by Holly Magister, CPA | Sell a Business |

In this episode, Holly Magister, a CPA with expertise in business sales, offers valuable insights into tax planning for entrepreneurs preparing to sell their businesses. Dive into the nuanced tax considerations discussed and learn proactive strategies to enhance sale proceeds while reducing tax liabilities. This episode serves as a hands-on roadmap for business owners, equipping them with the knowledge to make informed choices and optimize their financial results throughout the intricacies of business exits. Tune in for essential guidance!

by Holly Magister, CPA | Sell a Business |

Have a Question? Ask your Question at the bottom of any article. One of our advisors will answer. When selling a business, you’ll likely engage various advisors to help you navigate the process, maximize the sale price, reduce risks associated with the deal...

by Holly Magister, CPA | Sell a Business |

Learn why business buyers view your business as unattractive and it fails to sell once it’s on the market. We’ve summed up the top seven reasons and included suggestions regarding how to overcome these obstacles.

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

Choosing the right intermediary or business broker to represent a business owner in the sale of their business can make all the difference when it comes to the right price, the right buyer, and the ability to close the deal.

by Holly Magister, CPA | Sell a Business |

When it comes to the sale of a business, there are a number of costs – both expected and unplanned – all business owners should understand before they agree to sell their business. A few of our Featured Advisors have weighed in, offering their expertise and perspective to explain the costs – from business broker fees and legal costs to hidden fees – as they relate to selling a business.

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

Selling a business can be overwhelming. Here, we explore 20 ways that business brokers pay for themselves when selling a business.

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

As an intermediary, I have many conversations with business owners about how much their business is worth. As these conversations progress, owners realize that it’s not how much they make, it’s how much they can keep that truly matters.

by Holly Magister, CPA | Sell a Business |

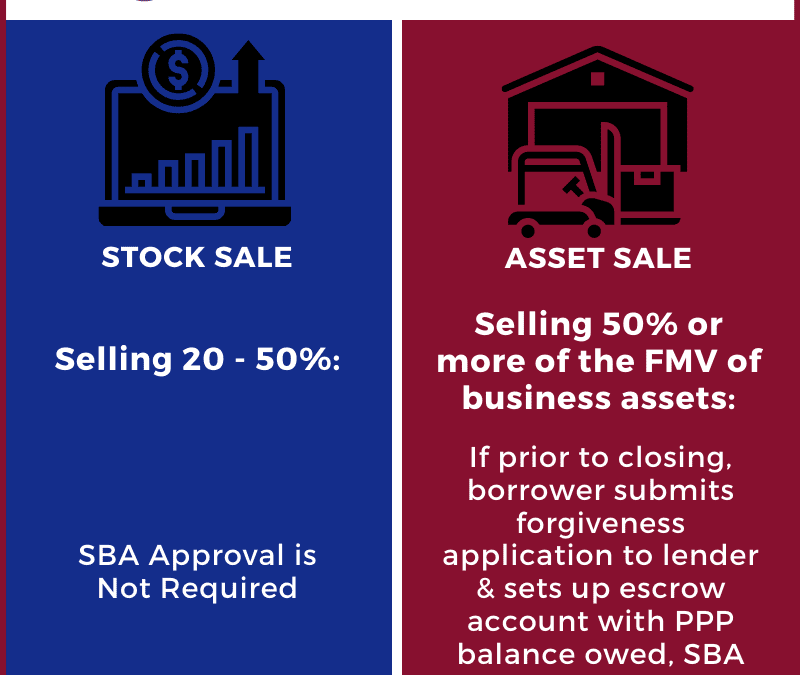

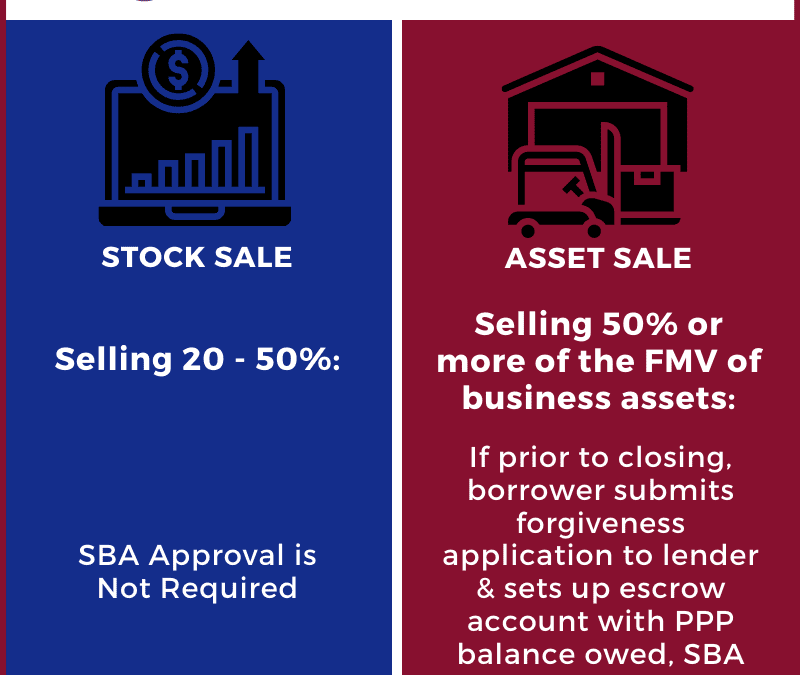

The Small Business Administration (SBA) issued a Procedural Notice on October 2, 2020 which offers business owners and lenders guidance on how Paycheck Protection Program (PPP) Loans are to be handled when a business has a change in ownership.

This post summarizes the notice and includes an Infographic to assist business owners. It includes the following topic:

When does a Business Sale Require the SBA’s Approval

Does a Business Sale Require the PPP Lender’s Approval or Notification

Required Steps Pre and Post-Closing for PPP Borrowers

SBA Timeframe to Approve a Sale or Merger when a PPP Loan Transfers

Does the EIDL Grant Impose Additional Steps When Selling a Business

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

The COVID 19 Era has begun. In addition to lives lost, there’s an economic toll that has yet to be determined at the time this content is being written. With small businesses on life support, these are scary times for business owners and for the intermediaries helping owners navigate through them. So how has COVID 19 affected business transactions?

by Holly Magister, CPA | Sell a Business |

If you’re considering the sale of your business, or possibly the acquisition of another competing business, it’s important to understand the selling/buying process.

An often overlooked and important first step during the process of buying or selling a business involves the negotiation of certain terms the buyer and seller will ultimately agree to at the closing table once the due diligence phase of the process is completed.

If either party ignores the importance of the initial terms’ negotiations, they can often end up with a bad deal or no deal at all.

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

As a business broker serving business owners who want to explore their options for exit, I get this question at almost every listing appointment:

“How long will it take to sell my business?”

The research indicates the answer is as follows:

For businesses that sell for under two million dollars, the IBBA’s research indicates it’s going to take 7-9 months…

Essentially you could have a baby in the time it takes to sell a business.

Many owners aren’t excited about this answer, but there are a few things you can do to expedite the sale of your small business. Let’s explore how to sell a business quickly.

by Holly Magister, CPA | Sell a Business |

One of the greatest risks any buyer faces is what will happen to the business’ best customers post-sale. Will the top customers celebrate the founder’s great accomplishment or maybe decide it’s a good opportunity to negotiate better pricing or payment terms with the new owner? Or worse yet, will they be spooked by the new owners and find an alternative vendor?

Astute buyers measure this risk quickly. Typically, one of the first questions experienced buyers ask the business broker is about the presence or lack of a customer concentration.

For the business owner considering the sale of his business in the near future, having a clear understanding if a customer concentration exists is vitally important. In fact, the lack of a customer concentration is a great selling point.

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

Often successful business owners invest in real estate because it can be a tax efficient way to handle the retained earnings of a business. And when it comes to exit planning, business owners with real estate have more exit options. This is a good thing. For...

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

Have a Question? Ask your question below and one of our Advisors will answer. Yes it’s easy to get fixated on the sale price. It’s the number you tell people years after the sale if you want to brag. However, much like losing weight, the sale price of your...

by Neal Isaacs, MBA, CBI, CM&AP | Sell a Business |

Have a Question? Ask your question below and one of our Advisors will answer. Commercial Lease Assignment Problems As part of selling your business, the lease can be one of the most overlooked barriers to completing the deal. The buyer and seller may have a...

by Holly Magister, CPA | Sell a Business |

Speaker: Holly A. Magister, CPA and Certified Financial Planner® This post is intended to help those who either own a business or advise business owners in the lower-middle market — defined as a business with gross revenue between $5MM and $50MM — and is...

by Holly Magister, CPA | Sell a Business |

v Have a Question? Add it to the bottom of this post! When a business is sold, sometimes an adjustment to the purchase price is needed to make up any difference between available working capital at the time of closing, and the working capital needed to maintain...

by Holly Magister, CPA | Sell a Business |

There are many ways to compute the value of a business, and an equal number of differing opinions regarding a particular methodology’s relevance to an entrepreneur who starts and grows a viable business. But what seems to truly matter most to the entrepreneur who has...

by Andrew N. Jones | Sell a Business |

As consumers, we’ve become increasingly familiar with the notion of paying a monthly fee for various business and lifestyle services. Whereas we once rented movies by the title by driving to Blockbuster, we now have access to virtually unlimited content on Netflix....

by Holly Magister, CPA | Sell a Business |

The American Stock Exchange (AMEX) is the third-largest stock exchange by trading volume in the United States. AMEX was acquired by the New York Stock Exchange (NYSE) Euronext in 2008, at which time its name was changed to NYSE Alternext US. In 2009 it became the NYSE...