Business Lending from Banks

Business Lending from Banks

Whether you’re a Main Street small business, an Entrepreneur growing a business from start-up, or a Middle Market Business about to embark on an Initial Public Offering (IPO), chances are you’ve had to turn to your local or regional bank or credit union to borrow business capital. And chances are you’ve learned these business lending institutions make their decisions based on what is known in the industry as the three C’s of lending:

Cash Flow

Collateral

Credit History (or Credit Score)

Now in recent years, commercial banks and credit unions have tightened up their lending/loan criteria to the degree that obtaining business loans is restricted only to those businesses with a proven track record of profitability. Of primary importance is the financial performance of the business over the last two years. What also serves a guidepost for lenders is the underlying credit score of the business owner(s). Without a good personal credit score, certain lenders will simply opt out or decline the loan request. In such cases, the business is forced to seek alternative lending companies at a higher cost of capital.

Long Term Financing

Bank and credit union term loans are best suited to permanent financing needs. In other words, if an entrepreneur needs to finance an asset or investment with a useful life of several or more years, term loans are most appropriate. Similarly, if a loan is needed to finance an improvement to real property then a longer term loan of ten years or more is advisable.

Short Term Financing

Banks and credit unions also offer qualified businesses a Line of Credit (LOC) to meet short-term or day-to-day cash needs. Such operating funds, made available through a line of credit, allow the entrepreneur to pay his trade invoices and to meet payroll while waiting for his customers/clients to pay their invoices. Without a business line of credit, most businesses, small and large alike, would be forced to close their doors. Lines of Credit are in many cases secured by and tied to trade Accounts Receivable and in certain cases Inventory.

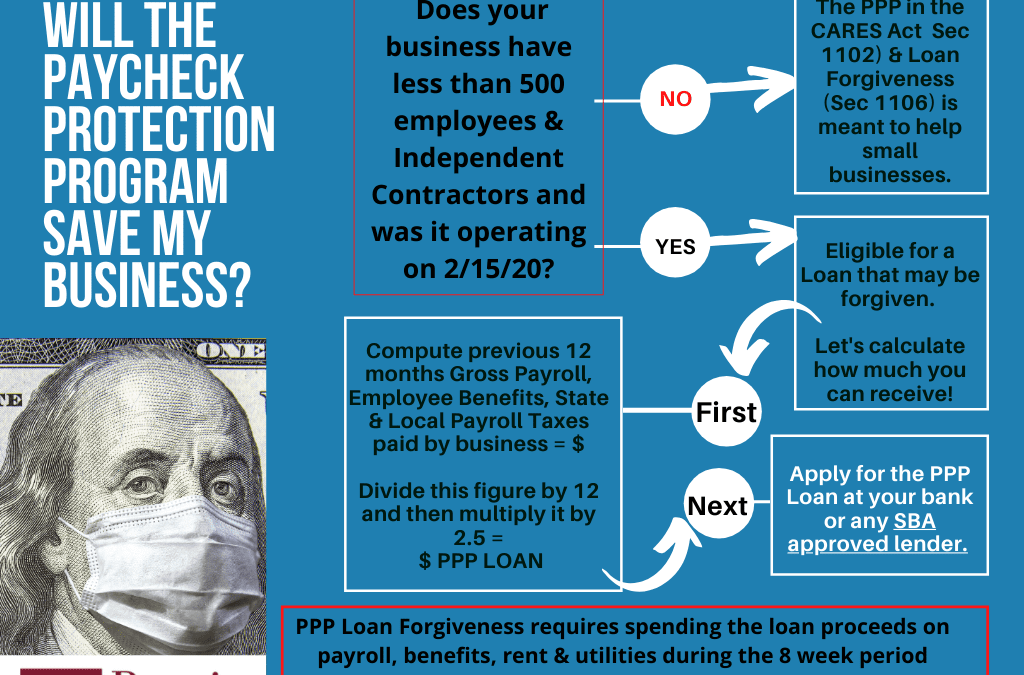

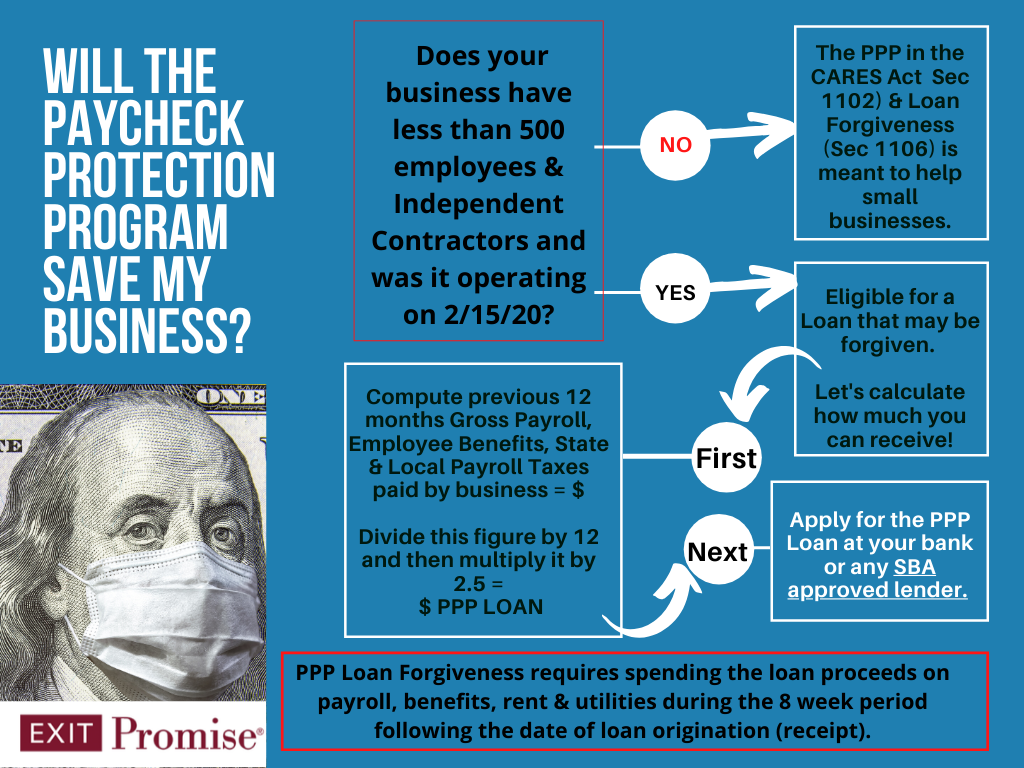

SBA Business Lending

When a business does not meet the Cash Flow and Collateral requirements to qualify for a loan, a Small Business Administration (SBA) Loan may be offered. In such a case, the bank makes the loan to the business and the SBA stands behind the bank to guarantee a portion of the loan in case of default.

What is an SBA Loan?

It is important to understand that SBA loans are not granted directly by the SBA to borrowers to start, acquire or grow a business. Instead, the SBA provides a guarantee to bank for the funds it lends to small business owners. For the lending institution this reduces the risk associated with lending to small business owners, and for entrepreneurs it creates financing opportunities for businesses that may not qualify for traditional loans.

The interest rate that is charged on an SBA loan is based on the prime rate. The SBA can’t set the interest rates; however, it does regulate the amount of interest that a financial institution may charge an SBA borrower.

Generally, SBA guaranteed loans and granted by a private lender, and are backed up to 80% by the SBA. This both reduces risk to the lender, and makes reasonable loans available to businesses that would otherwise struggle to obtain affordable financing. Keep in mind that your business will need to qualify as a small business based on standards created by the SBA.

What Types of SBA Loans Are Available?

SBA programs vary depending on the needs of the borrowing business . There are loans designed for everything from working capital and growth capital to disaster recovery. Below, we’ll outline some of the most popular SBA loan programs.

7(a) Guaranteed Loan Program – This is the most common business loan offered by the SBA. Called the 7(a) General Business Loan Guarantee Program, this loan can be used for a variety of purposes to support the various short and long-term needs of startups including: working capital, revolving funds, refinancing existing debt, equipment purchases, real-estate purchases, and more.

7(a) General Business Loan Guarantee Program loans are generally guaranteed up to $750,000, with 80% being guaranteed on a loan $100,000 or less and 75% for loans over $100,000.

Businesses will need to post collateral in exchange for the loan, just as they would for a traditional loan. Collateral may be accepted in the form of:

- Stocks and bonds

- Savings accounts

- Accounts receivable

- Life insurance policies

- A person who is capable (and willing) to take responsibility for the loan balance in the event of default.

- Real estate

- Machinery and equipment

- Land

504 Local Development Company Program – This is a long-term, fixed-rate financing SBA loan designed specifically for the purposes of obtaining machinery, equipment, or real estate. These loans are offered by Certified Development Companies (CDCs) and are typically financed 50% by the bank, 40% by the CDC, and 10% by the business.

These loans require that businesses meet certain public policy goals (like creating or retaining jobs) in an exchange for below-market, fixed-rate financing.

Microloan Program – This loan is designed to assist businesses who seek to borrow less than $25,000 in working capital with the purpose of purchasing supplies, inventory, furniture, equipment, and machinery. This loan is unique because it allows a small business to borrow an amount that would otherwise be too small for a traditional business loan.

Microloans are offered via non-profit and community-based organizations, who have been approved as SBA Microloan lenders. These approved organizations receive long-term funds from the SBA, and then make smaller, shorter-term loans available to small business owners in their communities.

Disaster Loans – These are available to homeowners, businesses, and renters, and may be used to restore, repair, and replace assets and real estate that have been destroyed in a natural disaster.

State Business and Industrial Development Corporations (SBIDCs) – These loans are capitalized through state governments, and may fund very high-risk ventures, or low risk ventures, depending on the SBIDC. These are long term loans (5-20 years), intended for the expansion of a small business or the purchase of equipment.

CDC-504 Loans – These loans offer fixed-asset financing through CDCs (Certified Development Companies), which are nonprofit corporations sponsored by private-sector organizations or state and local organizations that contribute to economic growth.

Energy and Conservation Loans – These loans are specifically designed to support small businesses that contribute to the conservation of the nation’s energy resources.

The Export-Import Bank (EXIMBANK) and The Export Working Capital Program – These programs (sometimes referred to as an export-assistance loan) offers opportunities for small companies to finance foreign marketing opportunities, such as exports.

SBA Express – SBA Express loans are offered for businesses who need an accelerated turnaround time for an SBA loan approval. These loans promise that a response to an application will be given within 36 hours.

Community Adjustment and Investment Program Loans – These loans are designed to create new sustainable jobs as well as maintain old jobs that are at risk as a result of changing trade patterns with Canada and Mexico.

The Small Business Innovation Research Program (SBIR) – This program is intended for American-owned small businesses with fewer than 500 employees, providing these businesses access to more than $1 billion in federal grants and contracts.

Who Can Fund SBA Loans?

SBA loans may be funded via three types of lenders: preferred lenders, certified lenders, and infrequent participant lenders. Not all banks can be certified by the SBA, as they must meet certain specific criteria. These criteria include: a minimum of 10 years SBA lending experience, an impressive SBA loan record (with very few loans being bought back by the SBA), an impressive record of loans to local borrowers (especially to minorities and women), and a record of lending to local small businesses.

Preferred Lenders – These institutions are certified lenders who have worked their way to the top of the list of SBA lenders, thanks to their superior performance. These lenders are consistently the SBA’s “best and most reliable” lenders, and as such are awarded the “Preferred” designation.

Certified Lenders – Certified lenders are institutions that are certified to award SBA loans. These institutions have staff that are trained and certified by the SBA. They decide whether or not to award the SBA loan to the borrower – however once they submit the paperwork, the SBA has the final say. The SBA doesn’t review and approve the loan until after the financial institution has already approved it.

Infrequent Participant Lenders – These institutions offer SBA loans on a sporadic basis. In these cases, the lending institution sends all the loan paperwork through to the SBA, who then completes an independent assessment, and determines whether or not to grant the loan.

Is My Business Eligible for An SBA Loan?

Your business may be considered eligible for an SBA loan assuming it’s independently owned and operated, isn’t dominant in its field, and meets any employment and/or sales standards required by the SBA. Loans may not be awarded to any speculative businesses, nonprofit enterprises, media businesses, amusement parks and recreational businesses, or any business affiliated with investing, lending, gambling.

Before the SBA will be willing to approve a request for funding, you’ll need to be prepared to prove that your business is prepared to compete successfully in its industry. It’s imperative that you research and determine which field your business is best positioned to compete in, and list it as such on your SBA application. The approval on your loan may be dependent on the classification assigned by the SBA.

Other factors that will weigh into your qualification for an SBA loan include: your business goals, how much money you plan to borrow and how much of it will go into the business, your management capabilities, your business experience, a projection of what your business will earn in the first year (particularly if you are a startup), your current personal financial position (including debts and liabilities), and the collateral you can offer as security for the loan.

Don’t be surprised if the SBA requires you to explain or prove any portion of your application. Be prepared with detailed financial (or pro-forma) statements, and keep notes on everything that you add to the loan application so that you can quickly refer to where the information originated. Additionally, as with any other major loan application, don’t make any major purchases or financial changes during the duration of the loan approval process.

What Type of Business Lending Is Right for My Business?

Deciding which SBA loan is right for your business will take some research and self-evaluation. Here are some questions the SBA suggests you ask yourself in preparation for applying for a loan:

- Are you having trouble paying your obligations on time? Do you need working capital?

- What is the nature of your need?

- Are you in search of funds to launch or grow your business, or do you need a cushion against risk?

- How urgent is your need for financing?

- What is your risk level?

- What will the funds be used for?

- Is your business cyclical or seasonal?

- What is the state of your business’s industry?

If considering an SBA Loan, you should also be prepared to pay additional fees to close the loan.

By completing a thorough analysis of your business’ current status and needs, you’ll be adequately prepared to decide which SBA loan is an ideal fit. To learn more about what the SBA offers, visit their website: https://www.sba.gov/loans-grants.

Business Lending from Banks

Business Lending from Banks

A business debt schedule is a tool that helps businesses review, assess, and visualize debts. A debt schedule allows businesses to make strategic decisions about paying off debt, acquiring new debt, or creating long-term projections for investors and creditors. It also helps a business owner understand the monthly debt service requirements for his or her business.

A business debt schedule is a tool that helps businesses review, assess, and visualize debts. A debt schedule allows businesses to make strategic decisions about paying off debt, acquiring new debt, or creating long-term projections for investors and creditors. It also helps a business owner understand the monthly debt service requirements for his or her business.

Business debt consolidation refers to the practice of taking out a new loan to pay off any number of other business debts (generally unsecured debts). Multiple separate debts are combined into one new loan, often with more favorable loan terms and conditions. Such terms and conditions may include a lower interest rate, a longer

Business debt consolidation refers to the practice of taking out a new loan to pay off any number of other business debts (generally unsecured debts). Multiple separate debts are combined into one new loan, often with more favorable loan terms and conditions. Such terms and conditions may include a lower interest rate, a longer

Once you’ve successfully

Once you’ve successfully