by Holly Magister, CPA | Sell a Business |

Selling a business is one of the most exhausting endeavors an entrepreneur will undertake. Unfortunately, many simply do not succeed. In fact, only one out of ten entrepreneurs will actually complete the business sale process and transfer their business to another.

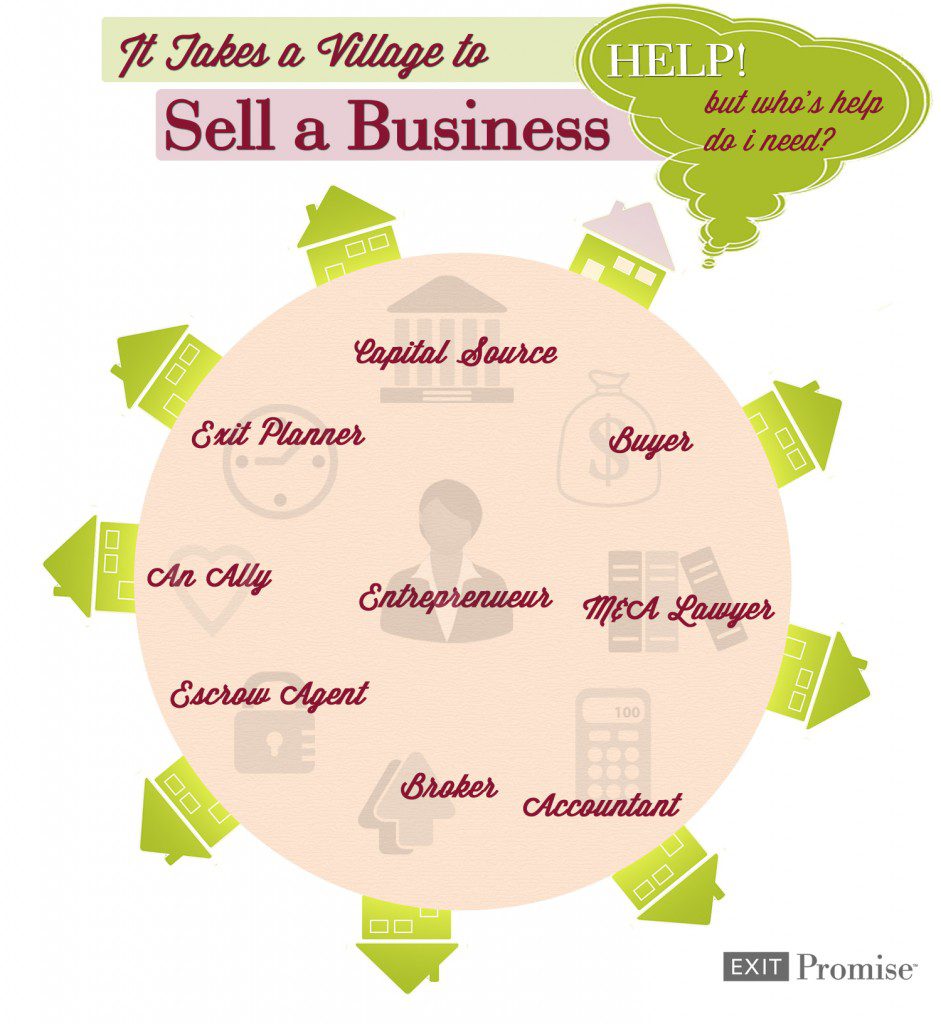

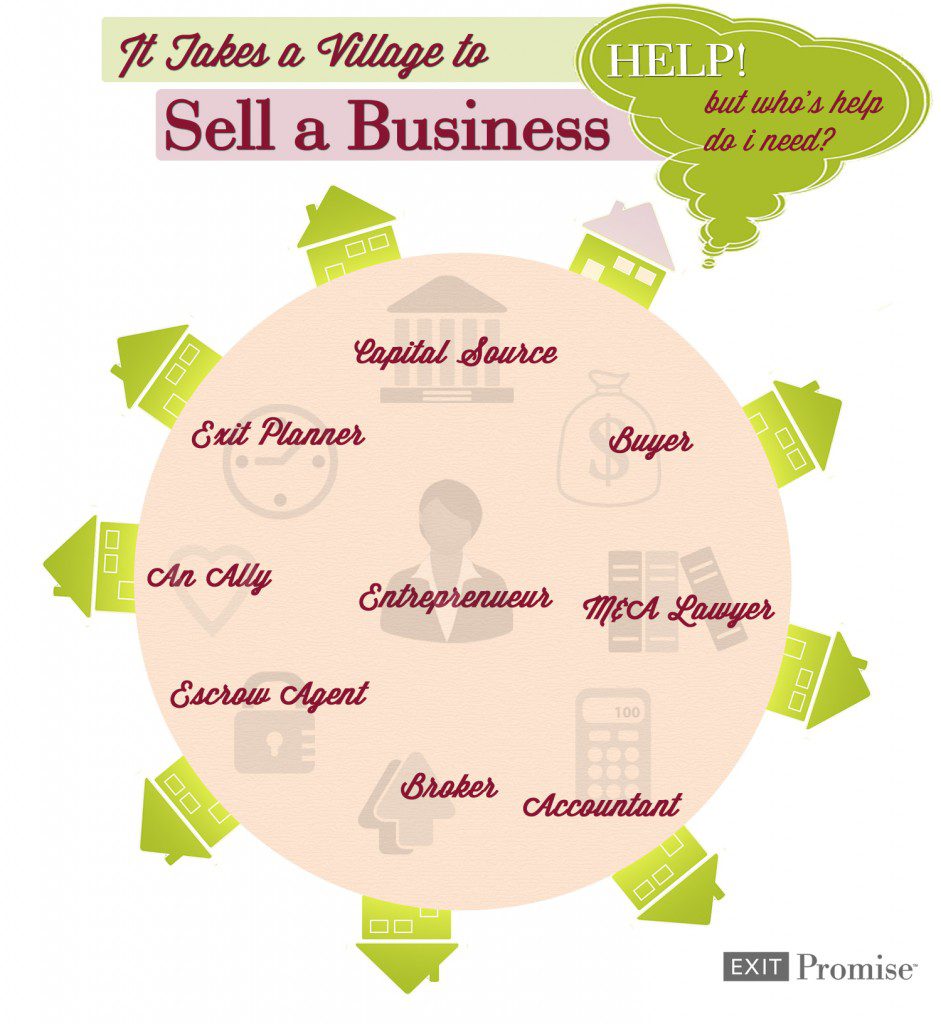

Selling a business involves many different parties, all of whom have a special role and a unique skillset. Most importantly, they must all work together. Those entrepreneurs who succeed recognize ‘it takes a village to sell a business’.

So who is involved when you’re looking to sell?

Help Selling a Business

1. Exit Planner

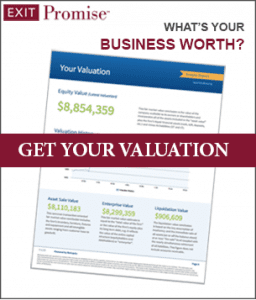

The exit planning professional offers unbiased advice intended to educate and guide the entrepreneur as they consider options to transfer their business to another party. Ideally, an Exit Planner should be well-versed in the tax, legal, financial, and estate planning issues related to mergers and acquisitions.

Exit Planners also should be able to advise an entrepreneur about how potential buyers or successors will view and value the business in its present condition as well as how to improve its value. A good Exit Planner will explore all options available to transfer a business, including but not limited to ESOPs, Key Management Buyout, and Private Equity.

The ideal time to hire an Exit Planner is two-to-ten years before the entrepreneur’s intended exit. The earlier one is engaged, the more likely the entrepreneur will fall into the 10% of businesses that sell successfully.

2. M&A Intermediary or Business Broker

Depending on the gross revenue of the business , either a Mergers and Acquisition Intermediary or a Business Broker will be needed to market the business to the various parties. Usually Middle Market businesses with gross revenues of $5 Million per year and over are usually represented by M & A Intermediaries. Smaller businesses with gross revenues under $5 Million per year are usually represented by Business Brokers. Of course, there are exceptions. Often M&A / Middle Market deals can be regarded as those with a purchase price in excess of $1 Million and Business Broker / Small Business deals are regarded as those with a purchase price under $1 Million. Either way, it’s important that the Seller find a representative who is familiar with the business, its industry, and the market for potential buyers.

3. Business Buyer

Although most entrepreneurs initially think they will sell their business to an outside party such as a competitor or investor, in many cases other types of buyers present viable options. Such other buyers include: key employees or management team, employees through an ESOP, Private Equity Groups, vendors, and family members. Regardless every buyer has its unique set of challenges when attempting to negotiate, finance, and close a deal.

4. M&A Attorney

Of course hiring an Attorney who understands the numerous potential pitfalls when selling a business is critical to the Entrepreneur. And not all Attorneys are equal. Just as one would seek a medical doctor who specializes in orthopedics if you have a problem with your knee, the entrepreneur should seek an Attorney who specializes in corporate/business transactions if they want to sell their business. If not sooner, an M&A Attorney should be consulted as soon as a Buyer presents a Letter of Intent to a seller.

5. Accountant

Similar to the M&A Attorney, an Accountant or CPA should be selected carefully and consulted when a Letter of Intent is received. Many terms defined in the Letter of Intent have tax implications to both the seller and the buyer. If proper tax counsel is sought, the net cash received by the entrepreneur after the sale can be positively impacted.

It is common to find M&A Attorneys and CPA’s who have worked together on multiple deals. Accordingly, they are a good source of referrals to one another.

6. Escrow Agent

Almost every Buyer sets forth a provision in a Stock or Asset Purchase Agreement where some of the purchase price is set aside in an escrow account until certain terms or conditions have been met by the Seller following the closing of the transaction. Conditions related to the proper and final transfer of Intellectual Property rights, entity closure, collection of Accounts Receivable, and many other post-closing matters may be tied to the release of the escrowed funds to the Seller. Hiring an independent escrow agent who will follow the mutually agreed upon terms and conditions of the escrow agreement is just as important to the Seller as it is to the Buyer.

7. Capital Source or Banker

Although it is not the seller’s responsibility to source the capital to purchase the business, the seller should be aware that the buyer’s capital source can have a large impact on the sale transaction. Capital sources are known for conducting their own due diligence on the business and on the purchase agreement. This can slow down the process and in some cases cause the sale to not close. Additionally, the buyer’s lender or other source of business capital may place conditions on the seller via the stock or asset purchase agreement which may be unfavorable to the seller. Careful review of all terms in the purchase agreements by the seller’s M&A Attorney and CPA is absolutely necessary.

8. A Good Friend

Ask any entrepreneur who has sold their business successfully and they will tell you there was always ‘someone’ that stuck by them through the lengthy and tumultuous process. That person may be a key employee, an advisor, a spouse, or simply a good friend. Regardless, and without fail, they will recall that “I couldn’t have done it without them”.

by Holly Magister, CPA | Sell a Business |

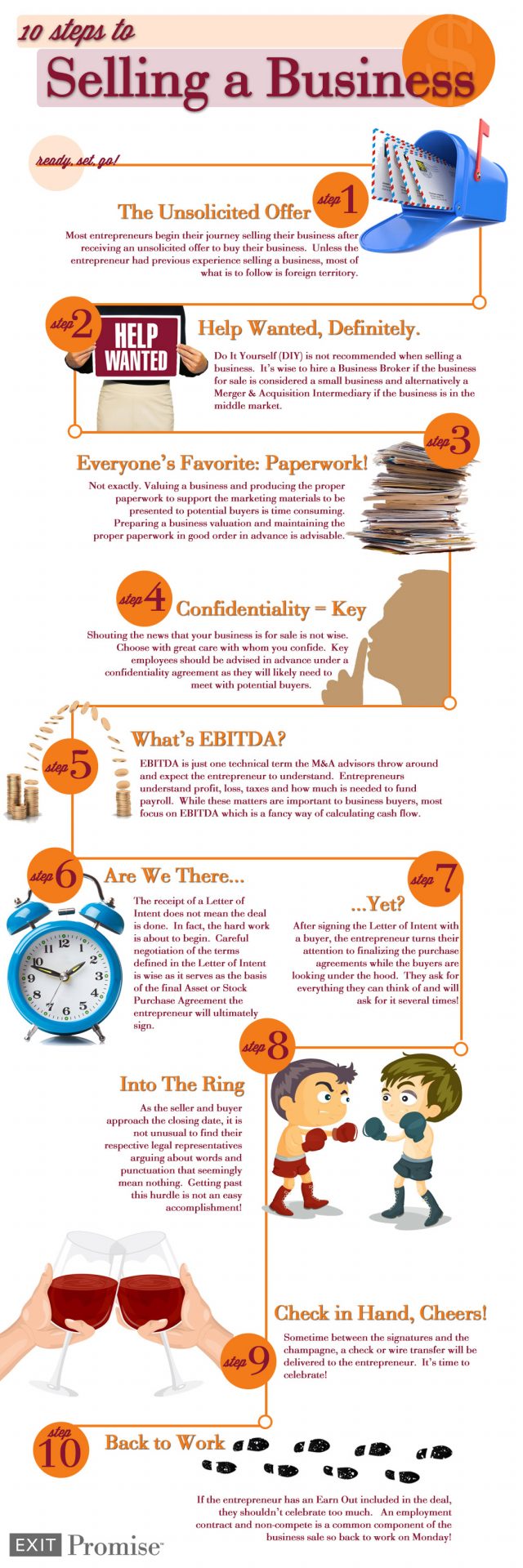

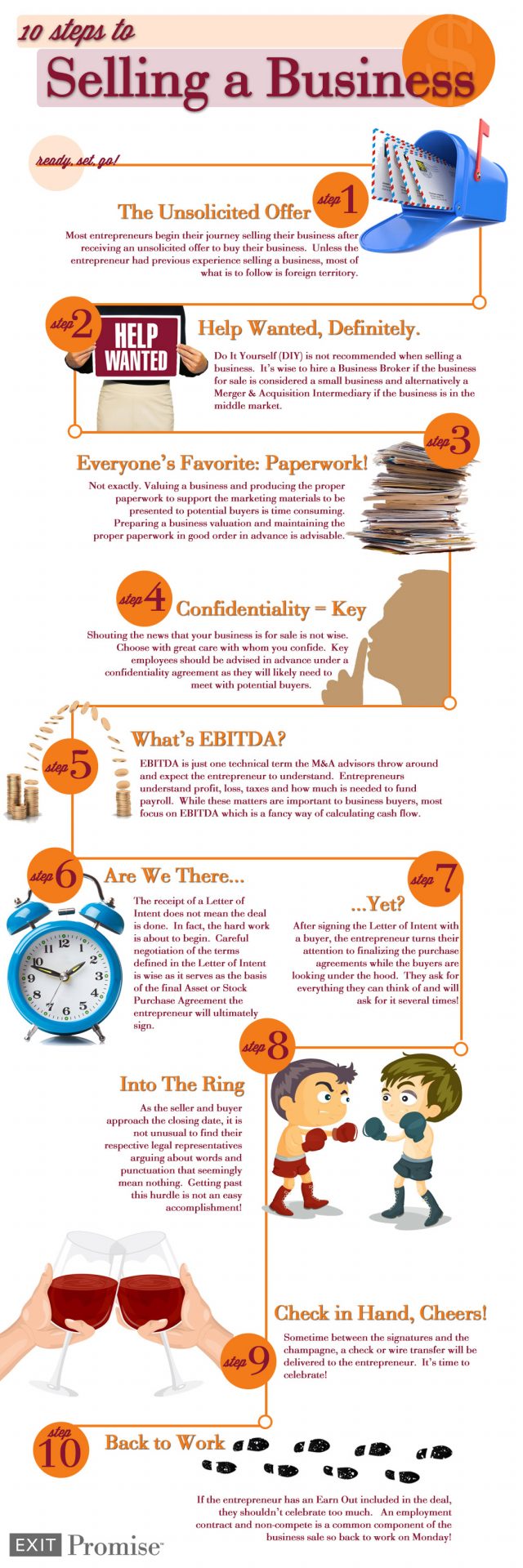

Selling a business often is a tumultuous, emotionally-draining experience for a business owner. Unless you’ve sold a business previously, the journey feels awkward and is marked with multiple high and low points.

To guide business owners, especially the first-time seller, we’ve created the 10 Steps to Selling a Business Infographic.

(Click on the image to view larger size. For more details, scroll down!)

1. An Unsolicited Offer to Buy your Business Arrives

Less than 10% of all business owners plan for the sale of their business and their eventual exit. Because this is so, most owners begin the journey selling their business after receiving an unsolicited offer to purchase. When they receive such an offer, they often scramble to learn what they should do.

In many cases, this first solicitation is not a good offer and often it’s from a competitor attempting to learn more about the competition. Without proper exit planning in place, a business owner should proceed with great caution. Unless they have previous experience selling a business, most of what follows is foreign territory.

2. Help, I need an M&A Advisor

Do It Yourself (DIY) is not recommended when selling a business. It’s wise to hire a Business Broker if the business for sale is considered to be a small business. Alternatively a Merger & Acquisition Intermediary is a good choice if the business is in the middle market.

Unfortunately, many business owners consider themselves a ‘jack of all trades’ and believe they can handle the sale of their business just as they have handled many other important matters in their business successfully. The problem with this thinking is that selling a business is unlike anything else the business owner has attempted in the past. One wrong move can be fatal.

3. What’s EBITDA? We generate profit!

EBITDA is just one technical term the buyers and M&A advisors throw around and expect the entrepreneur to understand. Business owners understand profit, loss, taxes, and how much is needed to fund payroll.

While the traditional financial terms and practical matters are important to business buyers, most buyers focus on EBITDA which is a fancy way of calculating the annual cash flow generated from the business.

4. Who May I Trust to Know I am Selling a Business?

Shouting the news that your business is for sale is not wise. Choose with great care with whom you confide. Key employees should be advised in advance under a confidentiality agreement as they will likely need to meet with potential buyers.

Never share with your suppliers or customers your plans to sell your business until the buyer has made an offer you have accepted and disclosure becomes necessary in the Due Diligence stage.

5. The Painful Paperwork is Worse than Tax Season!

Valuing a business and producing the proper paperwork to support the marketing materials to be presented to potential buyers is time consuming.

Preparing a business valuation and maintaining the proper legal documentation related to your customers, employees, vendors, landlord and all other significant parties well in advance is advisable. These are just a few of the important steps taken when an exit plan is created.

6. We have our LOI… Is it Over Yet?

The receipt of a Letter of Intent does not mean the deal is done. In fact, the hard work is about to begin. Careful negotiation of the terms defined in the Letter of Intent is wise as it serves as the basis of the final Asset or Stock Purchase Agreement.

Although the Letter of Intent is typically not binding to the buyer and seller, not negotiating in good faith after a LOI has been signed is a recipe for trouble. This is another step in the process where your advisors, especially your Attorney, play a vital part in the outcome.

7. Due Diligence. Are We There Yet?

After signing a Letter of Intent with a buyer, the business owners turn their attention to finalizing the purchase agreements while the buyers are looking under the hood. Buyers ask for everything they can think of during Due Diligence and will (likely) ask for it several times!

Often a secure data room is set up where all of the pertinent closing documents are drafted and reviewed by all parties. The documents sent to the data room by the seller and attached to the final purchase agreements are very important. A skilled and cautious advisor will scour these documents for accuracy before they are submitted for review and inclusion in the data room.

8. The Attorneys are Fighting Like My Kids

As the seller and buyer approach the closing date, it is not unusual to find their respective legal representatives arguing about words and punctuation that seemingly mean nothing. The details in the Stock Purchase Agreement or Asset Purchase Agreement are very important. Getting past this hurdle is not an easy accomplishment!

9. Signatures and Champagne

Sometime between the signatures and the champagne, a check or wire transfer will be delivered to the business owner. It’s time to celebrate!

10. No, Just a Long Weekend. I Have an Earn out

If the business owner has an Earn Out included in the deal, they shouldn’t celebrate too much. Since the pandemic decimated many company’s EBITDA, Earn Outs have become commonplace in deals.

An employment contract and non-compete are also very common components of the business sale, so it’s back to work on Monday!

by Holly Magister, CPA | Sell a Business |

This is the third part of a three part series telling how one entrepreneur took a chance on an emerging market, weathered an economic storm, and exited a business with a bright future.

This is the third part of a three part series telling how one entrepreneur took a chance on an emerging market, weathered an economic storm, and exited a business with a bright future.

‘Nothing I Would Have Done Differently’

It was 2010 and for Richard Hagerty, a Pittsburgh-based entrepreneur and CEO of the search-marketing agency IMPAQT, the time had come.

After starting IMPAQT in 1999, Hagerty had seen the company master its market, experience periods of rapid growth, and successfully weather tough economic times.

Hagerty had been informed that the nation’s largest customer relationship marketing agency Merkle was looking to acquire a search marketing firm, so he decided to reach out. Shortly thereafter he met with the company’s officials at their headquarters in Maryland. The seeds to what became a healthy business relationship had been sown.

He had received acquisition interest before. Back in 2007 and right before the economy took a turn for the worse, he entertained some thoughts about getting out but never took them too seriously. There were even some lowball offers thrown around during the recession from outside companies figuring it would be a good time to swoop in and acquire IMPAQT on the cheap.

As 2009 and 2010 dragged on and the economy slowly turned the corner, more interest started coming in and this time Hagerty was really listening.

One thing became clear to Hagerty after his first meeting with eventual successful bidder: he liked the way Merkle did business. After starting IMPAQT from the ground-up, the last thing he was looking to do was to relinquish rights to the company he worked so hard to create to an organization that wouldn’t uphold his reputation for integrity following his departure.

The two came to an agreement several months after the initial meeting and began a three-month period of due diligence. In February of 2011, Hagerty sold his company for the sum he was looking for with the stipulation that he accept a two-year earn-out.

In detailing the acquisition process, Hagerty commended the work of an experienced Exit Planner, whom he said was right by his side with valuable advice every step of the way. He hired his Exit Planner nearly four years before selling his business which proved to be a smart move. The planner was able to help Hagerty resolve a customer concentration issue and decipher the various deal terms that came his way over those years. Hagerty said that the expertise brought to the table by the exit planner gave him the assurance he needed to move forward with the deal when the time and terms were right. It was time for this entrepreneur to execute his exit plan.

“It was absolutely the best,” Hagerty said of his advisor.

He still remembers the day he signed his company away, or in his words, “the most insane day of my entire business life.”

Hagerty said he was caught off-guard when the final word came through letting him know that the deal had been finalized. He had imagined the closing procedure would be a longer, more drawn-out ordeal.

“I always thought I’d be celebrating it with champagne,” Hagerty joked. “It was just crazy to think that it had happened during a conference call.”

As required by the contract, Hagerty spent the next two years stepping away from the company he built.

What’s next for the career entrepreneur? Well, he’s been spending a lot of time recently traveling on his motorcycle, a longtime passion of his.

But don’t be fooled. By no means does the 66-year old plan on calling this a retirement. Hagerty said he’s currently interested in pursuing his next business venture, whatever it may be, and hopes to not just focus on one thing per se.

“I think that several opportunities are going to come to mind…I sort of look at my future as that,” Hagerty said. “I’d like to be involved in a few things.”

As Hagerty now open-endedly ponders his next move, he knows one thing for sure. He has no regrets.

“It was a long journey, but a successful one,” he said. “There’s really nothing I would have done differently.”

by Holly Magister, CPA | Sell a Business |

Do it yourself (DIY) is all the rage. Everywhere I land online, and even as I shop the retail stores, inside real brick and mortar, I see this big trend. “Build your own backyard paradise, raise your own chickens and bake your own birthday cake”. I get it! And I don’t necessarily disagree. We are all more capable than we give ourselves credit for!

I believe this trend was a necessity for many during and after the great recession. When people were pulling back on spending, they simply found ways to DIY.

Today, I had to stop in my tracks and chuckle a bit though. I ran across an article about the importance of confidentiality when selling a business on Inc.com. As I read the article, I found myself shaking my head back and forth. No, no, this is not a DIY project!

The author warned he always advised business owners that they should work with a business broker and not sell a business yourself, however the majority of the article was dedicated to describing the steps to take to sell ones’ own business.

Don’t Try This at Home

If you have ever endured the process of selling a business with the assistance of professional advisors who specialize in mergers and acquisitions, you will agree with me that this is not something to try at home! You are not whipping up dinner for your friends. If you mess up dinner, you make reservations and get a good chuckle out of it. In fact, if your friends are like mine, they probably won’t let you forget the mess you made. I think we can all agree the long term consequences of such a DIY project are nil. Not so, when you sell your own business!

Business Buyers love to Bypass the Barriers

The harsh reality is this. Even if you work with an advisor such as a business broker or intermediary, business buyers will do their best to circumvent the barriers put in place to protect you. These barriers include confidentiality agreements, withholding proprietary information such as your businesses’ trade secrets and customer lists until it’s the appropriate time, and, equally important, access to you! The advisor you hire plays a vital role in establishing and maintaining your protection.

I agree with the author of the article who states that for a business owner who is representing himself in the sale of his or her business, maintaining confidentiality is critically important. However, this is only one of the many critically important matters that deserve full attention. The list of other critically important matters must be attended to as well. And yes, if you DIY all of those matters you can’t forget will include running your business too!

It reminds me of the quote “a man who represents himself has a fool for a client”.

What do you think? Do you know anyone who has successfully sold his or her own business as a DIY project?

by Holly Magister, CPA | Sell a Business |

This three part series tells how one entrepreneur took a chance on an emerging market, weathered an economic storm, and exited a business with a bright future. Read part one here.

‘Dire Straits’

Success doesn’t come without its obstacles.

Just ask Richard Hagerty, a 40 year business veteran and successful entrepreneur. After seeing years of rapid growth at IMPAQT, the search-marketing agency he created in 1999 at the height of the dot-com boom, things began to get a little rocky around 2008 as the U.S. economy took a nosedive.

What initially seemed like a short-term, manageable downturn quickly spun out of control.

“We lost 46 percent of our business in nine months,” Hagerty said.

With prospects seemingly bleak and news reports of massive layoffs circulating around the country, Hagerty knew he had to take control of the situation at his company and make some tough decisions.

While so many other companies at the time had turned to layoffs to help balance their budgets, Hagerty refused to even consider it. There would be cuts, sure, but no one was going to be let go, he decided.

He chose to be upfront with the company’s 80 or so employees and laid out his strategy.

“I sort of drew a line in the sand,” Hagerty said. “I’m not letting anyone go. We’re going to make this work and here’s what I need you to do.”

First, there were temporary pay cuts across the board, 10 percent for the non-management staff for six months, and 25 percent for managers for nine months. Bonuses, too, were eliminated for roughly a year.

Then came the coffee. Well, not just the coffee. After placing the company’s budget through rigorous scrutiny, Hagerty was able to extract $1.1 million in costs altogether.

“It was sort of dire straits,” he said.

Then it was time to get proactive. Instead of waiting for the recession to pass IMPAQT by, Hagerty got creative and began offering consulting services. While client numbers were low, the extra work proved beneficial, he said.

And like the coffee and the bonuses, clients, too, made their way back to IMPAQT. He recalls a major player in the banking industry as being one of the first to come aboard following the recession and believes that had he laid off workers, there’s a good possibility the new business would never have come IMPAQT’s way.

Throughout the economic storm and admittedly for Hagerty, “very, very tough times,” only one employee out of the nearly 80 on staff left the company. And it was by the employee’s choice. Today, he considers this one of his greatest accomplishments.

“We kept everybody and when you look back on it, I think it was the right decision,” Hagerty said.

Now just before the recession began, Hagerty said he began to think about his eventual exit from IMPAQT. He had courted some mild interest but hadn’t started to seriously consider his strategy.

But after a successfully weathering the economic storm, combined with the ensuing peace of mind that IMPAQT wasn’t going away anytime soon, Hagerty decided to get serious about his options.

by Holly Magister, CPA | Sell a Business |

This three part series tells how one entrepreneur took a chance on an emerging market opportunity, weathered an economic storm, and exited with a bright future.

“Right Place at the Right Time”

It almost seems like cliché advice a commencement speaker would offer to a group of graduates.

Keep your ear to the ground, work hard and always be on the lookout for the next big thing. And when that next big thing does indeed come, don’t be afraid to take a chance on it.

Fortunately for Richard Hagerty, a Pittsburgh-based entrepreneur with over 40 years of business experience, he never stopped searching for it.

It was the late 1990’s and search engines were hot. A small company by the name of Google had just launched and the prospects of entering into that market seemed interesting.

Hagerty at the time was heading 3W Interactive, a data-driven analytical firm which he had intended initially to provide political campaign management services. Looking back on it now he admits the company “was a little ahead of its time” given how the public’s interest in politics has grown.

“It would’ve been really good now,” he figures.

Not finding the kind of growth he was looking for with 3W Interactive, Hagerty remained on the prowl for a new venture and began hearing some rumbles about search marketing. He analyzed the market and saw an emerging opportunity to enter it.

As the number of search engines grew and more people began to use them regularly, Hagerty applied his background in data and analysis to come up with a way to measure the success of search optimization. Enter the “search position score,” a weighted value that allows companies to monitor and track their visibility and click rates across multiple platforms.

It was new. It was bold. It was 1999 and IMPAQT, the company Hagerty would go on to run for roughly next 13 years, was born.

And just as a reference point, Google wasn’t even the most prominent search engine at the time in a market that included at least a dozen viable competitors. Does anyone remember AlltheWeb?

Talk about ahead of its time.

It didn’t take long for IMPAQT to begin attracting big-name clients. Within the first few years, some of the biggest players in the insurance and pharmaceuticals fields had signed up for IMPAQT’s services.

“We and a few competitors really owned the Fortune 500 (and) Fortune 1,000,” Hagerty said. “There were a lot of people doing search, but they just weren’t able to play in that space.”

By 2003, Hagerty estimates, the winners and losers of the early Internet-era rush were beginning to show their hands. One year later, Forrester Research would go on to name IMPAQT a leader in its field, an honor it would bestow upon the company three more times.

“It was such a shot to the business,” Hagerty recalls.

A little targeted name branding didn’t hurt either. Years before the idea of IMPAQT ever materialized, Hagerty purchased the rights to the name, honing in on the “Q” as he figured it could play off of the word ‘query’. Someday down the road, he imagined a company name like that could come in handy.

He had nailed it.

During a meeting with a PR firm shortly after the company’s launch, Hagerty said everyone kept talking about how it had a real shot to “make an impact on the industry.”

It was an instant hit, he said. From there on, the company played up the “Q” as much as it could and really let the name help drive the brand.

“It ended up to be a great name,” Hagerty said.

Things were on the upswing for the innovative organization. IMPAQT was sporting a full house while many other competitors were having their bluffs called and eventually folded.

“We were in the right place at the right time,” Hagerty said.

Part two…

by Leilani Costa | Sell a Business |

During the initial negotiations of a  business sale, one of the primary issues is whether to structure the sale as an asset sale or a stock sale. Typically the seller and the buyer have opposing preferences in this regard. The seller generally prefers a stock sale; while the buyer generally prefers an asset sale.

business sale, one of the primary issues is whether to structure the sale as an asset sale or a stock sale. Typically the seller and the buyer have opposing preferences in this regard. The seller generally prefers a stock sale; while the buyer generally prefers an asset sale.

Asset Sale vs Stock Sale

An asset sale involves the sale of individual assets and liabilities, while a stock sale involves the sale of the owner’s/owners’ shares in the business. This article highlights some of the considerations and preferences in choosing an asset sale versus a stock sale. However, every business transaction is unique. Sellers and buyers should always consult with their professional advisers, such as their attorneys and accountants, prior to deciding upon the structure of the sale.

Considerations and Preferences in Choosing an Asset Sale

- The buyer generally prefers an asset sale.

- The transaction documents are typically more complex.

- The seller often has less favorable tax treatment.

- Contracts, permits and licenses often can be transferred only after obtaining third-party consents.

- Majority, rather than unanimous, shareholder approval is typically needed.

- The buyer is often able to limit its liability to those liabilities that the buyer agrees to assume (however, there are significant exceptions, such as environmental and ERISA).

- The buyer and the seller need to consider the impact of C-corporations versus S-corporations.

- The purchase price needs to be allocated among the assets.

Considerations and Preferences in Choosing a Stock Sale

- The seller usually prefers a stock sale.

- The transaction documents are typically simpler and fewer.

- The seller often receives favorable tax treatment.

- Contracts, permits and licenses often can be transferred without third-party consents.

- All shareholders must be willing, or there must be a mechanism to require all shareholders, to sell their shares in order for the buyer to acquire the entire business.

- The buyer is subject to all of the seller’s liabilities, except to the extent that the seller indemnifies the buyer.

- The buyer typically assumes the seller’s basis for the assets, unless the buyer files an election to step up the basis in the assets.

- The buyer may not be able to use tax loss carry-forwards, subject to limitations.

- The buyer often assumes more risk because of unknown or undisclosed liabilities.

This document is intended to provide information of general interest and is not intended to offer any legal advice about specific situations or problems. Neither the author nor Metz Lewis Brodman Must O’Keefe LLC intend to create an attorney-client relationship by offering this information, and anyone’s review of the information shall not be deemed to create such a relationship. You should consult a lawyer if you have a legal matter requiring attention.

by Paul Cronin | Sell a Business |

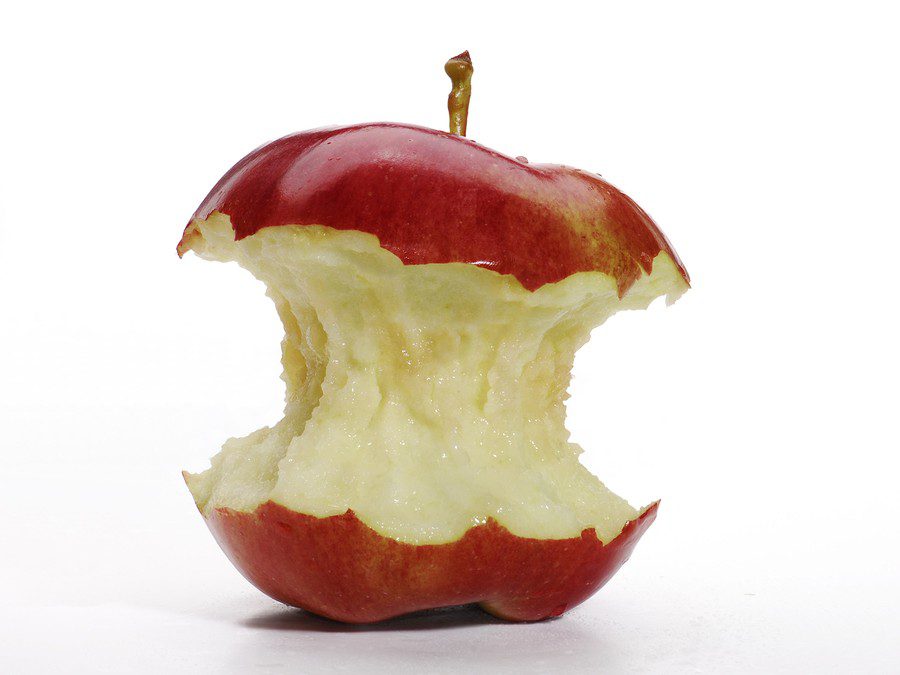

This is a story with an unhappy ending about when is a good time to sell a business. I heard this story from employees who worked for a company many years ago. I knew the company well and as far as I know, this is the truth.

for a company many years ago. I knew the company well and as far as I know, this is the truth.

The owner (Jerry) had all the right credentials: undergraduate and law degrees from prestigious colleges, and a big ego. He had bought a small company with his brother and built it into a multi-million dollar company over many years. We’ll call it Smithco. The brothers built a company with a sterling reputation and many prestigious customers. Twenty years go by and they wanted to take some money off the table. A giant international player wanted to add Smithco to their portfolio to “create synergy” with similar type products of another subsidiary. One brother would leave to head up the leading industry trade association; Jerry got a 5 year contract as CEO of the business, now a wholly owned subsidiary.

It started out great. The parent firm brought in resources to build up IT systems, staff, marketing and more. Business blossomed. People were happy. Five years went by. Then, the CEO of the parent felt that they needed to sell off non-core business lines. The synergy wasn’t adding value. Smithco was in play. Other industry players wanted Smithco’s brand and key customer relationships. Jerry was not about to see “his” company be absorbed by an “inferior competitor”, so he made a bid to buy the company back from the parent. Being secretive by nature, Jerry sought to keep most management out of the loop. People were unhappy when they found out. Some left, but not enough to hurt the business. Jerry was successful in buying back his company and now owned a bigger business than the one he had sold earlier. He had an office with a spectacular view of a world class skyline. He offered all three of his kids a stake in the business, but only one joined the company. Life was good.

Now is his late sixties, Jerry pondered what to do next. The internet was just starting to explode and he saw young inexperienced companies making a killing. Then, he was approached by a Private Equity group (PEG). Jerry was told that he could sell for many, many millions, if he could show the PEG a path to do so. Jerry doubled down and went after products that were riskier. It started to pay off. Sales exploded, Jerry made many more millions. People were very happy. But Jerry miscalculated. The market for the new products collapsed. Sales nosedived, profits disappeared. The PEG went away. There were $millions in dead inventory. His son was not up to the task of turning things around, neither of the other kids had interest either. Even a key executive turned down the CEO role. Top talent left. More desperate efforts failed to make a difference. Jerry spent hours staring out the window at that skyline. His assistant would prod him, “You have to make a decision, what are you waiting for?” He would just sigh. Months went by.

Then he made a plan, it would save himself, but ruin almost everyone else. Jerry didn’t care anymore. He wanted out, and to keep his millions. He would not save the business with his personal wealth. What happened? A once “inferior competitor” bought key assets, then the weak assets (and all debts) were spun into a separate company that went Chapter 11. Ninety-five percent of the employees were laid off, many without notice or severance (the buyer offered Jerry money to give everyone a few weeks’ severance – Jerry said he wanted that cash for himself). Many employees showed up for work one day and found the doors locked with a note saying “out of business” and to contact the company attorney for further instructions. Creditors sued. Suppliers went bankrupt. Employees had to get in line for money owed to them. His brother was forced to resign from the industry association. Jerry was persona non grata in the industry. He didn’t care. He even landed an adjunct professorship at an MBA program, where he cast himself as a success story. Pathological, don’t you think?

The competitor that bought the assets was in turn bought by a larger firm and promptly ran the brand into the ground. In a few short years, a once great company and brand simply ceased to exist.

So what is the lesson? I guess if you’re greedy by nature, then you’ll agree Jerry did just fine, and probably sold too late. But if you are like me, you shake your head and wonder how Jerry lives with himself and his delusions of grandeur. His former friends and colleagues want nothing to do with him. What is the price you can put on that? Sometimes you simply have to know when “enough is enough”. And that taking an extra bite of the apple just isn’t worth it. What do you think?

by Holly Magister, CPA | Sell a Business |

Last week was one of those weeks I will never forget.

Over the course of a few days, we closed a business acquisition and celebrated with another client his retirement afterforty plus years of entrepreneurship. These back-to-back events served to prove the truth that in life one will get what one gives. No matter how long it takes, how you treat others will catch up to you. Good or bad. And last week, I saw firsthand the consequences of how two entrepreneurs lived their lives from both ends of the spectrum.

Special Assets Departments vs. The Entrepreneur

In the past, I’ve shared stories about Special Assets Department bankers who work with entrepreneurs in financial trouble. Employees who work in this department, often referred to as the bank’s work out group, make entrepreneur’s lives difficult. And I am being kind. Last week was no different.

As we sat at the closing table, my client was prepared to purchase a business and payoff its line of credit in full. This is music to the ears of a workout group bank officer. Or so you would think. Unfortunately, the owner of the target business had a bad habit of not returning telephone calls from the workout group banker , and it came back to haunt him. You see, when it came time to wire the buyer’s money to pay off the business line of credit, the workout group banker went radio silent. For four hours we were unable to make contact with the banker to obtain acknowledgement of the wire transfer and finalize the deal. It seemed the banker decided it would be a good time to delay returning the seller’s phone call.

Businesses do not change hands until the transaction attorneys on both sides bless the transfer. And without the banker’s confirmation, there was no deal. You get what you give.

Another Entrepreneur’s Retirement Party

The next day, I attended a retirement party for another entrepreneur who completed his two year employment and earn out agreement. This was quite a different scene. As I parked my car, I began to choke up. I wasn’t expecting that. I was truly looking forward to attending a party and had no intentions of crying!

During the retirement party, the company’s key employees recounted this man’s entrepreneurial journey as if they were roasting a rock star. It was absolutely hysterical. More than one hundred attendees were listening and laughing to the point of tears. And then I realized it. I wasn’t the only one in the room who appreciated how this entrepreneur treated others and this time it wasn’t tears of laughter I was fighting back.

One employee after another shared their stories about how this entrepreneur always did the right thing. He put their welfare in front of his own again and again for forty years. Was it always pretty? No. And that’s what makes it so beautiful. This entrepreneur was totally transparent. He made mistakes, owned up to them and could laugh about it. But above it all, he kept his promises. Reverence for this entrepreneur was immeasurable. You get what you give.

As I reflect on the events of last week, it became apparent to me how these two entrepreneurs ended their entrepreneurial journeys exactly the way they lead their lives.

by Michael Silverman | Sell a Business |

The many years of hard work and long days at the office may be about to pay off—you have just

received an offer from a potential buyer to acquire your business. Just as you developed and followed a detailed business plan to build your business, now you need to develop a well-thought out plan covering the sale of your business, paying proper attention to the due diligence process.

There are many traps for an unwary seller in connection with a buyer’s due diligence investigation of a seller’s business. In this context it is critical that the seller’s professional advisors carry out due diligence on the seller’s business before the buyer conducts that same exercise. In this regard, the seller’s lawyers and accountants will need to do the following:

- Carefully review all documentation, reports, financial statements, tax returns, corporate records (including shareholder minute books, stock ledgers, organizational documents, and shareholder agreements), and material records and agreements for the business (collectively, the “Material Business Documentation”) to (i) identify and correct any issues or problems relating to the seller’s business and (ii) ensure that the seller will not be providing to the buyer certain confidential information that should only be provided when it is more clear that the transaction is very likely to be completed;

- Cause all of the Material Business Documentation to be assembled in a data room where they will be reviewed by the buyer;

- Engage a third party to provide a valuation of the business;

- Assemble and prepare a team of key managers of the business who will be responsible for meeting with the buyer and its representatives for purposes of addressing the many issues, questions, and requests they will have; and

- Assist the seller with each step during the process of completing the transaction, including the preparation and execution of a confidentiality agreement, a letter of intent, employment agreements and a purchase agreement.

While due diligence is often associated with a potential buyer’s analysis of the corporate records and material agreements of the business it is seeking to acquire (commonly known as the “target company”), due diligence is not a one-sided process. It is very important that a seller and its professional advisors invest a great deal of time analyzing all facets of the seller’s business before a potential buyer conducts its due diligence.

Problems that arise in the buyer’s due diligence investigation can affect the timing and the amount of the purchase price to be paid to the seller, and even the viability of the transaction itself. A careful review of the seller’s Material Business Documentation will enable the seller’s professional advisors to identify and resolve any problems that may exist before the buyer uncovers those problems during its own due diligence review. By conducting internal due diligence, the target company will be able to develop a complete picture of its business and resolve any problems that may exist and thereby minimize the length, risks and costs associated with the buyer’s due diligence review of the target company.

The buyer’s formal due diligence process generally begins after the parties have signed both a letter of intent (which describes the structure and material terms of a potential transaction) and a confidentiality agreement (which requires each party to keep confidential any information obtained from the other party in regard to the potential transaction), and it often continues until the transaction has been completed.

Many think of due diligence as a process where a team of lawyers very closely scrutinize all of the Material Business Documentation. However, legal due diligence is only one piece of the overall due diligence process.

In addition to engaging a law firm, typically the buyer will seek the assistance of accountants, financial advisors and environmental consultants. As the due diligence investigation can be a very time consuming, risky and expensive process for the target company, it is critical that the letter of intent place restrictions on the scope and duration of the buyer’s due diligence investigation.

While the parties negotiate the terms of a purchase agreement, the target company will be providing a large volume of documentation to the potential buyer and its professional advisors so that they may fully assess the state of the target company’s business.

The buyer typically gets access to these documents by conducting an on-site review in a physical data room that the buyer has set up in an office, or by reviewing electronic copies of the documents that the buyer has set up in a virtual data room that is accessible by computer. The type of data room used for the due diligence process generally will depend on the amount of documentation that needs to be reviewed, the amount of time available to conduct the due diligence review and the amount of money the parties are willing to spend on the transaction.

In the early stages of a potential transaction, the target company should assemble a team of managers who are the most knowledgeable about the inner workings of the company’s business. These individuals will work with the company’s professional advisors, as well as the buyer and its professional advisors, in responding to questions and document requests concerning the target company. The target company’s legal team will field and review due diligence requests and determine whether and when the company should provide certain information to the buyer and its counsel.  Before the target company provides any documents to the buyer, the company should provide the documents to its legal team so they can review their terms and take inventory of all the documents being delivered to the buyer.

Before the target company provides any documents to the buyer, the company should provide the documents to its legal team so they can review their terms and take inventory of all the documents being delivered to the buyer.

The target company’s legal team will prepare a due diligence checklist, which categorizes and summarizes of all of the Material Business Documentation that the target company has provided to the buyer. This checklist will assist the target company’s key managers and employees in determining whether the company has fully disclosed its Material Business Documentation to the buyer. The due diligence checklist will also assist the target company and its legal counsel in preparing disclosure schedules to the purchase agreement where the target company identifies certain information and documentation that was not provided to the buyer in the due diligence process.

The process of selling a company may seem daunting for an entrepreneur who has invested so many years focused solely on the growth of the company. Entrepreneurs often get so caught up in the business aspects of their companies that they forget about the regulatory and legal aspects of their businesses. As such, once you begin to give consideration to selling your business it is very important to engage a legal team to carefully evaluate and organize your Material Business Documentation and guide your company through the whirlwind known as due diligence.

by Holly Magister, CPA | Sell a Business |

If I have said under my breath once, I have done so at least one hundred times… “The devil is in the details!” As we  work with business owners and deal makers on the hunt for profitable businesses to acquire, this expression has become our theme song!

work with business owners and deal makers on the hunt for profitable businesses to acquire, this expression has become our theme song!

Recently, we have been working closely with one of our clients while they sorted out the details from documents dating back several decades to the language drafted into a Letter of Intent negotiated about six months ago. And every word, literally—every word in between, has been scrutinized.

Hard work? Yes. Exhausting? Of course. Rewarding? Absolutely! So, with several thousand pages of documentation, where are the details that matter?

A little background regarding how we got here…

This week we found ourselves at the very end of a transaction that started nearly one year ago. Yes, in early 2010, the economy was not in good shape and this company in particular was not doing as well as they had in the past. So, the deal when presented last year looked pretty good to all.

The purchase price multiple was lower than the business owner wanted, however the acquiring company had a strong balance sheet with Venture Capital behind it. They were paying most of the offer price in cash and the balance in the form of a reasonable earn-out payment.

The details in this deal—specifically, the way in which the earn-out payment was calculated seemed reasonable at the time the transaction was negotiated. Reasonable for both the Seller and Buyer of the business. However, neither the business owner nor buyer expected the company to actually exceed the revenue targets by a factor of two. In this case, the revenue target directly impacts the calculation of the earn-out payment. And that is exactly what happened!

In the final hours….

As we sat across the table with the Buyer’s Venture Capital analyst in my conference room, he asked question after question while he simultaneously replied to emails on his laptop. We answered the questions and wondered when the buyer and his financial team would realize that the financial projections provided to them last year were understated.

Really understated…

The actual current years’ financial results presented to the buyer in the final days of the deal were much better than everyone expected. This meant that the full earn-out payments would be paid for the upcoming calendar year, barring a disaster. And because the business owner recently signed a very large, multiple-year contract with a new customer, it also meant that new contract would produce a very nice earn-out payment for the seller as well.

This is where I found myself reminded that “the devil is in the details.” The terms negotiated into the Letter of Intent to sell a business stated that if the financial performance of the company suffered materially before the acquisition closing, they would be able to renegotiate the purchase price. This is not an unusual Letter of Intent term. However, we negotiated into the LOI terms that provided the opposite protection as well. Essentially, this meant if the company’s financial performance improved materially before closing, the seller would likewise be able to renegotiate the purchase price.

And so we did. Truly, the details matter.

by Andrew Jones | Sell a Business |

Business Risk Premium Factors

Business Risk Premium Factors

One of the most crucial, yet subjective, aspects of any business valuation is determining the specific company risk premium of the business being appraised. The specific company risk premium varies with each company and is intended to be an adjustment to reflect a variety of circumstances inherent in the company and its industry.

For a business valuation analyst engaged in determining an appropriate specific company risk premium, the following factors should be considered (at a minimum) when considering an exit strategy:

- Economic and Industry Conditions – National, regional, and local economic conditions can have a dramatic impact on a company. In addition, the industry in which the company operates may have more or less risk than the average of other companies.

- Financial Benchmarking – A financial benchmark compares the company’s financial performance against companies of similar size within its respective industry. A comprehensive financial analysis addresses the strengths and weaknesses of the company in terms of size, growth, liquidity, profitability, asset management, and leverage.

- Management Team – A company that is highly dependent upon the knowledge and expertise of a single person is considerably more risky than a company that has several key managers. In addition, the relationships between members of the management team can have a dramatic impact on risk.

- Competition – The level of competition in the company’s market can have a dramatic impact on risk. Does the company operate in a competitive market? What are the company’s strengths and weaknesses when compared to competition?

- Customer Base – The diversification of the company’s customer base can directly affect risk. How strong is the customer base? Does the Company depend upon only a few customers or a main customer for a majority of its revenue?

- Diversity of Company’s Products/Services – The diversification of the company’s product line or service line can directly affect risk. Are profits highly dependent upon a specific product line or service line?

- Government Regulation – Is the business highly regulated? Are there areas of future government regulations that could significantly impact the company’s operations going forward?

- Supplier

s – Is the company heavily reliant upon a few suppliers that could have an adverse effect if relationships became difficult?

s – Is the company heavily reliant upon a few suppliers that could have an adverse effect if relationships became difficult?

When quantifying the specific company risk premium, it is important for the valuation analyst to consider the above factors and any other business valuation items that are truly unique to the subject company. As a result, the selected specific company risk premium is based on the judgment of the valuation analyst and should reflect the level of risk within the subject company and its industry.

by Holly Magister, CPA | Sell a Business |

It is a unique pleasure to find two equal partners or shareholders acting in harmony over selling a business.  Unfortunately, when I say “unique”, I mean rarely ever. Please understand, it is not as if this never happens. It is just so unusual, that when faced with the situation, I’m simply delighted to not need to resolve the equal partner deadlock!

Unfortunately, when I say “unique”, I mean rarely ever. Please understand, it is not as if this never happens. It is just so unusual, that when faced with the situation, I’m simply delighted to not need to resolve the equal partner deadlock!

Challenges Facing Business Partners Looking to Sell Their Business Typically Falls Into One of These Scenarios:

The Stubborn Mule Business Partner Syndrome

This is where both partners agree it is time to sell the business. One works diligently toward that end. He or she gathers the requested documents, attends all of the meetings, makes time for consultations, etc. With some hard work and a little luck, they receive an offer to buy their business. This is when the other partner shows up and says, “no, that offer won’t do.” In fact, he or she goes on to tell the buyer, or their agent, “that amount of money is not even half of what I will sell this business for.” You see, the stubborn mule partner typically has a different valuation calculation and it usually results in an offering price twice that of any willing buyer.

Co-shareholders Riding the No Rules–So Too Bad Gravy Train

In this scenario, the equal shareholders never put in place any agreement whereby one or the other shareholder could initiate or trigger the purchase or sale of their portion of the business to the other or to a third party. This is a very dangerous situation for the business, the shareholder’s families, as well as the employees. So many things can change over the course of one’s life. Disability, divorce, death, or the sudden onset of “deadbeat” or irresponsible behavior is a real threat to any partnership. Without a written agreement, whereby the specifics are defined to resolve such situations, many unforeseen situations could expose all parties related to a business enterprise to danger.

In this scenario, one of the two partners wishes to sell their share of the business to the other partner or wishes to acquire their partner’s share of the business and hold 100% ownership. Given the fact that prior to this point in time the two partners had not negotiated the terms of such a sale or acquisition, they suddenly find themselves at odds. How do the partners now fairly negotiate a valuation formula when they each may have a differing opinion of the financial facts to be used in the formula?

Typically, it is in the best interest of one of the partners to acquire the other’s share of the company. And at the same time, the other partner wants to hang on as long as possible. The partner wants to stay on the gravy train, and because no prior rules have been established, this partner simply does not respond to any sale/acquisition conversations. They adopt the “no rules–so too bad” strategy. They hang on and make everyone miserable.

The Till Death Do Us Part Reality of Equal Business Partners

If you’ve ever been married, you know what having a 50-50 relationship is like. I often joke with would-be entrepreneurs who tell me they want to start a business with their best friend. I ask them: “Would you marry this best friend?” If not, then please reconsider. It’s really not a joke at all. It is a valid question for anyone considering taking on a 50-50 partner in business.

Just as it is common to find deadlocks between spouses, it is also common to find deadlocks between siblings in family businesses when it comes time to resolve ownership issues. Often these partners and family business members have worked side-by-side for decades. And in many cases, these relationships are relatively good relationships. Relatively good that is until it is time to sell the business.

In this scenario, the terms of the agreement to sell to a third party are never agreed upon in advance. Negotiations between the partners linger on for months, years, even decades. In reality, these partners may actually take their business to their grave…Till Death Do Us Part.

In this scenario, the terms of the agreement to sell to a third party are never agreed upon in advance. Negotiations between the partners linger on for months, years, even decades. In reality, these partners may actually take their business to their grave…Till Death Do Us Part.

Creating a Cross Purchase Agreement with your Business Partner

If you are fortunate enough to be in the planning or early start up phases of your business and you have a partner or partners, you have an opportunity to create a workable cross-purchase agreement to avoid these deadlocks later in your entrepreneurial journey. Stop what you are doing and make this a priority!

If on the other hand you are already far along and in the midst of a sale or acquisition attempt with your partner(s), it’s a good idea to create some basic guidelines for conduct before you proceed further. Stay tuned for tips on developing these selling ground rules for multiple owners in my next blog post.

by Andrew Jones | Sell a Business |

When considering your business valuation and business risks in the hopes of selling that business, there are many factors to consider. One important factor to understand is the application of valuation discounts. The valuation of a controlling interest versus a minority interest within a privately held business can have different values, depending on the circumstance. Due to the inherent differences between controlling and minority interests, the value of a minority interest is not equal to its pro rata portion of the whole. This is a direct result of the application of minority interest and lack of marketability discounts.

When considering your business valuation and business risks in the hopes of selling that business, there are many factors to consider. One important factor to understand is the application of valuation discounts. The valuation of a controlling interest versus a minority interest within a privately held business can have different values, depending on the circumstance. Due to the inherent differences between controlling and minority interests, the value of a minority interest is not equal to its pro rata portion of the whole. This is a direct result of the application of minority interest and lack of marketability discounts.

Minority interest discounts reduce value in order to reflect the minority interest’s inability to control the company’s management and policies. When quantifying the minority interest discount, the valuation analyst must consider several factors that include – the voting rights of the minority interest, the level of control and associated benefits of the minority interest, the contractual agreements in place between the owners, and relevant state law.

Lack of marketability discounts reflect the difficulty an investor would have in selling an ownership interest. Typically, investors consider the liquidity of an interest (i.e., how quickly it can be converted into cash at the owner’s discretion). Therefore, the market will pay a premium for liquidity or, conversely, exact a discount for lack of it. Factors affecting a privately held business interest’s marketability include – transfer restrictions, dividend-paying policy, size of the block of stock, and whether the owner possess elements of control.

The application of valuation discounts depends on the level of value indicated by each method used by the valuation analyst. If all methods utilized indicate values at the same level, applicable discounts may be applied at the conclusion of the valuation. However, if the methods utilized indicate values at different levels, then appropriate discounts would be applied separately to each individual method.

However, if the methods utilized indicate values at different levels, then appropriate discounts would be applied separately to each individual method.

It is important that the valuation analyst apply appropriate valuation discounts to adjust the level of value indicated in the valuation method to the level of value being estimated in the valuation assignment. Failure to comply with the proper application of discounts can result in a serious distortion to the estimate of value and result in a meaningless valuation conclusion.

Although the application of appropriate valuation discounts is left at the professional judgment of the valuation analyst, a qualified appraiser can support discounts that will withstand IRS scrutiny and appropriately estimate the interest being appraised.

by Michael Silverman | Sell a Business |

If you have the opportunity to buy or sell a business, negotiating the terms of a letter of intent (an “LOI”) is one of the first and most critical steps in the process of completing the transaction. A well-written letter of intent provides a valuable foundation for a potential transaction as it captures the parties’ intentions with regard to the structure, timing and material terms of the transaction. An LOI often imposes significant obligations on each of the parties, and consequently is typically the product of fairly intense negotiations between the parties.

If you have the opportunity to buy or sell a business, negotiating the terms of a letter of intent (an “LOI”) is one of the first and most critical steps in the process of completing the transaction. A well-written letter of intent provides a valuable foundation for a potential transaction as it captures the parties’ intentions with regard to the structure, timing and material terms of the transaction. An LOI often imposes significant obligations on each of the parties, and consequently is typically the product of fairly intense negotiations between the parties.

Is a Letter of Intent Legally Binding?

An LOI is just one legal document that formalizes the first stage concepts of a negotiation, including, for example, the acquisition or disposal of a business (other documents such as confidentiality agreements are key, too). While an LOI is not itself a legally binding agreement, an LOI typically contains certain provisions that are legally binding on the parties. Letters of intent can be used in negotiations for any type of agreement, but are most often associated with the negotiation of a potential acquisition or disposal of a business. This article focuses on their use in that respect.

During the early stages of negotiating a transaction, the parties will typically enter into an LOI to create a foundation for the deal and develop a time line for negotiating and completing the transaction. In attempting to reduce their thoughts to writing, the parties generally will identify and attempt to resolve early on those issues that may be “deal breakers.” If those issues cannot be resolved at this stage, then the parties can part ways and avoid incurring the significant investments of time and money that go along with negotiating and completing a transaction. An LOI also plays an important role in assisting the buyer to obtain financing for an acquisition as potential lenders can look to the LOI in evaluating the preliminary terms of the deal and the protections that the buyer has obtained.

In General a Letter of Intent Should Define the Following Matters:

- The structure of the deal (i.e. it should indicate whether the buyer will be purchasing the stock or the assets of the target entity);

- The purchase price of the acquisition (which can be expressed as a fixed price or a range) and when and how the purchase price will be paid;

- The conditions and contingencies for closing the transaction (typical contingencies for the buyer’s protection are obtaining financing for the transaction and being satisfied with the results of its due diligence review of the target entity);

- Confidentiality and non-disclosure provisions or a reference to the parties’ separate confidentiality agreement;

- An exclusivity provision that prohibits the target entity and its owners from having discussions or negotiations with any third parties relating to the sale of the target entity’s stock or assets;

- A provision that makes clear that the letter of intent will terminate if the potential transaction is not completed on or before an agreed upon deadline;

- The scope of the seller’s obligation to make indemnification payments to the buyer following the closing date, and the period following the closing date during which the buyer may bring indemnification claims against the seller;

- The responsibility of the parties for the expenses they will incur in connection with attempting to negotiate and complete the potential transaction; and

- A provision stating which, if any, of the terms of the LOI are legally binding on the parties.

A buyer and a seller can obtain many important protections in a well-drafted LOI. However, a letter of intent can be a trap for the unwary as the document imposes an obligation on the parties to negotiate in good faith the terms of the potential transaction, and it may contain certain provisions that are legally binding on the parties. As such, it is very important for the parties to get their legal counsel involved at the outset of the negotiation of an LOI. The attorneys for the parties can counsel their clients regarding the specific terms and protections that need to be included in the LOI and which provisions of the LOI should be legally binding.

What Should a Business Buyer Want in a Letter of Intent?

There are a number of important protections that a buyer should obtain through an LOI. Among other things, a buyer will want an LOI to (i) condition the completion of the transaction on the buyer’s obtaining financing for the deal and being satisfied with the results of its due diligence investigation of the business and (ii) include an exclusivity (or a “no-shop”) provision that prohibits the seller and its owners from having discussions with third parties regarding a sale of the business for a defined period (often between 60-90 days).

The seller also needs to be protected by an LOI. Most importantly, the seller wants to preserve the confidentiality of its business and financial information that it shares with the potential buyer during the negotiations and to ensure that the buyer is not able to solicit the seller’s employees or customers in the event negotiations fall through. Additionally, the seller will want to clearly define in the LOI the material terms of the potential transaction so that it has assurance that those terms will not need to be further negotiated in the future.

By entering into a letter of intent, the buyer and the seller assume a “good faith obligation” to negotiate and complete the transaction that is defined in the LOI. In the event the deal breaks down and the parties turn to litigation to resolve a dispute, courts will analyze the terms of the LOI to determine the extent to which the parties intended to be legally bound by the document. In cases where the parties agree on the essential terms of a transaction and intend for that agreement to be binding, a court will determine that the LOI is indeed an enforceable contract. The most important factor in determining the enforceability of an LOI is the language in the LOI itself. As such, the attorneys for the parties play a critical role in making sure the LOI is only binding on the parties to the extent they intend.

The act of putting words to paper creates an implicit obligation for the buyer and the seller to abide by the terms of the LOI and use good faith efforts to consummate the transaction described in the document. As such, it is very important to draft the LOI in a manner that carries out the parties’ intentions and protects the parties’ respective interests.

by Holly Magister, CPA | Sell a Business |

When you sell a business, typically you will find language in the Stock or Asset Purchase Agreement that defines exactly what the Seller and the Buyer agree to do or guarantee as part of the transaction. In other words, each may agree to make the other party not responsible. The term used to identify this particular form of guarantee is indemnification.

When you sell a business, typically you will find language in the Stock or Asset Purchase Agreement that defines exactly what the Seller and the Buyer agree to do or guarantee as part of the transaction. In other words, each may agree to make the other party not responsible. The term used to identify this particular form of guarantee is indemnification.

To indemnify another party in the sale or purchase of a business means the party being indemnified is not responsible.

Often the language in a Stock or Asset Purchase Agreement related to the indemnification clause in the sale of a business is hotly debated by the buyer’s and seller’s respective legal counsels.

The reason for this elevated attention to the indemnification language has to do with post-closing liabilities. If one party in the transaction indemnifies the other with regard to a specific matter and that matter triggers a financial loss after the acquisition or sale has closed, then the party who indemnified the other may be held financially responsible up to the amount of the loss sustained.

Because the legal and financial ramifications may be extensive, it’s advisable to insist that legal counsel clearly spells out for the seller or buyer the potential risks associated with an indemnification clause in the sale of a business.

by Holly Magister, CPA | Sell a Business |

The “indemnification basket” is one of the most important deal terms found in the Letter of Intent and ultimately in the Purchase Agreement and is often misunderstood by both the buyer and seller of a business.

The “indemnification basket” is one of the most important deal terms found in the Letter of Intent and ultimately in the Purchase Agreement and is often misunderstood by both the buyer and seller of a business.

Buyers want the basket to be as low as possible and Sellers want it to be as high as possible. Baskets may be one of two types: a deductible basket or a tipping basket. Understanding the specific way a basket works, as negotiated and defined in a purchase agreement, will prevent you from leaving money on the table when it’s time to sell your business.

Before we address when the indemnification clause should be negotiated, let’s clarify what exactly the indemnification is and why it’s important to both buyers and sellers.

Indemnification Basket Definition

When you sell a business, typically you will find language in the Stock or Asset Purchase Agreement that defines exactly what the Seller and the Buyer agree to do or guarantee as part of the transaction. In other words, each may agree to make the other party not responsible. The term used to identify this particular form of guarantee is indemnification.

To indemnify another party in the sale or purchase of a business means the party being indemnified is not responsible.

Often the language in a Stock or Asset Purchase Agreement related to the indemnification clause in the sale of a business is hotly debated by the buyer’s and seller’s respective legal counsels.

The reason for this elevated attention to the indemnification language has to do with post-closing liabilities. If one party in the transaction indemnifies the other with regard to a specific matter and that matter triggers a financial loss after the acquisition or sale has closed, then the party who indemnified the other may be held financially responsible up to the amount of the loss sustained.

Because the legal and financial ramifications may be extensive, it’s advisable to insist that legal counsel clearly spells out for the seller or buyer the potential risks associated with an indemnification clause in the sale of a business.

When Should Indemnification Be Negotiated?

If you are the business owner selling your business, this term should be negotiated when the Letter of Intent (LOI) is contemplated. Subsequent to the buyer’s due diligence and as you get close to the finalization of the deal, it becomes much more difficult to keep the basket as a layer of protection, unless it has been negotiated in the LOI.

And if you are the party buying a business, it is a good idea to keep the basket as low as possible and not part of the Letter of Intent (LOI) so you have something to negotiate with later in the acquisition process.

The basket term defined in the purchase agreement addresses materiality with regard to post closing indemnification for the representations and warranties made by the seller. It is intended to reduce risk and can make the task of completing a deal manageable. Just as no two deals are alike, it is true that no two baskets are alike. The basket varies in form (deductible vs. tipping) and size, so it is important to understand and define this term carefully in the purchase agreement.

Deductible vs. Tipping Indemnification Baskets

The basket concept in the sale of a business is similar to the concept of a deductible in an insurance policy. Just as an insurance company defines a deductible in its insurance policy, the basket specified in the purchase agreement of a business defines the dollar amount of post closing claims from the buyer which must be exceeded before the buyer may pursue a refund for the claim from the seller.

Baskets are needed by both parties to establish a threshold for which a buyer may pursue indemnification for a breach in the seller’s representations and warranties made in the purchase agreement.

A buyer may pursue indemnification claims when defined as a deductible basket only when such claims in total exceed the basket (or floor) amount. And only the excess is subject to repayment by the seller.

Alternatively, a buyer may pursue indemnification claims when defined as a tipping basket once claims from the buyer reach the basket amount defined and then repayment by the seller will include the total of all claims.

For example, if claims from the buyer are $400,000 and the purchase agreement defines the basket as a deductible basket in the amount of $100,000, the seller will be responsible to repay to the buyer the excess $300,000.

If in this example, the basket is defined in the purchase agreement as a tipping basket, the total amount of claims $400,000, would be subject to repayment.

Carefully defining the type and amount of indemnification basket is always recommended so you don’t unintentionally leave money on the table.

by Jennifer M. Novotny | Sell a Business |

Throughout the lifecycle of a business, it is important for a business owner to remain focused on increasing the profitability, competitive advantage and market reach of the business. An entrepreneur typically accomplishes these objectives by (i) reinvesting the profits of the business to increase its workforce, customer base and cash flow and (ii) using business profits (along with other financing) to acquire competing businesses. Such business acquisitions typically serve two purposes by eliminating competitors and increasing the growth rate, product and service offerings, and market share of a business.

This article focuses on the critical nature of the due diligence process in connection with a business acquisition.

A thorough due diligence review of the business being acquired (commonly known as the “target company”)is critical to identifying the risks, fixed and contingent liabilities, and problems (which are not otherwise disclosed by the seller in the acquisition agreement) that need to be evaluated carefully by the buyer, in addition to the value, efficiencies and synergies that the buyer can realize from an acquisition. The term “due diligence” broadly describes a detailed assessment of the many different functions, tangible and intangible assets, and liabilities of a business. A due diligence review is conducted by experienced lawyers and accountants, and this investigation will enable a buyer to accurately assess the following:

- When acquiring a business, will the buyer be able to realize unique competitive advantages from the acquisition?

- Are the employees of the target company subject to noncompetition, nonsolicitation and confidentiality obligations that protect the target company’s goodwill, customer list, and other important proprietary or confidential information? Are these contractual obligations assignable by the seller to the buyer?

- What third-party consents will need to be obtained in connection with a sale of the business? Is the target company a party to material contracts (including supply, employment, license and distribution agreements) that may not be assignable in connection with the transaction?

- What contingent and/or fixed liabilities of the target company need to be excluded from the transaction and retained by the seller?

- Will the buyer be able to retain the key customers and employees of the business?

- How much working capital does the business require?

The scope of a due diligence review should be thorough but appropriate for the transaction. This requires the buyer to consider how much time it has to conduct the due diligence review, how much it wants to spend on the review and the resources of the target company. A common misconception is that acquiring a smaller company is relatively easy; however, an acquisition of a smaller business may require additional legal due diligence due to the target company’s inadequate record keeping and limited resources to assist the buyer’s professional advisors with the due diligence process. Based on the information obtained from the target company in the initial stages of the review process, the scope of due diligence may become more or less comprehensive.

In conducting the due diligence review, the buyer’s legal team will obtain important information about the target company from both primary and secondary sources. Primary sources, which include the target company’s responses to written due diligence requests, management presentations, documentation set forth in a data room, and the target company’s disclosure schedules, may not be accessible until a later stage in the due diligence process. Consequently, it is important for the buyer’s legal counsel initially to obtain background information about the target company by reviewing secondary sources of information such as media articles, the target company’s website and judgment and lien searches covering the target company. Additionally, the buyer’s legal advisors will typically review the following categories of documents from the target company:

- Corporate Documents. In addition to the corporate organizational documents (i.e. articles of incorporation, bylaws, shareholders agreements, minute book, stock transfer book, etc.), the buyer’s legal counsel will want to determine whether the target company is qualified to do business in jurisdictions outside of its state of incorporation/organization. If the target company is not qualified as a foreign corporation in certain jurisdictions in which it does business, then the target company’s ability to sue and enforce agreements in that state may be impaired and the target company may be subject to certain compliance penalties.

- Financial Statements and Tax Returns and Reports. A review of the target company’s year-end financial statements and tax returns and will enable the buyer’s legal advisors to identify the existence of any material issues related to the target company’s financial operations or tax compliance measures.

- Litigation Documents. If the target company is frequently involved in similar types of litigation, there may be an underlying problem in the operation of the company. As such, the buyer’s legal counsel will carefully review all documentation relating to all actual or threatened litigation in which the target company has been involved within the previous three to five years to determine the extent of the target company’s liability.