Welcome to IBBA insights, providing expert advice on buying or selling small businesses. IBBA insights is presented by the International Business Brokers Association, the world’s largest nonprofit organization for those helping others sell or buy businesses. Now, here’s your host, Cress Diglio.

CRESS: Hello and welcome to today’s edition of IBBA insights. Again, I’m your host, Cress Diglio. Very excited for today’s show. As business owners, selling a business for the maximum amount of money is your dream. Every business owner dreams of that. They want to sell their business for the absolute top dollar amount they possibly could, but what they should really be concerned about is how much of that money do they get to keep?

That’s not how much you get. It’s how much you keep. Nobody loves to hear the word taxes. It literally makes some people cringe. One day every business owner will exit their business, and hopefully there’s a payday associated with it. And if there’s a payday associated with it, there are going to be taxes associated with that payday.

Today, we’re going to speak with an industry expert who’s going to help us better understand and prepare for that payday and keep more of the proceeds in the sale. Today’s guest is Holly Magister. Holly is a Certified Public Accountant who specializes in growing and selling valuable businesses in the lower middle market.

She founded Enterprise Transitions LP, a boutique growth and exit planning business. Holly’s also the founder of Exit Promise .com, an online resource for business owners who want to grow and sell a valuable business. She’s contributed articles to Forbes, Intuit, and many other businesses related websites over the past few years.

Recently, Holly authored and delivered an online consulting education class for Lorman Education Services, Inc. On the topic of selling your business, negotiating terms and conditions. Holly, welcome to IBBA insights. So happy to have you today.

HOLLY: Thank you very much, Cress. It’s my pleasure to be here.

CRESS: My colleague, Neil Isaacs, works with us at the IBBA on the podcast. When he brought up your name and we started talking about you, I was like, yeah, we have to have Holly on the show. And I know we’re going to talk about taxes and it’s tax season right now. When everyone hears all these shows on taxes and it talks about the new tax strategies, new tax laws, and sometimes that can get a little boring, but we’re going to talk about things that happen all year round because you sell your business, there’s going to be a tax consequence or tax day associated with that.

And so we really want to talk to the business owners today, Holly, about what does that mean for them, how they could potentially prepare for that and keep more of that. If you don’t mind, I’m going to jump into a few of the questions I have for you. So can you explain the significance of tax planning when it comes to selling a business?

HOLLY: I would say it really starts with educating the business owner because business owners have started their businesses and operated them for the most part from a one-year tax planning perspective. That being, I want to pay as little taxes as I possibly can.

Please help me, Mr. and Mrs. CPA, do that. That works, but in very short increments. What happens is that as they approach the sale of their business, especially if they’ve done no tax planning, they have absolutely no idea what they’re in for because the taxation of the sale of a business is completely different from anything that they’ve ever done before.

And really, I would be safe to say, confident to say that the sale of a business is one of the most tax complex events that anybody will ever have. The federal tax code is convoluted as it is, but when you sell your business, it’s even more. And what further complicates that is that how one transaction is taxed is not necessarily the same as how another is taxed.

So you may have a friend who sold their business and they may say, I paid capital gains tax, which we’ll talk about in a little bit. And they may be paid 20%. This is at the federal level, but the way their business was structured was different than yours. The way the deal was structured was different than yours.

All of that means that your taxes will very likely not be anything like your friend’s taxes. I guess the first lesson there is don’t ask your friends for tax advice about how to sell your business. It is definitely something that you want to address with CPAs who work with mergers and acquisitions on a regular basis and also attorneys who can negotiate those transactions for you as well. To be clear, just I want to make sure you understand what’s at stake is understanding what you could end up paying if you do not fully understand and don’t do some tax planning.

The variables that impact whether or not how much you pay, some of them you have no control over whatsoever. And again, we’ll talk about that, but before we get into all of that, I just want to clarify that we’ll only be addressing federal taxes today because each state has its own set of rules. Some tax, some states have no taxes on transactions, while others and many do. So, just to make that clear, I won’t be covering anything today about your state income taxes.

CRESS: No, thank you for making that clear. Before we move on, I really want to establish the foundation of the importance of planning. A lot of business owners are out there, they’re running their business and the sale of their business is nowhere on their mind.

And they think they’re going to run it for the next 20 years and there’s plenty of time to prepare. But as we know, life happens and maybe someone, maybe it’s something, a bad reason. There’s an illness, a sickness, a death. Maybe it’s a good reason. There’s an opportunity somewhere else where they have to relocate whatever the reason might be.

So how important is it for a business owner today to be able to have those conversations with their CPA or their tax planner or their financial advisor about setting up and getting ready for potentially the one day that they may sell their business. When do you start that? When is too soon? And is there such thing as too late?

HOLLY: It’s never too soon. I think your point’s well made. My experience tells me that two things drive people to sell their business. The first being someone knocks on their door, unsolicited offer comes through the door. They want to buy your business. Maybe it’s a competitor. Maybe it’s somebody who simply wants to buy your business because it’s what they would like to do.

The second reason is they have a health scare and that health scare causes them to think I need to sell the business. Sometimes it’s their spouse has a serious illness and suddenly they have to sell their business. You don’t want that to be in the middle of tax season because you’re not going to get the CPA’s attention that you deserve.

So that’s why I always advise clients or prospective clients get a CPA who understands mergers and acquisitions and get the planning process started.

We were talking a little bit before about the implications. If a business owner doesn’t, there are certain circumstances where more than half of what the purchase price is paid to federal taxes.

I know that’s hard to imagine. And then you add on some potential state taxes and possibly local taxes. The proceeds are greatly diminished. It’s very, very imperative to start that planning process sooner than later.

CRESS: You mentioned some of the tax implications that a business owner should be aware of before selling their business.

Everyone sits there, Holly, and they think, and they say, wow, I’m going to get a million dollars for my business. But like you mentioned, by the time you figure your transaction costs, whether it be a broker fees or your professional fees with your accountant, your attorney, whomever, and then taxes on top of that, it could be much different outlook or outcome than what you originally thought.

And then you realize, wow, I don’t know that I can afford to sell my business. So you want to expand upon that just a little bit?

HOLLY: Sure. Well, there are, depending on the type of business you own in terms of it’s, how it’s taxed, then that would be something such as a C-Corp, an S-Corp, an LLC, partnership, or even a sole proprietorship, depending on those five variables, and then whether the track the transaction is a stock deal versus an asset deal.

Those two variables, when you consider all of those, throw them up in the air and whatever lands on your plate, you could potentially be paying a part, one part of your transaction at ordinary income tax rates, and you know those vary based on the total income that you or you and your spouse have as well as your filing status. There’s a very wide range of tax rates for that.

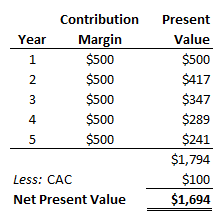

Then you have the capital gains taxes that ranges from zero that jumps up to 15 percent and then 20 percent and then if you are have a business that is actually a passive activity for you, then you have also the net investment income tax of 3. 8%. So you’re looking right there at up to, for capital gains, 24%, I’m rounding.

And then you have another form of taxation, which is the recaptured tax rates. And that’s for depreciated assets that you have on your balance sheet that are sold to your buyer. And that basically caps out–it’s an ordinary tax rate, but it does cap at 25%. So your head’s not spinning, but it probably is.

Even for seasoned advisors, it’s complicated. There’s a lot of moving parts. Understanding the tax implications based on your business entity structure and the type of sale that you have, asset versus stock sale, there’s a lot of moving parts. So again, that’s why I advise clients to, to really get good advice before you go into the sale.

Again, and I also mentioned it’s difficult if you have to sell your business quickly, meaning putting it on the market within a few months, which is reasonable. If you’re doing that during tax season, and for most CPA firms, that’s between January–well, I’d even go as far to say between October 15th when the tax extensions are done–through at least mid April. CPAs are quite busy at that time. I just wanted to make it clear that when you sell certain types of businesses, like a C corporation, there is a situation where you have to pay the income tax twice as a C corporation business The corporation itself pays income tax on the transaction, and then when the assets are distributed, or the cash is distributed to the business owner, there’s a dividend tax that they’re paid, paying at the shareholder level.

Now that’s in the case where you, the C corporation is sold under an asset transaction or an asset sale, which is really quite common, particularly for smaller businesses. But just that alone, the fact that if you’ve got a C corporation and you’re selling the assets, you’re triggering two levels or double taxation.

I personally have a real problem with that, but I can’t change the rules. And in that case, very easily you’re paid more than 50 percent in federal income taxes on that transaction.

CRESS: Ouch, that, that hurts just hearing you say it. I mean, is there anything that can be done about that? Are you just at the mercy of the rules?

HOLLY: Yes, there is something that can be done but it does take some, a long time to plan and actually have it work for you. There is the possibility to convert a C corporation to an S corporation. Doing so, you have a five-year window or waiting period where that transaction would be regarded as an S corporation transaction instead of a C corporation transaction.

For people who have a long runway, that’s an option. And so it should certainly be something that you discuss with your CPA firm to see if they advise doing so. There’s a lot of quirks and things that you have to be careful of. If you’ve got NOLs in a C corporation, it’s difficult to do an S election because those end up not being used.

And I’ve seen that coming out of the pandemic. There are quite a few companies, C corps, that have some NOLs that are hanging out there. So that S- corp election or conversion is a little more difficult to do. But it should certainly be something that you talk to your CPA about on a regular basis to see if it makes sense to do.

There are other ways around that. I’ll be covering that a little while later. The C corporations can be beneficial as well, if they were set up as a small business, a qualified small business, a corporation under code section 1202. A lot of startups today are forming those C corporations and using that code section or that election because there’s some favorable tax treatment there.

But if your business is up and running, you can’t go back and reform it. It’s just, it’s not an option. I wish there were more options for us.

CRESS: Yeah, at the end of the day, it is what it is. That’s why sometimes they say in the sale of anything that whether in life, you make your money on the buy, not the sell in business.

Sometimes you’re going to be taxed according to how you set yourself up and how you’ve transacted along the way. And what may have been good or made sense when you started might not make sense today. So nice to know there are potentially some options to get out of certain things, but certainly it’s not sounding very easy or something that happens quickly.

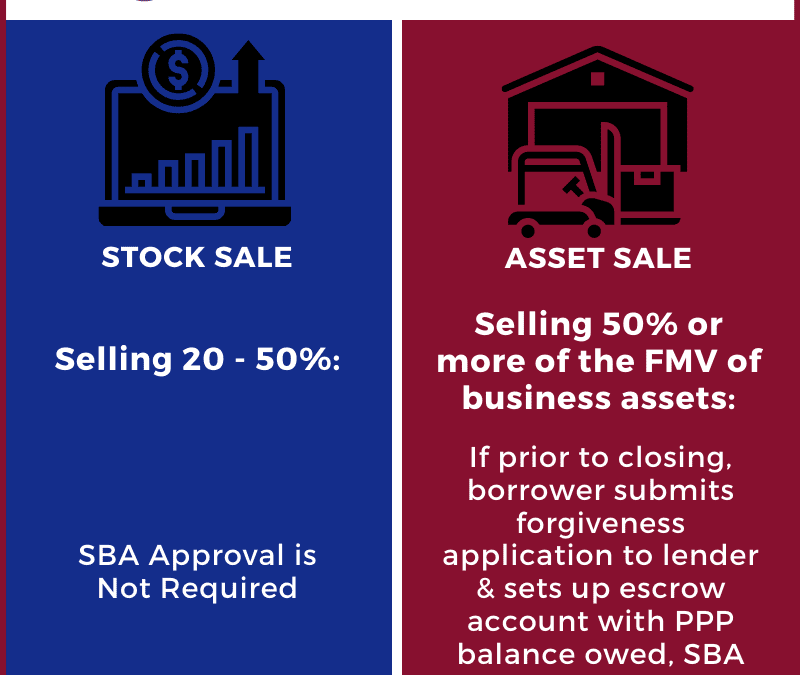

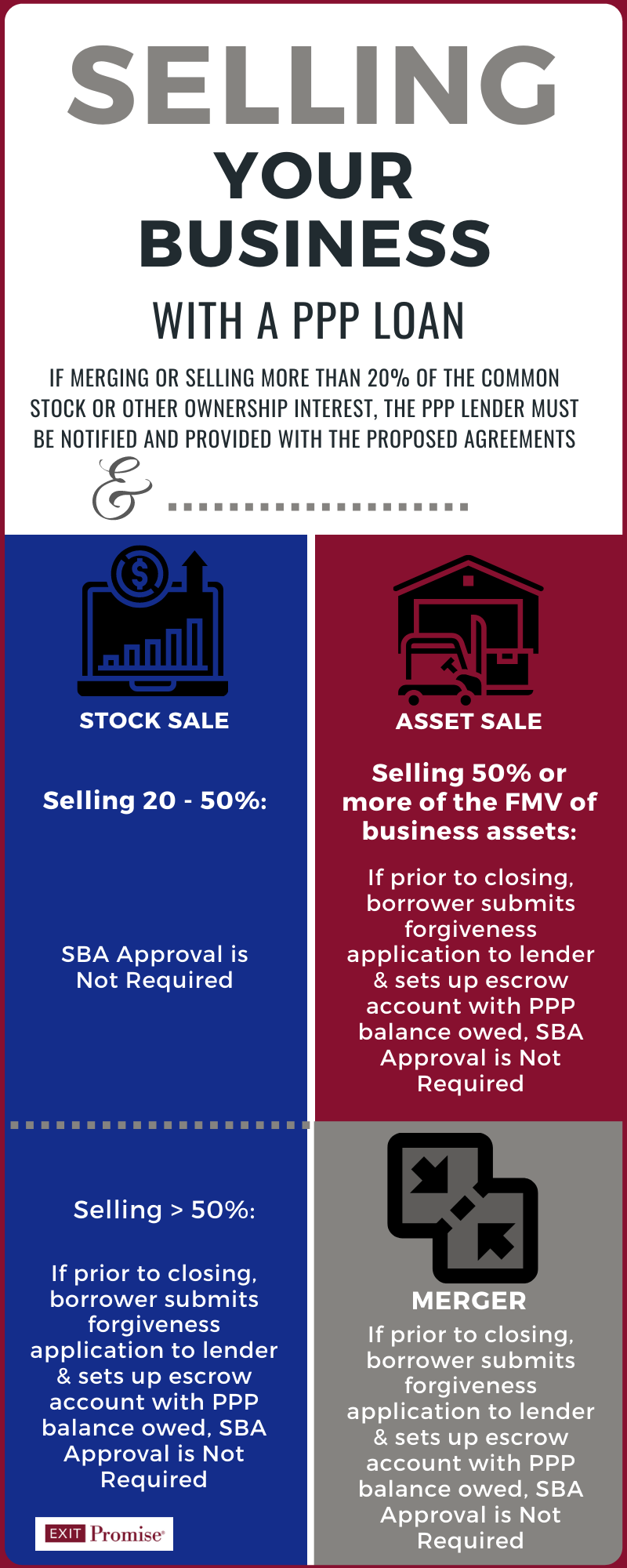

HOLLY: There is another way, and that is if I could explain the difference between a stock sale and an asset sale. We were talking up to this point, really we’re focusing on the type of business entity where a C corporation faces that double taxation. The S corps LLCs, they do not have the double taxation situation.

However, you still have to be careful about how this, the business is actually sold. A business could be sold to a buyer under what’s called a stock transaction or stock sale where the buyer, whether it’s a corporation, or a private equity firm, or an individual, they would come in and they would buy the stock that you have, the stock certificates that you have for your business, lock, stock and barrel.

That situation is one where it’s capital gains tax treatment for you, which is usually favorable to the seller. What ends up happening is the buyer now steps into your shoes as the shareholder. Nothing changes with the corporation, just

goes on. The only thing you might have to do is go to the bank and say to the bank. “This is the shareholder. Now I’m no longer the shareholder.”

They read your documents, and you get new signature cards. It’s that seamless in regard to the sale, much different than an asset sale. When that is done, when a stock sale is done, it’s generally more favorable to the seller and less favorable to the buyer.

And that’s because what the buyer is doing is they’re buying the company as is with all of its current plusses and minuses, all the good things and bad things, but also it’s buying its history. Everything that’s happened in the past is the new shareholder of that corporation or entity, or generally, or LLC, that’s also valid.

What ends up happening is that new buyer assumes that liability for the past, present, and the future. That’s a big difference between a stock sale and an asset sale, which I’ll cover in a moment. Stock sales are problematic for buyers because number one, they’re assuming all that liability, but number two, they don’t get what’s called the step up in basis.

They simply have paid all the shareholders for their stock, and they now hold that as what they paid for their stock. They can’t appreciate any assets. Moving forward, whatever’s on the books being depreciated at that point in time, they get benefit from, but they’ve now paid a lot more money for assets that have been either partially or fully depreciated. So it’s not a great deal for the sellers. And for that reason, for the buyers, stock sales are generally not all that common, particularly for small businesses. As the business size in terms of revenue and value go up, stock sales are more common.

With that said, the other side of it is an asset sale. And in that situation, what the buyer is doing is they’re saying, no, I’m not buying your certificates. I’m not buying ownership of this business, your shares. I’m going to buy the assets. The reality is they buy certain assets, and they may assume certain liabilities.

That’s great for the buyer because the buyer then has assets at a step up basis based on what they paid you for it. As the seller, they can depreciate those assets. It also absolves them for the most part of all the sins of the past. That’s what I always call it. And again, buyers like that. They want to assume liability for the business from the day of closing forward as opposed to in the past, sellers don’t necessarily like that as much because it can work for or against them, depending on what’s known as the tax basis that is in their assets.

Those assets can be sold using capital gains rates, but they also may have depreciable assets that will be taxed at ordinary tax rates under the recapture rules, but there is a cap of 25%. Again, part of those assets can be sold at a tax rate of the capital gains rates, which has a range, but generally lower than ordinary.

And then, lastly, inventory. If you’re selling a business and you have, let’s say, a million dollars of inventory on the floor and your buyer comes in and acquires your assets under the asset sale, they’re going to buy your inventory and generally if the fair market values a million, you generally would allocate a million to that inventory.

What’s good about that is that when that inventory is sold to a buyer under an asset sale, they take that as an ordinary expense. So that’s again, very good for the buyer. Again, going back to a stock sale, that’s not the case because they bought the business at large from the shareholders. So there’s a big difference between selling a business under a stock sale versus an asset sale.

As I just described, it’s rather heated, and knowing what you’re going to do in the future when you sell your business is impossible, and that’s because you can only control part of the variables being what is the type of entity that you have. You can, to some degree, control that. If you have some time, you can convert to a C to an S corporation.

But what you cannot control is whether or not the buyer is going to want to buy your business under a stock deal or under an asset deal. Again, my experience tells me smaller deals are typically asset deals. The larger your business, the larger your EBITDA or valuation, the more likely a stock deal is possible.

CRESS: It’s very fascinating, Holly. You talk about different structures on the deal, how it affects the seller, what it means to them, because it’s important again, how much do I get to keep? So we talked about planning in the beginning, sooner rather than later, talked about the different types of sale, whether a stock sale or an asset sale. We talked about the different type of entities and what that means.

For a business owner that’s going through a sale right now, are there any tax deductions or credits available to them during the sale of the business?

HOLLY: Anything that is related to the transaction itself, such as your legal expenses, your tax advisory expenses any other advisory fees. Obviously your brokerage fee, what you’ve agreed to pay to your broker or to your investment banker. That’s a deductible expense. And sometimes even escrow fees are required at which you end up figuring out at the end of your deal. Those are deductible to the transaction costs.

There’s some benefit to that. One of the things that I think is really important because there are so many moving parts when a business is sold is for a business owner to be proactive. And you could do this maybe after your tax season is over, you filed your taxes, maybe go to see your CPA in the summertime and say to them, I want to pretend I’m selling my business and I’m going to make some assumptions.

I’m going to sell my business for $2 million. And I would like to know today what I would pay income taxes in a situation, if it were a stock deal or if it were an asset deal and your CPA is going to say, well, well, well, we’re going to have to make some more assumptions here, but they could walk you through on a very important thing that has to be done for an asset deal, and that is the allocation of purchase price against the assets that are assumed.

I have done that with clients when I used to practice as a CPA. I always called it the fire drill. What would the number look like? And by going through that exercise and with your CPA, you’ll begin to learn in real dollar terms, what, for example, a $2 million sale price would look like under the two scenarios.

And the more the CPA shares with you that how that is computed, the more likely you will understand and feel a little less confused about how to approach a deal when actually you do go to sell.

CRESS: Holly, these are areas where the seller who is represented by a business broker, a business intermediary, a business advisor. This is their time for their professionals to shine and help and add value to the transaction as well.

Because although the seller would like certain things, even in the asset allocation, the buyer might not quite want the same thing because they mean different things to the buyer than they mean to the seller. So it’s very important to understand, these are things we’d like to have. But they very much are negotiable items and need to be prepared to be negotiated at the proper time.

HOLLY: Absolutely. A lot of the decisions really can’t be made regarding how your taxes will actually appear on your tax return until you get through the transaction.

CRESS: When a business is marketed for sale. It’ll be marketed on behalf of the seller in an offering or offering this business for this price point, if it’s marketed with a price.

And this is the structure that the seller would like to see. The seller would like it to be an asset sale. So in the offering, the seller is going to put it to market with their offering, but then a buyer’s going to come to the table and say, thank you. I see what you have in the marketplace. I see what you like. Here’s our offering to you. And then, then the negotiations begin.

HOLLY: You summed it up quite well. It’s wishful thinking for the most part. Once you have offers, you have to take what’s best or closest to what’s best for you as a seller. With that said, there, there’s always this friction going on between the seller and the buyer regarding what’s best for their side? Is it a stock deal? Is it an asset deal?

I have found that there are some ways to bridge the difference in one side having a much better outcome with a stock deal versus the other side having a much better deal with an asset deal. By better meaning net cash to the settlers. When I work with clients who are going through that process, one of the things I try to help them to understand is they do have some options at the end.

If there is a situation where particularly you have a business that, for example, has government contracts. Let’s use that as an example. Any government contract that you sign is going to basically say that the business may not sell their business in any way, shape or form as without our permission.

What that causes a buyer to do is to look at it and say, well, the only way I can really buy this business without running the risk that these contracts with the government are going to be at risk and to get this deal closed is for us to buy the stock. In that situation, the buyer is forced to buy the stock because then at that point, they’re stepping into the shoes of the shareholder and they’re not necessarily needing to go to the government agency and say, by the way, we’re buying this and having any kind of hiccups in the deal.

In those situations, The buyer is forced to acquire the business under a stock sale. That’s not necessarily great for them because, again, they don’t have the opportunity to depreciate any assets. They don’t get that, what they call, the step up in tax basis. The problem is they really can’t do an asset sale.

There is a code section called code section 338 (h) 10. If that’s not obscure, I don’t know what could be. But that code section allows the buyer and the seller to

basically get the best of both worlds. It’s an election they both make and it’s basically saying to the government where buyer says we’re buying this under a stock deal. However, for tax purposes, the deal is going to be treated as if it were an asset deal.

If that’s possible, the two parties are then able to compromise on the purchase price. Or alternatively, what could happen is the seller can end up increasing their purchase in order to get a better deal. Or alternatively, they may say, you know what? We’re just going to compromise on another matter and allow you to take a stock deal. The 338 (h) 10 election is really a valuable tool, and I am seeing it being used more and more in recent years.

But there are some things, of course, hoops to jump through. One of the things is that the buyer has to be a C corporation or an S corporation. That generally is remedied by a new company being formed. That’s pretty simple to do. The other side of it is that for tax purposes, the seller has to be either a C corporation or an S corporation. So being a C corporation isn’t always bad. In fact, it’s great if you are a qualified small business.

That said, there are some things that at the end of the deal or general or sometime in the middle of the deal or towards the end of the deal that you can make the situation better as the seller if you utilize some of these, this particular code section.

CRESS: Holly, as a business intermediary, these are very important things to know and understand, but they could also get you in a little bit of hot water.

If you’re not careful, because sometimes we’ve utilized this several occasions again, more and more. The problem we sometimes run into is we may be talking to their attorney or their accountant that has never done this or doesn’t realize you can do it. And now they become slightly embarrassed and they dig their heels into it.

No, you can’t do that. That’s impossible. And it’s such a fine line because you never want to make enemies of your, the people on your own team. But it’s still in the best interest of the client potentially to get the deal done.

HOLLY: Absolutely. I have worked with many business owners who have. been very loyal to their CPA and their attorney, the people who started with them when they started their business, or maybe it was their parent’s attorney and CPA that they kind of inherited when the business was transferred to them.

I see it all the time. And there are plenty of very competent, very good CPAs, excellent attorneys, but not all of them know mergers and acquisitions. And this particular area I just mentioned is very oriented only to people who do mergers and acquisitions, your local CPA, your local attorney who does all sorts of things, including wills and trusts and real estate transactions and whatnot, they’re not likely going to have any expertise in this area.

I don’t recommend throwing those folks out the window. They bring a lot to the table because many of them have a lot of history in their head. They understand that the seller, they understand the importance of their Legacy, their family business, et cetera. However, what I do recommend for sellers is to consider bringing on co-counsel or another CPA that works in tandem with the founding CPA firm, and that has this expertise so that they can step in and help them.

I recommend doing that early in the process, not late in the process, because to your point, Cress, that can be a problem. They can find themselves embarrassed. They may not maybe do what’s in the best interest of the client. I introduced that concept of having co-counsel and a team of CPAs that can be brought in, meaning somebody else who’s got just that expertise for M&A that is necessary to get the deal done.

CRESS: And I think a lesson to be learned, Holly, for the business intermediary out there listening. Is the education of the client also the ability to understand who the team is up front and maybe having those conversations one on one with the team members when you’re talking to the CPA about gathering up, gathering the tax information, the financial information.

You talked about different type of deal structures. And one of the things we run into, and then you could start the conversation there. Now, if they don’t understand most of the time, they’re going to look at them and say, yeah, yeah, that, that could be a possibility.

And then they’re going to go do a little research and figure out what it is we’re talking about. But if you start like everything else, if you start that process early, you have a much better chance of succeeding and getting things done. And we could talk about this particular point on and on. But we only have so much time in the show.

So I want to get on a couple of things that are very important, Holly. And one is, and I talk about this with almost every guest I come on in their area of expertise. I ask, are there any common mistakes or misconceptions that sellers have regarding the tax implications of selling their business?

HOLLY: This one is not understanding the difference between the purchase price and the take home cash price. And I have been around a number of business owners that really get hung up on the purchase price. The purchase price is just one part of the equation. If you can structure your deal with careful planning and good advice, with good advisors around you, you could have a lower purchase price and actually take home more cash pretty easily with proper planning. And of course, getting, being a little lucky on the type of buyer that you have. I’ve been involved with deals where they’ve had two letters of intent, one’s higher than the other, but the deal structure on the lower offer was better.

And the clients went with the lower purchase price in order to actually put more money in their pocket.

That’s only possible for a business owner to do if they understand the big picture, which again, takes some time, takes some planning and education on the part of the business owner.

CRESS: Not only that, Holly, it takes being associated and knowing experts like yourself and your company to be able to jump in and assist and help in the transaction. I said it at the beginning of the show. It’s not so much how much you think you’re getting. It’s how much you get to keep. And you just said that again. So there sometimes the lower offer is the better offer. And if you’re just looking at the top line number, then you’re never truly going to be able to service your client. And as a business owner, you may never truly able to get the best deal for yourself.

HOLLY: Absolutely true. I’ve seen it multiple times when with dueling letters of intent, it really comes down to the devil is in the details. And it’s important you have the right team. And there, again, I stress there are many very competent CPAs and attorneys, but that doesn’t necessarily mean they know mergers and acquisitions, tax and law.

That’s, it’s a niche area of practice. And there are many of those across the country that you can tap into. If you’re looking for some friendly advice, look for one of your peers who’s done a deal that’s similar. In the type of business you’re in and the size of your business, because if you’re a $1 million–I’ll make this up–an electrical contractor, that deal looks much different than a $25 million electrical contractor in the way in which it’s structured and also in the type of buyer. The more sophisticated the buyer, the more sophisticated their advisors will be, and they know how to negotiate these deals. You have to have someone at the table that is equal and on par with their abilities.

CRESS: Holly, someone might be listening out there right now: “Holly keeps mentioning mergers and acquisitions, but I’m not a 50 million company.”

Well, you don’t have to be in today’s world. You have a lot of the private equity groups and firms out there that are doing, once they have a platform company, they’re doing ad on acquisitions. And they are programmed to do business a certain way, and they’re going to do business a certain way. And you never want to be outmanned, outsmarted, and you want to make sure that when they’re coming in, you know, just as much as they do, and you’re ready to negotiate with them.

So, a smaller business that you would think that these things we’re talking about are never going to come into play. That’s, that’s not true.

HOLLY: That’s why when I recommend working with an attorney, I’m looking for an attorney with M&A experience and a team behind him or her, which allows the M&A attorney to do the M&A piece, but allows the experts around him or her to step in with the HR expertise that’s needed or the IT experts needed. If it’s a health care company, all the HIPAA and all of the bells and whistles that you have got to have when you’re representing and warranting things in your agreement. Those are really important people to getting the deal done.

And to your point, it’s so well made, CRESS. It is so true. The deals I’m seeing, even a $4 million deal, which don’t get me wrong, that’s a lot of money, but for a private equity firm, that’s nothing. But they’re still putting the same team they’re putting on for a $40 million or $400 million. It’s amazing to me, the due diligence that they go through and the agreements that you get, especially if it’s a stock deal, the agreements are very complex. So you need an M&A attorney with a team around him or her to support the entire deal and all of its aspects.

CRESS: I saw a private equity firm through a colleague of mine buy a

$750,000 company because it was in their space in the area they wanted to be and added tremendously to what they were doing.

So again, is that the norm? No, but can it happen? Yes. And so we want to make sure that you’re prepared. We’re running out of time, but I have two more things I definitely want to talk about. We are in tax season. So the, I have to ask you the standard question, any recent changes in the tax laws or regulations that sellers should be aware of if they’re planning on selling their business?

HOLLY: I wouldn’t call it recent. What I would say is that I would be very wary of the situation that we’re about to encounter on January 1st of 2026. The current Federal Estate Exemption is decreasing, being cut by half, unless, of course, Congress does something before then. I’m not holding my breath. They have a hard time, it seems, getting things done.

So, if nothing happens, instead of having an estate, if you’re single, where your exemption level is $13.6 million. It’s going to automatically drop to seven million for a single taxpayer. For married filing jointly, it doubles, but there are many single business owners and that could be someone who’s a widow or widower. Or if they’ve been divorced, it doesn’t matter if they’re single, they’re filing that way. They only have a $7 million exemption at the federal level for the estate taxes. And the estate taxes range from zero to 40 percent.

Why I consider that to be kind of an alarm bell is if you’re selling your business and you’re single and you’ve got to pay, I’ll be generous and I’ll say you end up paying 40 percent in income taxes because you did some planning and things turned out to be okay. Federal, state, local taxes, 40%. And then you roll that into your investments and die the next year. If it’s over 7 million, your total estate, the excess is going to be taxed at basically another 45%.

CRESS: Ouch.

HOLLY: So. Yeah, it’s really $7 million seems like a lot of money, but it’s not particularly for business owners. And again, it doesn’t if you’re married filing jointly. Yes, you’ve got twice that, but I’ve done many deals that are in the 20, 30 million range. So there’s a lot of estate tax planning that should be done. And now is the time. It’s a use it or lose it opportunity to be gifting away some of that wealth that’s been accumulated.

It’s beyond the scope of today’s conversation.

CRESS: Yeah.

HOLLY: But there are very effective ways that that can be done. Again, the right kind of legal counsel to help you get through that. But all is not lost, but planning is definitely necessary.

CRESS: And on that note, Holly, I want to say this. Yes, we talk about big numbers sometimes.

But a lot of money is all determined on who’s sitting there. Someone works 20 years and they build a business and they sell it for three quarters of a million dollars or a million dollars, or even a half a million dollars, the tax consequences and the burden just as important to them. As the person that sells a business for $10 million, maybe even there.

So more than because that’s what they have. That’s the fruit of all their labor and the rewards are going to be more important for them to maybe keep as much as that as they possibly can.

Here’s the time I love in the show, because you’ve been so kind and you’ve been so gracious to share a lot of information with our listeners and our audience.

Here’s where I’d like for you to be able to talk about the resources and tools available to sellers to help understand and manage their tax aspects of selling their business. And I know your company does that. So please tell us about the services you guys provide.

HOLLY: I’d like to share the website that we built back in 2010. We started ExitPromise.com at that time. After I had a conversation with one of my clients, this conversation today that you and I had, and when she left my office, she said to me, you really should try to help people who can’t afford the consulting that I pay for.

She said, I’m very happy to pay the consulting fees, but I know many people who aren’t in a position to do that and it stuck with me. I was like, oh my gosh, I get it. So we started a blog in 2010 and it’s evolved to a platform where business owners can join with a free membership.

And they have access to Q& A for many different types of advisors, including business brokers, investment bankers, attorneys, CPAs, HR experts. We built that, and it’s going strong and it’s a free resource to business owners. I have been advised by others to not make it free, but I keep thinking about that conversation I had with my client about the need to help people who don’t have the resources to pay for some of the consulting.

Now, I would tell you many of those folks have become clients of the advisors that we have on the platform. That’s all great, but even if they don’t and they take that information and they take it to their CPA their attorney or whomever and say, what do you think?

What do you know? That’s really exciting for me! We’ve had millions of visitors over the years, business owners who I believe we’ve helped, and I’m committed to continue to help them in that way.

CRESS: What an amazing and generous resource. And look, you can’t go wrong by giving. It all comes back to you tenfold. It might not be that person, but it might be who that person knows. And even if it doesn’t come back to you in some way, it comes back to you in knowing that you were able to help someone that maybe couldn’t have been able to afford the services that are provided and probably needed more by them than the person that, that could afford it.

So kudos for you setting that up. Kudos for you for everything that you do. We’re recording this show during tax season, and I know it’s a very busy time of year for you, although you’re always busy. So I want to personally thank you for taking the time to come on IBBA Insights and share everything that you shared with our audience.

Thank you so much.

HOLLY: Oh, it’s been my pleasure, Cress. Thank you very much.

CRESS: Well, guys, it was great hearing from Holly and everything that she shared. You’re probably gonna have to listen to this episode a couple of times and go back and write down and take notes on some of the things that she said. So again, I want to thank Holly for being on the show.

But if you enjoyed this episode and you’d like to listen to other episodes of IBBA Insights, you can go to IBBA.org/insights. And once you’re there, you could subscribe by clicking the Apple, Android or email icons that you never have to miss another episode ever again. I appreciate your continued support of IBBA Insights.

Be on the lookout for the next episode featuring guests who are going to help you in your business, professional practice, and life. I want to wish each and every one of you a great day.

Often successful

Often successful