discount for lack of marketability or lack of control in the business may reduce the value of the gift although the IRS imposes penalties on valuations that have been understated deliberately.

Accordingly, it’s important to be able to fully substantiate the valuation with discount when gifting business equity to another person.

Estate Tax Business Valuation

The estate tax applies to assets and property transferred to family members when a person dies. As with gift tax valuations, business valuations for estate tax purposes may be eligible for certain discounts. The estate tax only applies to estates exceeding a certain value; for 2014, the value is $5,340,000.

Selling a Business Valuation

When selling a business, the business owner should have a professional business valuation done. This will avoid an asking price that is much too high and that turns off potential buyers, and also protects against a price that is too low and undervalues the business.

Various Business Valuation Experts:

Certified Valuation Analyst – CVA

Certified Valuations Analysts have studied business valuation and passed a test administered by the National Association of Certified Valuators and Analysts. CVAs may be CPAs or hold other business degrees with substantial experience in business valuation. (In April 2013, the Accredited Valuation Analyst – AVA credential was merged into the CVA credential.)

Certified Business Appraiser – CBA

Certified Business Appraisers are business professionals who have completed Business Valuation and Certification Training, passed an exam, and submitted two demonstration reports for peer review. The Institute of Business Appraisers manages CBA training and certification.

Recently, the CBA designation has become part of the NACVA organization.

Accredited in Business Valuation – ABV

The Accredited in Business Valuation credential is granted by the American Institute of CPAs. CPAs must pass the ABV exam, complete either 6 business valuations or 150 hours of valuation experience, and must complete 75 hours of valuation-related continuing professional education.

Accredited Senior Appraiser – ASA

Accredited Senior Appraisers in business valuation must have at least five years of full time appraisal experience and must pass four Principles of Valuation courses. This credential is granted by the American Society of Appraisers.

Certified Public Accountant – CPA

The Certified Public Accountant license is granted by each state. CPAs must meet their state’s education and experience requirements and pass the Uniform CPA Examination. Not all CPAs have experience in business valuation work, so it’s prudent to ask about their specific training, continuing education classes and actual business valuation engagements and not assume the CPA is the appropriate professional advisor.

Business owners should look for these credentials and certifications to ensure their business valuations are done correctly. To find the right business valuation expert, business owners should also search for experts who have experience in the specific type of valuation they need.

When You Simply Want to Know What Is My Business Worth Is a Business Valuation Expert Needed?

There are times when a simple valuation is what a business owner needs. He may be assessing how much life insurance he should purchase to cover a cross-purchase agreement with co-owners. Or maybe it’s just his curiosity getting the better of him.

Knowing the value of a business, based on how the company has financially performed over the past couple of years in relation to its competitors, would be worthwhile to most business owners. Do they want to hire a business valuation expert to satisfy their curiosity? Not likely. That’s when using an online business valuation service makes good sense.

by Holly Magister, CPA | Business Valuation |

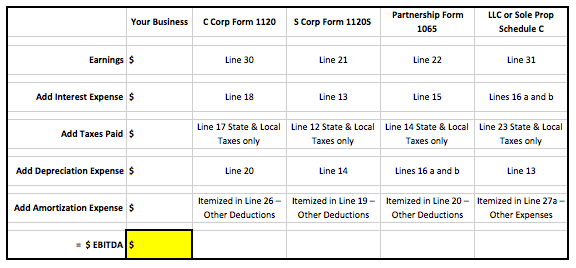

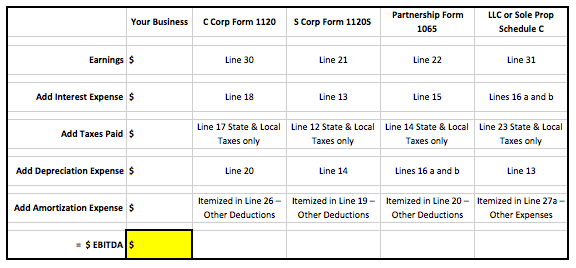

In this post, we explain how many businesses are valued based on a measurement known as EBITDA or Adjusted EBITDA.

Valuing a business starts by understanding:

- How the EBITDA Measurement is Used to Value a Business

- The Importance of the EBITDA Multiple

- How to Calculate EBITDA (free tool) and

- The Valid Adjustments to Compute Adjusted EBITDA

One of the many questions asked by business owners as they plan for the sale of their business is related to the Adjusted EBITDA definition. Its computation is important to business owners because it’s a vital part of a multi-step process used in the valuation of a privately held company.

Adjusted EBITDA is used by Business Brokers in the valuation and sale of smaller businesses often referred to as ‘Main Street Businesses’. Likewise, the concept is used by Merger & Acquisition Intermediaries or Investment Bankers when representing businesses for sale in the lower middle and middle market.

Before we define Adjusted or Normalized EBITDA, understanding what this measurement means in the context of business valuation is a worthy exercise.

How to Value a Company

Main Street and Middle Market Business Valuations use a variety of measurements to determine an approximate fair market value of a business. Neither the valuation methodologies nor their underlying measurements are carved into stone. Instead, each industry or type of business tends to use a variety of valuation techniques to suit its own needs.

For example, a professional services business like an Information Technology (IT) company, is valued typically on a multiple of 1 to 1.5 applied to (or multiplied by) its annual gross revenue. Alternatively, businesses in other industries may rely more heavily on the Adjusted EBITDA measurement to determine business value.

Generally speaking, the greater the business’s gross revenue, the more likely its business valuation will be derived in part by the Adjusted EBITDA measurement.

EBITDA Multiple

As mentioned above, a ‘multiple’ is applied to a given measurement such as annual gross revenue or Adjusted EBITDA to determine the business value.

The product of this multiplication is one component in the business valuation. Additional adjustments may be made for assets and liabilities associated with the business operation or entity.

The EBITDA multiple also varies widely from industry-to-industry and even from year-to-year. When M&A activities increase, the EBITDA multiples used in business valuations tend to rise. When business acquisitions are less attractive in the private markets, the EBITDA multiples tend to drop.

While much debate exists over which business valuation methodology and measurement should be used, suffice it to say understanding the ‘Adjusted EBITDA’ concept is a worthy exercise for the entrepreneur. It’s useful because this measurement tells a business buyer how much cash a business produces on an annual basis. And such a measurement becomes more important to both the seller and the buyer as the business grows its annual revenues.

Before we explore Adjusted EBITDA’s definition, let’s define EBITDA and show you how to calculate it.

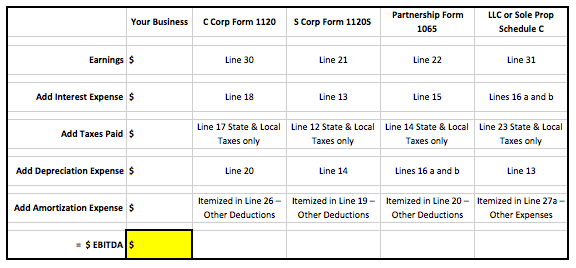

EBITDA Calculation

EBITDA is an acronym for Earnings Before Interest, Taxes, Depreciation and Amortization.

Most business owners don’t focus on this measurement of cash flow from operations until it’s time to understand it in terms of business valuation. And often that doesn’t happen until the business owner begins his exit planning or selling process.

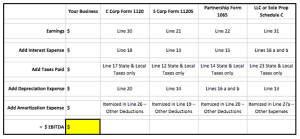

Here’s a simple formula to calculate EBITDA from the figures found on your 2017 business federal income tax returns:

Adjusted EBITDA Definition and Calculation

The EBITDA measurement of cash flow from operations often only tells the owner or buyer of a business part of the story.

In most private businesses, certain forms of income and expenses are not standard. Instead, it is safe to say anomalies related to certain income and/or expenses may exist.

Accordingly, to get a true picture of the business’s cash flow, an outside party will need to normalize EBITDA measurement. By normalizing EBITDA, a business buyer is better able to compare the cash flow from one business to another. In fact, another name used by M&A advisors for Adjusted EBITDA is ‘Normalized EBITDA’.

A few of the adjustments made to normalize EBITDA may include:

Adjustments which will Increase EBITDA

• Excessive rent expense paid to a related party

• Excessive compensation and/or benefits paid to business owners, employees, relatives, etc.

• Excessive automobile expenses paid on behalf of business owners and/or employees

• Excessive travel and entertainment expenses paid on behalf of business owners and/or employees

• Charitable contributions

• Legal, Accounting and other professional fees not related to the ongoing operations of the business

• Excessive or lavish office related expenses

• Excessive bonuses paid to business owners and employees

• Bad Debts expense outside of the normal range

• Any expense considered discretionary and not customary to the industry by the business owner and/or management

• Any expense considered outside of the normal costs to operate a business such as a lawsuit settlement paid to another party

Adjustments which will Decrease EBITDA

• Excessive Management Fee Income from a related party or related business

• Excessive Rental Income outside of normal rental rates for the market

• One time windfalls such as a lawsuit settlement received

Once a business owner, his M&A and valuation advisors, as well as any potential buyers are able to reach agreement with regard to an Adjusted EBITDA figure, this key measurement is then used in the formula to determine the business value.

While this measurement is calculated on an annual basis, it’s not unusual for buyers to review the previous three years’ Adjusted EBITDA. By doing so, a buyer is able to assess the normalized cash flow trend and compare it to the gross revenue sales trend for the same three year period. If the two trends are consistent, it’s reasonable to assume additional sales growth in the future will result in an increase in cash flow. Of course this situation is desirable and exactly what a business owner should strive to achieve as he plans for a sale or business ownership transfer.

Exit Promise Members — Download your EBITDA Calculator!

by Matt Harnett | Business Valuation |

Cash Out and Still Have a Piece of the Pie via the Majority Recapitalization

Recapitalizations can be used to provide liquidity to owners, refinance the balance sheet or fund future growth initiatives. When the owners sell a majority of the business but still retains some ownership, it is termed a majority recapitalization.

When company growth results in the business becoming the owner’s largest asset, it may be time to consider “taking some chips off the table” through a majority recapitalization.

When this is the case, an owner may seek to recapitalize the business by selling a portion of the ownership. The proceeds can be used to invest in other stocks, businesses, assets or securities to diversify the sellers’ finances and decrease risk.

Some may ask, if a business owner wants liquidity, why not sell the entire business? This is driven by a myriad of reasons while the most prominent examples of representative transactions are detailed below.

- First, a business owner may not be “ready to retire”. They may want to maintain operational management and cultural influence of the company but seek some financial liquidity.

- Second, a business owner may want to retire or decrease their day-to-day management of the Company but they still believe that the company has strong long-term growth potential that will increase the future value of the business. For this reason, they may seek to retain some ownership of the business so they can enjoy “another bite of the apple” when there is a second liquidity event.

- Another reason owners seek recapitalizations is to raise growth capital. The owner may see a tremendous growth opportunity for the business which requires a financial partner that can provide a capital injection. In turn for the capital, they may have to sell a portion of the company.

- Sometimes recapitalizations are done to shift ownership between partners in a company, inter-generational transfers or between management, owners and financial sponsors. Other times recapitalizations include paying off debt, taking a cash dividend by raising debt, paying out an investor, or shuffling the capital structure to increase the amount of free cash flow available for growth.

Whatever the reason is for the recapitalization, so long that the business owner retains a portion of the ownership, the owners are wise to seek a strategic or financial partner that is willing and able to help grow the business. This is because they want to increase the value of their holdings as much as possible.

Further, the business owner should evaluate the cultural fit, and the financial, management and operational expertise that the partner brings to the table.

It is prudent for the business owner to hire proper representation when undertaking a recapitalization. This includes legal counsel, an accounting firm, an investment banker, and sometimes a business valuation expert. These professionals are worth their cost.

For example, the attorney will help structure the agreements and protect the owners’ interests. The accountant can prepare financial statements that the banks and financial partners will need to analyze. Also the attorneys and accountants can help structure the most tax efficient transaction. The business valuation professional can help determine the company’s proper value.

An investment banker or business broker can be extremely helpful to the owner. Not only can they help run the recapitalization process but their efforts typically increase what the owners get paid by creating a competitive bidding process for the company’s equity.

Obviously, price is only one factor to consider when choosing a long term partner, and competent professionals can guide the recapitalization, increase options by finding and assessing potential partners, and represent the business owners’ goals.

So as business owners review their exit options, selling a portion of the ownership via a recapitalization is worth considering. It can help business owners diversify their assets and put in play a longer term plan for another payday down the road.

by Holly Magister, CPA | Business Valuation |

Often business owners ask me one of those “quick questions”. Usually I chuckle because the answer that follows and implementation of the advice offered is anything but ‘quick’! Just this week, I was asked a common question from an entrepreneur struggling to grow his business. He asked “what can I do to ultimately maximize the sale price of my business?”

Often business owners ask me one of those “quick questions”. Usually I chuckle because the answer that follows and implementation of the advice offered is anything but ‘quick’! Just this week, I was asked a common question from an entrepreneur struggling to grow his business. He asked “what can I do to ultimately maximize the sale price of my business?”

It was clear to me this entrepreneur was looking for a silver bullet. I didn’t have one for him. However, I was able to share with him the 4 ways to increase the value of a business. By the end of our conversation, he knew what he needed to do.

I explained there were four factors that will have the greatest impact on the sale price of his business. With those factors in mind, this entrepreneur will be better prepared to answer his own eventual question: how do I price my business for sale?

1. The Larger the Business, the Greater the Sale Price

This is obvious. Right?

Yes, it’s true. But the real reason size is the most powerful and, in my opinion, the most impactful factor on the sale price of a business is not really related to dollars, profit and loss statements, or EBITDA multiples. Rather it has everything to do with the people and systems established in a larger business. The larger the business, the more likely the human resources and the business systems they operate have very little to do with the entrepreneur’s activities. The business’s lack of dependence on the entrepreneur is extremely important to a buyer, and in a smaller business it’s much less common. Growing a larger business takes work, discipline, and ultimately makes the removal of the business owner from the day-to-day operations and management necessary.

2. Strategic Buyers Pay More for a Business

Not all buyers are alike. A business sold to an internal group of employees, a co-shareholder or family members typically result in a lower sales price. A business sold to a financial buyer will be looking for a healthy return on their investment above what they would expect from investing in stocks and bonds in the open market. Financial buyers typically pay more than internal buyers but less than a strategic buyer.

above what they would expect from investing in stocks and bonds in the open market. Financial buyers typically pay more than internal buyers but less than a strategic buyer.

The strategic buyer’s motive to buy a business is not always apparent to the seller. Such a buyer may want to get into a new market without taking the time to develop the infrastructure to add a new product or service. The strategic buyer may want access to a new distribution channel, geography, or have underutilized assets they could deploy selling and servicing another business’s customer base. Regardless of their motive, the strategic buyer offers more to a seller than the internal or financial buyer.

Understanding who may be a potential strategic buyer is powerful for the entrepreneur. Aligning a business to be strategically attractive to another business is prudent.

3. Consistent Revenue Growth for Three Consecutive Years Puts the Seller in the Driver’s Seat

When a business is growing three years in a row, all is right with the world. Employees, sales teams, and vendors are pleased to be working with the business. The bankers love it, too. As long as the revenue growth isn’t excessive, the entrepreneur is able to grow the systems, hire good people, and make everyone happy.

Alternatively, if revenue is shrinking as the entrepreneur puts their business on the market, buyers are wary because the risks are great.

Buyers will carefully examine three full years of financial data in addition to the current year-to-date financial statements before making an offer through a Letter of Intent. Having consistent financial statements with increasing gross revenue is one of the best ways to be positioned as an entrepreneur undertaking the selling process.

4. The Lack of Concentrations Reduces the Business Buyer’s Risks

Buyers view customer, supplier, and employee concentrations as risky. Frankly, they should and so should the entrepreneur. When a business has few customers, suppliers, and vitally important employees, they face extraordinary risks not associated with larger, well-established businesses.

Any customer who represents more than 8% of the business’s gross sales revenue is considered a customer concentration. Diversification of the customer base is necessary.

Concentrations exist on the supply side as well. Without a formal supplier agreement in place, any significant supplier of goods or services to a business holds the upper hand in the business relationship. Again, this form of risk should be eliminated.

Key employees are important to any successful business. But those without formal agreements can put the business in a precarious position, particularly when the business is for sale or sold. Steps should be taken to reduce this business risk as well.

By eliminating customer, supplier, and employee concentration risks, the entrepreneur will increase their likelihood of selling their business and in doing so will increase the sale price they receive.

Although there are additional factors that impact the sale price of a business, an entrepreneur will benefit greatly if they are able to address these four factors as they grow their business. As I mentioned previously, there is no silver bullet for my client or other entrepreneurs. In fact, the gross sales price is only part of the equation when selling a business. The structure of the transaction is also very important if a business owner desires to maximize the net cash proceeds he or she receives. That’s a blog subject for another day.

Oh, by the way did I mention the entrepreneur’s company is only four years old? Truly, this entrepreneur understands the importance of planning and knows it is never too early to begin thinking about an exit from the business.

by Holly Magister, CPA | Business Valuation |

EBIT Definition: an Acronym for Earnings Before Interest and Taxes

EBIT is a term commercial bankers , investment bankers, Chief Financial Officers and other financial advisors often use as a measure of a business’s earnings from operations. It is an acronym for Earnings Before Interest and Taxes.

, investment bankers, Chief Financial Officers and other financial advisors often use as a measure of a business’s earnings from operations. It is an acronym for Earnings Before Interest and Taxes.

- EBIT reveals operating profitability without non-recurring or unusual income or expenses

- EBIT measures operating profitability by eliminating financial expenses a business may incur

- EBIT is helpful when you want to compare several businesses with different tax and/or capital structures

When selling a business, this measurement is very important to investors and buyers and is often included in other financial ratios to determine the business value. As for business owners, it’s also worth keeping track of as it’s an indication of the financial overall health of the business.

EBIT is not a Generally Accepted Accounting Principle (GAAP), however it is a very popular measurement in the financial and investment communities.

How to Calculate EBIT

To calculate EBIT, start with the Net Income or Net Operating Income for the business for a given period of time. Normally, it is a twelve month period and most often either the previous rolling twelve months or fiscal year. The Net Operating Income will appear above the Extraordinary Income or Expenses line on the company’s Profit and Loss Statement, also known as the Income Statement.

Add to the Net Operating Income any Interest Expense incurred by the business such as interest paid to banks, financing companies, vendors, suppliers, lenders, and the business owners;

Also add to the Net Operating Income any Tax Expenses paid that are not payroll related. The taxes to add back to the NOI are earnings taxes or taxes associated with income the company earned during the period being measured.

For example, the FICA, Medicare, and Unemployment taxes paid by the company for its employees would not be added back when computing EBIT. Such payroll taxes are ordinary and necessary to operate the business and generate a net profit. Similarly, sales taxes which may be paid or collected and included in the company’s Cost of Goods Sold or Operating Expenses are also not added back to income when computing EBIT. Whereas, the federal, state, and local taxes paid on behalf of the company’s earnings are not part of the business’s operations and are added back to the Net Operating Income.

It’s important to note that when you calculate EBIT, you do not add depreciation and amortization expense. If you do so, you would be computing EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization).

EBIT vs. EBITDA

EBIT and EBITDA are similar, however EBIT measures a business’s earnings from operations and EBITDA measures a business’s cash flow.

by Holly Magister, CPA | Business Valuation |

As I meet with business owners, I’m often asked the same question: “When is the best time for me to sell my business?” The answer to this question is not the same for every business owner, for many reasons.

For instance, a business owner may want to sell for personal reasons, and not for reasons related to the business or its financial condition.

Unfortunately, when personal reasons drive the need to sell a business, the outcome is typically not ideal. More positive results are obtained when business owners are willing to chart a course as they consider selling and realize it’s a process, not an event.

Best Way to Sell a Business

If a business owner wants to optimize the sales price of his or her business, it is best practice to establish a three-to-ten year time frame to sell the business. This may sound crazy to some, but hear me out.

There are three factors which have the most impact on the value of a business when it is sold to a third party. Two of the factors are not in the business owner’s control while one is. It’s been my experience that business owners typically don’t like things they can’t control. Sorry if this seems like a blunt statement. Nonetheless, it’s true.

So if you’re a business owner and want to sell your business, what should you do?

Understand the Three Most Impactful Valuation Factors When Selling a Business

1. The business’s EBITDA or the cash a business produces over a three year period. This single factor is controllable by adopting proper planning to create a profitable business model that’s executed by good management.

2. The Industry in which the business operates. Is the industry growing, exploding, shrinking, or disappearing? If it’s one of the latter two, the business owner has a much shorter time frame during which to sell before the business’s value may be gone. Alternatively, if the industry is either growing or exploding, the timing of the sale is critical due to changing valuation multiples. These values may change rapidly so it pays to know the current industry multiple and the direction in which it’s moving.

3. The M&A climate, or in other words, the relative cost of capital for private enterprises. Mergers and Acquisitions activity goes up and down. If an investor is unable to find sufficient returns on his or her money by investing in stocks, bonds and real estate, then investing in a private enterprise becomes more attractive. That’s when the M&A climate is most favorable. Conversely, when the stock, bond and real estate markets are healthy and producing nice returns for investors, buying private enterprises falls out of favor.

The business owner is truly only able to control the EBITDA their business produces, so I recommend focusing on improving EBITDA first. By doing so over a three (or more) year time frame while keeping an eye on the industry itself as well as the M&A climate, an entrepreneur will be well positioned to take advantage of good timing when it arrives.

by Holly Magister, CPA | Business Valuation |

The Definition of EBITDA: It is an acronym for Earnings Before Interest Taxes Depreciation and Amortization. EBITDA is often used as a measure of a business’s cash flow. Also it is used frequently in many business valuation formulas, depending on the business’s specific industry.

For example, the value of a business may be defined as a multiple of EBITDA. If the industry multiple is six (which would be very good), then the value of a business in such an industry would be six times the business’s EBITDA. Many other factors, not just industry type, impact the multiple applied to EBITDA for business valuation purposes.

How to Calculate EBITDA

To calculate EBITDA, start with the Net Profit shown on the bottom of the business’s Profit and Loss Statement, or alternatively the Taxable Income shown on the bottom of the business’s tax return. This is the Earnings figure or starting point.

Add to this Earnings figure the following:

- Interest Paid to banks, financing companies, vendors, supplier, lenders and the business owners;

- Taxes paid on the Income of the business. Do not add sales taxes paid or employment taxes paid on behalf of the business’s employees or employer-related payroll taxes;

- Depreciation deducted on the Profit and Loss Statement or Tax Return. If your business elected to take a Code Section 179

- Deduction on the tax return, this should be added as well; and

- Amortization deducted on the Profit and Loss Statement or Tax Return. The Amortization expense figure is usually found in Miscellaneous Expenses and is not shown separately on the first page of the tax return.

Learn more about EBITDA

EBITDA – What is its impact on when you should sell a business?

by Holly Magister, CPA | Business Valuation |

The best solution to a problem lies in uncovering what the root cause of the problem really is. So often, this is the case when an entrepreneur is struggling with profitability in their business.

The best solution to a problem lies in uncovering what the root cause of the problem really is. So often, this is the case when an entrepreneur is struggling with profitability in their business.

Over the past few posts, we have discussed the concepts of how a minimum order policy and Pareto’s Principle applied to the customer/client base can be very powerful. These concepts all contribute to help you increase the value of your business.

How is This Done?

By understanding clearly which customers/clients offer you the greatest profit, you automatically focus a bright light on the remaining customers/clients who do not. Those are the ones that actually cost you more than what they offer you in doing business with them. This is the worst form of Leaving Money on the Table and it is very important that you do what is necessary to remedy the situation.

Does This Sound Familiar?

Over the years, you have had a number of long-time, customers who for many reasons always need something extra. Not sometimes, all the time.

They are the customers who call you late Friday afternoon and need a shipment to be sent FEDEX because blah, blah, blah… Of course your day shift already went home. It is 3:30 p.m. and the FEDEX pickup driver is on your loading dock.

How about the customer who complains when you have been forced by your suppliers to raise your prices by 3% for the first time in three years? They are the customer who orders once a year and pays their bill 45 days late.

I Am Afraid I Know the Answer

Unfortunately, we all know the likes of the customers described above. I swear there is a training camp out there someplace for these folks!

It is very important to understand that you own the business and it is up to you to decide with whom you will, or will not, do business.

I just love this quote from The Leap by Rick Smith:

Above all else, remember this: Whatever traps we may feel stuck in are largely of our own making. What we have built, we can also undo.

What we can dream, we can achieve.

I can apply this to many facets of my life. And no better than the decision you face every day when you agree to do business with someone… or not!

To really understand your company’s profitability—or in other words—where you make money and where you are losing money, look closely at the customers/clients who fall below the line in the 80/20 Pareto’s Principle exercise. Do some or many of these customers/clients drive you crazy? What are their common characteristics? Do they all buy the same things or services from you? Do they all come from the same place or have similar demographics? Look closely.

In our next post, we will explore how to remedy this situation so you will not find yourself trapped by doing business with customers/clients who force you to leave money on the table.

by The Contributors | Business Valuation |

Your worst nightmare comes true! You get an email on Friday afternoon from your largest customer indicating that they are changing suppliers for “strategic reasons.” They represent 20% of your sales revenue and 35% of your profits.

Your worst nightmare comes true! You get an email on Friday afternoon from your largest customer indicating that they are changing suppliers for “strategic reasons.” They represent 20% of your sales revenue and 35% of your profits.

Common Customer Concentration Risks

In a world of increasing commoditization and focus on cost, it becomes more difficult to manage this customer concentration risk as customers are forced to change suppliers to remain competitive. There are many reasons that a key customer changes suppliers. Some common examples of customer concentration risk include:

- Lower pricing from domestic competition

- Imports from low cost countries

- Acquisition (acquirer of your customer has another preferred supplier)

The obvious strategy to reduce customer concentration is to diversify and increase your customer base. A complimentary strategy, one adopted by many a business savvy entrepreneur, is the Long Term Supply Agreement, or LTSA. A big advantage of a Long Term Supply Agreement is that it can be achieved in a much shorter timeframe than reducing customer concentration. A LTSA will not eliminate all of the risk of losing a key customer, but it will make a significant difference under many scenarios.

What is a Long Term Supply Agreement?

A LTSA is a contractual arrangement with your key customer that commits them to buy, and you to sell, products or services for a specified period of time under certain conditions. Many times companies have this implied commitment/relationship with their customers, but formalizing the arrangement through a LTSA will protect you when market conditions change, and will result in taking your relationship to the next level.

The key to business success with a LTSA is that it be structured as a win-win arrangement between you and your customer, and that the agreement be flexible enough to withstand the test of time through both long and short markets. If these parameters do not exist, then the chance of the agreement being in place for the long term is low. A successful strategy, and one that significantly improves your chances of “selling” the concept to your customer, is to structure the agreement in a way that parallels how you transact business today.

As an entrepreneur, selling the concept of the LTSA to your customer can be delicate. The key is to educate them on the win-win and flexibility elements of the agreement and begin this introduction with a straight forward one-page concept.

Customers Have Two Concerns When Considering a Long Term Supply Agreement:

- Concern that the supplier will require the customer to buy products or services that they don’t need (typically referred to as Take or Pay).

- Concern that they take themselves out of the market for buying these products or services, which leaves them vulnerable to paying higher prices than their competition.

There are many ways to structure the terms of the agreement to eliminate both of these concerns. Each agreement will be different based on the individual company circumstances, but below are a few concepts to consider:

- Volume or service: provide flexibility to accommodate changes in customer’s demand. Fixed volume or service LTSA are a win-lose proposition.

- Pricing: include a competitive price clause, but make it precise so you’re not faced with matching price for a dissimilar competitive offer.

You will get a wide range of responses from customers when you initially propose the concept of a LTSA. Some customers will request or require an incentive to move forward with the process, we call this the cost of long term supply insurance. A good time to propose the concept of a LTSA is in response to a customer-initiated request for a concession (e.g. price reduction). In most cases you will need to meet this request anyway to maintain your supply position, so why not exploit the opportunity?

These agreements do not have to be overly complex and long legal documents. Language that is more concise and straightforward will always be more accommodating to the customer. Many times a couple of pages in addition to standard terms and conditions should be sufficient.

Start now! This process generally takes a number of iterations and can take some time to negotiate. Begin with developing the one-page concept and review it internally through the eyes of your customer to make sure that it meets the criteria above (win-win/flexible). The rewards are significant and help lay the foundation for your business success.

For more impact, consider taking the concept of a LTSA one step further by recommending that your customer propose the same concept to their key customers. Chances are that some of your key customers have the same customer concentration risk on their end, which could ultimately impact your company.

by | Business Valuation |

The various types of business valuation reports produced by a business appraiser can be confusing to an entrepreneur, especially when the appraiser belongs to more than one valuation association. Under most appraisal standards, a business appraiser can produce two types of reports: a detailed appraisal report or a calculation report.

The various types of business valuation reports produced by a business appraiser can be confusing to an entrepreneur, especially when the appraiser belongs to more than one valuation association. Under most appraisal standards, a business appraiser can produce two types of reports: a detailed appraisal report or a calculation report.

The difference between the two versions of the business valuation report is the content and level of information provided. The appropriate report option and the level of information necessary in the reports are dependent on the intended use and the intended users.

A detailed appraisal report includes detailed explanations for all aspects of the business valuation analysis. This report is the most inclusive appraisal available and strictly complies with business valuation standards. Detailed business valuation reports are recommended for estate tax audits or gifting of a business interest where a third party, such as the IRS, may be reviewing the document. For the entrepreneur, additional purposes of a detailed appraisal include litigation support, buy/sell agreement valuations, and stockholder disputes.

A calculation report is an abbreviated version of a detailed appraisal report and typically excludes detailed analysis of the business and the industry. This report is based upon limited procedures that are agreed upon by the appraiser and the client.

The distribution of a calculation report is limited only to the client. A calculation report is often used for internal planning purposes such as the sale or acquisition of a business interest, business planning, succession and estate planning.

The distribution of a calculation report is limited only to the client. A calculation report is often used for internal planning purposes such as the sale or acquisition of a business interest, business planning, succession and estate planning.

Due to the fact that every business valuation report is customized for a specific purpose and audience, problems can occur when a client tries to use a report for which it was not intended. Having a thorough understanding of the type of valuation report required can not only save time but money as well. When considering any valuation need, please be sure to clearly define with your valuation expert prior to the start of the engagement the intended purpose to ensure the proper report will be prepared.

by Andrew Jones | Business Valuation |

Understanding a company’s operating results is an important factor for a business owner to determine the value of a business. However, the operating results must be placed in the proper context by comparing them to results of the industry as a whole. By doing so, a business owner is able to understand how they are doing financially relative to their industry peers. This exercise is known as benchmarking.

Understanding a company’s operating results is an important factor for a business owner to determine the value of a business. However, the operating results must be placed in the proper context by comparing them to results of the industry as a whole. By doing so, a business owner is able to understand how they are doing financially relative to their industry peers. This exercise is known as benchmarking.

Benchmarking provides business owners with the ability to compare various performance measures against companies of similar size within an industry. Through proper comparison, a company can point out its operating strengths and weaknesses, assess management effectiveness, and identify areas where it is outperforming or underperforming the industry.

Financial ratios are classified into five major categories that highlight a company’s liquidity, efficiency, financial leverage, profitability, and value. Some of the more useful financial benchmarks include, but are not limited to, the following:

- Sales and Profitability Trends

- Gross, Operating, and Net Profit Margins

- Inventory, Accounts Receivable, and Accounts Payable Turnover

- Salary and Compensation Data

- Current Ratio and Quick Ratio

- Debt Coverage Ratios

- Price to Earnings Ratio

When a business owner looks to improve the value of a business, benchmarking is fundamental to the process of continuous improvement. While improvements occur incrementally, the metrics need to be monitored, analyzed, and recalibrated periodically.

The following steps should be taken in order to ensure proper benchmarking:

- Determine what is critical for the company’s success.

- Identify metrics that measure the critical factors.

- Identify appropriate benchmarking data.

- Measure the company’s performance.

- Compare the company’s performance to the benchmark.

- Create and implement an action plan to achieve the desired benchmark.

- Review the process on a continuous basis.

Overall, benchmarking provides a credible reference point and helps analyze the areas within a company that need improvement. Through proper benchmarking, a company can drastically improve its operations and cash flow, which ultimately enhances value.

by Andrew Jones | Business Valuation |

At some point in time, every business owner will leave their business (voluntarily or involuntarily). Through proper planning, an owner should expect to achieve their desired goals. Statistics show that the value of an owner’s business accounts for over 90% of their personal wealth. However, more than 75% of all business owners do not have a formal transition plan in place.

At some point in time, every business owner will leave their business (voluntarily or involuntarily). Through proper planning, an owner should expect to achieve their desired goals. Statistics show that the value of an owner’s business accounts for over 90% of their personal wealth. However, more than 75% of all business owners do not have a formal transition plan in place.

More often than not, the need for a business valuation arises when one of the four D’s occur (Death, Divorce, Disability, or Distressed Business). In order to be a valuable tool, a business valuation should be used on a periodic basis to provide an owner with an appropriate value of their business, while assisting in the exit strategy process. A business valuation should not be merely the result of an event requiring it.

What is a Business Valuation?

A business valuation is more than the application of mathematical models used to derive value. It is also a thorough understanding of the Company’s industry, operations, financial position, management team, and particular business risks (all of which have a significant impact on business value).

What is the Value of My Business?