by Holly Magister, CPA | Grow a Business |

Many small business owners borrow money to start and grow their business. And is often the case those same business owners find themselves hitting credit limits established by banks and other lenders causing enormous growing pains for the business. Simply stated, running out of business capital when you’re growing a business is difficult at best.

Although debt financing offers a business owner the least costly form of capital to grow and maintain a business, a business owner may find himself in a position where his business is growing so rapidly and he’s unable to borrow enough money to adequately finance or capitalize his business. We call this situation hyper-growth and it often forces the business owner to add another form of more expensive (borrowed) capital to the balance sheet.

Although debt financing offers a business owner the least costly form of capital to grow and maintain a business, a business owner may find himself in a position where his business is growing so rapidly and he’s unable to borrow enough money to adequately finance or capitalize his business. We call this situation hyper-growth and it often forces the business owner to add another form of more expensive (borrowed) capital to the balance sheet.

Before we explore how the cost of debt impacts how a business may grow, let’s establish how to compute its total cost.

Facts and Figures for the Cost of Debt Computation

From the borrower’s perspective, the cost of debt is defined as an annual rate similar to the annual rate of return on an investment in common stock or bonds. In this case, the lender is offering money to the business borrower and receives a rate of return, expressed in an annual timeframe, on its loan.

To compute the cost of debt for the business borrower, you will need to know the following information:

- Interest or Funding Fee charged by the Bank or other Lender (expressed in the form of a % of the amount borrowed).Note whether the interest rate is expressed in a daily, monthly or annual timeframe here: ___________ You will need to know this important fact when you start to compute the total cost of debt.

- Amount of Money Borrowed $_____________

- Application Fee (this fee is typically a flat or stated amount or expressed as a %) $_____________ or _____________%

- Origination Fee (this fee is typically a flat or stated amount or expressed as a %) $_____________ or _____________%

- Idle Usage Fee (this fee may be assessed by the lender if a line of credit is not fully utilized by the business and may be a flat or stated amount or expressed as a %) $_____________ or _____________%

- Early Payoff Fee (this fee may be expressed in a flat amount or in the form of a %) $_____________ or _____________%

Calculate the Cost of Debt for Your Business

Once you’ve identified all of the fees typically associated with borrowed capital, you will be able to calculate the cost of debt. This formula may be used to compare the total cost of borrowed capital between banks and other lenders to identify the least cost alternative.

Download our free workbook and enter in your own facts and figures to compute your cost of debt. The workbook has three examples: One shows all of the various costs a lender may assess; the second is an example of typical Bank Loan costs; and the third is an example of Alternative Lender costs. The workbook also includes several spreadsheets loaded with the formulas and ready for your own data input.

In fact, if you have several banks or lenders offering you a loan or line of credit, this tool may help you understand how the terms offered translate into the true cost of debt in order to determine which lender is making you the best offer.

Despite the fact that debt is typically the least costly form of capital, many business owners are averse to the notion of borrowing money for their business. In many cases, it is because the business owner doesn’t understand the relationship between the cost of debt and the opportunity to grow their business and their profit.

Contrary to what many business owners believe, there are times when it is foolish for a business owner to avoid debt. While that statement may seem very bold, let’s spend some time looking at the cost of debt and how it relates to a few measurements of business profitability so I may explain further.

When a business owner uses debt (or any other form of capital) to grow his business, he should pay attention to the cost of debt (or other capital) as it relates to the business’ gross profit margin and net operating income margin. It is wise to be mindful that the cost of debt (or capital) should not exceed either the business’ gross profit margin or its net operating income margin. To illustrate, let’s review an example and start with the definitions of gross profit margin and net operating income margin.

The Gross Profit Margin is that portion (or percentage) of every sales dollar generated which remains after the direct cost to create the product or service is deducted. If you’re selling widgets for $1.00 and they cost 60 cents to manufacture, then the company’s Gross Profit Margin is $.40 or 40%.

The Net Operating Income Margin is the profit (or percentage) of every dollar in sales generated that remains after the direct cost to deliver the product or services as well as the indirect costs to operate the business are deducted. Indirect costs would be expenses like rent, insurance, professional fees, etc. If you’re selling widgets with a gross profit margin of 40% and your indirect expenses total 21% of sales, then your company’s Net Operating Income Margin (or Net Profit Margin) would be 19%.

Cost of Debt vs. Gross and Net Profit Margins

In the example noted above, a business generating a 19% net operating income margin (or net profit margin) has enough income from every additional sale to justify borrowing money to grow its sales as long as the cost of debt is equal to or less than the net operating income margin rate of 19%.

Similarly, if a business is generating 40% gross profit from every sale and its indirect costs are relatively static, it stands to reason that every additional dollar of revenue could significantly increase the business’ net operating income margin. Accordingly, this reasoning contributes to the theory that may justify a business borrowing money to grow sales at a cost of debt equal to or less than its gross profit margin rate of 40%.

A Few Important Notes Regarding Cost of Debt for the Business Owner

1. Applying the cost of debt analysis is valid when you consider the cost of capital, regardless of its source. In other words, this comparison of the cost of debt to the gross margin and net operating margin is also valid when considering the use of other forms of capital such as mezzanine or equity.

2. Most businesses are unable to sustain in the long term the practice of borrowing when the cost of debt is in excess of 20% simply because they don’t have high gross profit margins nor do they have static operating expenses. On the other hand, a business in certain industries that enjoy a relatively high gross profit margin, is more likely to take advantage of borrowing or financing with relatively more expensive capital.

A business has opportunities to grow its sales by borrowing money to finance the production of products or the delivery of services at a cost of debt which is within the limits of its Net Operating Income Margin, and in certain cases within the limits of its Gross Profit Margin. It’s imperative for the business owner to fully understand the business’ cost of capital before making the decision to grow the business with borrowed or other forms of capital.

by Kathleen Kuznicki | Grow a Business |

When people come to talk with me about patenting their inventive idea, inevitably this question arises: “How long does it take to get a patent?” When I tell them the patent approval process will probably take close to three years, their jaws drop in surprise. “Really, it’s going to take that long?” YES.

I know it is disconcerting. An innovator spends all that time and effort developing an inventive product or process, spends all that time and effort to market or license their invention, and spends all that time and effort working with an attorney to translate their invention into a patent application, at great financial cost and risk to themselves, just to have their patent application languish at the United States Patent and Trademark Office (USPTO). In this article I am going to discuss the process at the USPTO and some of their metrics (as of February 2014) to explain why patent application pendency at the USPTO is so long. So even though you may not like the long pendency, you will understand why.

The Short Answer

The USPTO is being swamped with patent applications and does not have enough examiners to process them. Also some applicants will fight the USPTO to the “bitter end” to get a patent issued through the USPTO’s various procedures. This causes an examiner to file several actions against an inventive concept, increasing the overall prosecution time, and ultimately causing the whole patent application system to back up.

The Long Answer — The Patent Approval Process

In 2012, the last year for which statistics are available, 542,815 patent applications were filed. The last several years have seen a steady rise in patent application filings, with 2005 being the last year that less than 400,000 patent applications were filed (390,733). As of February 2014 there are 7,966 patent examiners with a backlog of 604,692 patent applications to be examined. This backlog is down from September of 2011 when the backlog was over 700,000 patent applications.

The longest stretch of time for an applicant is actually waiting for their patent application to be examined initially. As of February 2014 the average pendency before the first office action is 18.1 months (down from 27 months in Oct. 2011) with an average total pendency of 28.1 months for final disposition of the patent application, i.e. an allowance or an abandonment (down from 34 months in Oct. 2011). An allowance means that the claims were accepted by the examiner and that a patent will issue from the application. An abandonment means that the applicant is no longer pursuing a patent, i.e. they give up on the application. For those that give up after the first office action, the average disposal time will average approximately 24 months (applications are abandoned if there is no response within 6 months of the mailing date of the office action). For those that choose to go on and fight after their first office action, the disposition time will be closer to the three year mark.

The final disposition rate stated above does not include prosecutions that are continued by the filing of Requests for Continued Examination (RCEs), which occurs after the second office action which is usually deemed a final office action. If an applicant wants to fight and make further arguments and/or amendments to get an allowance after a final office action on a specific application, they must file the RCE and pay the additional cost. The final disposition rate average is increased to 37.9 months when RCEs are included. Applicants may also choose to file a continuation, a divisional, or a continuation-in-part application that claims priority to an original parent application that is given a final disposition. Though these child applications are considered new applications for the USPTO timing metrics discussed above, they contribute the backlog of applications that need to be examined. One inventive concept may have several patent applications pending at the USPTO.

For those who wish to have a quicker disposition of their patent application, applicants can opt to file for Prioritized Examination. The goal for applications filed under Prioritized Examination is to have a final disposition within 12 months of prioritized status being granted. There are some restrictions for these applications. There can be no more than 4 independent claims, no more than 30 total claims and no multiple dependent claims. There is also a substantial fee – $4,000 for non-small entities, $2,000 for small entities and $1,000 for micro-entities. At this time the USPTO is limiting the total number of applications granted prioritized status to 10,000 per fiscal year. For fiscal year 2013 a total of 6872 prioritized examination requests were made, with 6333 of them granted prioritized status (14 remain pending). For fiscal year 2014 so far there are 3,774 prioritized examination requests with 2,645 of them being granted prioritized status and 986 remaining pending. The pendency for the first office action on prioritized examination applications has averaged 2.46 months with a total pendency to a final disposition on these applications averaging 6.55 months. The USPTO also has Accelerated Examination Programs, but these have very specific requirements and are too complex to go into detail here.

So if you wish to pursue getting a patent issued on your inventive concept, you need to be patient and you need to be prepared to wait!!

by Chris George | Grow a Business |

Most individuals who consider themselves entrepreneurs believe they must start their own business to earn the title. However, what some do not realize is that the entrepreneurial spirit can be fulfilled in a variety of ways, not the least of which is purchasing an existing business. The following is a list of advantages for buying a business over starting one from scratch.

Startup Costs

One of the biggest reasons many entrepreneurs cite for not starting their own business is the high cost of startup. Depending on the industry, these costs could range from thousands to millions of dollars. In the long run, purchasing a business can often prove to be less expensive than starting one because the inventory and equipment are included in the purchase price. While the upfront costs of buying a business typically are higher than what an owner would put into the business initially, it is important to consider the owner’s time and the cost of paying someone to do all of the creative work and implementation.

Existing Customers

Not only does the business come with inventory and equipment, but there are existing customers to consider. One of the most difficult aspects of building a business is finding customers that will not only utilize the business, but become repeat clientele. When buying a business, the cash flow is immediate and does not need to be built up, which can often take years. A previously established market and customer base is quite valuable. However, it is important to decipher if the clients’ loyalty lies solely with the business owner, or if it’s with the business and brand itself.

Goodwill/Branding

The owner of the startup has already done a lot of the hard work for the buyer. Building a brand and commercial goodwill take both time and money. If the business demonstrates a positive track record with its customers, then brand loyalty is established already and only needs to be nurtured.

Now care must be taken to ensure that an overabundance of personal goodwill is not connected with the existing business owner. Personal goodwill often includes things such as unique skills, exclusive access to clients and information, and a personal tie-in to the overall brand. Too much personal goodwill will cause the business to lose value once the owner leaves.

Established Procedures

The original owner will have already set all of the groundwork for future employees, including the buyer. Rather than having to do the work of determining best practices, this has already been done for the buyer. Much of the time spent on the creation and management of official procedures is saved when one acquires an existing business.

Perhaps the advantages of buying an existing business over launching a start-up may be the right path for you.

by Chris George | Grow a Business |

Finding the potential acquisitions, having a source of capital, and possessing negotiation savvy are all important elements when buying a business. However, people often overlook the attitude of the buyer and how greatly it can affect the outcome of the deal.

Confidence is key. The buyer demonstrating that they are qualified to run the business is crucial to completing a deal, because a seller, who has poured their life into building their business, will want to be assured that they are leaving it in good hands.

A balance between confidence and an understanding of what it truly takes to run a business is needed to close a deal. Confidence that borders on arrogance will put off a seller, since they are well aware of the difficulty of managing their business and will not want to feel belittled. A seller will be able to see through a buyer that is overconfident in their skills. While attitude is important, so is a solid background in business.

The best way for a buyer to ensure that they have an adequate understanding of the business is to learn as much as they can about the company before making an offer and perform thorough due diligence. As with job interviews, it is vital that one enter the business buying process with complete knowledge of the company in question, understanding their unique challenges and prospects, and be able to indicate this to the seller.

Observe the attitude of the seller as well. Do they seem that they have lost faith in the business? Are they itching to get it off their hands, or are they struggling to let go? Both of these emotions can have their pros and cons.

A seller that wants to abandon their business as quickly as possible could see some potential faults of which the buyer is not yet fully aware. On the other hand, they could simply be burnt out and all that the business needs is some new management to become even more successful than it has been in the past.

If the business owner is hesitant about selling their business, it does not always indicate the health of the business either. It could be that it is failing and they are not quite willing to admit this fact to themselves . On the other hand, they could also be burnt out but feel that the potential is still there, which is why they have made the difficult decision to sell. Attitude is everything but sometimes it can be difficult to put into definite terms without a bit of intuition.

It is important to examine the attitudes of the company’s clients as well. Are they completely loyal to the business owner, and is there a potential for them to leave once the company changes hands? Are they disenchanted with the direction that the business has gone, and is there still a possibility to turn this around? Understanding the customer base is vital to determining the viability of a target.

by Matt Harnett | Grow a Business |

As markets recovered post-recession, business owners have been presented with many growth opportunities. These opportunities may include:

- Financing an acquisition

- Entering a new market

- Launching a new product line

- Expanding a plant or adding a new manufacturing process

- Adding a new distribution channel

And the list goes on….

However, a business owner may not have access to the capital needed to execute on a growth strategy.

Where does a business owner turn?

- One option is turning to commercial banks. While the cheapest option, banks often require personal guarantees and collateral available to support the entire loan amount which is often unrealistic during growth periods, when making an acquisition or when financing a business which is not capital intensive.

- Another option is equity capital. However, new equity is expensive because the company trades a cash investment for shares of the company, resulting in the dilution of the existing owners. “Last-in” capital will often require a premium ownership interest in the company – greater than the pro rata share of the actual dollars invested as well as certain Board control rights.

- Fortunately, there is a capital market in-between senior debt and equity financing called mezzanine debt. Mezzanine debt is also referred to as subordinated debt or junior capital.

Mezzanine Market and Definitions

- Mezzanine investors seek profitable companies with growth opportunities that are not able to obtain all the capital needed from a senior bank.

- Mezzanine investors evaluate the predictability of future cash flows and the company’s ability to provide repayment of its temporary capital. As such, “mezz” investors target established businesses with profitable track records because cash flow is required to service the interest only payments. Mezzanine is not available for start-ups or as venture capital

- In general, the mezzanine investor targets companies with revenues of $10-100 million and EBITDA of $2-10 million, and seeks to invest between $3-15 million into each company – often thought of as the “lower middle market”.

- Mezzanine is privately negotiated and customized to the particular need of the business and “fills the gap” on the company’s balance sheet between senior secured debt and equity. This is where mezzanine gets its name. It is in the middle of debt and equity, and is derived from the Italian word mezzano, which means middle.

Features of Mezzanine Debt Include:

- More expensive than senior debt and less expensive and less dilutive than private equity.

- Senior debt requires principal repayment which decreases the amount of capital available for growth, unlike mezz which is non-amortizing / balloon.

- Even though equity does not require a current interest cost, it is the most expensive form of capital. This is because the new equity receives its pro-rata portion of the company’s profits in perpetuity. Also, if the company is sold, the new equity gets a large portion of that cash, which dilutes the value of the original owner’s shares.

- Does not require management control. Mezzanine is “temporary capital” that fills a need. Mezzanine does not seek to be a long-term shareholder, but rather to achieve a target return within a 3-7 year period. Accordingly, Mezz does not require a change of control to exit (unlike equity). However, if the investment matures and the company is not able to refinance and repay the mezzanine note, the mezzanine investor may require a sale to seek repayment of the obligations due.

- That said, businesses often utilize a mezzanine debt investment to support growth and maximize revenue and EBITDA (and therefore increase equity value) with the ultimate goal of selling and exiting the business within a 3-7 year time period.

- Flexible terms that reinforce a growth plan. Mezzanine investors typically do not require the business to amortize the debt for 5 years. Because the debt is interest only it allows the company to reinvest cash flows into the business instead of amortizing debt. This is also more tax efficient when compared to equity capital.

- Mezzanine capital will be subordinated to senior financing and is not as liquid as other forms of traditional debt. As such, mezzanine receives a higher coupon, often 12-14% interest only. On average, mezzanine investors target “all-in” returns of 14-18% depending on the risk of a deal, which is less than the 25-35% targeted by equity investors.

- As such, depending on the risk/reward profile on the transaction, mezzanine investors often negotiate an equity co-invest or warrant alongside their debt to supplement their return (referred to as an “equity kicker”). In this situation, the mezzanine investor is likely to offer strategic support to the business.

When growing your company, mezzanine debt is an attractive option for the savvy business owner. If you have a solid business with a good growth plan, you will find investors that are interested in providing the capital. In fact, if the opportunity is very attractive, you may have several “bags of money” sitting on the table and you can pick your favorite one! The value and relevant experience that each mezzanine partner offers will be different. Therefore, when selecting be sure to:

When growing your company, mezzanine debt is an attractive option for the savvy business owner. If you have a solid business with a good growth plan, you will find investors that are interested in providing the capital. In fact, if the opportunity is very attractive, you may have several “bags of money” sitting on the table and you can pick your favorite one! The value and relevant experience that each mezzanine partner offers will be different. Therefore, when selecting be sure to:

- Decide what you are looking for and what are the differentiating factors of the investors.

- Evaluate the overall cultural fit

- Ask “how will you all react in tough times?”

- Assess their track record with companies like yours, and

- Measure the value you feel each investor brings to your company.

In the end you are picking a partner, so choose wisely!

by Holly Magister, CPA | Grow a Business |

If you’ve grown a valuable business, there is no doubt your employees are a big part of your success. You also know that hiring, training, and managing a great team of productive employees is a difficult task. And keeping your best employees is yet another accomplishment! But the painful truth is your competition would be very pleased to hire away your best employees.

After devoting great resources to their development, many entrepreneurs worry about the potential loss of valuable employees to their competitors. They worry they may become vulnerable to demands for promotions, pay raises, increased benefits, and perks. They worry about having employees who are not under some form of contractual agreement because when it becomes time to sell the business its value will be less. Entrepreneurs were advised in the past few decades to address these concerns through the use of a non-compete clause in an employment agreement. But increasingly and in many jurisdictions the enforcement of a non-compete clause, where an employee agrees not to work for a competitor within a certain geographical location for a defined period of time, has become problematic at best.

We now see successful entrepreneurs addressing this problem proactively by using non-solicitation clauses in various agreements to keep their best employees on board without the use of restrictive employment non-compete agreements.

How to Keep Your Best Employees with a Non Solicitation Agreement

1. Employment Agreement Non Solicitation Clause

Successful entrepreneurs respect the fact that certain employees will move on. Such employees may not like the way the business is managed, or they simply may find greener pastures. The wise entrepreneur also recognizes there is a level of employee departure that is ordinary and not cause for alarm. However, it is also wise to protect your investment in employee development by preventing such departing employees from pilfering those who remain with the organization through the use of an employment agreement non solicitation clause.

An employment agreement non solicitation clause states that the employee agrees, during the term of his or her employment, and for a stated period of time after, to not directly or indirectly solicit for hire or create other forms of contractual relationships with remaining members of the entrepreneur’s business.

2. Confidentiality Agreements Non Solicitation Clause

Another use of a non solicitation clause focuses on when entrepreneurs open up their business affairs to outside parties, such as banks, vendors, suppliers, advisors, and others. Since an enormous amount of confidential information is shared between the parties, every entrepreneur should have in his quiver a ‘standard’ confidentiality agreement containing a non-solicitation clause which any third or outside party must execute before meaningful conversations about the business commence. Such use of a non-solicitation clause in a confidentiality agreement will protect the entrepreneur from outside parties soliciting for hire or creating other contractual relationships with employees.

3. Strategic Partnership Non Solicitation Clause

Unfortunately, not all conversations about potential strategic partnerships begin with the execution of a confidentiality agreement. Everyone is excited about the synergistic potential of a partnership and the parties begin to share information. If all goes well, a strategic partnership agreement is formulated and executed ultimately. But regardless of the presence or absence of a confidentiality agreement prior to execution, the strategic partnership agreement should always include a non-solicitation clause which prevents all parties from soliciting employees or creating relationships outside of the agreement for a specified period of time.

4. Letter of Intent Employee Non Solicitation Clause

When an entrepreneur sells his business, he typically receives a Letter of Intent from the prospective buyer. Letters of Intent are negotiable between the parties and its defined terms and conditions should serve as the platform from which the ultimate stock or asset purchase agreement is drafted.

Although most negotiations between a buyer and a seller of a business typically start with a confidentiality agreement, such agreements do not always include an employee non-solicitation clause. Accordingly, negotiating the employee non-solicitation clause into the Letter of Intent to buy a business is prudent as it will ensure the buyer won’t be soliciting the business’s best employees in the event negotiations fail.

5. Love Your Best Employees

Embedding a non-compete clause into an employment agreement to keep employees from working for the competition was the method of choice used by many entrepreneurs for several decades. Over time, entrepreneurs and employees alike have learned this method often caused more trouble than intended.

The use of non-solicitation clauses in an employment agreement coupled with their inclusion in agreements with outside parties protects the entrepreneur’s investment in developing productive employees. It also allows an employee the freedom to seek and work wherever he or she chooses.

The successful entrepreneur recognizes that a restrictive non-compete agreement with his employees is not necessary. In many cases, keeping the best employees from jumping ship may be accomplished simply by placing the employees’ interests first. It’s a golden rule that in many cases does the trick!

by Sabrina Baker | Grow a Business |

For most companies, the end of the year is a time when employees and leaders go through the annual review process. This process is designed to rate performance for the year and, if applicable, apply a merit increase. Many companies consider this their performance management system. A true performance management system however is much more involved.

For most companies, the end of the year is a time when employees and leaders go through the annual review process. This process is designed to rate performance for the year and, if applicable, apply a merit increase. Many companies consider this their performance management system. A true performance management system however is much more involved.

True performance management is an ongoing process. It occurs all year long. It involves ongoing dialogue between leader and employee. It requires constant alignment of employee goals against business objectives. It fosters the ability to make a meaningful impact on employee performance for both the sake of the employee and the company.

When implementing a performance management system, there are three keys to making the system effective.

Performance Management Alignment

As I mentioned above, an effective performance management system aligns business objectives with employee goals. It takes a look at company culture and strategic direction and creates goals based on those objectives. This alignment helps each employee understand how they contribute to the growth of the company. When employees feel that their contributions make a difference, they are more effective.

Communication Between Leader and Employee

Effective performance management systems create an environment where open communication between leader and employee is not only encouraged but expected. The leader should be willing and able to provide performance feedback at any given time, not just at annual performance review time. In turn, the employee should be able to provide feedback about what they may need to better perform their job. Similarly an employee should feel free to talk about the desired direction they want their career to go and how the company may help them get there.

Consistency Identifying Good or Poor Performance

In any performance management system, the true test of its effectiveness is whether it can consistently identify good or poor performance. Meaning, the system should be very clear about what good performance looks like, what bad performance looks like, and the rewards or consequences associated with both. This system should be applied across all employees at all levels. To accomplish this, identifying behaviors and goals must begin early in the design phase and, once completed, everyone must be trained on how to identify effectively the differences in performance. A performance management system that does not apply standards consistently serves to inhibit company growth rather than influence it positively.

A performance management system that does not apply standards consistently serves to inhibit company growth rather than influence it positively.

While the overall design of a performance management system can be a bit complicated, keeping these three keys in mind will help focus the project. In the end, moving from just an employee appraisal system to an overall performance management system is what allows employee performance to truly have a positive impact on company performance. Without it, chances are good that leaders and employees are just checking the box at annual performance review time and giving it little to no thought the rest of the year.

by Kathleen Kuznicki | Grow a Business |

Persons or businesses that own intellectual property have certain rights in that property. Intellectual property includes copyrights, trademarks, patents, and trade secrets.

Persons or businesses that own intellectual property have certain rights in that property. Intellectual property includes copyrights, trademarks, patents, and trade secrets.

Owners of these properties are free to give as little, or as many, of their rights in these assets to other parties. This is done through intellectual property licensing agreements.

In these agreements, an intellectual property rights owner (licensor) authorizes certain rights to another (licensee) in exchange for an agreed payment in the form of either a fee or a royalty, or some combination of both.

It’s important to note that a licensing agreement does not convey ownership; ownership is conveyed through an assignment in which all the rights to an intellectual property are given to another.

When/Why should you be a licensee of intellectual property?

- If you have a product* that potentially infringes another’s intellectual property

- To improve your product by combining it with another’s intellectual property

- To cut down on R&D costs and the time; commercializing your product earlier

- To expand your business by utilizing another’s intellectual property

(*Product is defined broadly as anything that falls under intellectual property such as but not limited to: artistic or literary works, equipment, technology, know how, merchandise with another’s branding, etc.)

When/Why should you be a licensor of intellectual property?

- If you have valuable intellectual property that is desirable to third parties

- If you have intellectual property that you are not utilizing

- To increase your revenue through licensing fees or royalty payments

- To expand the existing market for your business.

What are some of the provisions that should be included in a license agreement?

- A clear definition of the intellectual property that is the subject matter of the agreement

- Any use or field of use limitations

- Whether the agreement is an exclusive or a non-exclusive license

- Any territorial restrictions

- Whether the agreement is perpetual or time limited

- Ownership of the rights to any new intellectual property that might result from the agreement

- Whether the licensee has the right to sublicense

- Amount and structure of fees and/or royalty payments

- Non-disclosure of confidential information provisions

- Requirements for termination of agreement by either party

People try to use template licensing agreements found online or copied elsewhere to keep the cost of drafting an agreement low. However, each licensing situation is unique; individual parties have distinct requirements that need to be fulfilled by their licensing agreements.

The terms of the intellectual property agreement should be specific to the situation at hand. Not ironing out precise details and utilizing broad or vague clauses from template agreements might ultimately result in in higher costs down the line for both parties, because a dispute might arise that ultimately leads to litigation.

by Leilani Costa | Grow a Business |

Gone are the days when companies could choose the exercise price and option terms for stock options without thinking about IRS Code Section 409A consequences. Employees and executives, as well as independent contractors and advisors, could face significant taxes and penalties if their stock options are subject to, but not compliant with, IRS Code Section 409A.

What is Code §409A? Code §409A places restrictions on “nonqualified deferred compensation”, which is compensation that is earned in one year, but is paid (or is payable) in a future year. Stock options having an exercise price less than the stock’s fair market value on the grant date are deemed to be deferred compensation subject to Code §409A.

If Code §409A applies, then stock options generally may be exercisable only upon certain events, including: (i) a separation from service; (ii) disability; (iii) death; (iv) a specified time or fixed schedule; (v) a change in control event; or (vi) an unforeseeable emergency. Thus, the normal ability to exercise a stock option at any time during the option term, where the term extends over multiple years, would violate the requirements of Code §409A.

What happens of Code §409A is violated? If Code §409A is violated, the optionee could be subject to an acceleration of the taxable income, additional 20% income tax, and interest on the unpaid taxes. A recent case – Sutardja v United States, 11 Fed.C1.No.724T (February 27, 2013)—illustrates that the Internal Revenue Service (“IRS”) is willing to litigate Code §409A in the context of stock options. In such case, the IRS is attempting to assess taxes and penalties in excess of $5 million due to an alleged failure of stock options to comply with Code §409A.

Conclusion

Companies should review their stock option plans and granting practices to ensure compliance with Code §409A. Otherwise, as Sutardja illustrates, optionees (whether employees, directors, independent contractors or advisors) may be faced with draconian and significant taxes and penalties.

This document is intended to provide information of general interest and is not intended to offer any legal advice about specific situations or problems. Neither the author nor Metz Lewis Brodman Must O’Keefe LLC intend to create an attorney-client relationship by offering this information, and anyone’s review of the information shall not be deemed to create such a relationship. You should consult a lawyer if you have a legal matter requiring attention.

by Leilani Costa | Grow a Business |

Entering into a new contract is an exciting time for any company. The agreement is signed with the hope that it will grow the business and result in a long, mutually beneficial relationship with the other side. While such optimism is warranted, the importance of entering into a legally sound contract is critical to the protection of your business.

Contract Provisions Checklist

Principal terms, such as pricing, delivery of the particular good or service, and payment terms, are essential. These terms likely will be discussed and resolved during the initial negotiation stage. However, there are also difficult issues that need to be negotiated into the agreement in the event the contract does not perform as expected.

Negotiating the “what ifs” or the pitfalls if the contract goes bad are best addressed at the outset, when the parties are eager to reach an agreement and goodwill is at its highest. Ensuring that the company is adequately protected in the contract can be just as important as securing the contract in the first place. A good contract may not only assist the company in successfully resolving a dispute before it hits the courtroom, but it can also protect the company should litigation ensue.

Here are eight contractual provisions that any company should consider in order to reduce the threat and impact of litigation:

1) Indemnification

In its simplest terms, indemnification is a method of risk allocation and shifts liability from one party onto another. An indemnification clause in a contract can help ensure that the company is not liable for particular losses and/or not liable for damages to a third party.

Indemnification comes in many forms, but at its core, indemnification is a method to shift liability away from the company.

2) Limitation of Liability

This provision limits the types of claims that can be recoverable under a contract. It may also limit a party’s liability to a fixed monetary amount.

3) Insurance

Depending on the type of contract, insurance may play a factor. The company should consider requesting that the other side add the company as an additional insured under an applicable policy of insurance.

In contrast, the other side may request that it be added to your insurance policy. Be sure to check with an insurance broker or other professional when adding another company as an additional insured.

4) Termination Provisions

The termination clause or clauses in a contract should guide the parties on how to legally exit the contract. Often times, termination provisions are given short shrift or ignored entirely. However, the company should proactively and creatively think about potential disputes that can arise under the agreement as a written contract can specifically limit the circumstances under which a party can legally terminate the agreement. Dealing with termination issues at the outset can help avoid headaches down the road.

5) Automatic Renewal

Automatic renewal provisions (or evergreen clauses) provide that a contract automatically renews for a certain period of time unless a party cancels the contract before the automatic renewal date. Evergreen clauses are enforceable in most states.

When entering into a contract that contains an evergreen clause, be sure to calendar the cancellation date in order to avoid having a contract renewed unexpectedly.

6) Default Provisions

There are many ways that a party can default under a contract. The most common reason is failure to pay. Contracts should provide disincentives that discourage a party from defaulting, such as, making the defaulting party responsible for the payment of attorney’s fees and costs, interest, and collection costs incurred by the non-defaulting party to secure performance under the contract.

7) Entire Agreement Clause

Also known as a merger or integration clause, an entire agreement provision declares that the written contract represents the complete and final agreement between the parties. In other words, the written contract supersedes any prior written or oral agreements that the contracting parties might have had before signing the contract.

This type of contractual provision can stop either party from claiming that there were other promises and terms of the agreement that are not written into the contract.

8) Dispute Resolution

8) Dispute Resolution

The parties should address how disputes will be resolved under the contract, whether by mediation, arbitration, or through litigation. Addressing how disputes will be handled in the written contract can help lower the costs of litigation and mandate where and how disputes will be resolved.

While a good contract can propel a company to new heights, a bad contract can be a long-term burden for the business.

The contract provisions checklist above are just a sampling of any number of provisions that should be contemplated when entering into a written agreement. It is important to remember that each contract and transaction is unique and the above provisions may or may not apply depending on the circumstance.

by Jane and Scot Noel | Grow a Business |

Search optimization is all about getting more visitors to your website, right? Not really. If you think about it, SEO should be about getting more customers, not just visitors. Optimization is about attracting and converting your target market, not just any old search. In fact, a badly optimized site can attract all the wrong people.

Search optimization is all about getting more visitors to your website, right? Not really. If you think about it, SEO should be about getting more customers, not just visitors. Optimization is about attracting and converting your target market, not just any old search. In fact, a badly optimized site can attract all the wrong people.

Optimizing Your Way to a Drop in Traffic

The effects of SEO are not always straightforward or predictable. One scenario that can send a chill down the spine of even the most experienced SEO practitioner is a sudden and precipitous drop in web traffic. Certainly, it’s hard to impress the owner of a website with a report that says “visits declined 30% last month and are continuing to fall.”

And while it’s not intuitive, it is possible to create such a report and take credit for a big improvement in the client’s site optimization. Let’s see how.

Websites Can Attract the Wrong Visitors: Don’t Be One of Them

A few examples make it clear how much of your existing traffic might be a waste of time.

Industrial Guardrail vs. Deck Railing. One of our clients manufactures industrial guardrail. A careful examination of their web traffic showed that many of the visits to their site were from people looking for home deck railing. You could tell this by the phrases used in searches, by how quickly they left the site upon arrival, and by a tool in Google Webmaster Tools called “Content Keywords.”

Home improvement consumers were accounting for significant site traffic and contributing nothing to the business.

After carefully reworking site keywords and content, traffic (at first) took a nose dive. But what looked like a problem was actually a step in the right direction.

Machine Parts vs. Metric Conversions. Another interesting case study was a machine parts manufacturer that happened to have metric conversion charts on their website as a convenience for their customers.

Unfortunately, the previous developer had no concept of SEO and managed (just by accident) to optimize the website for “metric conversion tables.” In this case, the lion’s share of traffic to the site was from visitors interested in using the conversion tables, not in purchasing the machine parts manufactured by the company.

Correcting this problem meant an immediate fall off as far as web visits were concerned, but all that lost traffic was meaningless to the success of the company. They would have to be patient as a better traffic pattern built up over time.

Master Remodeling vs. Gutter Cleaning. A slightly different example involves not only optimization but the marketing message and design of a site. For one high-end home construction company the problem involved calls for gutter cleaning, home repair, and other handyman services. In this case not only was the optimization of the site askew, but the graphic design and content was leading visitors astray.

Master Remodeling vs. Gutter Cleaning. A slightly different example involves not only optimization but the marketing message and design of a site. For one high-end home construction company the problem involved calls for gutter cleaning, home repair, and other handyman services. In this case not only was the optimization of the site askew, but the graphic design and content was leading visitors astray.

In an interesting turn, the site was a little too “friendly” to homeowners looking for basic services. They needed a makeover for a high-end look and a message aimed at a more well-to-do target market. Their business is in the design and construction of luxury homes, which meant fielding calls for basic services wasted the time of not only the callers but more importantly, the company’s customer service staff.

Good News in Falling Numbers

Of course it is never a pleasant experience to tell a web site owner their website traffic has been cut in half. After all, they’ve often invested a significant amount in SEO, both in money and trust, to reach that result.

Are there any other numbers we can look at that might offer some good news?

Thankfully, there are! A variety of web statistical tools can provide the data you need. The freely available Google Analytics, for example, is good at providing the following:

- Bounce Rate. A “bounce” refers to a visitor who comes to one page on your site and leaves from the same page. It’s generally considered a sign that they weren’t that interested. A typical bounce rate is 60%. If SEO changes make the bounce rate drop, it’s a sign of reaching a better audience. People are interested enough to explore the site.

- Pages/Visit. If a visitor has some interest in a site, they will likely visit more than one page. They will explore the site. Therefore, as the number of pages per visit increases, it can be seen as a measure of how well the site is engaging the interest of its target market.

- Time on Site. A potential customer is going to have to go through a conversion experience. They need to evaluate what they are seeing and decide whether to make contact or look elsewhere. That takes time, even if it’s only a few seconds more on average. Therefore, the time on site increases, the more likely the site is engaging with the right audience.

- Visitor Flow or Paths. Exactly what are visitors doing when they reach your site? Following the paths they take in stepping from page to page can be instructive. Do they flit around as if lost? Are they walking through a logical path? If a path includes the About Us page and ends on Contact Us, it can be inferred they found something of interest, attempted to validate your qualifications, and then decided to make contact. Most paths are not so straightforward, but all have the potential to tell you something about visitor behavior.

Summary

Successful SEO does not always mean increased web traffic. Depending on what has been happening before optimization, improved search results may mean a drop in traffic. If done well, however, over time more useful traffic should be attracted and the downward curve is likely to reverse for a more successful upward trend, one that brings in the right target market and more valuable results.

Learn more about Jane and Scot Noel, the owners of Chroma Marketing Essentials, a web development company. Since 1999, CME’s reputation for developing search engine friendly websites has attracted a variety of industrial, consumer, and professional web clients.

by Holly Magister, CPA | Grow a Business |

Profitability is directly related to a company’s gross revenue, particularly as it relates to its varied customer types.

What does gross revenue mean to your company’s profitability?

Everything.

Let’s back up to review the concepts we’ve covered in previous posts so we may explore gross revenue further.

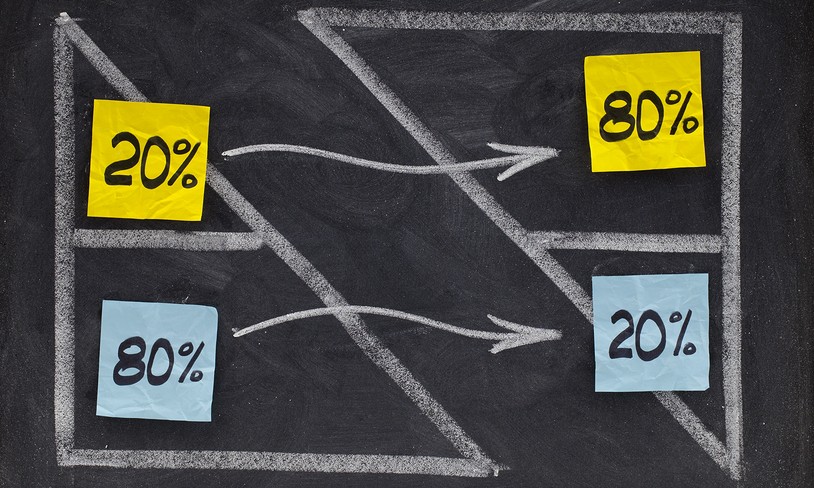

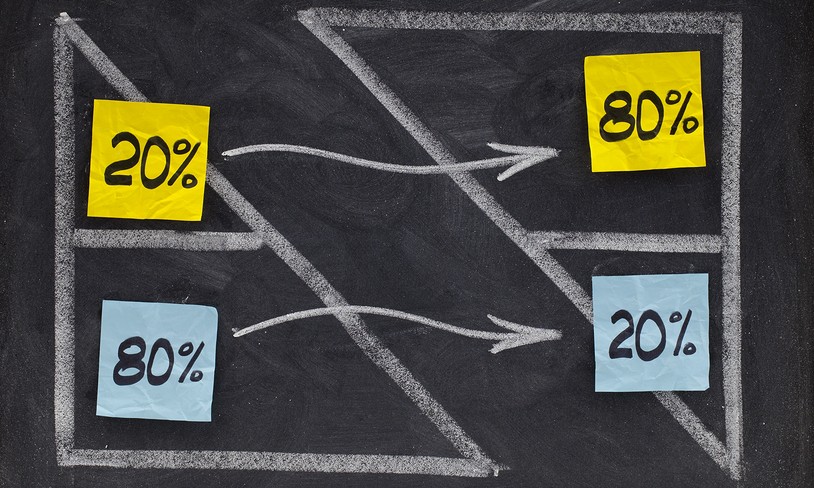

When we looked closely at your company’s gross revenues in our last post, Pareto’s Principle (80/20 Rule) Applied to Business, a few weeks ago, it became clear that sales made to all customers/clients fall into either the 80% or 20% category (below or above the Pareto’s Principle line). Specifically, those customers/clients who appear above the line usually number about 20% of your total, yet they produce 80% of your business’s profit.

Pareto’s Principle Tells the Story

This reality can be quite scary, especially when you consider the flip side of Pareto’s Principle.

Think about it for a minute. It’s very likely that the majority of your activities, and consequently your company’s resources, are dedicated to producing a product or service for that part of your customer base that offers little or no profit (the bottom 80% of customers that produce only 20% of your profit). To more fully understand this, it is good to look at the average gross revenue for each of your customers/clients on a yearly basis.

Think about it for a minute. It’s very likely that the majority of your activities, and consequently your company’s resources, are dedicated to producing a product or service for that part of your customer base that offers little or no profit (the bottom 80% of customers that produce only 20% of your profit). To more fully understand this, it is good to look at the average gross revenue for each of your customers/clients on a yearly basis.

Let’s go back to the list of customer/client’s revenues for the prior year. We looked at this in a previous post when we calculated the average revenue.

Calculate the average gross revenue amount for customers/clients who appear above the Pareto’s Principle line by totaling the gross revenues for this group and then dividing that sum by the number of customers/clients in the group.

Do the same for the customers/clients who appear below the Pareto’s Principle line.

You will likely find the average gross revenues from these two groups of customers/clients differ greatly. It wouldn’t surprise me if you told me that the Average Gross Revenue for the second group (those that fall below the Pareto’s Principle line) is not enough to cover the direct costs to produce an order or deliver a service.

So, here is where you should pause and ask yourself if you are making any profit on the customers/clients in the group that falls below the Pareto’s Principle line.

Is your company set up to handle these customers/clients or is there a better fit for them elsewhere?

And here are the most powerful questions:

- What if you had only clients/customers who produced the average gross revenues similar to those who fall above the Pareto’s Principle line?

- What would your company look like?

- Would you be more profitable and maybe not work as much?

- Would your employees be happier?

If you have taken the time to crunch these numbers, please share with us what your insights are and if you plan to change anything about your business model.

by Holly Magister, CPA | Grow a Business |

Recently I took my nine year old daughter and a carload of her friends to our town’s Volunteer Fireman’s Carnival for an evening of ferris wheels, funnel cakes, and laughter–of course! It was a Friday night after a long week. Truly, I would have benefited from a simple dinner at home to unwind from the week. Sound familiar? However, I intuitively knew that the laughter of those children was most important and desperately needed…so off we went.

Recently I took my nine year old daughter and a carload of her friends to our town’s Volunteer Fireman’s Carnival for an evening of ferris wheels, funnel cakes, and laughter–of course! It was a Friday night after a long week. Truly, I would have benefited from a simple dinner at home to unwind from the week. Sound familiar? However, I intuitively knew that the laughter of those children was most important and desperately needed…so off we went.

As the girls were getting out of the car, they caught sight of the ferris wheel in the distance and the excitement erupted into chaotic squeals, giggles and laughter. I found myself feeling a bit nervous for their safety as the other cars were moving in and out of the parking spaces nearby. I regained their attention and reminded them that they promised me to apply the buddy system to keep safe. All was well…

In typical fashion, the Fireman’s Carnival delivered all that was anticipated. It rained all week, so the grounds were like a mud filled sponge and no amount of hay can fix that. It always rains during the week the carnival comes to our town. The children never take notice of the condition of their shoes. It is all about the laughter.

When I was nine, I loved carnival rides too. Another mother and I were lamenting the fact that somewhere between the age of 21 and childbirth the ferris wheel went from thrilling to terrifying. How does that happen? I think it is just about the same time that we adults forget how to laugh. And I believe entrepreneurs need more laughter in their lives.

Among my successful Entrepreneur clients, I observe that they know how to keep all of their troubles in perspective. Simply put, they have not forgotten how to laugh! And given the times we live in, they have been laughing a lot! Don’t get me wrong, they do not disregard reality or not take their business or life seriously. They keep perspective and know the value of childlike laughter!

After an evening of laughter, it was time to return home with our funnel cakes “to go”. Dad and big brother were waiting for them. As we returned to our car, we found ourselves “in trouble”. No, I am not kidding. As we approached my car, a Policeman asked me if I was Holly Magister and if that was my car? Never a good question when posed by a Police Officer! His cruiser cornered me and his spotlight was squarely on me! “Yes, officer. What is wrong?” I replied. My panic-struck heart was pounding and my nine year old began to cry.

Truly, my first thought was that someone died and they were trying to find me to deliver the news. What else could it be? My daughter thought I was going away in handcuffs forever because that is what she sees on TV. She never saw a Police Officer that close before–one that knew my name. They were hunting down my mom!

The Officer told me that “the white SUV next to me suffered a “door ding” and he was there to investigate the accident.” “Is this truly necessary?” I asked the young man who was standing next to his prized mode of transportation. (Okay, if you have read my earlier blogs, you know that I ask this question a lot!) With no reply to my question, I asked it another way… “Did you have to call the Police?”

It turns out that the nine year old’s chorus of squeals, giggles and laughter muffled the sound of the “door ding” that the neighboring SUV suffered several hours earlier. And the young man felt that he needed the protection of the Police to make certain that justice would be served. This young man discovered his “door ding” and decided to wait for me to return to my car. He waited more than two and one half hours!

The Police Officer informed me that it was his “job to determine if the door ding was inflicted with malicious intent or by accident.” I replied, “I do not know any nine year old that would have malicious intent of any kind and I am grateful for that!” He was not pleased with my reply and further informed me that he “did not want this to get ugly”. Regardless of the absurd situation, I decided to save my sharp tongue and sarcastic sense of humor so the Officer did not feel compelled to take me away! Besides, the funnel cakes were getting cold.

Today, I learned that the body shop did not consider the SUV’s injury to be a “door ding”, instead it was a “paint transfer”. And it would take only $554.73 to make it go away!

The white paint from the SUV that was “transferred” onto my blue car was undetectable after a $6.00 wishy-wash at the gas station. What a bargain! But here is the best part…after my car was washed, the shine revealed no less than 11 “door dings”. Real ones!

As I share this story with you, and more recently my family, I am reminded of the numerous “door dings” we endure as Entrepreneurs, parents, and humans for that matter! And I believe that it is the endurance and perspective gained along the way, not the removal of the door dings, that make the difference! To know that the door ding the white SUV suffered was because of a child’s excitement and laughter put a smile on my face. Are you smiling?

As for my door dings, all eleven of them, they are not going away! They serve to remind me daily what really matters… endure, keep perspective and remember to laugh every chance you have!

by Sabrina Baker | Grow a Business |

Employee handbooks are an essential part of any growing business.

One of the most common questions I get from small business owners is, “when do I need an employee handbook?” In  a perfect world, an employee handbook would be part of the startup protocol, but that usually isn’t the case. In the midst of building a website, working on business development and actually putting together a sellable product, writing policies and procedures is not top of mind. So, the next best and most critical time to develop an employee handbook, is the minute you hire your first employee.

a perfect world, an employee handbook would be part of the startup protocol, but that usually isn’t the case. In the midst of building a website, working on business development and actually putting together a sellable product, writing policies and procedures is not top of mind. So, the next best and most critical time to develop an employee handbook, is the minute you hire your first employee.

Establishing a handbook early on in a business helps the business owner do several things.

3 Reasons Your Staff Needs an Employee Handbook

- Provides vision. More than just policies, an employee handbook gives a business owner a place to lay out the vision and mission he or she would like their employees to embrace. It is a breeding ground for company culture.

- Provides information. Rather than spend precious time answering the same questions over and over about vacation time or benefits, an employee handbook provides a reference point for all employees to review as questions arise

- Provides protocol. Unfortunately, employee issues are bound to come up. An employee handbook establishes a course of action that a business owner will take when such issues arise. Without it, the business owner is often making things up as they go, with can be a very slippery slope.

It is easy to put a project like this on the back burner. Getting caught up in doing the business can certainly make something like this seem unnecessary and it may be for now. There will come a day however when you need to discipline or even terminate an employee. There could even come a day when that termination could be challenged in court. If that happens, a good employee handbook could be your best defense.

You can find employee handbook templates online or many employment attorney’s or HR consultants are more than happy to customize one for you. So however you go about it, make sure an employee handbook is established for your business very early on.

Learn more about Sabrina Baker, PHR., President of Acacia HR Solutions, a Human Resource Consultancy and Social Recruiting firm outside of Chicago, IL. Acacia HR Solutions is focused on helping companies find, lead and retain the best employees possible.

Find Sabrina Baker on Google +

by Holly Magister, CPA | Grow a Business |

The Pareto’s Principle as applied to your business is a great way to increase profit using 80/20 rule and is a worthy exercise if you desire to improve cash flow and increase the value of your business. However, many business owners struggle to recognize where they are making money and where they are not!

We shared with our readers the first step in Understanding the Importance of a Minimum Order in our last post. If a business owner takes this first step, they have a complete top down list of her customers or clients—those producing the greatest to the least amount of gross revenue to their business.

With this information, the business owner is now armed with extremely valuable information to understand where they are making money and how they may improve the value of their business. Without this understanding, an entrepreneur will undoubtedly, leave money on the table.

To the delight of many successful business owner, the Pareto’s Principle applied to their customer base gross revenues tells them exactly the source of their profit as well as their unprofitable relationships. By applying Pareto’s Principle, also known as the 80/20 Rule, an entrepreneur will uncover the true source of their company’s profit.

Pareto’s Principle Definition

The Pareto Principle is defined as: approximately 80 percent of the effects are derived from 20 percent of the causes. What this means in a business setting is that 80% of a company’s profit comes from 20% of its customers.

If you have completed the first step in this exercise, you have your list of customers sorted from the greatest gross revenue to the least. To assess if Pareto’s 80/20 Principle applies to your business, follow these instructions.

- Add up all of the gross revenue from all of your customers for the past twelve months. The Quickbooks® report from the first exercise should show you this amount on the bottom of the page. If not, total the gross revenue from this list. This amount should represent the total gross revenues of the business over the past year.

- Multiply the total gross revenues (answer to step number 1 above) by 80% ( $XXX. x .80)

- Starting at the top of your list of customers, begin to add the first customer gross revenue to the next, and the next. Repeat this until you reach approximately the figure you have from step number 2 above. When you reach this amount, stop and draw a line below this customer on your list of customers.

** The customers that appear above this line are those customers that produce for your company approximately 80% of its total gross revenue.

- Count the number of customers that appear above the line in step 3.

- Count the number of ALL customers in the total list of customers.

- Divide the figure from step 4 into the figure from step 5.

** This amount represents the number of customers (percent of the total) that produces approximately 80% of a company’s gross revenues.

Pareto’s Principle states that it is very likely 20% of a company’s total number of customers produces approximately 80% of its gross revenue.

What is the percent of total customers that produces 80% of your company’s revenues?

In our next post, we will share insights to be gained from the 80/20 rule to help you improve the value of your business. By understanding the Pareto’s Principle and applying it to your business, you’ll will be less likely to leave money on the table!

by Holly Magister, CPA | Grow a Business |

Most business owners find themselves extremely reluctant to turn away an order for any reason. The notion of telling a client or customer that their business or order is too small is frightening to even the most seasoned business owner. However, if you don’t want to leave money on the table, and instead desire to make more profit, setting and enforcing a minimum order policy is absolutely necessary!

Most business owners find themselves extremely reluctant to turn away an order for any reason. The notion of telling a client or customer that their business or order is too small is frightening to even the most seasoned business owner. However, if you don’t want to leave money on the table, and instead desire to make more profit, setting and enforcing a minimum order policy is absolutely necessary!

This post is intended to help business owners recognize, first and foremost the source of the PROFIT in their business. Many are shocked to learn that most of their effort and headaches are derived from servicing the least profitable segment of their business. Sad but true.

Before we attempt to determine the correct, or optimal, minimum order amount, a business owner needs to first determine where the profit is coming from.

There is simple and enlightening way to do this, especially if your financial records are kept on QuickBooks®.

Start by looking at where your business, in terms of gross revenues, came from in the last twelve months. Start at the top and list your Customer or Client that produced the greatest gross revenue and then follow that up with the next, and then the next, etc. until you have exhausted your entire list.

If you use QuickBooks®, it is easy to get this information. Go to:

- REPORTS;

- SALES BY CUSTOMER;

- Select the period to measure—One year is a good timeframe for this exercise. Place the twelve month period in the “To” and “From”;

- Select SORT BY TOTAL;

- Select Z TO A (the default is A To Z).

This report will provide a summary of a company’s gross sales dollars by Customer or Client from the Greatest to the Least. Take a look and you may see that many of your headaches are related to servicing the names on the bottom of this list.

This is the first, very important step that a business owner must take to understand their company’s profitability—and the possible notion that they may be leaving money on the table as a result of their company’s minimum order policy (or lack thereof!).

Our next post in this series will address the next steps in this analysis by introducing the 80/20 Rule also known as the Pareto’s Principle (or Law).

by Holly Magister, CPA | Grow a Business |

Recently, I had the good fortune to attend a conference where a gentleman and his wife shared their personal story about forgiveness in their business and personal lives. It was an unforgettable story that hit home.

Defining the Successful Entrepreneur

Chuck Sandstrom was by all accounts a successful entrepreneur. He and his wife were well-respected members of a  flourishing business community. They had it all. Mind you, they worked for what they accomplished. None of it was handed to them.

flourishing business community. They had it all. Mind you, they worked for what they accomplished. None of it was handed to them.

All was well until one seemingly ordinary day in 2009 when Chuck visited one of his rental properties. He was nearly beaten to death. His assailant had a history of troubles and this day was no different. Unfortunately for Chuck, he was in the wrong place at the wrong time. Chuck’s injuries put him in a coma for several months. Subsequently, he spent several years in physical and occupational therapy and suffered financial ruin.

Chuck Sandstorm stood before our group to share how much he has personally gained from the ordeal. Please understand, it wasn’t our sympathy he was seeking. He wanted to share with us how empowering it is to forgive. Chuck’s assailant is serving a sentence in Federal Prison and left two young boys at home. Chuck told us that by reaching out to help his assailant’s two boys, healing and forgiveness took root in he and his wife.

Growing a Business Can Hurt

Honestly, as I listened to his story, I couldn’t help but to be humbled by this man of courage and kindness. I recalled the times when others hurt me as I pursued growing a business. Yes, it has happened. People I trusted have hurt me. And I’m willing to bet it has happened to you too. However nothing I have ever experienced is even close to the depth of pain, injury, and suffering that Sandstorm endured. And he forgave.

A wise friend of mine told me that while an offender may seek forgiveness, it is those who forgive that benefit most. He also suggested that waiting for the offender to ask for forgiveness is not necessary. If you saw the smile on Chuck’s face as he shared his story with our group, you would agree.

Find Holly Magister on Google+

by Holly Magister, CPA | Grow a Business |

Pareto’s Law applied to business likely will reveal to the entrepreneur that their business is serving (at least) two very different sets of customers/clients. And in trying to do so, he or she and their staff will suffer anxiety, frustration, and the loss of company profit.

Pareto’s Law applied to business likely will reveal to the entrepreneur that their business is serving (at least) two very different sets of customers/clients. And in trying to do so, he or she and their staff will suffer anxiety, frustration, and the loss of company profit.

So What is the Entrepreneur To Do When Pareto’s Law Applies?

First, I have found that most business owners are empowered by knowing exactly how their business’s two sets of customers/clients impact their Profit and Loss Statement.

So let’s start with the basics! Over the next four posts on this subject, you will need your calculator. Please don’t panic—none of you will have to take a test or need to call your Accountant. We are going to break down facts and figures in very simple terms found in your existing Profit and Loss Statement and Customer Sales records to shine the light on where you are making and where you are losing money. Ultimately, we don’t want you to leave money on the table.

Many people mistakenly believe only two figures matter on the Profit and Loss Statement. Every day you read in print journals and on the internet about Gross Revenues (the first figure at the top) and Net Profit/Loss (the last figure on the bottom). It is unfortunate that so much of the focus is on these two figures. A much more powerful measurement of profitability is buried in your Profit and Loss Statement and I believe it predicts the health, longevity, and ultimately the value of your business. This powerful measurement is the Gross Profit Margin.

Gross Profit Margin Definition

If you are not an Accountant or financial wizard, the term Gross Profit Margin may intimidate you. Let’s not let that happen—it is not that complicated!

The Gross Profit Margin is simply that portion (or percentage) of a dollar left over from a sale (the first figure at the top of a P&L Statement) after paying the direct cost to deliver the product/service to the customer/client.

For example, if you charge $1 for your product/service and you spend 30 cents to purchase, build and deliver the product/service, the difference between the two (what is left over) is 70 cents. Your Gross Profit Margin is 70%.

Don’t Delegate This!

The entrepreneur needs to know what her company’s Gross Profit Margin is and should monitor this percentage all the time. Expecting your Accountant to monitor this for you when you visit him or her once a year is too little AND too late!

The 70 cents that is left over (in our example above) is what the company has to work with to pay its operating expenses (salaries, office and plant costs, benefits, etc.). And if the gross profit margin is too low, there will be no money left over (profit) after paying the company’s operating expenses. And worse yet, if the operating expenses exceed the gross profit margin, then the company loses money.

Danger Below!

It is very likely that each set of a company’s customers/clients have a different gross profit margin. Unfortunately, it is not unusual to find that the customers/clients who sit in the group which fall below the Pareto’s Law line, do not produce enough money to even cover the direct costs needed to purchase, build and deliver the product/services to them! This is a very dangerous situation!

When this is the case, you might as well not take the order, or service this client at all. In fact, you would be better off sending them a check instead. I’m not kidding.

In our next post, we will explore how to derive this information from your financial records so you do not leave money on the table.

Find Holly Magister on Google+

by The Contributors | Grow a Business |

By Matthew Cottrill

By Matthew Cottrill

Are your business financials out of balance?

The Deceptive Busyness Trap is a debilitating business problem eroding cash flow and stifling growth.It’s a common issue facing many business owners who, over time, unknowingly become subject to its influence.

The Deceptive Busyness Trap occurs when a company spends significant amounts of time working with small customers and/or on small transactions. The impact on a business owner trying to grow a profitable business is analogous to trying to walk through quick sand. The more you struggle with it, the deeper you sink.

Many businesses fall under the 80/20 rule, which suggests that 80% of their revenues and cash flow come from 20% of their customers. In many cases this ratio is closer to 90/10. In the latter case, if a business has 300 customers, it means 270 (90% x 300) of those customers contribute only 10% of the total company revenue. It’s a significant problem facing small business owners.

How do business owners find themselves in this Deceptive Busyness Trap? Over time, and without realizing it, companies inadvertently can build a base of small customers through marketing efforts or word of mouth. Turning away an order or pushing back on minimum order amounts seems contrary to growth goals. Orders come in and are processed; it’s a natural progression.

The end result is that operations are running full, sales and customer service are buzzing, and the administrative staff is tapped out, yet growth is stagnant and cash flow is declining. Worse yet, competitors will recognize the problem in their own businesses and make changes in strategy. This redirects many of their small unprofitable customers with their minimal upside potential to your company.