by Julie Kline | Sell a Business |

A Term Sheet or Letter of Intent (LOI) is commonly used in the buying or selling of businesses.

A Term Sheet or Letter of Intent (LOI) is commonly used in the buying or selling of businesses.

The purpose of LOIs are to state clearly the principal terms that the parties have agreed to as part of the deal and to represent the intent of the parties to pursue the contemplated transaction.

Typically, LOIs are non-binding in terms of requiring the parties to close the deal. LOIs are entered into commonly at the beginning of the transaction prior to detailed due diligence and preparation of definitive purchase documents. The framework put into place with the LOI is then used to form the definitive purchase documents needed to close the deal.

Reasons to Use LOIs

There are a number of reasons to use LOIs in transactions. LOIs can help:

- Identify early on (prior to expending transaction costs) what terms are mutually agreed upon and which key terms may be deal breakers;

- Focus negotiations on key terms;

- Increase commitment and deal stability;

- Outline binding obligations such as exclusivity for negotiations, payment of costs and confidentiality concerns;

- Obtain third party approvals; and

- Enhance mutual understanding of deal terms for parties that have varying degrees of sophistication.

Reasons Not to Use LOIs

There are a number of issues which may outweigh these benefits, namely:

- The cost of negotiation and preparation of the LOI may be unnecessary or undesirable if the deal is easily understandable;

- Negotiation of the LOI can slow deal momentum;

- Improperly drafted LOIs may create unintended binding obligations to negotiate and close the deal.

- LOIs may inadvertently create a duty to negotiate in good faith which could eliminate the ability of a party to walk away if there is a change of mind.

- The LOI may weaken the negotiating position if the party later seeks to change the terms.

Intentionally Binding Provisions

While LOIs are typically non-binding, there are commonly certain terms within the document that are binding on the parties. The binding provisions typically relate to the exclusivity of negotiations, confidentiality of information during due diligence and the allocation of costs and expenses incurred during transaction.

Unintended Binding Provisions

The more definitive the LOI, the more likely it is that a court would state that the terms are sufficiently definite to be enforceable.

To avoid unintended binding obligations, the parties must clearly state which sections are binding and which are non-binding. If material terms are left out, the parties lower the risk of creating an unintended binding obligation.

Duty to Negotiate in Good Faith

Even if the LOI is non-binding, parties may be obligated to negotiate in good faith. The language in the LOI is important to clarify this issue. Courts are split on when this duty is implied in LOIs. Accordingly, careful drafting is necessary to avoid unintentionally creating a duty of good faith negotiation when such may not be desired.

Key Terms Outlined in LOIs

The following are the key points that most LOIs will include:

- Basic description of transaction and structure

- Principal deal terms (i.e. purchase price and payment terms)

- Closing conditions

- Key dates for due diligence and closing

- Allocation of fees and expenses

- Statement on binding and non-binding provisions

- Scope of due diligence

- Confidentiality

- Exclusivity of negotiations

LOIs are common place in acquisition deals, but there are a number of important issues to consider when utilizing these important documents.

LOIs serve a distinct purpose and deserve attention by the parties so that the purpose is achieved without the risk of the unintended circumstances discussed above.

Julie I. Kline, Esq.

This document is intended to provide information of general interest and is not intended to offer any legal advice about specific situations or problems. Neither the author nor Strassburger McKenna Gutnick & Gefsky intend to create an attorney-client relationship by offering this information, and anyone’s review of the information shall not be deemed to create such a relationship. You should consult a lawyer if you have a legal matter requiring attention.

by Matt Harnett | Sell a Business |

As a business owner, you have worked long and hard to get your company to a point where it can be sold. You have likely worked long days and endured sleepless nights at some point during your journey.

As a business owner, you have worked long and hard to get your company to a point where it can be sold. You have likely worked long days and endured sleepless nights at some point during your journey.

So selling is understandably a big and emotional decision.

You only get one chance to get it right (when selling your company). There are no mulligans or do-overs.

Yet, far too many business owners do not invest adequate strategic resources, thought or planning into preparing their business for sale… which costs them real money.

This is not done intentionally. You are busy running your business. You are responding to customers. There seemingly is not enough time, energy, or knowledge to apply to the process. Principals may not know where to begin, who to talk to, or how to increase their exit value.

As such, to avoid making the costly mistake of not preparing your company for sale, ask yourself a few key questions 3-5 years before you want to sell. This list is not all-inclusive, but it’s a good starting place — Questions to consider when selling a business:

1. How Does My Business Look From The Outside In? What Would Potential Suitors Like / Not Like?

What would the buyer want to see when purchasing a company? What items will decrease the value of the business and can I change those items over the next 3-5 years to increase my company’s value when I sell? Have I made the necessary investments into infrastructure, technology and equipment? Ask your advisors to poke holes and identify items as well.

i. By simply stepping into the buyer’s shoes, you and your advisors might identify some issues that need fixed or some opportunities that need to be developed. Even though this process is honest and painful, selling your company for an enhanced value someday will ease that pain!

2. Do I Have Concentration Risk? This could be significant customer, industry, product, or contributing margin concentration?

i. Diversifying revenues over the next several years will decrease risk for the buyer and his/her financial partners (banks, investment funds) therefore allowing for a higher purchase price. Most financial buyers want to finance some of the purchase price with debt. Diversification provides for a more financeable deal because it decreases risk. A more financeable transaction will result in relatively more bank financing (the buyer can put more leverage on the company) which often results in a higher sales price.

ii. Also, diversification makes your company a more attractive acquisition target to a private equity buyer because it affords a stable base from which to grow from .

3. How Reliant Is The Business On Me?

Have I built a management team strong enough that I can walk away from the business? Do I want to be active in some way post-sale? Are key management positions filled with qualified individuals?

i. Having addressed this big issue removes risk for the buyer and makes your life easier as well. Having already addressed these questions and concerns (that definitely will come up at the negotiating table) allows you to have an exit plan. This enables the buyer to focus on other important tasks and affords them the ability to leverage the experience / and legacy knowledge of this team upon your departure. If you know that continuity of a competent management team is a key risk you can remove for the buyer, why not address it now so you can attract more buyers and sell your business for more money?

4. Who Will The Likely Buyer Be?

It makes a difference if it is a strategic or a financial buyer and even more of a difference if you want to consider your management team as buyers. By thinking of who are the likely buyers well in advance of a sale, you can begin to position the business to the prospective buyer audience through personal contacts and by the intentional marketing of your business’s strengths.

5. Have You Found The Right Team Of Advisors?

It is extremely important that you assemble a competent team of legal, financial planning, tax, valuation, investor, and banker/broker professionals. Some entrepreneurs look at this as an added expense. However, when you are planning an exit, this might be the best thing you can do.

It is extremely important that you assemble a competent team of legal, financial planning, tax, valuation, investor, and banker/broker professionals. Some entrepreneurs look at this as an added expense. However, when you are planning an exit, this might be the best thing you can do.

Asking these questions and others will help you address items that otherwise erode the actual or perceived value of your business, therefore helping maximize value when you sell. Often times it makes sense to hire a certified exit planner and/or investment bank to help you prepare your business for sale, or work with a trusted capital provider. Seek advice from your attorney and accountant as there may be tax / legal considerations that affect how much money you walk away with and your legal risk post-transaction. Also, bankers and investors are good sources of advice.

Most of these key questions are simple concepts that just need some strategic focus, and remember, this is something you want to begin doing 3-5 years before you actually want to sell your company.

by Sabrina Baker | Sell a Business |

In a perfect world, when one business buys another, the staff of the purchased company would be able to transition into a role with the buying company.

In a perfect world, when one business buys another, the staff of the purchased company would be able to transition into a role with the buying company.

Unfortunately, this isn’t always the case. What’s more, the company being purchased may not know what is going to happen to its employees for some time. In many cases, the company being purchased will need to tell their employees about the sale before they really know what that means for their future. When this happens, how do companies get their employees to stay on board and keep them engaged during the transition?

While it may be impossible to keep everyone on board, there are a few tactics employers can use to encourage employees to see them through a transition.

Transparency

The worst thing that can happen for employees is to hear about the sale and their impending loss of employment through the grape vine or some unreliable channel.

Being completely honest with employees as soon as possible helps to maintain trust and relationships employees already have built with their leaders. The minute employees feel as though information is being withheld or trust is broken, they are unlikely to want to stick around.

Integration

If it has been determined that employees may have the opportunity to stay, integrating them into the new company culture as quickly as possible will help them build loyalty to that new company and its leaders.

If there is an interview process, helping employees prepare by sharing information or skills the new company would be looking for will help them feel supported in the transition.

Stay Bonuses

When and if it is determined that the new company may not be transitioning any of the current employees, stay or retention bonuses may be necessary to keep employees on board until the sale is final. And in many cases, stay bonuses can be effectively used to reward employees who are willing to allow the buyer to figure things out. Stay Bonus Plans don’t always mean the buyer intends to cut loose the employees after the plan expires and the employees are paid their bonuses.

Stay bonuses are paid out to employees who stay with the company until the closing date or some period in the future when the transition work is expected to be completed.

If the period between the announcement and the last official day or transition phase is long, it may be beneficial to pay out stay bonuses in increments at certain intervals or milestones throughout the sale or transition.

Dealing with employee retention during the sale of a business can be a touchy subject, but with the proper planning and forethought, employees can help businesses transition smoothly. And then it’s a win-win for everyone involved.

by Paul Cronin | Sell a Business |

When an asset has a grossly inflated price, it is by definition an asset bubble. Does this apply to many small businesses in the US? Probably yes, in my opinion. Most small businesses have a balance sheet listing some assets; therefore they are subject to being part of a bubble. There is an estimated $10 Trillion in private business equity in the US, largely in the hands of the Baby Boomer generation, according to research by the Exit Planning Institute. If there is a large market of assets, but not enough buyers, that is what creates the potential for a bubble. What I am not sure of is whether this situation will burst like a bubble and cause the next financial crisis, or if this is more like a balloon with a slow leak, thereby creating a drag on the US economy for many years.

Where’s the Crisis?

I have been reading for some time about a looming “crisis” of Baby Boomer business owners needing to sell their businesses to retire, seemingly en masse. One book written by Wayne Vanwyck, an entrepreneur who has built and sold a few businesses, is titled “The Business Transition Crisis”. There have been articles about a “Baby Boomer Tsunami” of businesses for sale. For business owners to counter this, many books and articles recommend common themes of “building value” and “thinking like a shareholder”. All valid points, but I have yet to see evidence of anything “moving the needle” for such owners to take much action. So what’s missing?

“Beat the Exit Bubble”

This recent book by Tensie Homan and Dan Meyer offers a slightly different take. Homan and Meyer had long careers in corporate development, i.e., they helped their company buy other companies. Their business exit strategy approach is to ask owners to think and act as BUYERS, not SELLERS, of their businesses.

Shifting your Context

I believe it was Albert Einstein who said that, to solve a problem, you can’t use the same thinking you used to create it. If a business owner thinks like a buyer, he or she will have shifted their context, or way of thinking. As former buyers of businesses, Homan and Meyer bring context to the conversation. I am thinking it’s what business owners (potential sellers) need to hear. Stop thinking like sellers, and start thinking like buyers. But what if you don’t want to sell? Or what if you think your kids (or employees) will take it over? Guess what, they are buyers too, so the advice is still relevant, even if they don’t pay you for it. Think about that for a moment, if your kids (or employees) are unwilling to use their capital, or borrow capital to pay you for it, then that means your business may be not worth much. As buyers, they just said the value of your business to them is ZERO. Ouch, that’s got to hurt.

How many will go dark?

I recently listened to a webinar that quoted a survey of business owners by PricewaterhouseCoopers, reporting that 40% of business owners EXPECTED to CLOSE their business when they retired. If so, that means millions of mom and pop businesses will go dark. I have also read that 80%of businesses that get listed for sale end up never selling. That means millions more businesses going dark.

Why I am optimistic

After reading this, I am sure a lot of M&A Advisors and business owners may be heading to a bar, or a bridge. Don’t do it. Here’s why. Many businesses were started by Baby Boomers who were simply good at “something”, and then struck out on their own. They were also very optimistic. I think that the Millennial generation will come to the rescue. Many are struggling to find jobs today, especially in corporate America, so they are turning to entrepreneurship. Millennials number 80 million in the US. They are all under age 34. That is a potentially rich source of buyers. It is true that many are handicapped with student debt (and some still live at home), but they are also extremely optimistic about themselves. Optimism is a requirement for all successful entrepreneurs. (I am a parent of two Millennials – so I know where of I speak).

What can an owner do?

I suggest taking a different tack on the “think like a buyer” mindset – instead, think like a Millennial buyer. Find out what they eat, where they shop, what they read, what makes their heart soar, what makes them passionate about something. Ask yourself how your business could appeal to them. If you do, you may not only grow your business in the short term, but one of your new customers may well become your new buyer. That would be a very happy ending to this story indeed.

by Julie Kline | Sell a Business |

Looking Over Your Shoulder: Just How Long Does the Threat of Indemnification Lurk?

When you sell your business, the purchase agreement between you and your buyer will contain a number of promises that you make to your buyer. These promises come in the form of representations, warranties, covenants, and other agreements relating to the business. Many of these provisions are tied to the disclosure schedules that you (or your attorney or both) prepare and attach to the purchase agreement. Still, there are other risks of breach of the purchase agreement that may be outside of your control. In addition, a buyer may also require supplemental indemnification provisions if it has concerns about specific liabilities, including specific environmental conditions; retained employee liabilities; product liability claims; current or pending litigation; and pre-closing taxes.

When you sell your business, the purchase agreement between you and your buyer will contain a number of promises that you make to your buyer. These promises come in the form of representations, warranties, covenants, and other agreements relating to the business. Many of these provisions are tied to the disclosure schedules that you (or your attorney or both) prepare and attach to the purchase agreement. Still, there are other risks of breach of the purchase agreement that may be outside of your control. In addition, a buyer may also require supplemental indemnification provisions if it has concerns about specific liabilities, including specific environmental conditions; retained employee liabilities; product liability claims; current or pending litigation; and pre-closing taxes.

Generally, indemnification is the buyer’s remedy for a breach of any promises made in the purchase agreement or losses incurred relating to specific liabilities outlined in the purchase agreement. Indemnification allocates the risk of various post-closing losses between buyer and seller. For this reason, the indemnification provisions of your purchase agreement will very likely be among the most heavily negotiated provisions in your purchase agreement. Since the buyer is more likely to incur losses after closing, the buyer will advocate for broad indemnification provisions. Since the seller is the one agreeing to pay for any losses covered by the indemnification provisions, the seller will advocate for narrow indemnification provisions and seek to minimize his or her obligation to pay the buyer for any post-closing losses.

Survival

Indemnification obligations survive closing – meaning the obligations remain in effect even after you close the deal and collect the purchase price. The survival period for the representations and warranties made in the purchase agreement usually ranges from six months to two years. Since the seller is the one agreeing to pay for any losses covered during the survival period, the seller will advocate for a short survival period to minimize the risk of losses springing up in that time frame. Buyers generally will want to ensure the survival period lasts at least through the completion of one audit cycle.

Certain representations have a longer survival period than other provisions. Generally, representations covering corporate organization, authority and capitalization; title to stock; taxes; environmental matters; and ERISA often survive until the expiration of the applicable statute of limitations or indefinitely. Covenants and other agreements usually survive indefinitely.

Limitations to Indemnification

To address the threat of indemnification post-closing, sellers will try to negotiate monetary limits on indemnification. Two common indemnification limitations are baskets and caps.

Baskets require a party to reach a certain amount of losses before any indemnification obligation is triggered. They usually only place limits on indemnification with respect to breaches of representations and warranties. In addition, certain representations and warranties are often excluded from the scope of the limitation. Baskets can be structured as thresholds, where once the threshold amount is exceeded, the indemnifying party is liable for the total amount of losses; or as deductibles, where once the minimum amount is exceeded, the indemnifying party is only liable for any amount over the minimum. A mini-basket may be included within a basket to require the losses from a particular claim to exceed a certain amount before being counted toward the basket.

Caps place a maximum limit on a party’s recovery. The cap is often limited to an amount less than the total purchase price and oftentimes equal to an amount placed in escrow (further explained below). Caps may apply only to breaches of representations and warranties and may exclude certain representations and warranties.

Indemnification as Exclusive Remedy

While some buyers may push back and try to preserve their right to bring other types of claims against the seller, most buyers will concede to indemnification being their sole remedy for breach of any promise in the purchase agreement. If the seller has negotiated monetary limitations on indemnification, such as baskets and caps, it is important that indemnification is the exclusive remedy of the buyer so that the buyer cannot exceed the limitations set by the purchase agreement by bringing other causes of action against the seller.

Escrow

A buyer will want to ensure that the seller has adequate funds to pay indemnification claims. Buyers will often ask that part of the purchase price be set aside and held in escrow to satisfy the seller’s indemnification obligations should the buyer incur post-closing losses. These funds are often held in escrow during the survival period.

In summary, the indemnification provisions in any purchase agreement are often times the most highly negotiated aspect of the agreement and deal in general. It is also one that is reliant on several other aspects of the agreement, namely the disclosure schedules. It is for this reason, you should pay particular attention to the representations, warranties, covenants and related schedules in any agreement to sell your business in order to manage the “threat” of indemnification post-closing.

This document is intended to provide information of general interest and is not intended to offer any legal advice about specific situations or problems. Neither the author nor Strassburger McKenna Gutnick & Gefsky intend to create an attorney-client relationship by offering this information, and anyone’s review of the information shall not be deemed to create such a relationship. You should consult a lawyer if you have a legal matter requiring attention.

by Paul Cronin | Sell a Business |

A friend called me recently and asked a question: Do you think you could help a young man, he has a big problem? It turns out that my friend’s friend knew this young man and his father. The father is a well-regarded attorney who has a solo practice – sounds like thousands of other attorneys in the US. The big problem was that the attorney had suffered a catastrophic illness, and would no longer be practicing law. To make matters worse, he was divorced and had no partner to help him. The son was now in charge of disposing of the law firm.

A friend called me recently and asked a question: Do you think you could help a young man, he has a big problem? It turns out that my friend’s friend knew this young man and his father. The father is a well-regarded attorney who has a solo practice – sounds like thousands of other attorneys in the US. The big problem was that the attorney had suffered a catastrophic illness, and would no longer be practicing law. To make matters worse, he was divorced and had no partner to help him. The son was now in charge of disposing of the law firm.

I asked the son his background. His reply, “I am artist”. I’m now thinking, great, this kid has no business training to understand what needs to be done. He knows that he knows nothing, but even worse, he doesn’t know what he doesn’t know.

Asked if his father were able to talk, the son said a little. I asked if his father ever talked about what he wanted to do with his firm. The son was vague, but said something about merging with another lawyer someday. I asked if the father was depending on the sale of the practice to help him financially, the son said he wasn’t sure, but that his father will need income.

At this point, I was getting ill. Imagine that this attorney, no doubt highly educated, resourceful, connected and probably making a decent living, had completely abdicated a central responsibility; he failed to draw up contingency plans for his now present situation.

Entrepreneurial Malpractice – The fact that the father is an attorney may not raise it to legal malpractice, but it’s not much removed. Even solo practitioners are entrepreneurs to some degree, and they need to think through succession and contingency planning. All of this is thoroughly avoidable with some basic planning habits.

Dying at His Desk – Were the father in a place to talk, I’d have asked him “what were your plans for retiring?” If he is like most lawyers I know, he’d have likely said: “I’ll never retire”, or “I’ll just wind down my practice over time”, or “I’ll figure that out later, I’m too busy now”. Excuses, excuses. What he and others are really saying is “I can’t think of another way to live, so I’ll just die at my desk”. It’s nonsense.

Dying at His Desk – Were the father in a place to talk, I’d have asked him “what were your plans for retiring?” If he is like most lawyers I know, he’d have likely said: “I’ll never retire”, or “I’ll just wind down my practice over time”, or “I’ll figure that out later, I’m too busy now”. Excuses, excuses. What he and others are really saying is “I can’t think of another way to live, so I’ll just die at my desk”. It’s nonsense.

How We Really Leave Planet Earth – We are born into the medical-industrial complex and we die through the medical-industrial complex. At this moment, my aunt is slowly passing out of this world in hospice. It will be a matter of days or weeks. This lawyer will need hospital, rehab and more. He won’t be dying at his desk.

So What to Do Now? – I connected the son to an exit planner and a business broker, before he signed any deals with another law firm. They were willing to give the kid some free advice and try to help. With luck, they will craft some deal to merge with another firm and give the father a chance to finance this portion of his life. There will be many bills due. Sadly the son must wrestle with all of this. He is a good son; at least his father raised him right. He could easily have walked away from his father and said, “It’s your bed, go lie in it”.

Three Existential Questions – If you own a business or a practice, you can avoid this kind of disaster by asking these three questions:

1. What should be the future of my business?

2. What should be the future of my life?”

3. Whom should I be talking to for help?

Ideally, you should ask these questions annually. Your business changes over time. Your industry changes over time. Your life changes over time. Asking these existential questions can get you in tune with the changes and force you to come up with good answers. If you don’t, you could be leaving a royal mess for your spouse, partner, employees, vendors and community at large. Is that the legacy you seek to leave?

by Leilani Costa | Sell a Business |

There are many pitfalls to avoid and precautions to be taken when contemplating the sale of your business to a competitor. In particular, selling a business to a competitor can have tricky antitrust implications that require much care prior to closing.

The seller must remain independent of the buyer until closing. However, some of the information that a seller shares during the time leading up to closing includes sensitive information that the seller generally would not share with a competitor. Sharing such competitively sensitive information with a competitor-buyer can constitute an antitrust violation for which the seller can face civil penalties.

The seller must remain independent of the buyer until closing. However, some of the information that a seller shares during the time leading up to closing includes sensitive information that the seller generally would not share with a competitor. Sharing such competitively sensitive information with a competitor-buyer can constitute an antitrust violation for which the seller can face civil penalties.

Much of this information sharing occurs during the due diligence process to help the buyer value the seller’s business and determine whether it wants to buy the business. To achieve these ends, the seller may need to share pricing information, price terms, marketing strategies, customer lists, and research and development plans with the buyer. However, the seller must carefully toe the line between sharing enough information to achieve legitimate ends and the over-sharing such information, which can have catastrophic antitrust implications.

There are some practical guidelines that a seller can employ during the due diligence process to sidestep these antitrust pitfalls:

First, and before sharing any sensitive information in any transaction, the buyer and seller should enter into a nondisclosure agreement (NDA). The use of an NDA is a common initial step in the potential sale of a business. NDAs protect from disclosure the confidential information shared between the parties. Employees, executives, and other agents of the parties who will be privy to information exchanged during due diligence should sign an NDA. In the sale of a business to a competitor, the NDA should provide that shared information (1) will only be used for legitimate purposes; and (2) will not be used to compete with or otherwise harm the seller.

Second, the seller should not share more information than that which needs to be shared for legitimate reasons, such as valuing the seller’s company. To achieve this end, whenever possible, the seller should desensitize information disclosed by:

- sharing information that is less sensitive, such as historical rather than current information, especially for pricing information and costs;

- redacting certain information, including customer names;

- aggregating information, instead of sharing individual pieces of competitively sensitive information;

- using information that is publicly available; and

- sharing sensitive information only with individuals who need to know, including only granting access to particular sections of a data room to certain individuals.

Third, the seller should not share information before such information is needed. The parties should consider whether it is necessary to share sensitive information early in due diligence, or whether it can be shared once the parties are further along in their negotiations. The seller should remember that if the deal falls through before closing, the parties will likely remain competitors.

Fourth, the parties should consider using an independent team or consultant to review competitively sensitive information provided by the seller. An independent team would include individuals who are working on the transaction but who are not involved in the part of the seller’s business that competes with the buyer’s business or which markets those lines or services. Electronic data rooms can be structured to only give access to particular information to the independent team.

In summary, depending upon the size of the business and industries involved, antitrust concerns are a legitimate concern when a transaction involves competitors. Competitively sensitive information can vary by company, industry, and market and great care must be given when handling such information during a sale transaction between competitors.

Learn more about how to sell a business to a competitor, especially when you receive an unsolicited offer to buy your business in one of ExitPromise.com’s free webinars.

This document is intended to provide information of general interest and is not intended to offer any legal advice about specific situations or problems. Neither the author nor Metz Lewis Brodman Must O’Keefe LLC intend to create an attorney-client relationship by offering this information, and anyone’s review of the information shall not be deemed to create such a relationship. You should consult a lawyer if you have a legal matter requiring attention.

by The Contributors | Sell a Business |

Many business owners who face the demands for cash when growing their business are tempted to sell their stock to outside investors or perhaps give away stock to retain a valuable employee.

Many business owners who face the demands for cash when growing their business are tempted to sell their stock to outside investors or perhaps give away stock to retain a valuable employee.

Diluting your ownership stake this way may solve the immediate problem, but it can have unforeseen consequences when the business eventually is sold.

Stockholders’ personal circumstances evolve in different ways over the lifetime of a company, and whatever the original intention everyone may not be on the same page when you are ready to sell.

A recent meeting with a potential client brought this into focus.

John had been building his industrial service company for almost 30 years and was ready to explore the potential for a retirement sale. On the face of it he had a business that was worth at least two million dollars. There was just one catch – a poisonous dispute with a minority stockholder that had been festering since the early days of the business.

The origins of the story are not that unusual. As the business grew John needed to add expensive sales resource to take advantage of a fast growing market. Cash was tight but he found a young, ambitious salesman willing to take a below market salary in return for a 30% equity stake.

Things started out well, but volume was being chased at the expense of margin, leading to an inevitable cash flow crisis. It took John almost three years to dig out of the resulting mess.

John blamed his co-stockholder and dismissed him from the sales role as soon as the problem came to light. There was much bitterness on both sides, and despite several attempts no agreement could be reached on buying out the minority stockholder.

For more than 20 years John ran the company to avoid any possibility of paying a dividend to his former employee, at considerable personal expense in additional taxes.

With John’s agreement we met with the minority stockholder, but it was clear that even for a 30% share of the proceeds he was in no mood to cooperate with a sale. An actual offer on the table may or may not have softened this position, but I wasn’t prepared to take that risk on a success fee basis and decided not to take John on as a client.

John’s problem was an extreme case but every year we see any number of situations where differing motivations within groups of stockholders prevent an exit sale:

- One stockholder looking to retire, but his co-owners needing to work on;

- Family companies where second generation stockholders have varying levels of involvement and emotional commitment to the business;

- Divorced couples unable to agree on the future and value of a co-owned business;

- Majority owners having to deal with the grieving spouse of a deceased co-stockholder;

- A minority shareholder with unrealistic expectations blocking acceptance of a fair offer.

In the interests of balance we also see businesses where a third party investment has been the springboard for rapid growth, or where an employee retained with an equity stake has become the driving force behind a company’s success.

The truth is that there are some situations where diluting the founder’s equity is the only way forward. If you find yourself in this place get legal advice on drafting a stockholder agreement at the start of an arrangement, with detailed rules about stockholder disputes and exit arrangements.

In the enthusiasm at the start of a new project this might seem unnecessary, or a waste of scarce money on legal fees, but in circumstances where you just can’t avoid diluting your equity position it is the best way to prevent future problems.

by Holly Magister, CPA | Sell a Business |

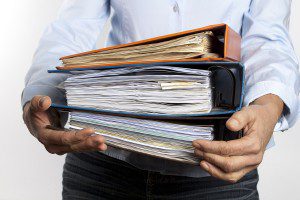

You have endured multiple meetings with potential buyers. You’ve written dozens of emails and suffered through several rounds of negotiations to secure the best price and deal structure. At last you have decided on the offer to accept. The worst is over, right?

You have endured multiple meetings with potential buyers. You’ve written dozens of emails and suffered through several rounds of negotiations to secure the best price and deal structure. At last you have decided on the offer to accept. The worst is over, right?

Think again – you have yet to experience the joys of due diligence and sale contract negotiation.

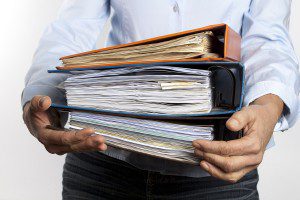

What is Due Diligence (When Selling a Business)?

So what is due diligence?

It is the most thorough examination of your financial statements, business records and contractual arrangements imaginable. All performed by the buyer’s experienced and highly skeptical advisors.

If there are any weaknesses in your business, or hidden problems, they will inevitably be found. You should expect questionnaires running to tens of pages, endless follow up questions and requests for additional information.

Sale & Purchase Contracts: What to Expect

Just wait until you see the sale and purchase contract. If you are selling shares a minimum of seventy to eighty pages of promises you have to make about the business, and steps you will take to make the sellers whole if they turn out to be untrue.

Many smart lawyers have contributed to this contract over decades of work so it covers every possible aspect of business activity.

You may be on the hook for problems with inventory, employment matters and other commercial arrangements for at least a couple of years. Liability on taxation and regulatory issues can potentially last for ever.

How Do You Survive Due Diligence?

Two things are essential – good preparation, and an unyielding commitment to full disclosure.

Preparation comes in two forms. Your broker or lawyer should provide you with a list of all the documentation and disclosures a buyer will typically ask for in due diligence.

Due diligence is less painful if you pull all this information together in a data room before the due diligence process begins, rather than releasing it piecemeal as the process unfolds. Doing so gives your advisors time to fully review each piece of information and prepare answers for any issues likely to arise.

The second area of preparation is a detailed record of the issues that have been raised, and agreements that have been made, during negotiation. Your broker should turn this into a detailed Letter of Intent to be signed by both buyer and seller. The lawyers will incorporate these details into the various contracts and supporting schedules.

Full disclosure is an absolute requirement if your sale is to survive the two to three month journey from agreeing to a deal to legal completion. If problems are found by the buyers in due diligence, or if you try to change the contract at the last minute, a deal may fall apart.

Buyers may wonder what else has been hidden if an undisclosed problem is brought to light. It is always a mistake to hide problems.

Almost any issue can be handled by your advisors if it is disclosed at the start, and presented alongside solutions to mitigate or manage the issue.

by Chris George | Sell a Business |

The reasons for selling a business are many. In the end, however, the desired result is the same – money.

The reasons for selling a business are many. In the end, however, the desired result is the same – money.

So how does one prepare a business for sale at a higher price?

The obvious answer is to sell when the business is doing well. A thriving business will excite buyer demand. Many of the same actions that produce a successful business are the same actions needed to prepare a business for sale.

Unfortunately, not every business will reach its maximum potential before an owner must consider selling. Just as some “fixer-upper” houses are sold at extremely low prices, a middling business will only receive moderate offers (at best), leaving the buyer in a position to put more money into improving it.

To prepare a business to sell for a higher price, an owner must “renovate” the business just as a home would be renovated. The key is to audit the company to determine which renovations will increase the value of the business.

Conduct a Holistic Business Review

A smart business owner will reach out to a support system of people who are affiliated with the company (lawyers, vendors, accountants, etc.) and ask for an honest assessment of the business’s vulnerabilities. Often these people will have useful insights they are happy to share, but they likely would never have shared them unsolicited.

Consulting these associates is a worthwhile endeavor; while a business broker can review books and offer essential expert opinions on the business and the current market, the company’s business contacts have an intimate knowledge of the daily workings of the operation, allowing a unique perspective.

Expand the Customer Base

Many small businesses rely on a minority of customers who generate a large percentage of revenues for the company. It is valuable to have a handful of loyal and consistent customers, but a buyer will be wary of any customer that comprises more than 20% of revenues. After all, a customer who was loyal to the old owner has no interest in remaining loyal to the new owner, and potential buyers often avoid this type of relationship.

Reducing customer concentration will aid in increasing the reliability of the business’s potential revenue and will enhance the company’s value both in selling price and in terms of salability.

Strengthen Core Competency

Potential buyers are more drawn to a company with a concentration on strong core management rather than one that is going in many different directions.

To prepare a business to sell at a higher price, an owner must make sure that all members of the management team share the same focus. A common direction, combined with the production of merchandise and services that add to the value of the core business, will elicit higher offers.

Reduce Industry Specialization

A specialty business may have a competitive advantage in a particular industry due to its industry expertise, but it will also be more susceptible to negative impact if the industry suffers a downturn. A lack of diversity can be a great risk.

In general, industry concentration is undesirable to potential buyers. Diversification of the industries served is vital to prepare a business to sell at a higher price.

Increase Your Take-Out Multiple

A business’s asking price is often a multiple of a profitability measure (such as EBITDA or SDE). The typical multiple can be three to ten times said measure, and there are many factors that can affect that multiple, both quantitatively and qualitatively.

Strict operational and financial plans will help improve those factors (new flooring, higher margins & profitability, etc.), but workplace motivation and excitement are also effective and will transfer to investors. The value of the business can be increased significantly by performing best practices. Increasing the multiple from five times the profitability measure to six times the same measure can have a significant impact and often may even mitigate tax consequences of the sale.

Selling a business can be an overwhelming undertaking, and often it is easy for a business owner to become more focused on a sale than on the business’s current performance.

Fortunately, all changes made to sell the business at a higher price are also changes that will benefit the company overall. In fact, these changes are appropriate at any time during the life of the business and will increase profits. The sooner these improvements are made, the better the position for the business when the time to sell becomes a reality.

With the help of an experienced business broker or M&A intermediary, a prepared business owner will retain a place of power, fielding multiple offers in an auction atmosphere.

by Greg Younts | Sell a Business |

What’s the Value of a Business Plan?

A business plan is critical to the success of any business. And, if the plan is frequently reviewed and updated, it becomes increasingly valuable over time. It provides valuable historical information to help a business owner make decisions on the future direction of the company.

A business plan is critical to the success of any business. And, if the plan is frequently reviewed and updated, it becomes increasingly valuable over time. It provides valuable historical information to help a business owner make decisions on the future direction of the company.

Effective business planning will enable the owner to both maximize profits and maximize the value of the company. If the exit strategy of the owner is to sell the business, effective business planning during the life of the business will contribute to successfully selling the business at the best possible price.

What Information is Included in a Business Plan?

The information included in a business plan is also of great interest to a prospective buyer who is evaluating the business as a possible acquisition. Some of the major business areas that should be included in a business plan that would also be of interest to a buyer include the following:

– Mission Statement and Company Philosophy

– Company History

– Short term and long term revenue and profit goals

– Organizational structure

- Current Organization

- Organizational growth plan

- Employee development

– Marketing

- Target market

- Major accounts and/or markets

- Sales and marketing strategies

- Competition

– Operations

- Current processes

- Planned and proposed changes to operations

– Product and\or service lines

– Documented history of key successes and failures during the life of the business

Complete and accurate books and records are essential for the successful sale of any business. Typically, a buyer’s first exposure to the confidential details of a business comes in the form of a comprehensive document covering the financial and operational aspects of the business. Presenting buyers with the details contained in a good business plan will make a great first impression and can shorten the time it takes to close the sale. Providing buyers with extensive details upfront can shorten the buyer’s evaluation and due diligence process.

The growth potential of a business is usually a huge factor in a buyer’s decision to acquire that business. Potential can be difficult to prove, but a well-documented business plan can give a buyer a comfortable level of understanding about the potential opportunities and challenges for the business in the future.

A business owner’s claims about potential are sometimes discounted by buyers, unless those claims are supported by the type of in-depth historical and current data that is included in a good business plan. A business plan not only helps to prove potential; it also provides the buyer with several ideas on a possible road map on how to achieve that potential.

The first time business owner will sometimes experience anxiety over their ability to successfully manage a business, even though they may be highly qualified. A business plan should help to relieve that anxiety. The plan not only provides valuable information on how to manage a business, but also enables the buyer to benefit from the years of experience of the previous owner. The new owner can see a history of both successes and failures in the business, and they will benefit from the lessons learned by the previous owner.

Gaining Advantage When It Comes Time To Sell

When the day comes to sell your business and you have a strong historical and current business plan to present to buyers, you will have a significant competitive advantage in attracting the attention of qualified buyers and in recognizing the best possible price for the sale of your business.  Many business owners do not have a written business plan. And, for business owners that have a plan, that plan is often lacking in good details and is almost never updated.

Many business owners do not have a written business plan. And, for business owners that have a plan, that plan is often lacking in good details and is almost never updated.

In summary, a good business plan is essential for managing a business effectively and will enable the owner to better grow the value of the business over time.

If you have owned a business for several years, what value would you place on a document that contains the details of every significant development, event and decision made during the life of your business? How valuable would this information be to a new owner?

by Holly Magister, CPA | Sell a Business |

This is the third part in a series called The Exit Interview featuring life-long entrepreneur Bill Hinchey. Read part one and part two here.

For Bill Hinchey, his entrepreneurial journey was one of rapid growth. Just not in the way he initially hoped for. In just 13 years, he saw the sun care product company he started with two partners in a Pennsylvania basement develop into a worldwide leader in the medical device industry.

For Bill Hinchey, his entrepreneurial journey was one of rapid growth. Just not in the way he initially hoped for. In just 13 years, he saw the sun care product company he started with two partners in a Pennsylvania basement develop into a worldwide leader in the medical device industry.

By the early 2000’s, the company, OraSure Technologies, was at the top of its field. Hinchey had survived through embracing innovation rather than resisting it and always keeping a lookout for the next big thing. In 2001, it was time for Hinchey to make his boldest move yet. He got out.

Hinchey sold his business, bought his family a farm and took on the greatest challenge of his life in becoming a fulltime father to his young children. “It was a great opportunity to do things most dads only wish they could do,” Hinchey said. His hiatus from the business world lasted about 10 years. Hinchey says he “found a lot of peace” in his decision, especially since it gave him some time to recharge his battery after working so relentlessly early on in his career to develop his brand.

But while this may seem predictable, Hinchey, like most entrepreneurs, can only be kept at bay for so long before that drive comes back. And so about five years ago when he was invited to judge a business competition at his alma mater, West Virginia University, he found himself being taken “back to where I was 20 years ago.”

There before him were young students with startup passion, much in the way he did when he first entered the marketplace. In particular, there was one presentation that dealt with mobile apps that blew him away and got his motor running once more. On the six-hour drive back to Pennsylvania that night, Hinchey admits it was “all I could think about.”

Already having found success in a market that Hinchey initially had little passion for, this time around he decided to enter one he could relate to. He couldn’t stop thinking about a recent football game he had went to where he looked up from his seat to notice most of the people sitting in his section were zeroed in on their mobile phones.

Hinchey remembered thinking, “The game’s on the field, not on the phone.” But a little more digging revealed a different reason for what at first seemed very bizarre to him. “People want to share the experience,” he said. “That’s what it came down to.”

And living five hours away from his native Pittsburgh, he could relate. Too many times, he thought, he’d just be sitting at home on a Sunday afternoon watching his beloved Steelers with no one to talk to other than some friends through text messages. A social network for sports fan to interact while watching the games seemed like a perfect idea to him. Sure, Hinchey wasn’t versed in social media or app creation, but the same could be said for his venture into the medical device industry as well. Hinchey went to work, began seeking out the right partners and funding sources and before he knew it, Steel City Buzz became a reality.

Having been out of the game for so long and then rushing back with a vengeance, Hinchey said that while the terminologies and players are now different, being a successful entrepreneur today still “takes the same as it did in the old days.” A good team, strong commitment and positive outlook are all keys to success, he says. “Always find the positive in every situation because you’re going to have a lot of negatives,” Hinchey said. The app is healthily growing and Hinchey says he’s not ruling out expansion either. Best part about it, he says, is he’s having fun building it everyday.

From the start, it’s always been about innovation for Hinchey. Sunscreen, medical devices and now internet apps. He says he’s fully committed right now but given his track record, he has no idea where his entrepreneurial spirit might lead him next. “Based on history, I wouldn’t be surprised when I’m 62 if I’m in a completely different business,” he laughs.

by Holly Magister, CPA | Sell a Business |

This is the second part in a series called The Exit Interview featuring life-long entrepreneur Bill Hinchey. Read part one here.

It’s the late 1980’s and Bill Hinchey just saw his young company, Solar Care Technologies, featured in a complimentary Wall Street Journal piece. Hinchey, along with two other guys he met while working for consumer products giant Proctor and Gamble, had recently set up shop in a business incubator in Pennsylvania’s Lehigh Valley to develop a sunscreen towelette.

It’s the late 1980’s and Bill Hinchey just saw his young company, Solar Care Technologies, featured in a complimentary Wall Street Journal piece. Hinchey, along with two other guys he met while working for consumer products giant Proctor and Gamble, had recently set up shop in a business incubator in Pennsylvania’s Lehigh Valley to develop a sunscreen towelette.

Undoubtedly the article had given Hinchey’s business a boost, upping its exposure and putting its name on the map. But as most young entrepreneurs come to learn, everyday is by no means another slam dunk waiting to happen.

As cliché as it sounds, one of the hardest parts is making sure the glass is always half-full, he says. That’s especially the case when in your first nine months of business, you rely on part-time work like delivering phone books to help pay the bills.

But that’s also where having the right business partners comes into play. “We were our own toughest critics but we were also there to support each other when we needed help,” Hinchey says.

The trio quickly realized that while their product was good, the market was still dominated by its biggest players. So when they had an opportunity just two years in to enter a licensing deal with Schering-Plough, then-parent company of industry leader Coppertone, they seized it.

But Hinchey and his partners are entrepreneurs and settling for a licensing deal after two years just wasn’t in the cards for them. And that’s where their tale gets rather interesting. Especially if you keep in mind that at this time George H.W. Bush was president and Al Gore had yet to invent the internet.

About a year after landing the Coppertone deal, the trio was approached by a Dutch medical device company that had caught the Journal piece some years back and was searching for a “young, hungry company” to move their products in the United States.

Sure, not one of them had the slightest idea about pushing medical devices. But a connection was made, a deal was signed, and before they knew it, Hinchey and his partners became the American importers for the company distributing their products across the country.

“Clearly our strategy back then was ‘Let’s throw a couple things against the wall and see what sticks,’” Hinchey said. “What was fortunate for us (was that) everything we threw against the wall stuck.”

And into the medical device market they went.

Willing to try it all out, the partners took a gamble on developing clinical chemistry test kits. Three years later, they went from zero kits to just about 40 million. Five years into the market and they bought the Dutch company that first sought them out.

“It’s mind boggling when I look back and say, ‘Did we really pull that off?’”

Hinchey’s company, which would then change its name to a more appropriate OraSure Technologies, continued to experiment within the marketplace, going on to create a saliva-based test for HIV, which he admits was a “game changer” in the early 1990’s.

For Hinchey, innovation was never a fear. It was a driver. And as he found out, sometimes that requires letting go of that great first idea and chasing the next one.

“You’ve got to be willing to cast that aside and go after what’s the new opportunity,” Hinchey said. You can’t have blinders on.”

by Holly Magister, CPA | Sell a Business |

This is the second part in a series called The Exit Interview featuring life-long entrepreneur Bill Hinchey. Read part two here.

So here’s the setting.

It’s Pittsburgh in the 1970’s and no longer will just “working hard” make ends meet. Pink slips are coming down in a flurry as the blue collar industries which helped build the city are quickly transitioning into rustbelt relics.

Growing up amidst this evident shift, Bill Hinchey doubts his father’s instructions could have resonated any clearer. At its core, his father’s message more or less embodied the same one that was most likely passed down to him. Work hard, he told his son, but again, this was 1970’s Pittsburgh. Even some of the hardest workers were coming down hard on their luck.

“My father drove it in to me that one of his wishes was for me to be my own boss,” Hinchey said. “Whether that’s running a pizza shop or having my own company, he just thought that you’re going to work hard no matter what you do and he felt that it was in my best interest if I was going to work hard, to work hard for myself and not let somebody else control my own destiny.”

And so, an entrepreneur was born. Hinchey didn’t dive right into the pool, but it didn’t take him long either.

At 27 and just out of graduate school at Carnegie Mellon in Pittsburgh, Hinchey packed his bags for Cincinnati for a job in the beverage division at Proctor and Gamble, the world’s largest consumer products company. Hinchey would go on to stay there a mere 16 months but he’ll admit that it only took him six days to realize he wasn’t cut out for the role.

While daring as many of these ventures are, it wasn’t necessarily a blind leap. Hinchey had just spent nearly a year and a half at a worldwide leader in consumer goods, had a working product in mind and had made two likeminded friends there which he says were also bitten by the “entrepreneurial bug.”

“If I was going to take a really high risk, that was the time in my life to do it,” Hinchey says.

The group had heard about a business incubator center in Bethlehem, Pa. on the campus of Lehigh University, where one of the three had studied. The opportunity to start a new business became too enticing and so once again, Hinchey found himself packing his bags.

“I know if I didn’t do it then that I would regret it for the rest of my life,” Hinchey said.

And just like that, Solar Care Technologies was born and the product the three developed, a sunscreen towelette, was so simple yet at the same time so innovative. Not only did it completely repackage sunscreen for portable usage, but it also became the first time the product was marketed for sports and recreation purposes rather than just the beach.

“We hit the market at the right time,” Hinchey said.

Quickly, the education and experience that the three brought to the table shined through as they conducted extensive market research and worked on product branding.

“When our product hit the marketplace, it looked like big-time execution,” Hinchey said. “It didn’t look like three guys and a dog in a basement making these things.”

A little entrepreneurial spirit didn’t hurt, either.

“You’ll never meet a successful entrepreneur that’s not a passionate person and can’t sell their story,” Hinchey says. “We just don’t take no for an answer. We’re the most persistent people on the planet.”

And validation came fast. Just a year in, the nascent company received acclaim in a Friday piece published in the Wall Street Journal. The story, he says, helped give the company both “incredible credibility and visibility.”

“It’s one thing to have your uncle Charlie tell you (that) you have a good idea,” Hinchey said. “It’s another thing to have the Wall Street Journal put the spotlight on you.”

Little did Hinchey know at the time, the exposure from that story would help take his company to new heights and the product developed in an incubator in tiny Bethlehem would soon reach customers around the world.

This is the first part in a series called The Exit Interview featuring life-long entrepreneur Bill Hinchey. Read part two here.

by The Contributors | Sell a Business |

For many entrepreneurs protecting the livelihoods of loyal employees after selling their business is an important consideration.

For many entrepreneurs protecting the livelihoods of loyal employees after selling their business is an important consideration.

There is always a fear that a trade sale to a rival will lead to job losses, perhaps even the closure of the entire business, as the new owners seek to boost profits by eliminating duplicated resources. This fear often pushes the entrepreneur towards considering a management buy-out, or even a zero consideration transfer of all or part of the company to other family members.

When advising a client facing this dilemma I always ask them to consider three important questions about their exit:

How do they see the timing of their exit? – do you want to leave right away or are you prepared to work on a full or part time basis for a period of time to facilitate the handover.

Who do they really want to sell the company to? – are you emotionally committed to a sale to existing employees or family members, or do you want to maximize value by finding a trade buyer that sees strategic gains?

How much money do they need to fund their future lifestyle? – a management buy-out or family transfer will probably mean a lower total consideration and payment on deferred terms over an extended period; can you really afford to wait for payment, and take the risk that things will go wrong?

The truth is that in most cases there is a tension between emotional and financial priorities. Employees and family members rarely have the resources to buy a company for cash up front. There is unlikely to be any post sale uplift of profit from cost reduction or cross selling opportunities that a trade buyer might enjoy, so a lower selling price is almost inevitable. Can you really afford to walk away from a higher selling price? Are you really prepared to wait five maybe even ten years for the full consideration?

You may be one of the lucky few that has built up considerable personal wealth outside the company and feels able to take these risks. You may be willing to continue working in the company in a less hands-on capacity for a number of years to make sure that things stay on track to meet your pay-outs; but this in itself is not a risk free option. For most entrepreneurs though, selling their business is the most important financial transaction of their lives. You will have taken considerable personal risks to build the company in the first place, are you really in a position to roll the dice again?

I try to encourage my clients to approach these difficult issues in the same way as they would any other business decision. Over the years spent building the business you will have faced many decisions that are a complex web of personal, financial, and practical considerations, and will have learned to balance the risks and gains involved.

Try and apply the same objective approach to this dilemma. Is the emotional gratification of doing the right thing really worth the potential losses involved? Putting feelings aside are you 100% confident that your employees and family members have the skills and drive to run the business on their own?

Can you afford the downside if the full selling price is never paid? The choice is yours.

by Andrew Jones | Sell a Business |

Most entrepreneurs build a business with a view to an eventual profitable exit. Most probably have lifestyle aspirations in mind that imply a certain amount of money to be realized from a sale. Whether they are looking at an exit now – or a decade from now – they need more than the subjective opinion of friends and acquaintances as to how much their business is worth. They need to be able to answer the question, “Can my company be sold today for enough money to fund my eventual retirement and lifestyle aspirations?” The answer will probably be no, but getting an objective assessment of the real value of their business now, puts them in a position to plan for the size of business they will eventually need to build.

Most entrepreneurs build a business with a view to an eventual profitable exit. Most probably have lifestyle aspirations in mind that imply a certain amount of money to be realized from a sale. Whether they are looking at an exit now – or a decade from now – they need more than the subjective opinion of friends and acquaintances as to how much their business is worth. They need to be able to answer the question, “Can my company be sold today for enough money to fund my eventual retirement and lifestyle aspirations?” The answer will probably be no, but getting an objective assessment of the real value of their business now, puts them in a position to plan for the size of business they will eventually need to build.

As an active UK Business Broker I talk to many business owners that have reached the point at which they want to, or in some cases have to, retire. Believe me this is not the point at which you want to find out that your business is only worth a fraction of your financial requirements. My job brings home to me every day that there are no guarantees about health, life expectancy, or business sustainability in today’s economy. For any or all of these reasons knowing the current value of your company is an essential part of long term financial planning for retirement. Many ask me when do I need a business valuation?

The type of business valuation you need varies considerably with the circumstances. If you are several years from a sale a full blown valuation is unnecessary. An experienced business broker by investing a few hours analyzing your accounts, and talking to you about the practicalities of your business, will be able to provide a realistic assessment of value. This should not be an expensive exercise. An experienced broker will also point out the features of your business that will worry potential buyers and reduce the selling price, such as an over reliance on your own expertise, or a large part of turnover with one customer. This valuable insight will help you put in place plans to address problems long before it is time to sell.

If you are ready to sell now your broker or another intermediary should provide a formal valuation as part of the initial fee paid for their services. If rather than seeking a third part buyer you plan to sell to employees or family members you will need an expert to prepare an independent valuation as part of the process.

Who should you use to prepare the valuation? Business owners often turn to their accountant to prepare a valuation. This might be a mistake. Most small firms of accountants are primarily tax advisors with little experience of the practicalities of selling a company. To cover this inexperience they tend to value on the high side when advising a seller, and the low side when advising a buyer. Larger firms of accountants will have corporate finance associates that specialize in company sale transactions. Unless your accountants have a specialist associate, find an experienced business broker or a specialist corporate finance advisor to value your company.

by Holly Magister, CPA | Sell a Business |

A Letter of Intent (LOI) to buy a business or its assets may or may not include an expiration date and time.

When the Letter of Intent expiration date and time is defined, the buyer is putting the seller on notice that he or she must either agree to the terms defined in the letter or lose the opportunity to sell the business to the buyer authoring the LOI.

It’s important for the entrepreneur selling his business to understand that the terms defined in the Letter of Intent are negotiable and should be considered carefully and explored with his or her Merger & Acquisition Attorney and CPA. While a Letter of Intent is generally not binding on either party, it defines various deal points important to both the seller and buyer.

Why Include an Expiration in an LOI?

Business buyers may choose to include the expiration date and time in the Letter of Intent because they are actively pursuing the acquisition of several businesses at the same time. If such a buyer did not include an expiration date in the letter, then the deal terms defined may be considered inappropriately by the seller as an ‘offer on the table’ indefinitely.

Buyers who are actively seeking targeted businesses for sale will include the expiration date and time so they may move on to other prospects in a timely manner if the deal terms are not acceptable to the seller.

Typically, a buyer would state its Letter of Intent is open for acceptance for 72 to 96 hours, or in some cases a one-to-two weeks.

by Matt Harnett | Sell a Business |

You may think a management buyout sounds like the management team is getting “taken out”. On the contrary, it is the exact opposite.

An MBO is a fancy acronym for when the current managers buy controlling interest of a company from its owners. That’s a good thing for management!

Often the company begins with the owners being the management team. As time passes and the company grows, new non-owning management members are added, or a second or third generation of family members inherit the business, but are not managing it.

When it comes time for the owner to sell the business, the natural thought is to “sell it to the highest bidder”. This is often done as a part of the “auction” process. Sometimes this makes sense, but other times it does not.

The advantages of selling to the highest bidder include a potential higher valuation. However, a huge disadvantage is that during the selling process the company’s financials and customers’ identity may become known to interested buyers — maybe even your competitors.

Advantages when selling to your management team via an MBO

The management team is an informed buyer. The managers know the business and growth opportunities better than anyone. They are likely to pay a reasonable price because they are confident in their knowledge of the company and their ability to execute growth strategies.

Also, the due diligence phase is typically faster and less intrusive when selling to the management. Management is familiar with the ins and outs and ups and downs of the company.

If you sell your business to an outsider, you may have several potential suitors digging through significant financial and operational details, as they obviously need to know what they are buying.

Ultimately, selling to an outsider will most likely take longer to close a transaction relative to selling to the management team. For these reasons, owners should consider a willing management team as a valid exit option, and not a last resort.

Other advantages of an Management Buyout

By selling to your management, you are rewarding the people who helped make you successful. You are changing their lives and giving them a shot at the American dream.

But just like any important decision with several options, there are pros and cons to a true “auction” process versus an “MBO”. Either situation will make more sense given different dynamics. That said there are certain transactions that are clearly best suited to an MBO.

Either situation will make more sense given different dynamics. That said there are certain transactions that are clearly best suited to an MBO.

So, as you seek to exit your company, it is wise to have an MBO as one of the serious options to consider. Talk with the management and get their thoughts before making a decision on which path to take (i.e. MBO or auction process to an outsider).

Then, talk with potential financial partners who can assist you and the management team in the creation of a financial solution that will work for all parties.

Often, the capital needed for ownership to change hands is available. The financial partner gets a good return for its investment, while a clear path for its exit is structured up front.

Owners get paid, the management team acquires controlling interest, and the financial partner is compensated for the service it provides. All parties benefit.

by Paul Cronin | Sell a Business |

(This is Part 2 in a post series by Transition Planning Expert Paul Cronin. Read Part 1 here.)

So, for all of you not planning, stuck on planning, or simply afraid of selling your business, here are the final 6 ways to leave your company unsuccessfully:

9. Working with conflicting advisors

This owner seeks the advice and support of professionals experienced in the transition process, but the different advisors give the owner different advice. The owner becomes confused and frustrated, and may stop the transition process. (The owner should assemble a team of transition advisors, who will work collaboratively to help the owner transition successfully.)

10. Inadequate value

Because owners didn’t plan adequately, didn’t improve the value of their companies or didn’t work with advisors experienced in the transition process, they didn’t get as much money for their companies as they could have.

E. Retiring Unsuccessfully

11. Exit-decision remorse

In this scenario, an owner makes a quick decision that they want to leave their company and they quickly transfer their company to new owners. They don’t take the time to look at all their options, and don’t have a clear idea of what they want to do with their life after leaving their company. After they have left, they begin to have second thoughts: “Did I make the correct decision? Maybe I should have stayed working longer. Maybe I should have tried to get more money for my company,” etc. Instead of enjoying their new life, they are obsessed by the thought that they may have made the wrong decision.

12. Retirement remorse

Owners may successfully transfer their companies to new ownership, but if they didn’t have a plan for a fulfilling new future, they don’t know what to do now with all their free time. They can become bored, even depressed, and miss their old lives as owners. At least then they had something interesting and meaningful to do. They think, “I shouldn’t have left. I don’t know what to do with my life now.”

13. Retirement rut

In this scenario, owners have successfully left their companies but didn’t plan what to do with their new lives. Because as owners they were busy all the time, they now find ways to become constantly busy, but these new activities don’t give them a sense of meaning or purpose. They have dug themselves into a hole of meaningless activity and feel unsatisfied and depressed, but don’t know how to make their lives more meaningful.

14. Post-Transaction Stress Disorder (PTSD)

In Post-Transaction Stress Disorder, owners successfully left their companies, and even had a plan for what to do with their new lives. But their plan was very limited and one-dimensional – for example, “I’ll play golf,” or “I’ll spend time with my grandkids.” They soon realize that their one plan is not working out as they imagined, and this one activity isn’t enough to bring them new meaning and purpose. They become bored and depressed. What they need is a more multi-sided, comprehensive and well thought-out plan for their new lives.

15. Financial deficit